hapabapa

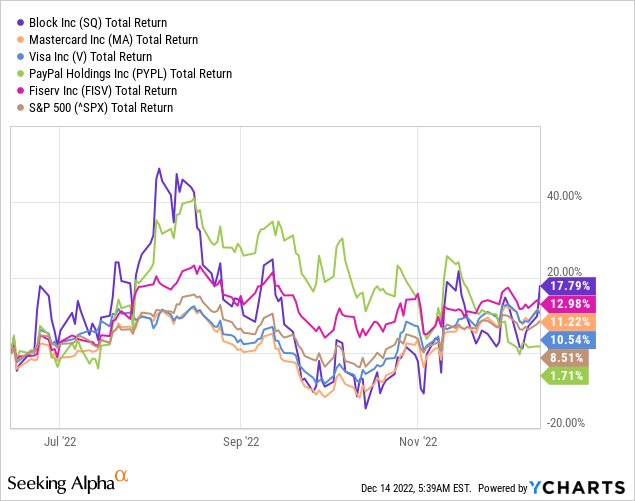

Optimism around Block (NYSE:NYSE:SQ) seems to have returned as of late. The share price is up nearly 18% in a matter of just 6 months since I laid out 3 major issues with the business.

This has made Block one of the best-performing stock in the digital payments space over the period.

But before concluding that the market got irrational at punishing Block’s share price in the first place and that it is now on track to recover the huge losses since late 2021, you should consider risk.

Over this brief 6-month period, Block actually underperformed when adjusted for risk. During these months, the broader market returned nearly 9% as we saw in the graph above and after taking into account the company’s beta of 2.59, it appears that SQ actually delivered sub-par results.

Seeking Alpha

prepared by the author, using data from Seeking Alpha

At the same time, companies like Visa (V), Mastercard (MA) and Fiserv (FISV) continued to capitalize on the post-pandemic recovery and thus outperformed the market.

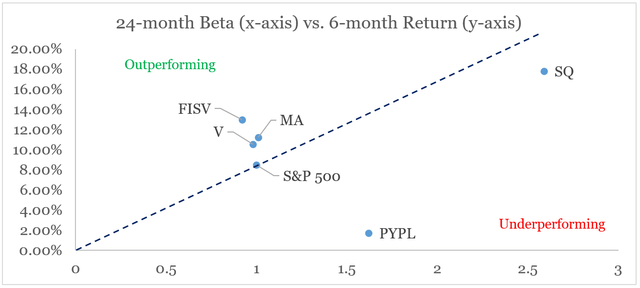

Not A Growth Story Anymore

As I noted back in June, one major issue with Block is its fading topline growth. That is why, in order to support its valuation, the management had to come up with a plan for expanding into new segments where it could show high revenue growth at least in the short-run.

This brought the expansion into cryptocurrencies and namely bitcoin which managed to show the exponential topline growth that investors were craving.

prepared by the author, using data from SEC Filings

For anyone who bothers to look at financial statements notes, however, it wasn’t very hard to conclude that there are issues associated with reporting bitcoin operations on a gross basis.

As if this is not enough, but now it appears that fiscal year 2022 will actually show flat to declining revenues on year-on-year basis.

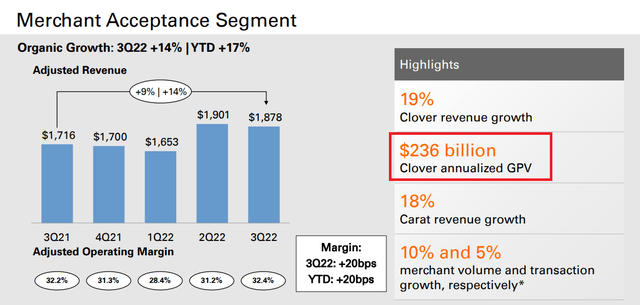

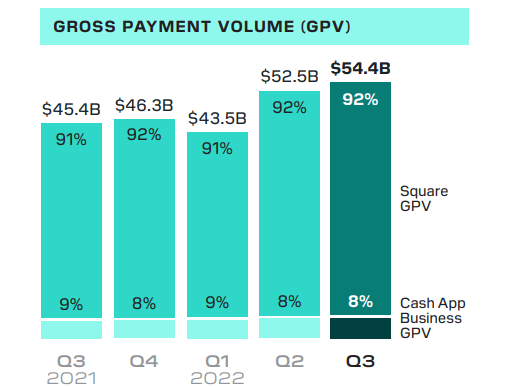

Even if we ignore the highly volatile bitcoin and cryptocurrency related stuff, Square – the backbone of the company, seems to be experiencing a slowdown in gross payment volume with an estimated 16% growth in October, compared to 20% in the third quarter.

