Sundry Photography/iStock Editorial via Getty Images

BlackRock (NYSE:BLK) is the largest asset manager in the world, with $10 Trillion in AUM. The company is incredibly broad, serving institutional and retail clients and serving as a leading provider of both active and passive investing vehicles. The company reported Q4 2021 results on January 14th, slightly beating expectations for EPS but missing on revenue. This was the 10th consecutive quarter for which BLK exceeded expected EPS. Prior to reporting Q4 results, the shares closed at $867.58, 10.7% below the 12-month high close of $971.49 on November 11, 2021. While the Q4 results were solid, with significant growth across business lines, BLK continued to sell off, falling to a 12-month low close of $662.87 on March 8th. At the current level, $745.07, the shares are 23% below the 12-month high.

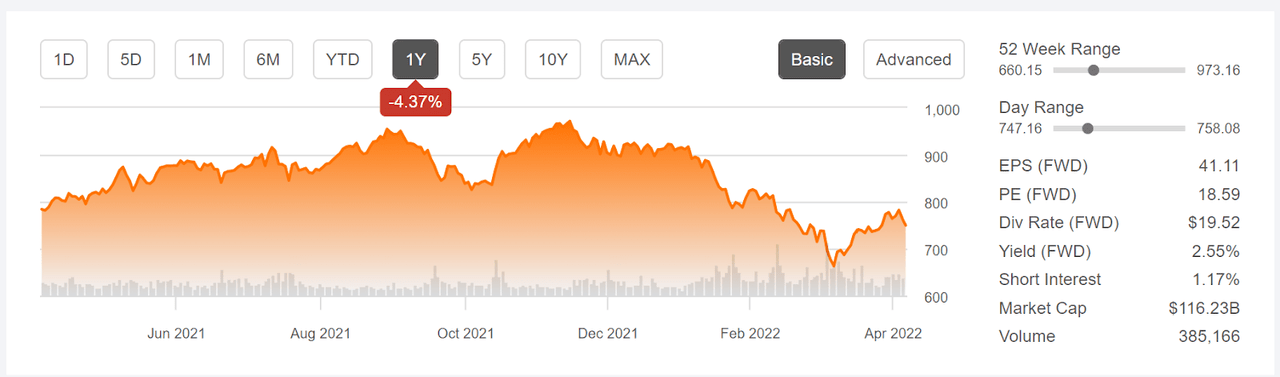

Trailing 12-month performance and basic statistics for BLK (Seeking Alpha)

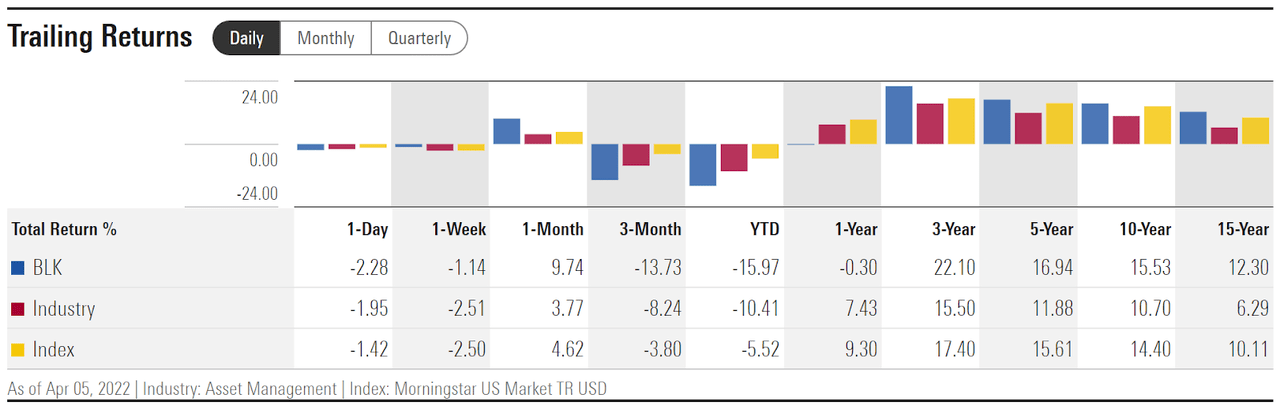

Shares of asset managers typically fall more than the broader market during declines because revenues from asset-based fees get smaller as the market value of AUM decreases. For the YTD, the Morningstar U.S. Market Index has returned -5.5%, as compared to -16% for BLK and -10.4% for the asset management industry as a whole (as defined by Morningstar).

