franckreporter/E+ via Getty Images

These are tough times for investors looking for fixed-income investments that pay enough interest to compensate for the current high inflation. One of the best alternatives we can find is Blackstone Mortgage Trust (NYSE:BXMT) which offers a very attractive ~8% dividend yield, and should have its earnings increase with rising rates. This compares quite favorably with the ~3% interest that investment grade bonds pay, or the ~5% that junk bonds pay, which also come with significant credit risk. We very much prefer a fixed-income alternative like BXMT, with its low loan-to-value (LTV) of ~64%, and position to benefit from rising interest rates.

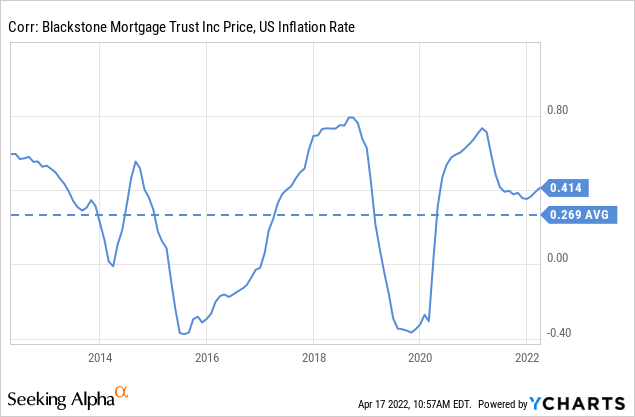

Inflation Tailwinds

In general the price of BXMT tends to increase more during rising inflation periods than during inflation cooling off periods, as can be seen by the average positive correlation of BXMT’s price and the US inflation rate.

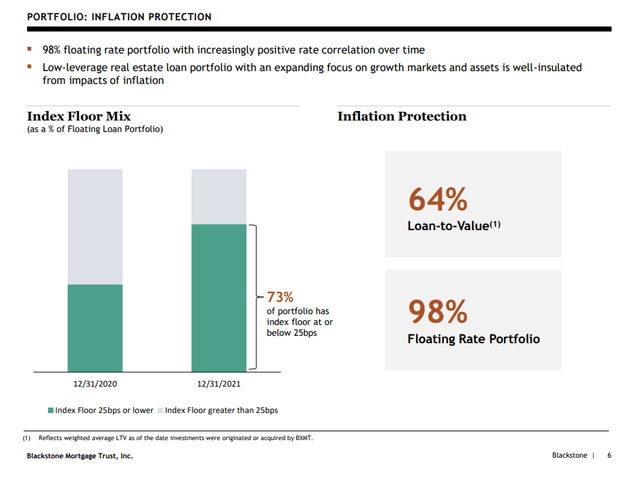

About 98% of the portfolio is floating rate, although there is still a portion of it that is operating at the index floor, so it might take a few rate increases before the full-benefit of floating rate portfolio become apparent in BXMT’s results.

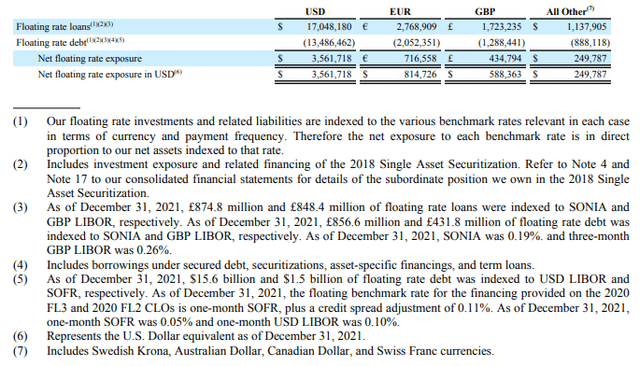

To get a better idea of how much BXMT can benefit from rate increases as inflation rises we can look at its net floating rate exposure. This can be found in the annual report in the table show below:

As can be seen, the biggest floating rate debt exposure by far is in USD. From the ~$3.5 billion in exposure we can deduce that an increase for example from 1% FED funds rate to 2%, would mean ~$35 million added to the bottom line of the company. With ~168 million shares outstanding that would add ~0.21 cents per share to the EPS. In other words, for every 1% increase in rates investors can expect roughly an 8% increase in earnings all else equal.

