AaronAmat/iStock via Getty Images

Is the United States government generating another blunder to sit on top of an earlier blunder?

The earlier blunder?

Well, the Wall Street Journal claims that the Federal Reserve, opening up the spigots in 2020 and 2021 to fight the possibility of an economic crisis, generated an inflation blunder that has not been corrected at this date.

The Federal Reserve…and other central banks…let “policy run amok” and then dismissed the signs of emerging inflation as “transitory.”

When the inflation it was facing was recognized as not being “transitory”, the Fed moved to raise its policy rate of interest and reduce the size of its securities portfolio.

We are in the early stages of this fight.

However, the Wall Street Journal argues, the government is now making another blunder.

The government is expanding its fiscal stimulus to extremes, just as the monetary authorities, at the earlier date, let its “policy run amok.”

Greg Ip picks up this argument in his column in the Wall Street Journal and takes it a step further:

“While President Biden touts the Inflation Reduction Act, which lowers deficits by $240 billion over a decade, he has also signed into law increased spending on veterans benefits, infrastructure, and semiconductors, while taking executive action that vastly expand food stamp and Obamacare benefits and cancel student debt worth $400 billion to $1.0 trillion.”

Mr. Ip quotes the Committee for a Responsible Federal Budget, which estimates that government deficits will be increased by $4.8 trillion.

The justification for these increases?

Well, all this borrowing can take place because the real cost of the borrowing will be around zero for the next decade.

The argument is that the real growth rates of the economy will exceed the real cost of borrowing…the nominal rate minus inflation…thus justifying the spending plans.

What proof is given?

Well, for the decade before the pandemic real rates were below the economy’s growth rate.

So, let’s do it again.

Massive Deficits

Well, we see that a new approach to deficits came about in the 2000s.

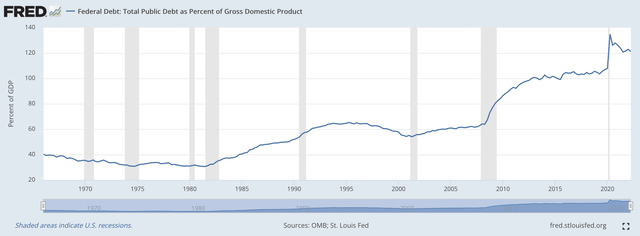

Take a look at this chart, it gives us a broad perspective.

Federal Deficit as a Percent of GDP (Federal Reserve)

We see that the federal deficit as a percent of GDP jumped during the time of the Great Recession.

Then the percentage rate jumped again during the time of the Covid-19 pandemic.

In the Great Recession, Ben Bernanke became the chairman of the Board of Governors of the Federal Reserve System.

Mr. Bernanke proposed a new strategy for the Federal Reserve to get out of the recession and produce a sustained period of economic growth.

The idea was for the Fed to generate rising stock prices that would create a wealth effect for consumers that would lead to accelerated consumer spending that would drive the economic recovery.

Mr. Bernanke’s plan was very successful

The economy produced the longest economic recovery for the United States in the period following World War II.

Consumer price inflation remained very low. The compounded annual rate of price increase during this time period was 2.3 percent.

However, during this time period there were a substantial number of asset price bubbles.

As I have shown in many different places over the past ten years, the government stimulus monies moved into asset prices rather than into consumer spending. As a consequence, asset prices could “bubble” while consumer price increases remained relatively low and relatively steady.

My research shows that this seems to be a logically transition built up over many years beginning in the 1960s. The economic policy that began in that period was based upon the Keynesian economics at the time and the statistical relationship that was discovered between unemployment and inflation, titled “the Phillips Curve.”

Furthermore, since the stimulus monies were flowing into assets rather than physical investment, the growth in labor productivity remained very low during this time period, after coming in below 1.0 percent.

This accounted for the very slow growth rate of real GDP during the time period, a compound rate of about 2.2 percent.

Consumer price inflation was low during this period of time but the economic recovery following the Great Recession was also the slowest since the end of World War II.

But, this was the picture of the economy that the government was working with when the Covid-19 pandemic hit.

Did Things Change?

The Federal Reserve reacted to the spread of the virus and pumped billions of dollars into the financial system and the economy.

The expectation seems to be that the economy would return to a growth rate similar to the one just experienced in the previous period of recovery, and price inflation would remain low.

The reason for this was again attributed to the fact that the “real rate of interest” was below the growth rate of the economy, just like it was in the 2010’s.

So, we got the Federal Reserve’s stimulus package.

Now, since there appear to be many things that the politicians want to achieve, and it appears that the “real rate of interest” will remain below the growth rate of the economy, that the federal government could follow up on the Fed and create substantial new budget deficits.

So, we got the Biden administration proposals for fiscal stimulus.

And, that is where we are today.

But, are things still the way they were previous to the shock of the Covid-19 pandemic?

Moving Forward

Can the Federal Reserve move forward and “do what it needs to do” to combat inflation, while at the same see the federal government create all the deficit spending it is doing, and so some success in reducing inflation?

The two policy efforts seem to fight one another.

Is this just adding more situations of disequilibrium to the economy?

Is the government its own worst enemy?

Be the first to comment