Looking at recent volume trends, we estimate Square GPV in October was up 16% year-over-year compared to 20% growth in the third quarter (…)

Source: Block Q3 2022 Earnings Transcript

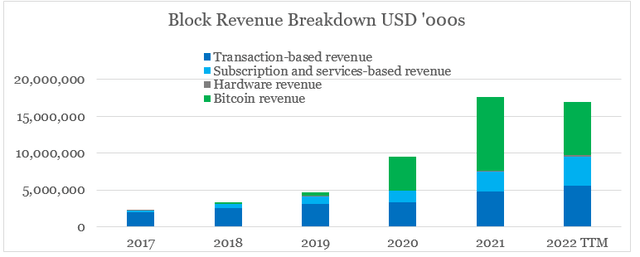

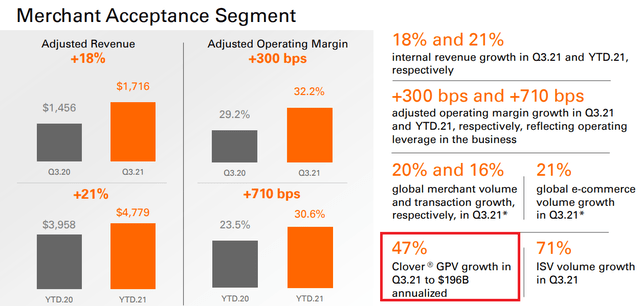

While seasonality in spending could help explain this, we should not forget that a 20% growth in GPV is hardly anything unique about Square. A major peer of the service – Clover, which is owned by Fiserv, has registered similar growth rate in GPV from $196bn on an annualized basis in Q3 2021 to $236bn on an annualized basis in Q3 2022.

Fiserv Investor Presentation

Fiserv Investor Presentation

Clover has also surpassed Square in terms of payment volumes which raises some important questions regarding the competitive advantages of Block’s core asset.

Block Shareholder Letter

Sacrificing Long-Term Investments

While Visa, Mastercard and Fiserv all have highly profitable legacy businesses that could act as a cushion during hard times, Block does not have this advantage. That is why, as sentiment within equity markets cools off, the pressure to deliver profits increases.

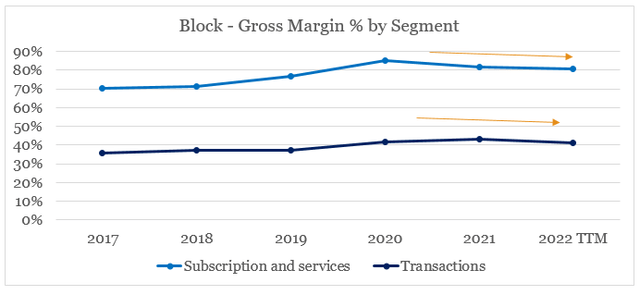

Unfortunately, it appears that achieving high and sustainable profitability would be easier said than done in Block’s case. Following the large jump during the peak of the pandemic in 2020, Block’s gross margins in two of its largest business segments is now slowly declining.

prepared by the author, using data from SEC Filings

The management did not appear very optimistic during the last conference call either as it now expects consistent performance in the last quarter.

We expect fourth quarter gross profit growth to remain relatively consistent with third quarter growth rates on both a year-over-year and three-year CAGR basis at the total company level.

Source: Block Q3 2022 Earnings Transcript

The prospects in front of Square business unit were also not very encouraging, even after excluding the recently acquired Buy Now Pay Later (BNPL) platform.

For Square, we expect the year-over-year growth rate for gross profit excluding our BNPL platform to moderate in the fourth quarter compared to the third quarter. Given we are now lapping $59 million of non-recurring PPP gross profit recognized in the fourth quarter of 2021.

Source: Block Q3 2022 Earnings Transcript

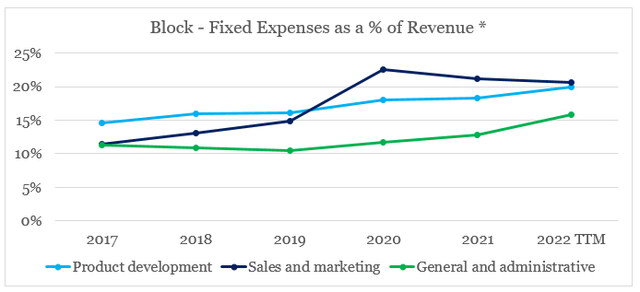

Moving down the income statement onto fixed expenses and this start to get ugly, as fixed costs relative to sales continue to skyrocket.

prepared by the author, using data from SEC Filings

* excluding revenue from Bitcoin operations

The one positive has been the declining share of sales and marketing expenses, but that alone is not enough to fully offset the increase in product development and general & administrative expenses.

In order to reduce current losses, Block’s management indicated that they will moderate their hiring and will also scale back on brand investment activities in 2023.

