alfexe

Over the past several months, we have seen our economy struggling with incredibly high inflation. This inflation has been largely centered on necessities such as food and energy, which makes it even more crushing for many people. This has caused many individuals to be forced to take on second jobs or make other sacrifices in order to obtain the extra money that they need to maintain their standard of living.

Fortunately, as investors, we have other methods that we can use to obtain extra money. One of these is to buy shares of closed-end funds that specialize in the generation of income. These funds offer us an easy way to access a professionally-managed diversified portfolio of assets that can in many cases deliver a higher yield than any of the underlying assets. In this article, we will discuss the BlackRock Core Bond Trust (NYSE:BHK), which is one such fund that investors can use today for this purpose. As of the time of writing, the fund yields a respectable 8.14%, which is certainly enough to turn anyone’s head. I have discussed this fund before but over a year has passed since that time so many things have changed.

This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s finances. This may be especially timely given that the bond market has been largely devastated over much of the past year due to rising interest rates but this has created some opportunities in the market as well so we will see if this is one of them.

About The Fund

According to the fund’s webpage, the BlackRock Core Bond Trust has the stated objective of providing investors with both current income and capital appreciation. This can be a hard objective to accomplish, particularly the capital appreciation part. This is because bonds only offer very limited amounts of capital gains because they do not benefit as the issuing company grows and prospers. Rather, bond prices vary inversely to interest rates. This is because when interest rates increase, existing bonds fall in price so that they give a similar yield to that of newly issued bonds with similar characteristics. Thus, the only real way for bonds to deliver capital gains is for interest rates to decline.

Yesterday, Federal Reserve Chairman Jerome Powell made statements that implied that this would not happen for a while. He implied instead that higher rates may be with us for quite a while,

“History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”

Thus, we can conclude that the fund will struggle to deliver capital gains for a while, barring something like the economy plunging into a deep recession. However, with rates at their current levels, newly-issued bonds are finally delivering decent yields so the fund will probably be able to do just fine by purchasing bonds and holding them for income.

The BlackRock Core Bond Trust differs somewhat from many other high-yielding fixed-income closed-end funds. The biggest difference is that this fund is buying investment-grade securities as opposed to junk bonds. These bonds possess lower yields than junk bonds but they do enjoy lesser default risk. This is something that should appeal to risk-averse investors, such as retirees, that are concerned about the preservation of their principal.

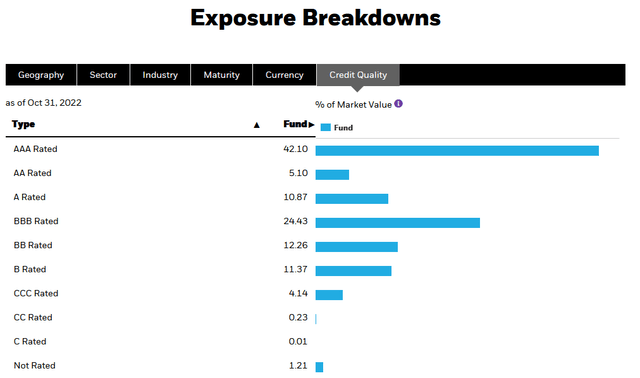

We can see the fund’s focus on investment-grade bonds by looking at the credit quality of its portfolio. As any experienced bond investor will know, the three major credit rating agencies (S&P, Moody’s, and Fitch) assign letter-grade ratings to companies and bond issues that theoretically indicate the risk that the company will default on its debt obligations. Here is how the fund’s portfolio appears in terms of ratings:

An investment-grade security is anything rated BBB or above. As we can see, that represents 82.50% of the portfolio. The remainder of the portfolio consists of fairly high-rated junk bonds. As an investment-grade bond issuer in general has a very low risk of default, the overall risk that investors will lose money appears quite low here.

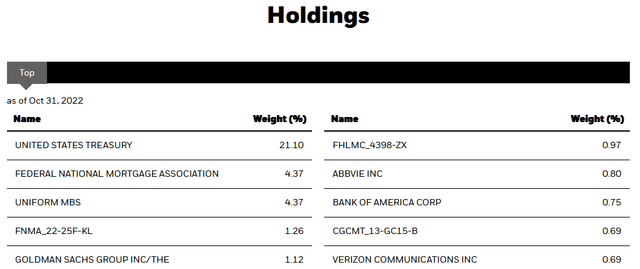

In addition to investing in very high-rated securities, the BlackRock Core Bond Trust further reduces its risk of losses due to default by investing in a substantial number of bonds. The fund currently has positions in 1,676 individual issues, which should mean that only a very small percentage of the portfolio is invested in any individual bond. Thus, even if a single issuer defaults, it will have no noticeable effect on the portfolio. Despite a large number of positions though, there are a few issuers whose bonds do account for a sizable proportion of the fund:

We can see that 21.10% of the portfolio consists of U.S. Treasury securities. This is a substantial proportion that would result in very large losses in the event of default. With that said though, if the United States government were to default on its obligations, then we would all have much bigger problems to worry about. We can also see that mortgage-backed securities account for a fairly substantial portion of the portfolio. However, the Federal National Mortgage Association (Fannie Mae) is also very unlikely to default. Although this agency is not explicitly backed by the Federal government, we saw back in 2008 that the U.S. Treasury will backstop these agencies in the event of default. Thus, we can probably consider these to be at no realistic risk of default. The takeaway from this overall is that investors should not really need to have to worry about losing money due to default with this fund.

