BalkansCat

Before the Q3 release, we concluded that:

- After our ECB rate hike assessment, we were forecasting an upside on BNP Paribas’ (OTCQX:BNPQY) (OTCQX:BNPQF) NII sensitivity with clear growth in the earning trajectory

- Wall Street consensus was not forecasting the French bank business plan

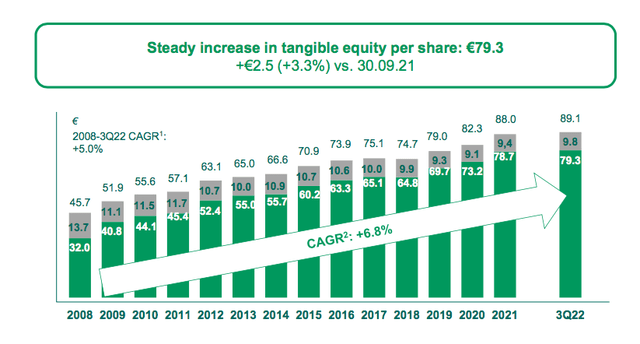

- On the valuation side, BNP Paribas was scoring at the highest ranking in yield (including dividends and buybacks) and at the lowest outcome based on Tangible Book Value (ex-SocGen).

Our buy case recap was also based on seven additional macro-to-micro reasons. You can have a look at our previous publication called “we reiterate our buy rating on BNP Paribas“. So, today we are back to comment on the quarterly accounts.

Q3 results

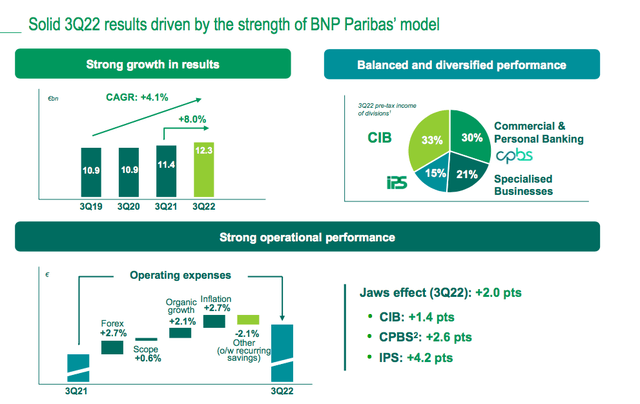

BNP Paribas recorded higher-than-expected revenues and profits in the third quarter of 2022, benefiting, like other European banks, from the increase in interest rates. The French giant closed the July-September period with a net profit up by 10.3% compared to the same period of 2021 which stood at €2.76 billion. According to analyst consensus provided by FactSet, this result beat expectations by almost 20%. Revenues increased by 8% to €12.3 billion, above the consensus expectations of €12 billion, of which €5.721 billion of net interest income, up by +9.6%, and commissions for a total consideration of €2.5 billion, down by 1.2%. Despite an unfavorable market environment, turnover from the corporate and institutional banking segment, which brings together investment banking operations, increased by 5.9% to €3.7 billion, thanks to the global markets division. Looking at the nine months aggregate, top-line sales increased by 9.4%o to €38.31 billion and net profit amounted to €8 billion. However, we should note that the bank’s cost of risk increased by 34% over the year, reaching €947 million, including a one-off impact of €204 million from the suspension of mortgages in Poland. At the end of the quarter, the bank RoTE stood at 11.4% with a Common Equity Tier 1 ratio of 12.1%. The solvency ratio was 10 basis points lower on a quarterly basis and BNP reiterated its expectation of an €11 billion capital benefit from the Bank of the West’s disposal.

Conclusion and Valuation

After having analyzed the quarterly report, our internal team confirms the buy rating with a target price of €72 per share. The company once again demonstrated better-than-expected profits in all divisions, in particular at the commercial banking level as well as at the corporate investment arm. We are not surprised to see a positive reaction from the market given the solid revenue performance and the bottom line. Our buy rating is confirmed and is also supported by a steady growth of its tangible book value.

Be the first to comment