Headcount makes up the largest driving — driver of our expense base. In 2023, we expect to significantly moderate our pace of hiring compared to recent years, which will benefit our financial results on a lag with greater leverage on headcount costs expected in the back half of 2023 and into 2024.

Second, sales and marketing. In 2023, we intend on pulling back on lower ROI, more experimental areas, including brand and awareness spend across both our Square and Cash App ecosystems

Source: Block Q3 2022 Earnings Transcript

While on paper, this could sound as a step in the right direction, in reality these reductions will provide only short-term results. Reducing hiring and brand investment activities is not a recipe for sustainable long-term growth in both revenues and profits.

Future Share Price Drivers

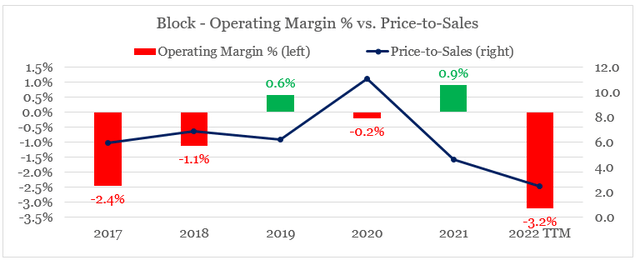

Given that operating margins reached a new low over the past 12-month period and topline growth prospects have worsened, Block’s price-to-sale multiple has reached a new low of around 2.3x.

prepared by the author, using data from SEC Filings

This has now caused management to pivot in its strategy from high growth at any price, to slower growth but with the intention of achieving profitability.

As you note, given the significant growth of our business, we’ve grown our investments over the past few years to create products and marketing engines that help us drive that top line growth paired with profitable unit economics across both of our ecosystems. Our preliminary 2023 plans really significantly moderate those expense — that expense growth as we focus on balancing growth and profitability.

Source: Block Q3 2022 Earnings Transcript

As we saw above, however, achieving high and sustainable profitability is highly uncertain. From declining gross margins to the company already scaling down of major expenses.

The macroeconomic environment is also turning from highly supportive during the pandemic, to being a major obstacle as probability of a recession in 2023 increases and real disposable income falls down.

FRED

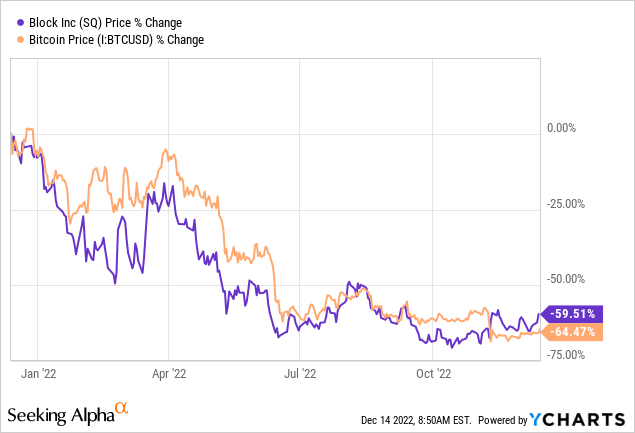

Expanding into high risk areas, such as buy now pay later and cryptocurrencies, is yet another headwind. ThusBlock’s share price has become quite correlated to bitcoin over the past year as opposed to being driven by other business fundamentals.

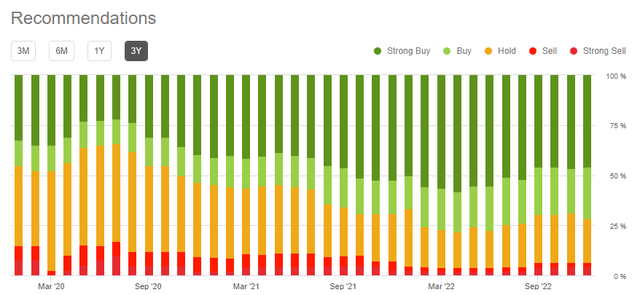

Last but not least, analysts’ optimism around the stock has remained high even as Block lost nearly 60% of its value over the past year.

Seeking Alpha

While this could be seen as a positive for anyone relying heavily on these ratings, it is also a major risk provided that Block fails to deliver on its promise of high profitability.

Conclusion

As Block share price rebounds from its lows and the company trades at roughly two times earnings, investors’ optimism is once again running high on the notion that the company is now a bargain. In reality, however, the share price was largely driven by the extremely loose monetary policy and tailwinds associated with the pandemic. Now that the dust has settled, the business model of Block is in the spotlight and it appears ill-positioned. Topline growth is slowing down, while sustainable GAAP profitability remains elusive. This will likely push Block’s management to cut expenses even more aggressively as we enter into the next fiscal year. At the same time competition is intensifying and the company’s share price is at risk even as it now trades at only 2 and a half times sales.

Be the first to comment