putilich

Note: The company reports in USD and I will exclusively use USD financials in this article.

Software and SaaS companies of all types have seen mighty pullbacks in recent months and valuations returning to pre-Covid levels. The company I am going to talk about today is a very small SaaS company trading in Canada on the TSXV and the US OTC. It suffered with the sector and microcap stocks in general. The stock has been steadily declining 75% from its peak in 2021, just to rebound by more than tripling from its bottom after – what can now be clearly identified as the inflection point – management for the first time communicated the financial healthiness of the company and provided guidance in the inaugural call.

This company is Boardwalktech Software (OTCQB:BWLKF). The company just made the leap from shrinking legacy product revenue to growing ARR in the high double digits, while being close to breakeven and in no need of additional capital to pursue its plans. Locked in recurring revenue with exceptionally high gross margins of 90%+ and almost unlimited runway for growth within the established “Land and Expand” strategy make BWLKF not only a rather safe but also highly rewarding investment at current prices.

Business model and product

BWLKF offers a digital ledger technology that is specifically focused on extensive and complicated Excel spreadsheets and the unstructured data that comes with those. The digital ledger is the heart of it all and the core of all the products they are selling. This is no blockchain hype although years ago right after going public they mentioned blockchain in a PR. Importantly they aren’t trying to replace the spreadsheet but integrate the spreadsheet and allow it to be the core of the process that is built around it, as is the case in most enterprises today. Their technology works with the “atomic unit” of data in contrast to other databases with columns for example. So, people can keep their beloved spreadsheets but build and automate a process around them to make things more efficient rather than emailing etc to collaborate on them. It is worth highlighting that entire supply chains are often managed with unstructured Excel spreadsheets and multi-million-dollar decisions are being made based on them. An important feature is also that they provide security and an audit trail for every change. Their whole business model is built around the consumption, collaboration and visibility of unstructured data. This is a significant market gap because dealing with structured data is perfectly solved by the likes of Salesforce for example. Perhaps most importantly, it is a no code application. Not a single line of code has to be written by the user, or indeed by BWLKF when implementing their solution.

There is a lot of content in terms of case studies, white papers etc on their homepage demonstrating the significant ROI for their products.

The product is highly sticky; the only times they lost customers is when these were taken over or in the early days of the company. In that specific instance a rather small customer was acquired by another entity and the contract not renewed. In the CEO’s words “There is a couple of instances where we just have flat out blown it. […] That was in the early days […] Once we get in, it is very sticky”.

The split between SAAS and services is around 60/40 for new implementations and is improving over time.

Go to market

Boardwalk uses primarily a direct sales model with regional sales and sales development representatives, with sales reps on a standard back-end weighted commission. Boardwalk is also starting to grow its reseller partner sales program, which is especially important for the new vertical they have recently entered: financial services. For this industry, you need to know the right people to talk to, you need relationships and a certain footprint to even get through the front door. BWLKF manages that by partnering with the likes of HCL for example. The first major step in this direction was announced just recently, having entered a long-term contract with one of the world’s largest banking and financial services companies based in New York. This is the largest deal to date and according to management will grow over time per the contract with additional upside from discretionary and optional expansion. Even though that bank remains unnamed, there are many indications, such as indirect references from management, that this is likely Citigroup. It is almost always the case that customers remain unnamed at first and over time show up in the marketing material of BWLKF.

BWLKF also retains a subsidiary in India with good relationships, as lots of IT work is outsourced there by enterprises.

Each product is licensed individually. They always negotiate a worldwide licence in the beginning. They then solve one specific problem for a customer and can afterwards easily upsell with another product or in another division since they are already an approved vendor by IT at that point. An important aspect to watch will therefore be growth at their existing customers including Apple, Verizon, EY, Coca Cola, Mars etc.

The simplest products are available for as low as $50k (usually $50k-$150k) and can then be expanded, integration fees range from $10k for easy jobs (hours) to $50-100k (weeks). These smaller deals are usually not considered material and thus not separately announced.

As mentioned prior, BWLKF is partnering with larger names such as HCL (in itself a customer) to sell their solutions mostly to the financial services market. Partners do the lucrative (for them) integration work and provide name/reputation and relationships. BWLKF retains the recurring license revenue. This is a fantastically scalable approach, making BWLKF non-dependent on internal resources, but instead being able to leverage these partners both in terms of pedigree and professional services capacity. A wake-up call of sorts seems to have gripped the sector when Citi was fined $400M for noncompliance and people familiar with the industry indicated to me that as long as the OCC is keeping the pressure on banks with regards to compliance, BWLKF should have a much easier job approaching them. As one person working in compliance put it to me: “When my boss needs a solution for a compliance problem, budget is not even a question”.

