Portra/E+ via Getty Images

Blade Air Mobility, Inc. (NASDAQ:BLDE) is my favorite cheap eVTOL (electric vertical take-off and landing) stock that could soar to the moon in 2024.

The urban air mobility movement is still in its infancy as eVTOL makers such as Joby Aviation (JOBY), Lilium (LILM), Vertical Aerospace (EVTL), and Archer Aviation (ACHR) work diligently on electric aircrafts.

While most eVTOL companies are currently generating zero revenue, Blade is one of the bright spots with an early jumpstart on the industry.

I rarely see cheap growth stocks with as much as opportunity as Blade has. This could be one of the best buys of the decade and now BLDE shares are trading at just around $4.

In this article, I’ll provide an overview of Blade and share why I’m so bullish on this company.

Blade’s Massive Revenue Growth

Blade was founded in 2014 by Robert Wiesenthal, who wanted to build an air mobility platform that would help ease traffic within major cities.

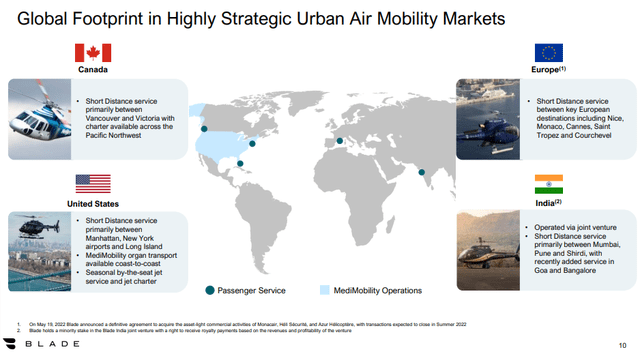

Commuters can book a Blade flight on the company’s app in the United States, Canada, Europe, and India.

Blade’s Global Footprint (blade.com)

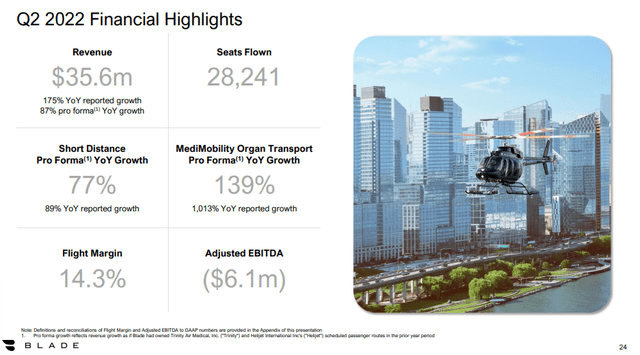

The company generated $37.5 million in Q2 2022 revenue (Up 175%) and net income hit $8.4 million for the quarter.

Blade Q2 2022 results (blade.com)

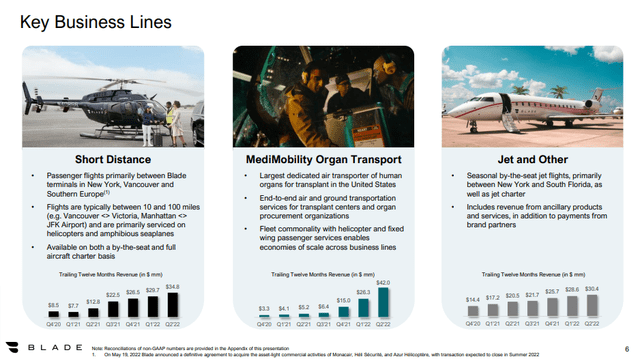

Blade’s business model is made up of 3 different categories: short distance flights, organ transports, and jet flights.

Blade Business Overview (blade.com)

Here’s a break of Q2 2022 performance by revenue source:

- Short Distance Flights: Q2 2022 revenue increased 89% to $11 million

- MediMobility Organ Transport: Q2 2022 revenue increased 1,013% to $17.2 million

- Jet Flights: Q2 2022 Revenue increased 32% to $7.4 million.

Short Distance flights represents the largest revenue opportunity as Blade scales its UAM (urban air mobility) network and adds more customers. The recent acquisition of Heljet will help increase revenue, plus I believe more people will use Blade’s platform in the future.

