herkisi

This article was originally published on Dividend Kings on Tuesday, January 3rd, 2023.

———————————————————————————-

Do you know the best way to retire rich and stay rich in retirement? It’s not a complex quant strategy using speculative investments like options, it’s simply letting the smartest and best people in the world work hard for you.

Why recreate the wheel when millions of the world’s best corporate executives have already spent centuries working out the easiest and lowest-risk way to compound income and wealth to a staggering degree?

Alternative asset managers like Blackstone (NYSE:BX) are a great example of how smart investors can ride the coattails of the greatest financial minds on earth to potentially retire in safety and splendor.

Here is the best introduction to private equity and alternative asset managers I’ve ever come across.

And here is a deep dive I did with Brad Thomas on Brookfield Asset Management (BAM), my personal favorite alternative asset manager.

But I’ve gotten several requests from Dividend Kings members for an introduction to Blackstone, a 6.6% yielding (variable payer) alternative asset rock-star that is one of the big six in its industry.

So let me show you how Blackstone offers a great combination of safety, quality, attractive valuation, and life-changing income and wealth compounding potential.

Why Blackstone Is One Of The World’s Greatest Businesses

Bottom line upfront

Blackstone is a variable-paying blue-chip whose policy is to pay out 85% of profits as dividends. In 2019, it converted from a limited partnership to a corporation, eliminating the K1 tax form that so many income investors hate.

That means it now pays qualified dividends that grow in-line with earnings over time.

Founded in 1985 by Stephen Allen Schwarzman and Peter Peterson, Blackstone is one of the world’s largest alternative asset managers.

- Schwarzman is worth $25 billion

- Peterson died worth $2 billion in 2007

Schwarzman is still the chairman and CEO of Blackstone, and that’s valuable for investors. Why? Because this isn’t just any founder CEO, he’s a living legend.

Mr. Schwarzman holds a B.A. from Yale University and an M.B.A. from Harvard Business School. Mr. Schwarzman is a member of The Council on Foreign Relations, The Business Council, The Business Roundtable, and The International Business Council of the World Economic Forum.

He’s a legendary shrewd businessman, a best-selling author, and one of the greatest philanthropists in the world.

- In 2019, Schwarzman published his first book, What It Takes: Lessons in the Pursuit of Excellence, a New York Times Best Seller, which draws from his experiences in business, philanthropy, and public service.

- he’s publicly committed to giving away at least 50% of his net worth to charity

- so far, he’s donated over $1.3 billion to causes ranging from ethical artificial intelligence or AI, to inner-city scholarships

In other words, Schwarzmann is a legend in his industry, along the lines of the Warren Buffett of alternative assets.

But Blackstone is hardly a one-man-shop, helmed by a single financial wunderkind.

Its Chief Operating Officer is Jonathan Grey, who joined Blackstone in 1992 and was formerly the head of its real estate empire.

Its Chief Financial Officer is Michael Chae, who has been with Blackstone for 25 years and is formerly the head of Asian and then international private equity.

In total, Blackstone is helmed by 27 men and women, all with similarly impressive levels of experience and success.

Its board of directors is similarly impressive, including

- a former Canadian Prime Minister

- a former US senator

- the current CFO of Alphabet

- former heads of other alternative asset mangers

In other words, if you want some of the best and brightest in the financial world to manage your money, you want Blackstone.

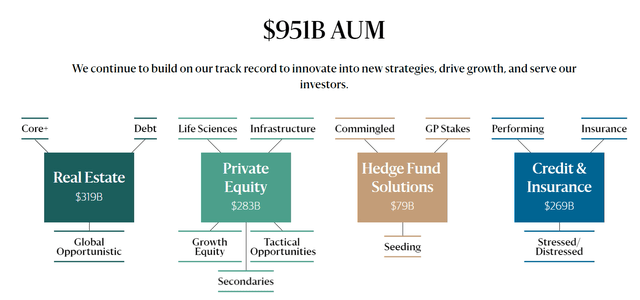

Blackstone’s $950 billion in assets under management make it the industry titan and one of the most trusted names on earth at what it does.

The company has four core business segments:

- private equity (24% of fee-earning AUM and 31% of base management fees)

- real estate (39% and 40%)

- credit & insurance (27% and 20%)

- hedge fund solutions (10% and 9%)

If you’ve ever wondered who those brilliant quants you see on CNBC or Bloomberg work for, it’s companies like this.

Wonder who exactly is investing in the advanced credit markets? It’s Blackstone and peers like BAM.

Wonder who is launching and managing those private equity funds and hedge funds that the ultra-rich are so fond of? You guessed it, it’s Blackstone.

Wonder who is out there making Shark Tank-like investments into private companies at an industrial scale? It’s Blackstone.