Trailing total returns for BLK vs. asset management industry and the U.S. equity market as a whole (Morningstar)

BLK has a beta of 1.37 relative to the S&P 500 over the past 10 years. This elevated beta means that BLK’s alpha is negative for this period, even though BLK’s 10-year annualized total return is more than 1% per year above that of the S&P 500.

With a 2.55% forward dividend yield, along with 3- and 5-year dividend growth rates of 11.6% and 13.0% per year, BLK will get attention from income investors. It is worth noting, however, that the consensus for annualized EPS growth over the next 3-to-5 year period is 7.7% per year. Maintaining the dividend growth rates of recent years is quite likely to result in a higher payout ratio.

One risk factor for BLK is that the current P/E is quite high compared to historical levels. The market has typically assigned a lower share price per unit of earnings than we see today.

I first wrote about BLK on Seeking Alpha in March of 2021, and I revisited my analysis in November of the same year. In both posts, I assigned a bullish / buy rating on BLK. For the period from my March analysis to the November writeup, BLK rose 30.1% vs. 17.2% in price appreciation for the S&P 500. Since my November analysis, however, BLK has fallen 22.5% vs. a decline of only 3.9% for the S&P 500. In March and November, the Wall Street consensus outlooks for BLK were bullish. In addition, the implicit consensus outlook from the options market was bullish on BLK at the times of my posts.

For readers who are unfamiliar with consensus outlooks calculated from options prices, a brief overview is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is called the market-implied outlook and reflects the consensus view reflected in the prices at which traders are willing to buy and sell options on the stock. For a more in-depth discussion than I provided in the previous link, I recommend this excellent monograph from the CFA Institute.

I have updated the market-implied outlook for BLK to extend through the end of 2022 and compared this with the current Wall Street consensus outlook is revisiting my rating on BLK.

