gk-6mt

The Crisis Is Fading And History Shows Boeing Can Rebound Like Many Other Companies:

When I read articles about Boeing (NYSE:NYSE:BA), I see many negative comments, which reminds me of similar comments I read back when Chipotle (CMG) was having a major food safety crisis which took the shares down to about $300. It took many quarters, but Chipotle got its act together, put the investigations and lawsuits behind them, and the doubters watched in disbelief as the stock subsequently went from $300 to around $2,000 per share. Chipotle is just one of many examples whereby a company faced a crisis that caused its revenues and share price to decline, only to see both revenues and the share price revert back to historical highs and even higher. This list includes Merck (MRK) which faced major issues with Vioxx, and Johnson & Johnson (JNJ) when Tylenol was recalled.

Boeing planes make up a HUGE part of the global airlines and freight fleets and fly everyday providing the SAFEST and fastest form of modern travel. I don’t know anyone who is afraid to fly a Boeing plane, and thousands of people fly Boeing planes every day. If Air Force One is good enough for the President of the United States, Boeing planes are going to be just fine for the rest of us. Let’s also remember that Boeing has a huge moat around it with only one other real competitor, which is Airbus (OTCPK:EADSY). Boeing continues to hold an incredibly strong position in the industry. It also has an important defense and space division.

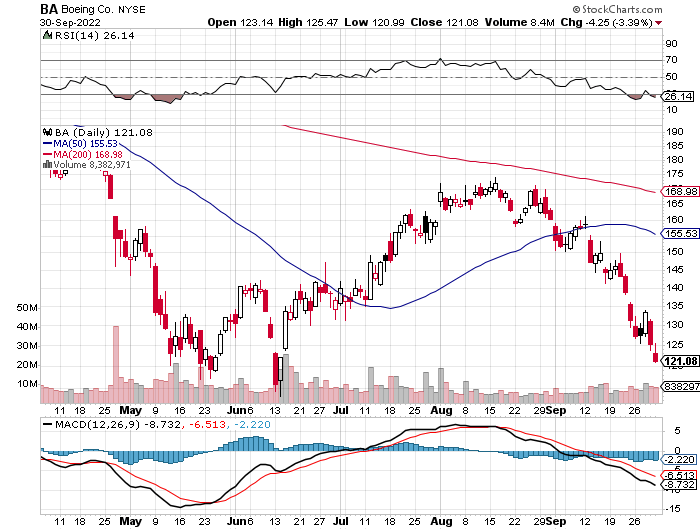

The Chart:

As the chart below shows, Boeing shares formed a bullish “double bottom” in May and June. The stock has been under pressure in the past couple of weeks as the market indexes are back to testing the lows hit earlier this year. It’s worth noting that Boeing shares have not retested the lows recently, and that is a sign of relative strength. One reason for improved strength is because Boeing continues to announce news that shows it is putting its problems in the past and it is receiving new orders. China Airlines just announced an order for twenty four 787 Dreamliner planes, and they mention that fuel efficiency was a big reason for the order. The shares are now oversold and if market sentiment improves, could be poised to trade back towards the 50-day moving average of about $155, and the 200-day moving average, which is around $168 per share.

StockCharts

Global Demand For Travel Is Expected To Triple By 2050, Plus Airlines Want New Planes Which Are Fuel-Efficient:

The future looks bright for Boeing, and major tailwinds will be population growth, increasing demand for travel and increasing demand for more fuel-efficient planes. A recent CNBC article points out that air travel is expected to triple by 2050. It also discusses the plans that airlines have to cut emissions, a big part of which is only possible by buying new planes since they are vastly more fuel efficient. Another huge positive for air travel in the coming years is the growing purchasing power in many emerging market countries. Many of these people have never taken a flight in their country much less outside of their country, and this should be part of what boosts air travel over the years. With these very positive long-term trends, it makes sense to be buying Boeing shares while it is facing short term concerns which appear to be fading in the next 12 to 18 months.

Earnings Could Revert Back To Nearly $20 Per Share And Take The Share Price Back To $400:

I think it is just a matter of time before Boeing sees its revenues, earnings and share price return to the historical highs. Boeing shares traded for about $450 in 2019. It earned $17.85 in diluted earnings per share in 2018, and had revenues of just over $101 billion that year. After a big drop due to Covid and Max issues, revenues are expected to be over $100 billion again in 2023. So revenues are rebounding back to pre-Covid and pre-Max issues. That’s why I think it is just a matter of time before the earnings per share and dividend are back as well. Share repurchases are likely to make a comeback in the future as well. I believe that in 2025, Boeing will get back to the share price and profit levels it enjoyed before the pandemic.

The Dividend Is Likely To Be Reinstated In a Couple Of Years And Could Provide a Generous Yield, If You Buy While The Shares Are Down:

It appears that Boeing is finally going to be able to deliver 787’s and other planes that they have been holding as inventory. This is going to lead to a huge improvement in the balance sheet since it can clear out inventory and use the proceeds to pay down debt. For example, the recent resumption of 787 deliveries is expected to generate about $9 billion in proceeds for Boeing. This along with the clearing of 737 Max planes will allow Boeing to pay down debt and position the company to resume paying dividends. I believe a dividend will return in the next year or two. The dividend payout was $8.22 per share in 2019, and it was suspended in 2020 due to Covid. Boeing will probably resume the dividend at a lower rate, but over time the payout of about $8 per share or more seems realistic. This would potentially give an investor who buys Boeing shares now at around $120, a yield of well over 6%, if the dividend is eventually restored to previous levels. Meanwhile, investors can sell call options to create their own dividends. This is an excellent source of income because the premiums are high.

Potential Downside Risks:

A deep recession is probably the biggest potential downside risk at this point, as it would take down nearly every stock. Recession fears and panic are already running high with the stock market right now and this can be seen just by looking at the Fear & Greed Index which is currently at extreme fear levels. This leads me to believe that a significant amount of recession risk is already priced into Boeing shares. It’s always possible for a stock to go down further however, so I suggest buying in stages and building a full position over months, or even years, by just buying some shares every month.

Management is another risk factor and it appears to be higher at Boeing than at some companies judging by missteps in the past. However, the company appears to have resolved multiple issues and it is now putting these in the past. This is evidenced by the fact that Boeing is moving forward with deliveries now that safety concerns have been addressed and it also recently settled with the SEC over claims that it misled investors about the 737 Max.

Summary:

Boeing has an incredibly wide moat and is part of a duopoly, which is a huge positive for the company and shareholders. The share price and investor confidence have been hit hard in the past couple of years due to the pandemic and safety concerns. But these issues are fading rapidly now. I think investors have to focus on what is on the horizon (and not the rear-view mirror) and they will see the likelihood of long-term aviation growth, the resumption of 737 Max and 787 plane deliveries in 2022. This will lead to an improved balanced sheet, and therefore it increases the likelihood of a dividend payout returning. The pandemic and safety issues appear to be one-time events that are over now. Boeing is expecting to report profits and strong cash flows in the coming quarters.

Investors should think of Boeing as a start-up that is not making a lot of profits now, but one that will see a big jump in profits in the coming years. For example, if I told you there was a company that would be slightly profitable in 2022, and then see earnings per share jump to about $8 in 2023 and then to around $14 per share for 2024, and about $18 for 2025, who wouldn’t want to get in on that?

Be the first to comment