For 37 years, Blackstone has been steadily building a more diversified global empire that targets non-correlated or higher return (or both) investment opportunities.

The kind that pension funds, sovereign wealth funds, and endowments buy and you can’t… except by owning the parent company.

Why I Like Blackstone And So Should You

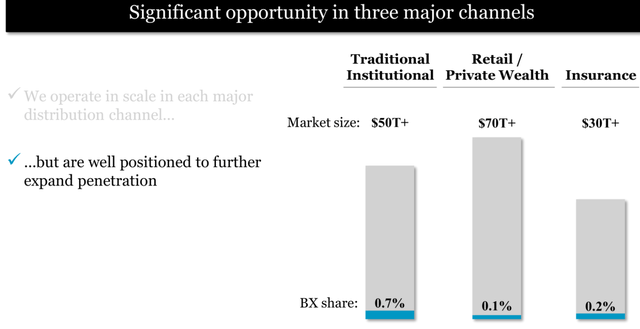

2018 Blackstone investor day presentation

Blackstone doesn’t do annual investor day presentations like BAM, so these numbers are a bit outdated.

- it’s estimated the potential addressable market is now about 2X larger

- a $300 trillion addressable market

For context, the entire global economy is $101 trillion in size, so you can see the scale of the investment opportunity with alternative assets is enormous.

In fact, it’s the single biggest investment opportunity I’ve ever come across, about 2X larger than the $150 trillion that BAM estimates could flow into green energy in the next 30 years.

And Blackstone sits as king of the hill in the single largest investment opportunity in history.

We consider Blackstone to be the preeminent alternative asset manager…

Blackstone has also built out a large base of employees–including in-house executives, consultants, and advisors–that have decades of industry experience and can successfully revitalize a company or property through cost-cutting, acquisitions, or other strategic maneuvers.” – Morningstar

What makes Blackstone special is its people and investment prowess. That’s why it generated $120 billion in net asset inflows in the first nine months of 2022, matching BAM’s impressive $120 billion in net inflows.

In a year when even the best asset managers saw AUM fall due to crashing stock and bond prices, BX and BAM stood out with impressive AUM growth of 15% and 20%, respectively.

Morningstar considers BX their favorite asset manager, partially because it is sitting on $182 billion in dry powder it can put to use in this bear market.

Blackstone’s diversified offerings and sterling reputation make it the one-stop-shop the ultra-rich and institutions turn to first for alternative asset investments.

Blackstone has, in our view, built a solid position in the industry, utilizing its reputation, broad product portfolio, investment performance track record and a cadre of dedicated professionals to not only raise massive amounts of capital but maintain the reputation it has built for itself as a “go-to firm” for institutional and high-net-worth investors looking for exposure to alternative assets.” – Morningstar

And unlike most traditional asset managers like BlackRock (BLK) and T. Rowe Price (TROW), those assets, paying relatively high but justifiable fees, are pretty sticky.

Blackstone’s funds come with seven to 10-year lock-ups (or even longer), and its average annual retention rate has been 90% for the last decade.

In other words, its clients stick with it for, on average, at least a decade.

So while Blackstone’s dividend is variable, it’s growing steadily over time and is not as variable as you might expect from an asset manager.

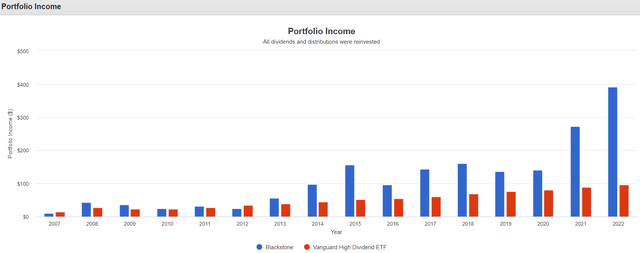

17% Annual Income Growth Over The Last 14 Years

You can see how high-yield blue-chips (represented by VYM) offer consistent income growth. They represent a solid core of one’s portfolio.

But there is certainly a potential place in one’s diversified portfolio for dividend-growth rockstars like BX.

Now that’s not to say that Blackstone is expected to keep delivering 17% annual income growth.

What Kind Of Growth Can You Expect From Blackstone

The downside of being the king of this hill is that BX can’t keep growing at a torrid pace. Analysts expect BX’s AUM growth to be 8% for the foreseeable future.

What does that mean in terms of earnings and, ultimately, dividend growth?

High single-digit growth combined with BX’s 6.6% yield, is exceptional long-term return potential. Even if you use the 5-year average yield to normalize the variable yield, you still get one of the best long-term income growth opportunities on Wall Street.