Wall Street Consensus Outlook for BLK

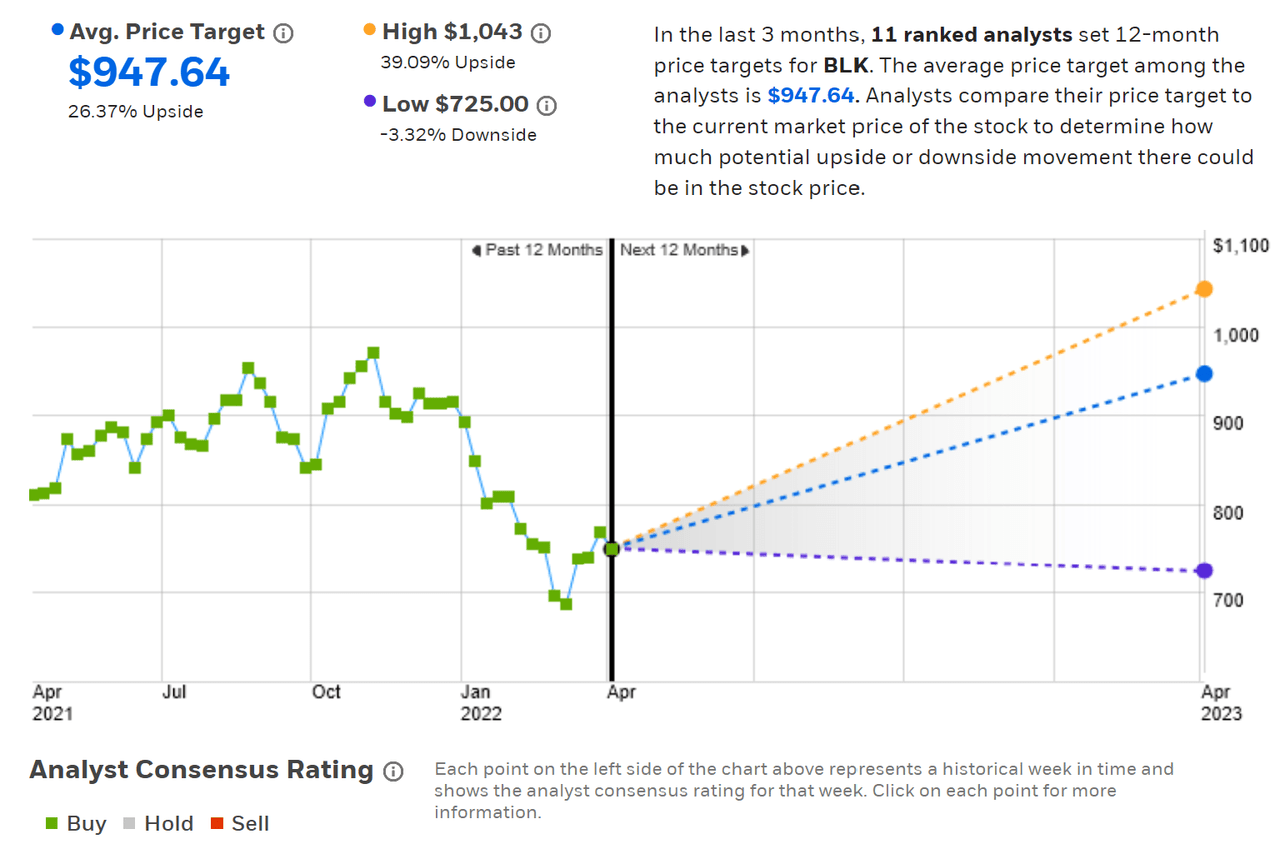

E-Trade calculates the Wall Street consensus outlook for BLK using the views of 11 ranked analysts who have published ratings and price targets over the past 90 days. The consensus rating is bullish, as it has been throughout the past 12 months, and the consensus 12-month price target for BLK is 26.4% above the current share price.

Wall Street consensus rating and 12-month price target for BLK (E-Trade)