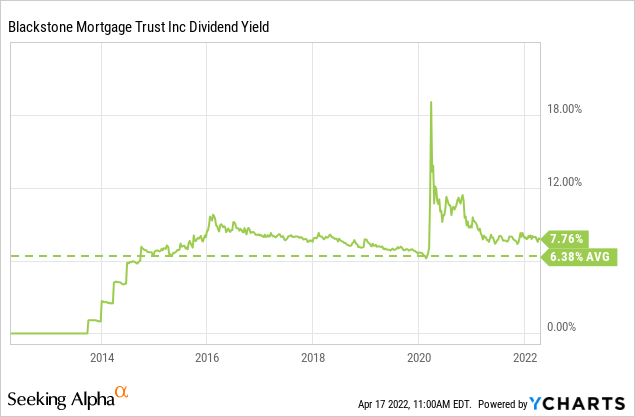

Dividends

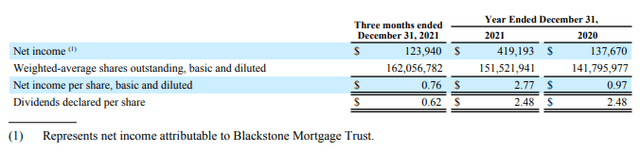

The main reason to own BXMT is for its high dividend yield of ~7.7% at current prices. The $2.48 annual dividend is covered by recent earnings of $2.77, the dividend was also paid during the challenging Covid crisis period of 2020, although for that year the dividend was not completely covered by earnings, the company having earned only $0.97.

In any case, absent any extraordinary events it is likely that the company will continue earning enough to pay its $2.48 per share. The current payout ratio is ~95%, and it has not grown in the last few years. However, should rising rates increase earnings meaningfully there is a possibility management will feel compelled to increase it.

Historically the dividend has averaged 6.3%, although this includes a brief period before the company started paying dividends. Still, given the alternatives we think a relatively safe 7.7% dividend is quite attractive.

Financials

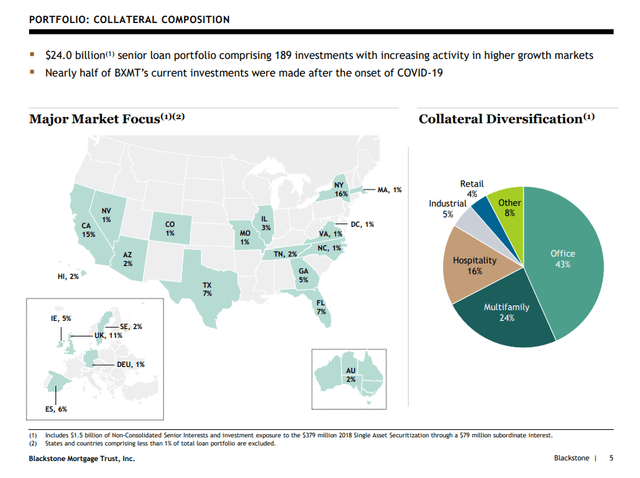

Another thing we like about BXMT’s business model is that its loans are made with significant equity from their customers, which motivates them to continue paying interest through periods of cyclical disruption and not default on the loans. The current average loan to value (LTV) of the portfolio is ~64%. Additionally, a very significant portion of the investments were made after Covid, which means these new loans must likely have been underwritten more carefully.

With respect to the collateral, we admit there is more office concentration than we would like to see, as well as hospitality. In any case, they tend to be big projects carefully thought out by the sponsors and that is why, even during Covid, BXMT experienced relatively few issues and was able to continue paying its dividend. The company has currently only 189 investments, which means they have to be very selective with each of them.