For any one customer they need to convince both the sales and the IT department, the latter usually has the final decision. Management knows whom to approach and how to convince people even though the biggest competition is usually internal tools, how it has always been done. It is very important to note that because BWLKF does not replace Excel but simply builds on top of it, they have a much easier time getting clients to adopt the product. The sales cycle strongly varies depending on size and complexity of deals. But especially for major clients it has significantly shortened to 6-9 months as management has indicated to me.

Management

Quality of management is especially important for microcaps. With Boardwalktech you would expect to find these people in billion dollar companies. Andrew Duncan Chief Executive Officer and Chairman of the Board has extensive experience, this being his 5th company in enterprise software, two of them being highly successful and the others being perhaps even more valuable experiences. “I hope, someday, we can be just like Salesforce.com” is a quote from him I have always kept in mind. It is crystal clear that Duncan knows exactly how to do enterprise sales and all the difficulties in proper execution.

Charlie Glavin the CFO has over 25 years of progressive experience, both on the corporate and investment side. For 12 years he was an analyst for Credit Suisse, Needham, and ThinkEquity Partners, so it is clear that he knows how investors think and what they expect from a company like Boardwalk. He also has a strong understanding as to the value of the platform and enjoys many contacts in finance that are able to support the company. Every single member of management and the board has decades of (the right) experience.

I would also highlight that from my own experience of talking to CEO and CFO, they have always been very transparent and forthright, both when it came to positive and negative developments. While they certainly have grand plans for the company, they tend to be realistic at the same time and strongly focus on underpromising and overdelivering.

Competition

In a sense, standard corporate inertia is the biggest competitor. There is naturally plenty of competition for digitizing specific spreadsheet applications for example, but this is an expensive and time-consuming task, while BWLKF offers so much more. Why not just use Google Sheets or Smartsheet? With compliance and security, it is not possible to work with 100s of users, so that solution is only good for hobby activities. Large enterprises would never likely bring critical data or functions simply on a Google Sheet. Integration work also only takes 2-3 weeks and as much in testing for large complicated spreadsheets, much shorter than specific low/no code applications, which can take 6-8 months to implement (for example: EY took from signing the contract to going live with clients about 6 weeks; something similar could have taken 20-40 SAP programmers 12 months). BWLKF can without any problem and quickly pull data from the likes of SAP, Oracle, Salesfore.com or ServiceNow. Finally, competitors allow less freedom eg in terms of data input or flexibility of the application and BWLKF preserves the Excel interface. In fact, BWLKF does not write or change any code.

In practice, BWLKF simply does not see much competition when they approach clients, a result of the niche they have successfully established for themselves. To the contrary, they often replace established players with their innovative solutions.

Opportunity and valuation

The TAM is literally unlimited. Wherever MS Excel is used (1.3B users) and unstructured data is prevalent (ie everywhere) BWLKF has a potential opportunity in front of itself. Of course, this should be taken with a grain of salt, but what is clear is that thousands of companies are heavily reliant on MS Excel for critical applications. The sectors immediately in focus per latest call:

Well, beyond the financial services industry, which we believe is key for our growth going forward, we are very focused on CPG, very focused on anything that is manufacturing and that has inventory risk of which there’s a lot of activity right now. And electronic components, chip manufacturers

The current pipeline is around USD 5-6M with 60% of it SAAS and 40% professional services.

Importantly this is only revenue in year 1 so does not reflect NPV accurately. In addition, the guidance calls for $7M revenue this year and one would assume that there is plenty of room for upside surprises considering that guidance assumes no closing of additional deals since issuance.

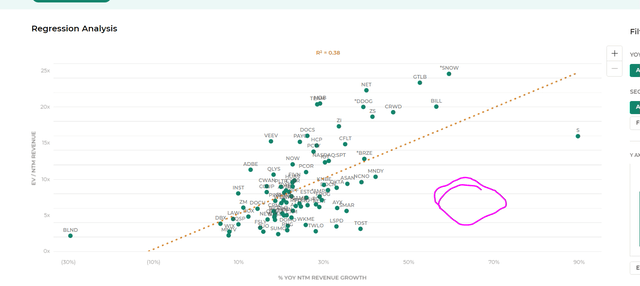

Based on that the stock trades at roughly 4.5 times EV/Sales. In my view, this multiple is clearly too low compared to publicly trades peers. The rich data set Meritech Capital suggests a more suitable multiple based on revenue growth and gross margins would be 9x. So there is some immediate upside based on that. Current ARR in excess of $5M makes for another very cheap multiple of 6-7 times.

