BlackJack3D/E+ via Getty Images

“Only when the tide goes out do you discover who’s been swimming naked.” – Warren Buffett

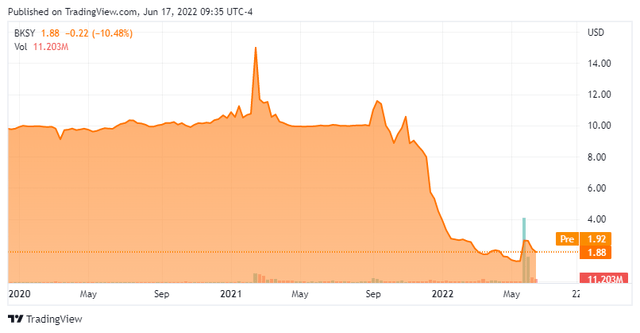

Today, we take our first in-depth look at small-cap concern BlackSky Technology Inc. (NYSE:BKSY). BlackSky came public late last summer via a merger with Osprey Technology Acquisition. Like so many of these SPAC debuts in 2021, the shares find themselves deep in ‘Busted IPO’ territory. The company is delivering impressive revenue growth in its fast-growing niche of the market, however. An analysis follows below.

Company Overview:

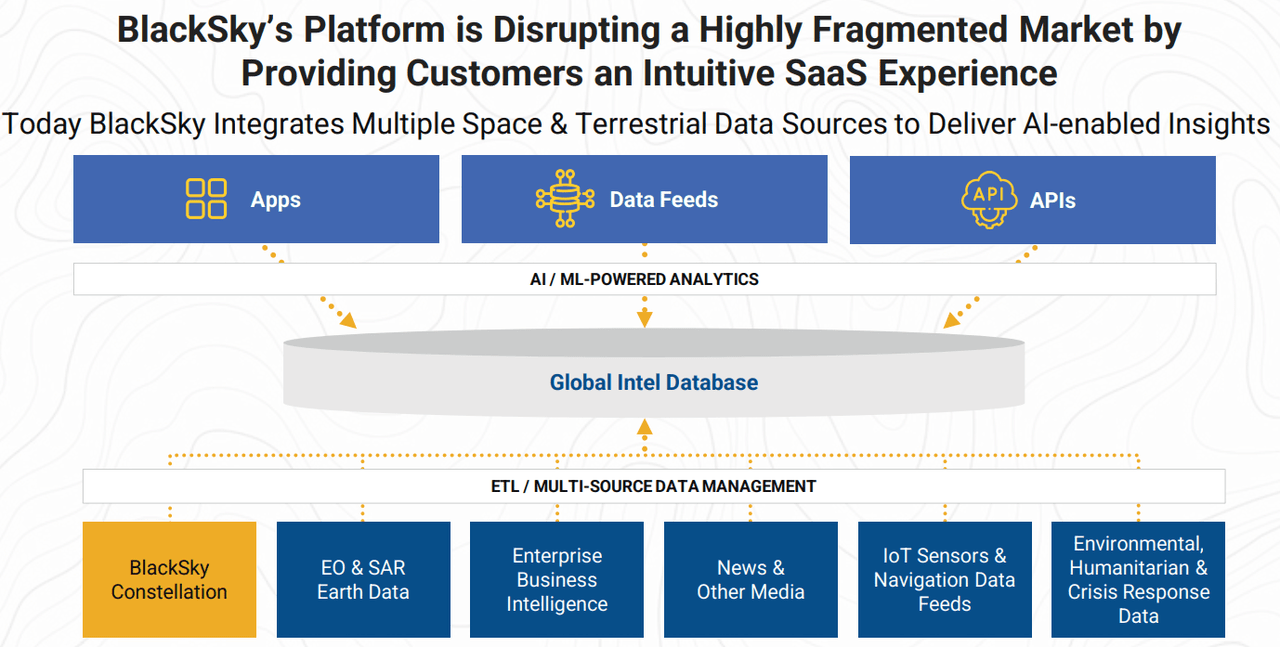

BlackSky Technology Inc. is based just outside of Washington D.C. The stock trades for just under two bucks a share and sports an approximate market capitalization of $240 million. BlackSky provides geospatial intelligence, imagery and related data analytic products and services, and mission systems. These include the development, integration, and operations of satellite and ground systems to commercial and government customer applications. The company delivers these insights and data via its Spectra AI SaaS platform which is powered by their proprietary space and terrestrial sensor network.