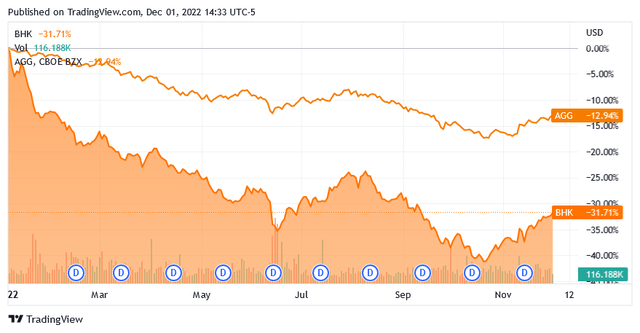

As stated earlier, bonds tend to decline in price when interest rates rise. This is because newly-issued bonds will have a higher yield than existing bonds so nobody will pay face value for the existing bonds in such an environment. As a result, the price of existing bonds will fall until they have a similar yield-to-maturity of similar bonds. We can see this in the price of the fund, as the price of the BlackRock Core Bond Trust has fallen 31.71% year-to-date. This is unfortunately significantly more than the 12.94% decline of the Bloomberg US Aggregate Bond Index (AGG):

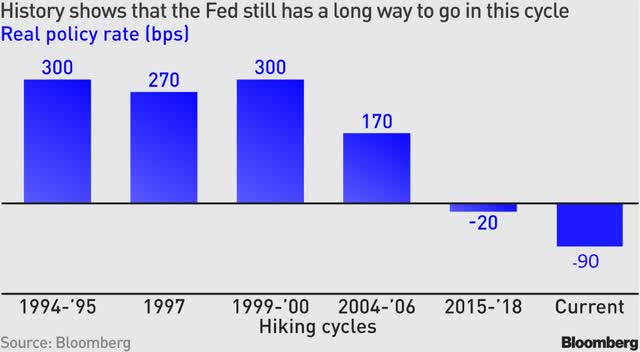

The BlackRock Core Bond Trust does have a substantially higher yield than the index fund but this is not sufficient to make up the performance difference. The reason for this is that the BlackRock fund uses leverage, which amplifies both its gains and losses. We will discuss this in more detail later. Unfortunately, this means that it will likely decline more than the index will as the Federal Reserve keeps raising rates. The reverse is also true and when the central bank does eventually pivot, the closed-end fund will likely outperform the index. However, as was already mentioned, it may take a few years for that to happen. The biggest question then is whether or not the worst is behind us. Despite Mr. Powell’s comments yesterday, the answer to that is probably not. This is because real yields are currently at the lowest rate that they have been in many years:

Zero Hedge/Data from Bloomberg

This is despite the fact that the Federal Reserve has been hiking interest rates over the course of this year. The reason for this is that inflation still exceeds the federal funds rate by a considerable margin. Economists are split over how high rates will need to be to defeat inflation, but I have seen predictions that the rate may need to be raised to over 10% in order to finally reduce inflation to the Federal Reserve’s target level. While we may not see rates that high, history does indeed show that the central bank will need to increase rates further. Mr. Powell’s comments yesterday lead to the same conclusion. Thus, we will likely see the fund’s price continue to decline for a while.

Leverage

As stated in the introduction, closed-end funds have the ability to use certain strategies that have the effect of increasing their yields beyond that of the underlying assets. One of the strategies that are used by the BlackRock Core Bond Trust is the use of leverage. Basically, the fund borrows money and uses that borrowed money to purchase bonds. As long as the interest rate that the fund pays on the borrowed funds is lower than the yield that it receives from the purchased bonds then this works pretty well to boost the yield of the overall portfolio. As the fund can borrow at institutional rates, this is usually the case.

However, leverage is a double-edged sword, since it boosts both gains and losses. We saw this earlier in the article in the fact that the fund has been underperforming the index. For this reason, we want to ensure that the fund is not using too much leverage since this will expose us to too much risk. I do not like to see a fund’s leverage above a third as a percentage of its assets for this reason. The BlackRock Core Bond Trust is significantly above this level as it has a leverage ratio of 41.22% of its assets. This is substantially above the leverage ratio that the fund had the last time that we looked at it, which is likely due to its asset values declining but the fund not reducing its leverage. This leverage could prove to be a real risk as rates increase so it is something that we will want to keep an eye on.