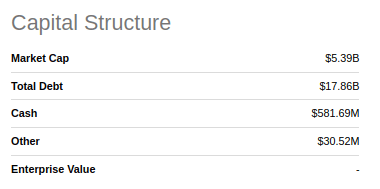

One thing that is important to remember is that BXMT is a leveraged operation, so mistakes get amplified for equity holders. As can be seen below from a snapshot of the company’s Seeking Alpha page, BXMT has a market cap of only $5.39 billion, cash of $581 million, and total debt of $17.86 billion. This gives a debt to equity ratio of 3.2x.

Seeking Alpha

Price targets

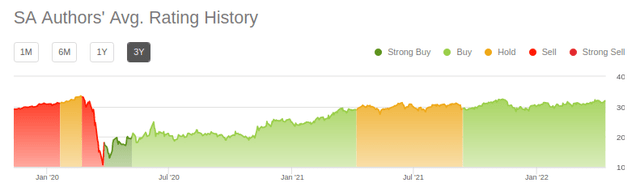

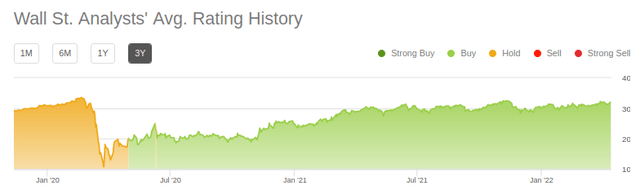

Historically, as a group, we Seeking Alpha contributors have done a decent job with the ratings given to the company. On average it had Sell ratings before the Covid recession, Strong Buy just after it, and Buy for most of the rest of the time. Currently the consensus is Buy, from both Seeking Alpha contributors and Wall St. analysts.

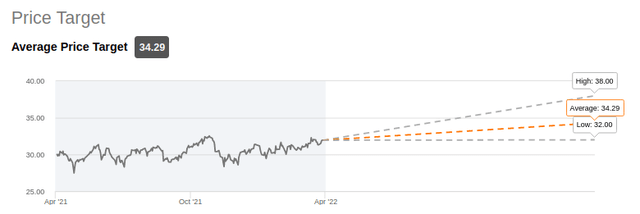

Talking about Wall St. analysts, their price targets for the stock are shown below, with a low price target of $32, an average of $34.29, and a high of $38. Even the low target is above the current price, although we admit this is not a company you buy for capital appreciation as much as for the high dividend yield.

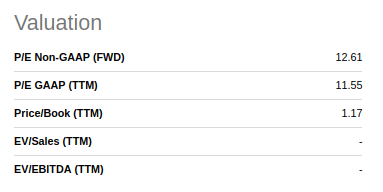

Valuation

Trading with a forward P/E ratio of 12.61x and a P/B ratio of 1.17, we find BXMT reasonably valued, and we believe most of the returns will come from the ~8% dividend, and we don’t expect much in the form of capital appreciation. Investors that are comfortable accepting this level of return can consider an investment in the company.

Seeking Alpha

Risks

There are a number of risks involved with investing in BXMT, the ones that we are worried the most about are:

- Risk of a new massive Covid wave that creates loan defaults from customers due to economic and travel restrictions.

- Work from home devalues the office properties that serve as collateral for many of the BXMT loans.

- A severe economic recession creates a significant default rate on the company’s loans and devalues the collateral.

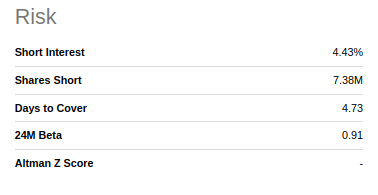

Looking at the risk section of the company’s Seeking Alpha page we can see that the short interest in the company is not too high at ~4.4%, and that the Beta is less than the market at 0.91, so this is not a very volatile company.

Seeking Alpha

Key Takeaway

BXMT offers an excellent dividend which we consider rather safe unless economic conditions deteriorate in an extreme way. The company’s portfolio withstood the Covid crisis impact pretty well , and we believe going forward it should continue to perform well. The company is also positioned to increase earnings as interest rates increase, thanks to its mostly floating rate portfolio and net floating rate exposure.

Be the first to comment