Nattakorn Maneerat/iStock via Getty Images

Another quarter came and went for BlackBerry (NYSE:BB), showing us that, unfortunately, the turning point for the Canadian company is still a long way off. The combination of actual results and forecasts for the next year paints a disappointing picture that cannot excite the company’s shareholders or potential investors. The uncertainty surrounding the sale of the patents also contributes to a sense of confusion that is often a company’s worst enemy.

Fourth Quarter and Full Year 2022

Revenue came in at $182M in the fourth quarter, flat compared to the previous quarter and down 12% compared to the same quarter last year. The year-over-year decline was mainly due to the absence of the Licencing business, which contributed $50 million in Q4/2021, compared to only $11 million now. Regarding the sale of the patents, BB management said that the Canadian and U.S. governments have given the go-ahead and that the completion of the financial terms is expected at the end of this quarter. That should not be a detail, however, because we know that the consortium that will buy the patents from BB will need to raise about $90 million before it can access the further $400 million needed to close the deal. It could be easy, it could be difficult, we just do not know because we have not received an update on that.

As for next year’s forecasts, the Canadian company expects a flat performance for its Cybersecurity business and about 15% growth for its IoT division. This is quite disappointing considering that the global cybersecurity business is experiencing its best momentum in history, due to the ongoing virtualization of many daily business activities around the world and the new winds of the Cold War blowing ever stronger on the planet. Part of the justification for this is that a significant portion of BB’s Cybersecurity business is UEM. However, as most enterprises move to virtualized workplaces and embrace the work-from-anywhere paradigm, BB ‘s UEM business should also be thriving, which is clearly not the case here.

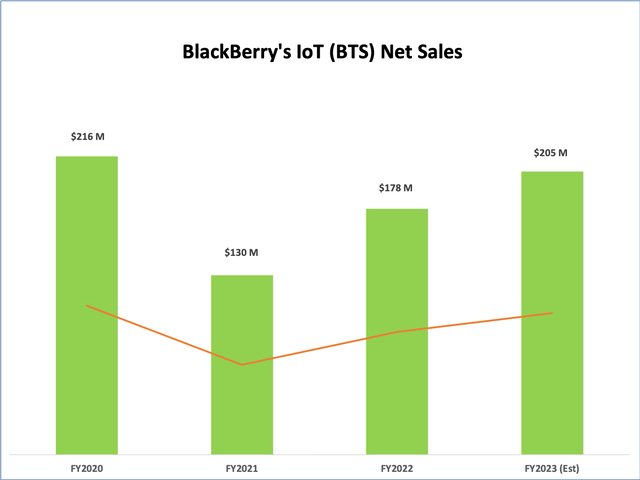

Moreover, even the positive growth of BB ‘s IoT segment must be viewed in a multi-year perspective: in fact, today’s IoT segment was still called BTS in FY 2019, and generated $204 million in revenue that year. We know that this segment grew by 6% in FY 2020, reaching $216 million, which is higher than the projected $205 million (midpoint) that the IoT division is expected to reach next year (see the picture below).

Company’s reports-Author’s elaboration

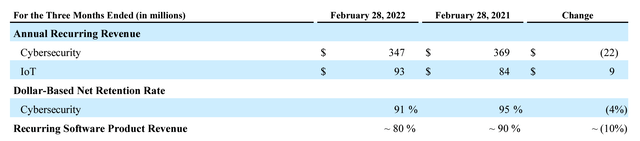

In other words: We are still where we were 4 years ago, and we do not really know if this segment has the potential to consistently evolve from there. Certainly, the ARR as well as the trends in recurring software revenue do not leave much room for optimism.

Company’s report

All in all, the overall picture for the Canadian company is still very cloudy and the value proposition is indeed not very clear either.

Patent sale and valuation

I have discussed patent sale negotiation at length before, for example here. In short, I believe that the final price agreed upon hardly compensates for the revenue lost during the negotiations. Indeed, BB management has always suggested that the negotiations abruptly halted the ongoing process of monetizing the company’s patent portfolio. In fact, the division’s revenues have plummeted by 80% in the last two years, after several years of steady growth: it’s worth noting that this was the only part of BB ‘s business that grew consistently over the years! To me, the numbers the deal shows us do not make much sense. It seems that the same doubts are also surrounding the investment community: below is an excerpt from the latest conference call.

