Scott Olson

Thesis

We follow up on our previous article on The Boeing Company (NYSE:BA), as we urged investors to ignore the pessimism in June to add exposure. We explained that the market had de-risked its expectations on BA, culminating in BA reaching levels last seen in May 2020.

Notably, BA has significantly outperformed the SPDR S&P 500 ETF (SPY) since our June article, as it garnered a return of more than 20% (Vs. the SPY’s 9% gains). While positive sentiments were also lifted by the resumption of its 787 Dreamliner deliveries in August, most of BA’s near-term recovery was notched pre-Q2 earnings. Therefore, we believe the market has astutely used the capitulation lows in June as a springboard to accumulate exposure while investors’ pessimism reached its feverish highs.

Our analysis indicates that BA’s valuations are more well-balanced now and close to our previous price target (PT) of $180. Therefore, we urge investors to be patient when assessing whether to add more exposure at the current levels.

Accordingly, we revise our rating on BA from Buy to Hold for now.

The Market Was Already Looking Ahead In June

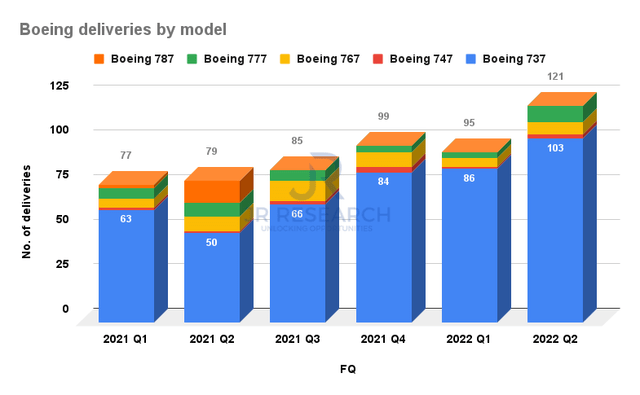

Boeing deliveries by model (Company filings)

Boeing posted total deliveries of 121 in FQ2, suggesting a solid slate in Q2. However, management’s guidance for MAX deliveries dampened investors’ sentiments somewhat as it highlighted deliveries to come in at the “low 400s” for FY22, well below the Street’s consensus of 450. In addition, management accentuated lower deliveries visibility from its Chinese customers, as it articulated:

We now expect delivery to be closer to the low 400s for 2022, short of what we discussed earlier this year, as we drive stability and predictability. We ended the quarter with 290 MAX airplanes in inventory, of which roughly half are designated for customers in China. Given this uncertainty with our customers in China, we now expect more deliveries of airplanes from inventory to shift into 2024. (Boeing FQ2’22 earnings call)

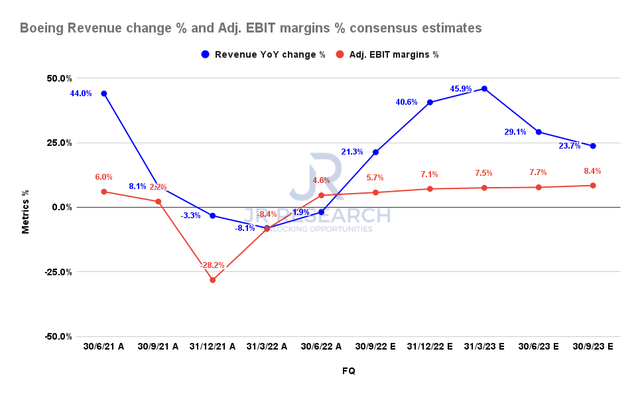

Boeing revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Notwithstanding, we are not unduly concerned with the revised guidance. Management highlighted that its cash flow recovery remains on track, lifted further by the recent 787 resumptions. Therefore, we urge investors to look ahead, not backward, as the consensus estimates (bullish) also point to a marked recovery.

For instance, Boeing’s revenue growth is estimated to continue recovering through FY23, with its adjusted EBIT margins also projected to follow in line. Management also alluded to its optimism in seeing improved underlying metrics moving forward, as CFO Brian West accentuated:

So in the short term, it will be a little bumpy as we start to roll out the 87s and continue to get confidence in our stability in the 37s. But over time, when we get to a point where both are stable and operating where we expect them to, the margin rate is going to go up. (Boeing earnings)

BA’s Price Action Suggests Near-Term Caution

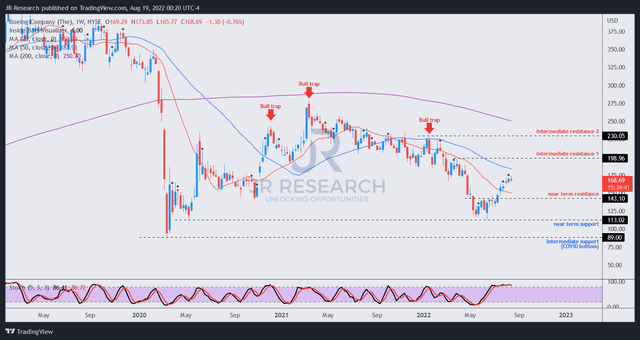

BA price chart (weekly) (TradingView)

As seen above, BA has recovered remarkably from its June lows of $110 as the market bottomed out, lifting BA’s buying upside. We are also confident that BA has also bottomed out in the medium term, further supported by its improvement in delivery cadence moving ahead.

However, we noted that BA notched most of its recent gains before its Q2 earnings, and even the announcement of its 787 resumptions didn’t lift buying upside much further.

In addition, we also observed that BA’s near-term momentum seems to have stalled, given its sharp recovery from June. Therefore, we postulate that the near-term upside in BA has been adequately reflected. As such, we think the reward-to-risk profile in BA is more balanced now. Therefore, investors should wait patiently for a pullback first before adding to improve their potential for outperformance.

Is BA Stock A Buy, Sell, Or Hold?

We revise our rating on BA from Buy to Hold.

We posit that the near-term upside in BA has been reflected, given its remarkable recovery from its June lows. Also, its momentum has stalled recently, suggesting that the market could be looking to digest its gains.

Investors should bide their time for a pullback first before adding more positions.

Be the first to comment