BlackSky’s on-demand constellation of satellites (a total of 14 right now after launching two satellites on April 2nd) can image a location multiple times throughout the day. Palantir Technologies (PLTR) has an equity investment in BlackSky. BlackSky also has a multi-year software subscription deal with Palantir to access the Palantir Foundry enterprise platform, and the company offers a solution that combines Palantir Foundry with its Spectra AI to expand the delivery of deep analytics and high-resolution imagery to its customers.

Company Presentation

1st Quarter Results:

On May 11th, the company posted first quarter results. BlackSky had a net loss on a GAAP basis of 17 cents a share. Revenues rose 90% from the same period a year ago to just under $14 million, which nicely beat expectations. Of this, Imagery and software analytical services revenue came in at $9.8 million. This was primarily driven by increased demand from new and existing government contracts. This segment now represents approximately 70% of total revenues and was up 63% from the same period a year ago. Gross margin did fall to 21.2% from 24.5% in 1Q2021. Management attributed this mainly to ‘higher engineering and systems integration expenses largely attributable to non-recurring design costs and material procurement costs’.

Leadership maintained full year revenue guidance of between $58 million to $62 million. That would represent 76% revenue growth from FY2021 at the midpoint of that range. Cap-Ex is expected to be between $52 million to $56 million, down from last year as leadership believes it has sufficient capacity to meet customer demand. On June 15th, management reaffirmed guidance and also announced a new CFO.

In late May, the National Reconnaissance Office announced its largest-ever commercial imagery contract effort worth billions of dollars over time. BlackSky was one of three firms chosen along with Planet Labs (PL) and Maxar Technologies (MAXR). The overall contract became effective as of late May of this year with a five-year base and multiple one-year options with additional growth through 2032.

Analyst Commentary & Balance Sheet:

On May 12, Benchmark lowered its price target on BKSY to $6 from $8 previously while maintaining its Buy rating on the stock. That is the only analyst firm commentary I can find on BlackSky so far in 2022. Just under 10% of the outstanding float on this equity is currently sold short. After posting a net loss of $20 million during the quarter, the company had just over $138 million in cash and marketable securities as of March 31st of this year, against just over $70 million of long-term debt. An insider bought $32,000 worth of stock in late February. That is the only insider activity in the stock so far in 2022.

Verdict:

The one analyst firm that has provided projections around BlackSky has the company losing 81 cents a share this year as revenues nearly double to $67.5 million in FY2022. Net loss is projected to drop to 47 cents a share in FY2023 with revenues rising nearly 90% to $127 million.

BlackSky is in an interesting and growing niche of the market. The current conflict in Ukraine has underscored the vital importance of real-time Earth intelligence for military, commercial, humanitarian and other applications. The market has crushed nearly all profitless small-cap growth names in recent months, regardless of their growth prospects. This remains a headwind.

This stock seems reasonably priced based on price to future sales, especially when the net cash on the balance sheet is taken into consideration. I recently profiled Planet Labs and took a ‘watch item‘ holding in that similar concern. I plan to do the same with BlackSky Technology. We will plan to revisit BlackSky again in 2023 as sales continue to gain traction, and hopefully as net losses drop significantly.

“It is a way to take people’s wealth from them without having to openly raise taxes. Inflation is the most universal tax of all.” – Thomas Sowell

Be the first to comment