Paul Treiber

Just a second question, just on the sale of the patent portfolio. To the extent that you can, can you just walk through some of the assumptions in terms of like the longer-term outlook that went into that arriving at that price? Because one of the things that investors look at as you look at the revenue in that segment, in the previous year, it was quite a large number. How do we put the sale price in context to the previous revenue that you generated in that segment?

John Chen

Okay. So, I would say, there’s still a lot of potential for this noncore set of patents. But two things obviously you know. One is, time is ticking down in the validity of the portfolio. Although we have a very young — we typically have, even with the noncore, somewhere around 8 to 10 years type average lifetime with the patent still remaining. So — but the — if you notice that — which you pointed out, the last couple of years — or the last few years, we have some good success. But those are with very big names.

And so, now, we need to go — the business needs to go cultivate pipeline for the smaller name, which typically takes a little longer time, a lot more back and forth. Big name does too, but big names have big numbers. So, in a way that the low-hanging fruit, we already approached. And so, I think the numbers we have done in market test the numbers, we think it’s very fair to both sides.

I am not sure I get the point of BB’s CEO response here.

Anyway, it is what it is, and we now have this lump sum of $600 million that BB will receive in exchange for its monetizable patent portfolio. To be precise, BB will receive only $450 million of the sum and the rest in annual installments over a very long period of time (8 years) if certain conditions are met. In fact, these installments have already been eliminated by the recent settlement of a class action lawsuit by defrauded shareholders. So, conservatively, you can only expect the first payment of $450 million, but even that is subject to some financial milestones that may not be so easy to achieve. The fact is that the consortium interested in acquiring the patents from BB is financing the purchase primarily with debt, but they also need to raise capital. The amount they need to raise is set at $90 million, as mentioned earlier, and no one knows how easy (or hard) that will be for them!

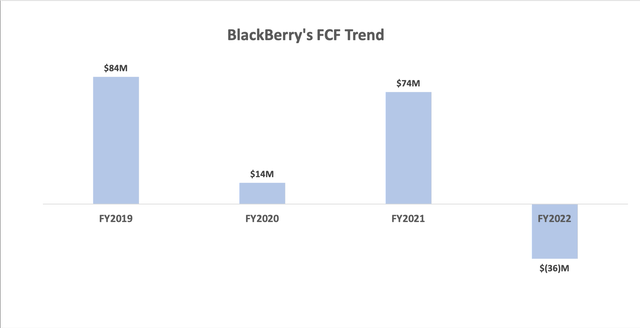

However, if we assume that BB will soon receive the money from the transaction, then the net liquidity of the Canadian company would be about $900 million. The question an investor should ask is: How much FCF do we need in the coming years to justify BB ‘s current capitalization, which is about $4B?

In the following chart, you can see the evolution of FCF over the last few fiscal years of BB.

Company’s reports-Author’s elaboration

That’s not very inspiring, is it? Of course, you can make all kinds of optimistic assumptions about the future of BB, just like for any other company in the world, but if we want to be realistic, the revenue of this company is not growing: so where is the cash flow going to come from in the next few years?

I would rather assume that BB could reach (at best) FCF of about $100M per year in a few years. That would imply a fair value of about $2.5B (or a little more than $5 per share) from a discounted cash flow perspective.

Bottom Line

BlackBerry’s fourth quarter results, released a few days ago, paint a bleak picture of the company’s business situation. BB shareholders unfortunately have to deal with considerable uncertainty about the future prospects of their company. The “closing” of the patent deal also leaves a lot of unease, as the final outcome is still uncertain. Incidentally, this unease is made worse when one considers that BB recently reached a settlement with a number of shareholders who claimed to have been defrauded years ago: the final amount of the settlement is about one-third of the total proceeds that BB was expected to receive from the sale of its exploitable patents.

Paradoxically, the overall market conditions are favorable for BB ‘s business, as the growth trend in cybersecurity currently appears robust. This is both a negative sign for the Canadian company, as it shows that it is not in a position to benefit from a positive business environment, but it could also be seen as a reason for optimism, or at least hope, if BB finally manages to fix its problems and get on the cybersecurity fast track.

Be the first to comment