Distribution Analysis

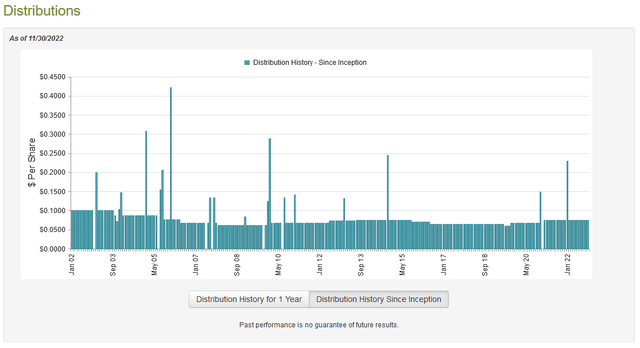

As stated earlier in this article, the primary objective of the BlackRock Core Bond Trust is to provide its investors with a high level of current income and capital appreciation, although the capital appreciation component is going to be quite hard to come by today. As the fund accomplishes this by investing in a leveraged portfolio of bonds, we can assume that it likely has a reasonably high distribution yield. This is indeed the case as the fund pays a monthly distribution of $0.0746 per share ($0.8952 per share annually), which gives the fund an 8.14% yield at the current price. The fund’s distribution has varied quite a bit over its history, although it has been reasonably consistent since the end of 2020:

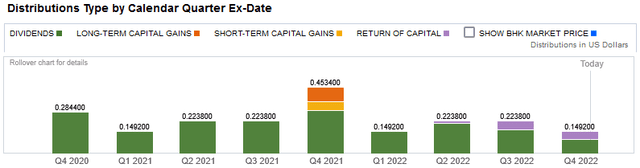

The fact that the fund’s distribution has varied quite a bit over the years is something that might be a turn-off for an investor that is seeking a safe and consistent source of income to use to pay their bills. However, it is not unusual for a bond fund because of its heavy dependence on interest rates and bond income to finance its distributions. The fact that the fund’s distributions are mostly considered to be dividend income helps to confirm this:

With that said, we do see a return of capital component in recent quarters. This is something that may be concerning because a return of capital component can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. There are other things that can cause a distribution to be classified as a return of capital though, such as the distribution of unrealized capital gains. In addition, it is possible for distributions to be classified as dividends when they are actually not (see here). As such, we want to investigate to determine exactly how the fund is financing these distributions and how sustainable they are likely to be.

Fortunately, we do have a relatively recent report to consult for this purpose. The BlackRock Core Bond Trust’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it will give us a good idea of how well the fund performed in the early stages of the Federal Reserve’s interest rate-hiking campaign, although it will not include information from the past few months. During the six-month period, the BlackRock Core Bond Trust received a total of $165,317 in dividends and another $22,742,199 in interest from the assets in its portfolio. This gives the fund a total income of $22,907,516 during the period. The fund paid its expenses out of this amount, leaving it with $18,826,127 available for shareholders. This was not enough to cover the $20,146,009 that it actually paid out during the period, although it did get pretty close.

The fund does, however, have other methods that it can use to obtain the money that it needs to cover its distribution. One of these is capital gains, but as we can expect from the rising interest rates over the first half of the year, the fund was generally unsuccessful at this. During the six-month period, the BlackRock Core Bond Trust reported net realized losses of $18,659,004 and suffered another $174,917,717 net unrealized losses. Overall, the fund’s assets declined by $194,629,149 after accounting for all inflows and outflows. Clearly then, the fund failed to cover its distribution. This is concerning as it may point to a distribution cut at some point in the future.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the BlackRock Core Bond Trust, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is unfortunately not the case with this fund today. As of November 30, 2022 (the most recent date for which data is currently available), the BlackRock Core Bond Trust had a net asset value of $11.05 per share but shares currently trade for $11.11 per share. This gives the shares a 0.6% premium to net asset value at the current price. This is substantially worse than the 4.64% discount that the shares have had on average over the past month and seems too much to pay for a fund that is likely to decline as the Federal Reserve continues to raise rates. Overall, it would be a good idea to wait a bit here until a more attractive entry price presents itself.

Conclusion

In conclusion, the BlackRock Core Bond Trust is likely to be a more appealing option than many other bond funds for conservative investors. This is due to its focus on investment-grade securities as well as its incredibly high yield.

However, unfortunately, the leverage that the fund uses to achieve its high yield is currently working against it because it is amplifying its losses as interest rates rise. Thus, it might be worth it to wait until the Federal Reserve is showing signs of stopping its rate hikes before buying in. The fact that BlackRock Core Bond Trust may have to cut its distribution in the near future also contributes to our sense of caution here. Sometimes waiting on the sidelines is the best thing to do, and this may be the case here.

Be the first to comment