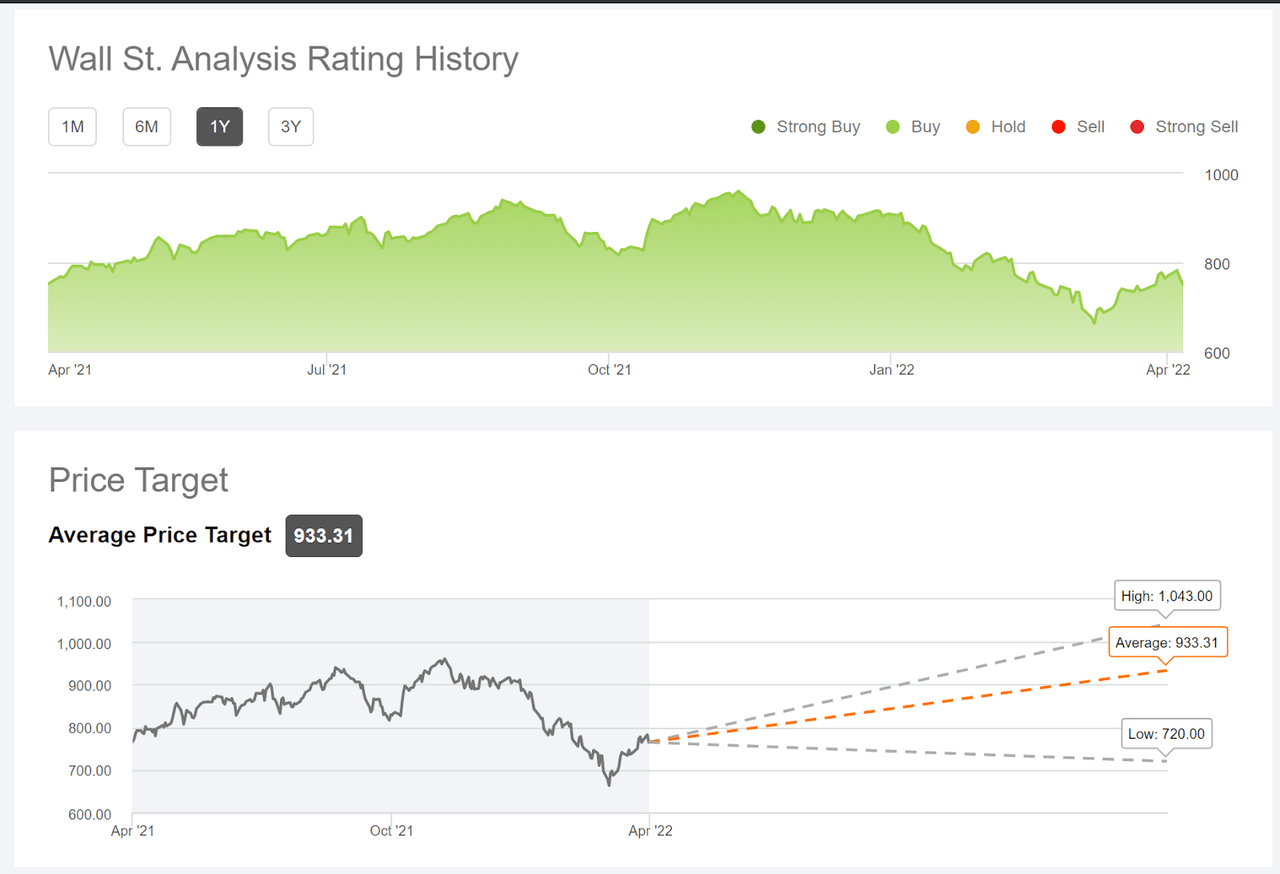

Seeking Alpha’s version of the Wall Street consensus is calculated by combining the views of 14 analysts who have published ratings and price targets over the past 90 days. The consensus rating is a buy and the consensus 12-month price target is 24.5% above the current share price. Consistent with the results from E-Trade, the consensus rating has been bullish for all of the past year.

Wall Street consensus rating and 12-month price target for BLK (Source: Seeking Alpha)

These two versions of the Wall Street consensus outlook are very similar, supporting a bullish view for BLK with expected price appreciation of around 25.5% over the next 12 months.

Market-Implied Outlook for BLK

I have calculated the market-implied outlook for BLK for the 9.4-month period from now until January 20, 2023, using the price of options that expire on this date. I selected this specific expiration date because it was the closest to the end of 2022. In addition, the options expiring in January tend to be the most actively traded, adding confidence in the representativeness of the market-implied outlook.