Long-Term Consensus Total Return Potential

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| Blackstone | 6.6% | 9.3% | 15.9% | 11.1% |

| Blackstone (5-year average yield) | 4.1% | 9.3% | 13.4% | 9.4% |

| Vanguard Dividend Appreciation ETF | 1.9% | 10.2% | 12.1% | 8.5% |

| Nasdaq | 0.8% | 10.9% | 11.7% | 8.2% |

| Schwab US Dividend Equity ETF | 3.4% | 7.6% | 11.0% | 7.7% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.8% | 8.5% | 10.3% | 7.2% |

(Sources: DK Research Terminal, FactSet, Morningstar, Ycharts)

Blackstone offers 13% to 16% long-term return potential, far more than almost any popular ETF or investment strategy.

Inflation-Adjusted Consensus Return Potential: $1,000 Initial Investment

| Time Frame (Years) | 7.8% CAGR Inflation-Adjusted S&P 500 Consensus | 11% CAGR Inflation-Adjusted BX Consensus | Difference Between Inflation-Adjusted BX Consensus And S&P Consensus |

| 5 | $1,453.75 | $1,685.06 | $231.31 |

| 10 | $2,113.39 | $2,839.42 | $726.03 |

| 15 | $3,072.33 | $4,784.59 | $1,712.26 |

| 20 | $4,466.40 | $8,062.31 | $3,595.91 |

| 25 | $6,493.02 | $13,585.46 | $7,092.44 |

| 30 | $9,439.23 | $22,892.30 | $13,453.07 |

(Source: DK Research Terminal, FactSet)

Even if BX delivers on the low end of its consensus range, that’s a potential 23X bagger, adjusted for inflation, over the next 30 years.

And with a $300 trillion addressable market, which is growing at a rapid rate, this kind of return could last longer than 30 years.

| Time Frame (Years) | Ratio Inflation-Adjusted BX Consensus vs. S&P consensus |

| 5 | 1.16 |

| 10 | 1.34 |

| 15 | 1.56 |

| 20 | 1.81 |

| 25 | 2.09 |

| 30 | 2.43 |

(Source: DK Research Terminal, FactSet)

Imagine 3X to 5X the yield of the S&P and around 2.5X higher long-term returns over time. That’s what BX offers.

But you don’t have to wait decades to make good money with BX.

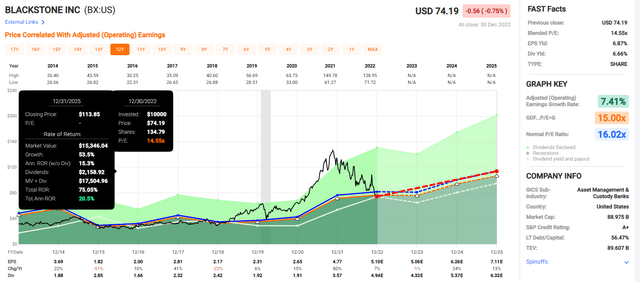

Blackstone 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

BX could potentially deliver 20% annual returns through 2025, an impressive 75% total return that’s about 2.5X more than the S&P 500.

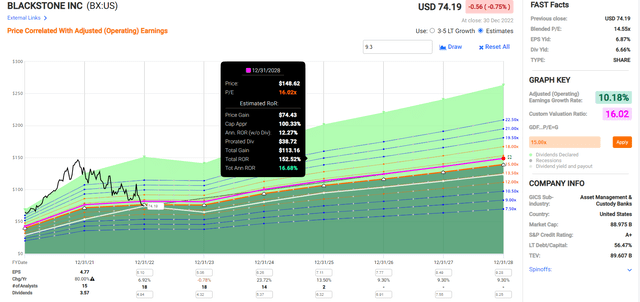

Blackstone 2028 Consensus Total Return Potential

(Source: FAST Graphs, FactSet)

BX could potentially deliver 17% annual returns through 2025, an impressive 150% total return that’s about 3X more than the S&P 500.

Blackstone: A Wonderful Company At A Wonderful Price

| Rating | Margin Of Safety For Low-Risk 10/13 Blue-Chip Quality Companies | 2023 Fair Value Price |

| Potentially Reasonable Buy | 0% | $96.96 |

| Potentially Good Buy | 20% | $77.57 |

| Potentially Strong Buy | 30% | $67.87 |

| Potentially Very Strong Buy | 40% | $46.54 |

| Potentially Ultra-Value Buy | 50% | $48.48 |

| Currently | $75.02 | 22.63% |

| Upside To Fair Value (Including Dividends) | 35.83% |

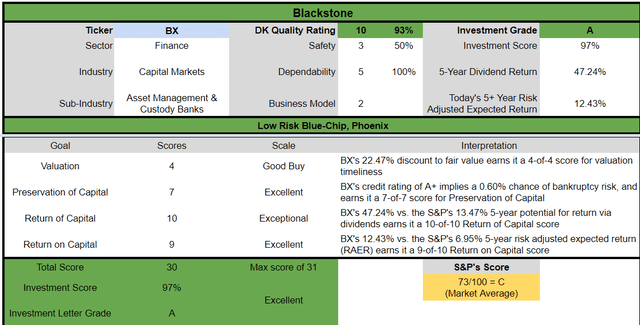

Blackstone is a potentially good buy today for anyone comfortable with its risk profile.