Blade’s MediMobility Organ Transport division, which is the largest dedicated air transporter of human organs for transplant in the United States, continues to grow its client base and is now serving a total of 59 transplant centers and organ procurement organizations across America.

Jet flight revenue has increased alongside growing demand as more people travel due to lower COVID-19 risk + eased travel restrictions.

My Bullish Take on Blade

Traffic congestion is a huge problem. Every major city in the world deals with too many cars on the road, making travel a headache for many commuters.

What if you could save countless hours by skipping traffic and reach your destination in a fraction of the time?

The Late NBA Legend Kobe Bryant was a huge fan of UAM and regularly flew in helicopters to beat LA”s traffic jams.

He was well ahead of his time and I believe more commuters will use urban aircrafts in the future.

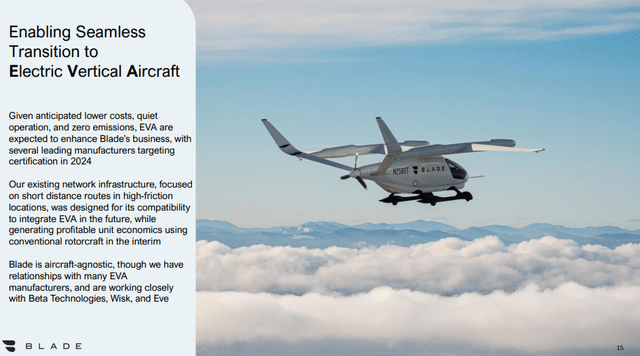

Right now, Blade doesn’t have any eVTOLs in its fleet because most eVTOL makers have yet to launch electric aircrafts. The company plans to add electric aircrafts in 2024 as the technology improves.

Blade eVTOL transition (blade.com)

BLDE stock trades at a price to sales ratio of 4, the lowest point I’ve ever seen since the company went public.

With so much fear in the markets due to rising interest rates, I’m buying as many BLDE shares as I can get my hands on in anticipation of 2024’s eVTOL gold rush.

Blade’s Cameo in Uncut Gems

A Blade helicopter was featured in the 2019 movie “Uncut Gems” featuring Adam Sandler and NBA Hall of Famer Kevin Garnett.

During the scene, Adam Sandler sends his girlfriend, Julia, to place a parlay bet on Kevin Garnett at a New York casino. In order to save time and avoid traffic, she takes a Blade aircraft directly to the casino and places the bet just seconds before the betting closes.

Investing in small companies that have been featured in films could make you a fortune if the past repeats itself.

A Tesla roadster made an appearance in the 2010 movie “Little Fockers” in 2010. Owen Wilson’s character referred to Tesla as “ecofriendly.”

Apple (AAPL) was mentioned in the 1994 movie “Forrest Gump.” Tom Hank’s character Forrest Gump received a letter from business partner Lieutenant Dan about an investment as “some fruit company.”

These examples will resonate with me forever, and I’m still kicking myself for not paying close attention to Hollywood’s foreshadowing tactics.

I’m not saying that Blade will become as successful as Apple or Tesla, but Blade shares several similarities to the two aforementioned companies.

Blade is a short 5 character brand name in a brand new industry that could change people’s lives forever.

Urban Air Mobility will save billions of hours of time wasted in traffic and unlock a whole new era of productivity for human beings.

Risk Factors

Blade is still a small company in a tiny niche market. It’s possible that several things could delay the company’s growth.

- Blade could lose revenue to other competitors such as Uber (UBER) who plan to enter the urban air mobility market.

- The company may get involved with publicized helicopter accidents or other issues that could deter commuters from using the platform.

- A larger company may buy Blade and take the company private at a premium. This would limit the potential upside for Blade shareholders.

- I’m overestimating how fast the UAM will grow and it could be a slow grind to higher revenue over the long run.

Conclusion

Blade is a company that changes lives. Commuters will save so much time by using the air instead of the ground for transportation.

Airline stocks are traditionally bad investments due to fuel costs and lack of ever increasing demand. Most commuters don’t plan on flying to another city or country but everyone needs to get around the city.

Blade’s focus on short distance trips could send BLDE shares to the moon over the next few years. At just around $4 per share, Blade is arguably my #1 stock to buy right now.

Be the first to comment