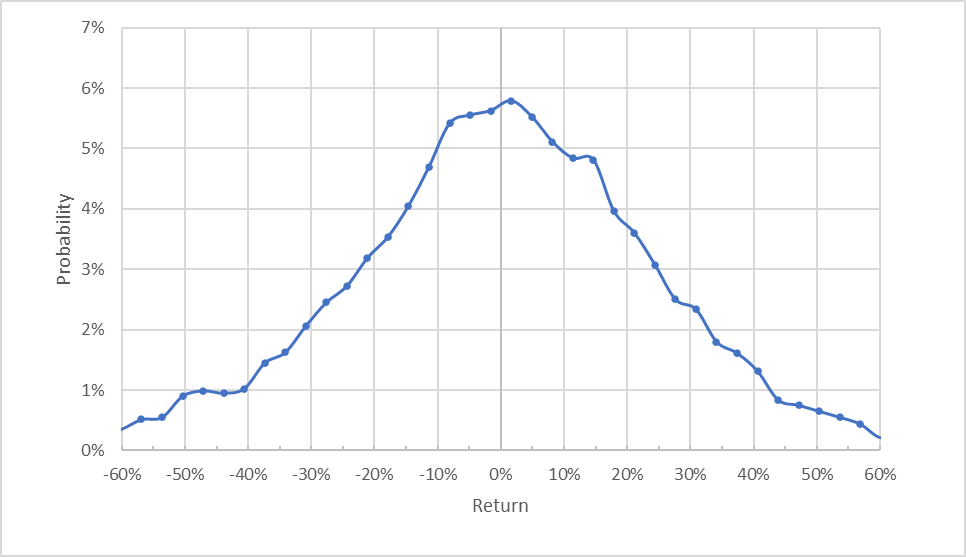

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Market-implied price return probabilities for BLK for the 9.4-month period from now until January 20, 2023 (Author’s calculations using options quotes from E-Trade)

The market-implied outlook for BLK is very symmetric, with comparable probabilities of positive and negative returns of the same magnitude. The peak in the probabilities is generally centered around zero, with the maximum probability corresponding to a price return of +1.6%. The expected volatility calculated from this distribution is 29% (annualized), slightly higher than the expected volatility from my previous analysis in November (25.7%). E-Trade calculates 26% implied volatility for the January 20, 2023 options.

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

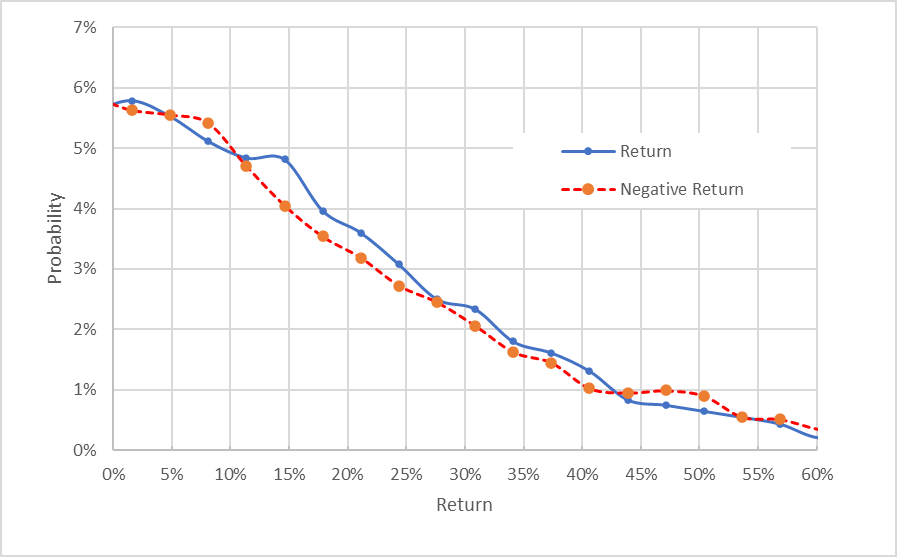

Market-implied price return probabilities for BLK for the 9.4-month period from now until January 20, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from E-Trade)

This view shows that the probabilities of positive returns tend to be slightly higher than the probabilities of negative returns, across a wide range of the most-probable outcomes (the solid blue line is mostly above the dashed red line over the left ⅔ of the chart above). This tilt in probabilities indicates a slightly bullish outlook.

Theory suggests that the market-implied outlook is expected to have a negative bias because risk-averse investors pay more than fair value for downside protection (put options). There is no way to verify that such a bias is present, but the expectation that market-implied outlooks overweight the negative return potential reinforces the bullish interpretation.

Summary

BLK shares are 23% below their high close from late 2021. BLK has fallen substantially more than the U.S. equity market as a whole for the YTD, as expected for an asset management company. The Wall Street consensus outlook for BLK continues to be bullish, with expected 12-month total return of 28% (25.5% in price appreciation + 2.55% dividend yield). As a rule of thumb for a buy rating, I want to see an expected 12-month total return that is at least ½ the expected volatility. Taking the Wall Street consensus outlook at face value, the expected total return is almost equal to the expected volatility (29% from the market-implied outlook). The market-implied outlook for BLK to January of 2023 is slightly bullish. I am maintaining my bullish rating on BLK.

Be the first to comment