We are here. (Meritech Capital)

Revenue from recurring license contracts was up 31% in Q4-FY22; while revenue from contracts signed since 2018 is now 95% of revenue (100% retention), growing at 46% CAGR since 2018

But over time BWLKF could easily get to $25M, $50M maybe $100M revenue, considering the goal of $1M per customer in ARR based on 10-15 applications per customer. “We estimate that there are a hundred mission critical applications that Boardwalk could in a typical enterprise be able to address”

Considering the substantial pipeline, the fact that the number of reseller partners is steadily increasing, the shortening sales cycle, heightened reputation from recent landmark deals, and improved sales methods, it is no stretch to assume the current growth rate can be sustained for the immediate future and beyond due to the large runway for growth. My minimum return expectations would therefore be in the 40% CAGR range without any multiple expansion.

Risks

The company needs to execute. The biggest risk is failure to grow sales and attract new clients. I mentioned corporate inertia before but management has repeatedly highlighted this as one of the biggest challenges in closing deals. On the other hand, superior ROI, immense time savings and regulatory pressure are good arguments to overcome any sort of inertia.

Perhaps the best way to illustrate Boardwalktech’s value add is a recent comment from the senior director at this page, when she said, what used to take me two days now takes me 15 minutes with the Boardwalk application

The additional exposure through resellers and reputational gains from landing large deals like with the recent major US bank should help as well.

While the company is not profitable just yet, there is absolutely no need to raise any capital, as management has repeatedly clarified. Of course this does not mean they wouldn’t consider a raise at higher prices if they had good use for the cash, which in the CFO’s thinking delivers a 5X ROI at least. Further, the revenue is mostly recurring, locked in and on auto renewal. This means that there is very low risk of sales actually declining and putting the financial health of the company in jeopardy.

The technology risk is completely behind the company and while they don’t break out R&D separately it has been about 20-25% of sales, though will shrink in % terms. They don’t need to do a lot on that front but of course keep innovating and rolling out new tools for customers. Especially though, and BWLKF has made good progress here already, the company needs to continue improving the onboarding process so that the sales cycle can keep shortening.

Competition is a very low risk, the digital ledger is patented (see also here)and so far there are no products offering the same comprehensive capabilities and easy implementation. Also their solution is not only better and simpler but much faster than the competition (implementation times of 6 weeks versus 6+ months). Yet again, the company is small enough and the opportunity large enough that competition, in particular within its niche, should not be an issue for Boardwalktech.

The stock BWLKF is trading on the OTC and is extremely illiquid. I would recommend trading on the Canadian TSXV exchange under the symbol BWLK, which often provides higher volumes although even there it is not easy to build a large position. Nevertheless, liquidity has improved in recent months, in particular through DTC eligibility. It should be noted that management has plans to get to the NASDAQ once the business has more scale.

There appears to be a warrant overhang with millions of warrants due for expiry by January. While this might look like a risk at first and could pressure the stock as the warrant holders sell their shares, readers should consider the following. Warrant exercise will bring a good amount of cash into the company’s coffers, which it will be able to put to good use. From an EV standpoint exercise is actually not even dilutive. Further, if I was a warrant holder, I would only exercise to sell if the stock was materially above the strike price, otherwise I would just walk away. Not a bad outcome if the stock were to be materially higher in a few months! On the other hand, exercising warrants is also a big commitment and could be seen as a sign of trust in management and faith in the company’s future and prospects. After all, exercise is an easy way to get exposure to millions of shares without driving up the stock price.

Summary

In summary, I am extremely excited about the future of Boardwalk, the company and BWLKF, the stock. After the company’s financial health has been confirmed (no raise needed) with sufficient cash while operating at breakeven, and locked in recurring revenue and sales growth – this company has all the characteristics of not only a relatively safe investment but also a potential multibagger. Boardwalk has extremely high margins, a scalable SaaS business model, high growth with exceptionally long runway, a supportive regulatory environment, high incremental return on investment and on top of all, a management team that can pull it off.

Be the first to comment