Serenethos/iStock Editorial via Getty Images

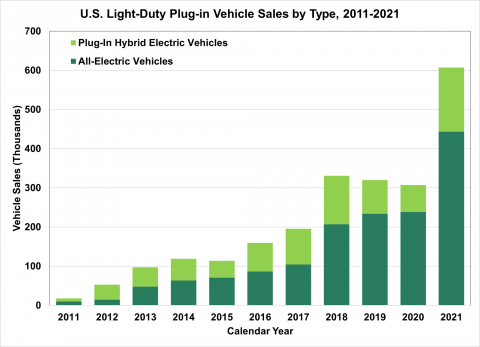

Blink Charging (NASDAQ:BLNK) closed out its fiscal 2021 financial year with a bang as revenue finished up a staggering 236% from the prior year. The Florida-based electric vehicle charging company continues to realize the growing adoption of its charging stations on the back of rising EV penetration. Indeed, sales of all-electric vehicles and plug-in hybrid electric vehicles in the United States nearly doubled from 308,000 in 2020 to 608,000 in 2021.

Department of Energy

This long-term shift is driven by a number of factors including state and federal support for consumer EV purchases. The rising cost of gas at stations has also had a positive effect on sales and will likely see consumer EV sales in the United States more than double in 2022. With a rising number of new EV owners being created each year and with the structural shift to electric consumer transport still in very early stages, ancillary charging companies like Blink Charging are likely to maintain the pace of their revenue growth for the foreseeable future. To highlight just how early this is, 2021 saw only 4% of new cars sold in the United States being all-electric. Hence, the growth ahead is likely to be dramatic.

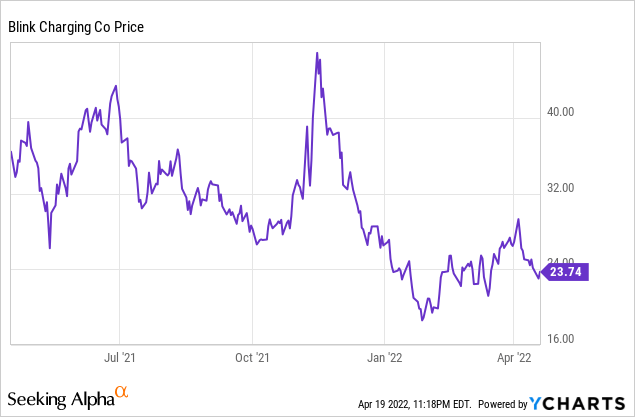

The market seemingly does not see this bright future ahead with Blink’s common shares down 51.6% from its 52-week high.

What does this mean for current and prospective shareholders? Not much. The previous valuation with shares switching hands at just under $50 per share was at a nosebleed 268x forward revenue multiple. This prompted me to write my first article on the company where I described it as the poster boy for peak electric vehicle euphoria.

Strong Revenue Ramp But Profitability Worsens

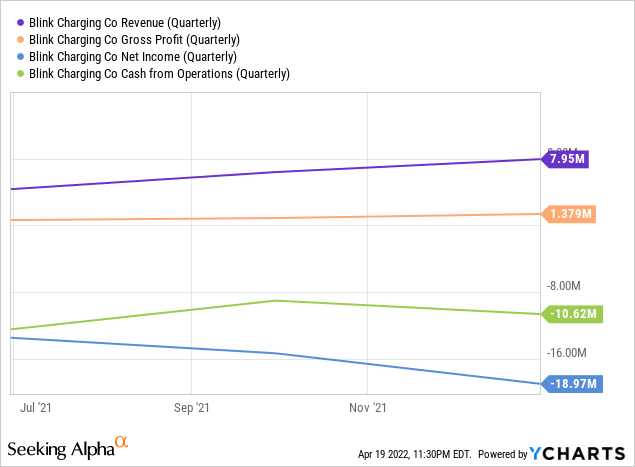

Zooming out to view Blink’s revenue growth on a quarterly and annual basis illustrates an upward sloping ramp. The company designs and operates L2 EV charging stations across the US. It also manufactures and retails its own single-family EV charging stations.

Hence, it firmly stands to ride the growing EV revolution across the United States as more EVs will mean an increase in demand for charging solutions. It’s that simple. This macro backdrop saw Blink realize fiscal 2021 revenue of $20.9 million, up 236% from the previous year.

Revenue for the fourth quarter at $7.95 million comprised almost 40% of total revenue for the year and was up 24% sequentially compared to the third quarter. Blink’s rate of growth is picking up due to the previously mentioned winds of change blowing over the consumer and business transportation markets.

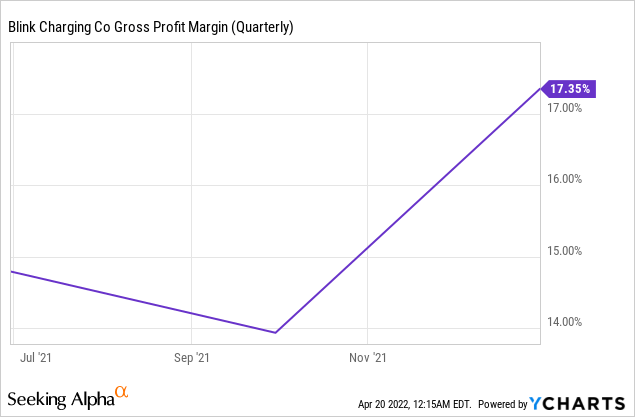

Gross profit margins at 17.35% saw Blink bring in gross profits of $1.38 million during the quarter. This was a marked improvement from the third quarter when margins were more than 335 basis points lower.

The overall economics of EV charging stations as a stand-alone business has been questioned on the grounds of the extent to which simply connecting to a city’s existing power supply and reselling the electricity to EV owners can be a profitable endeavour. So whilst Product Sales at $5.7 million comprised 71.7% of total revenue, Service Revenues at $1.8 million comprised 22.8% of total revenues. This latter segment has been flagged by bears as unlikely to have a positive impact on earnings in the near future and consists of charging service revenues, network fees, and ridesharing service revenues.

Blink’s cash from operations worsened to $10.62 million during the quarter and was an increase in cash burn on both a year-over-year and sequential basis. The most immediate effect of this was a contribution to a near $12 million decrease in cash and equivalents to end the quarter with $174.8 million. This provides ample runway at the present rate of burn.

Whilst the company did not provide fiscal 2022 revenue I would expect this to not be lower than $50 million. Hence, with Blink now trading on a market cap of $1.01 billion, the company’s forward 1-year revenue multiple stands at 20x.

A Critical Component Of The EV Shift

Charging infrastructure is a critical component of the EV revolution. So the continued rise in new EV sales will continue to drive Blink’s revenue ramp higher. The company’s current valuation is now less than 10% of what it was at its peak. 2022 alone will see a greatly expanded number of new all-electric EVs hit the market including that of recent upstarts like Fisker (FSR).

Critically, this growing nucleus of EV owners forms the bullish case for Blink. As more states institute deadlines for the phasing out of ICE vehicles, I would expect revenue growth to be maintained at a staggering rate for the foreseeable future. The future is electric and Blink is enabling this one charge at a time.

Be the first to comment