Blackstone Investment Decision Score

Dividend Kings Automated Investment Decision Tool

BX is a potentially excellent high-yield income growth opportunity for anyone comfortable with its risk profile. Look at how it compares to the S&P 500.

- 23% discount to fair value vs. 4% premium S&P = 27% better valuation

- 6.6% safe (though variable) yield vs. 1.8% (3.5X higher and growing 9% to 10% over time)

- approximately 13% to 17% long-term annual return potential vs. 10.2% CAGR S&P

- 2X higher risk-adjusted expected returns

- 3.5X higher income potential over five years

Risk Profile: Why Blackstone Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

BX’s Risk Profile Includes

- illiquidity risk (for its assets and funds)

- financing risk (a long enough bear market could eventually cause dry powder to run out)

- execution risk: BX owns and manages many of its real estate investments

- management fee compression risk: competition among the big six could drive down those lucrative fees

- regulatory risk: both domestically and internationally (such as the elimination of carried interest)

- currency risk: it owns assets all over the world

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

- S&P has spent over 20 years perfecting their risk model

- which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

- 50% of metrics are industry specific

- this risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of how a company’s risk management compares to 8,000 S&P-rated companies covering 90% of the world’s market cap.

BX scores 61st Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

- supply chain management

- crisis management

- cyber-security

- privacy protection

- efficiency

- R&D efficiency

- innovation management

- labor relations

- talent retention

- worker training/skills improvement

- occupational health & safety

- customer relationship management

- business ethics

- climate strategy adaptation

- sustainable agricultural practices

- corporate governance

- brand management

BX’s Long-Term Risk Management Is The 255th Best In The Master List 50th Percentile In The Master List)

| Classification | S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

| BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

| Strong ESG Stocks | 86 |

Very Good |

Very Low Risk |

| Foreign Dividend Stocks | 77 |

Good, Bordering On Very Good |

Low Risk |

| Ultra SWANs | 74 | Good | Low Risk |

| Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

| Low Volatility Stocks | 65 | Above-Average | Low Risk |

| Blackstone | 61 | Above-Average | Low Risk |

| Master List average | 61 | Above-Average | Low Risk |

| Dividend Kings | 60 | Above-Average | Low Risk |

| Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

| Dividend Champions | 55 | Average | Medium Risk |

| Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

BX’s risk-management consensus is average among of the world’s best blue chips and is similar to:

- Emerson Electric (EMR): Ultra SWAN dividend king

- Robert Half International (RHI): Ultra SWAN dividend aristocrat

- Essex Property Trust (ESS): Ultra SWAN dividend aristocrat

- PepsiCo (PEP): Super SWAN dividend king

- Coca-Cola (KO): Ultra SWAN dividend king

The bottom line is that all companies have risks, and BX is average, at managing theirs, according to S&P.

How We Monitor BX’s Risk Profile

- 21 analysts

- two credit rating agencies

- 23 experts who collectively know this business better than anyone other than management

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Blackstone Is A 6.6% Yielding World-Beater That Could Change Your Life

Let me be clear: I’m NOT calling the bottom in BX (I’m not a market-timer).

Blue-Chip quality does NOT mean “can’t fall hard and fast in a bear market.”

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck

While I can’t predict the market in the short term, here’s what I can tell you about BX.

Blackstone is the largest alternative asset manager in the world.

It’s led by management whose investing prowess is the stuff of legend.

It’s an A+-rated company with a 0.6% 30-year bankruptcy risk.

It offers a mouth-watering 6.6% variable yield today, but even smoothing for variable dividends, should yield around 4% long-term.

BX is growing 9% to 10% and could deliver 13% to 17% long-term returns.

BX is the industry leader in a $300 trillion market and has about 0.3% market share.

Its growth runway is decades-long and could deliver 23X inflation-adjusted returns over the next 30 years.

BX is 23% historically undervalued and a potentially good buy for anyone comfortable with its risk profile.

BX and BAM are the two largest and most dominant names in their fast-growing industry.

- like V and MA

- like LOW and HD

- like KO and PEP

Is BX better than BAM? Should investors own one over the other? That’s a complex question worthy of its own article.

But what I can say about BX is that this 6.6% yielding world-beater could change your life. If you buy it today, you’ll likely feel like a stock market genius in 5+ years.

Be the first to comment