Kanawa_Studio/E+ via Getty Images

Main Thesis / Background

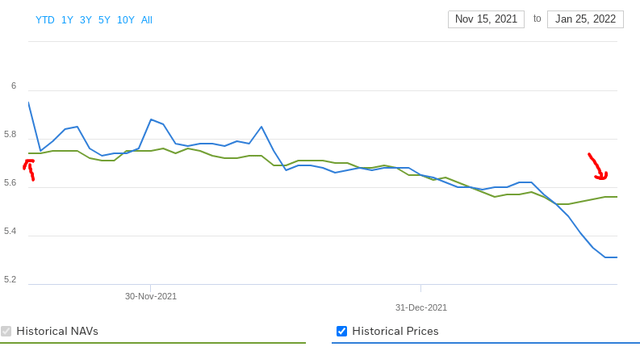

The purpose of this article is to evaluate the BlackRock Income Trust (NYSE:BKT) as an investment option at its current market price. This fund is one I have written about many times, and is managed by BlackRock (NYSE:BLK), with an objective to “manage a portfolio of high-quality securities to achieve both preservation of capital and high monthly income”, primarily through exposure to agency mortgage-backed securities. This has been a fund I used to own, but sold-off the position last year when I got concerned about future performance. In hindsight, this was absolutely the right move for me. While stocks and the broader market have struggled in the past few months, BKT in particular has been especially hit hard:

Performance Since Last Review

Of course, the total return is close to -10% or so, after we factor in the two distributions that have been paid. Still, this is very poor performance.

While this short-term move is not very comforting, it was sharp enough to cause me to re-evaluate this CEF to see if I should change my outlook going forward for 2022. After review, I do see a much more attractive investment environment for this particular option. The fund’s valuation is in discount territory, re-financing activity in the mortgage space is starting to slow (which can help income metrics), and the Fed’s tapering program, while a negative, seems to have been baked into current asset valuations. Additionally, the market’s recent volatility may have many investors, including myself, looking for a while to smooth out overall portfolio volatility. As a result, I am upgrading this fund to a buy, and will explain why in detail below.

What Happened? Premium Compression

To begin, I think it is important for us to look at the why behind BKT’s poor performance in the past couple of months. This is important to understanding if now really does represent a value/buy opportunity, or if the fund is still an “avoid” candidate. Clearly, a double-digit drop is nothing to take lightly, especially with a fund whose income level is normally in the 6-7% range. A drop of 10% wipes out the income for an entire year, and that hurts.

In this respect, what has been going on with this fund? The fortunate part is that there is not really any strong sell signal for the underlying holdings. The fund’s NAV has actually been holding up fairly well. While it is down slightly over the past two months, the fund has had two ex-dividend dates, so it is really a flat performance since then when it comes to net asset value (as evidenced by the green line in the graphic below):

Clearly, the NAV hasn’t been the real problem. So, what has? Well, as the blue line suggests, the problem is the market price. For value-oriented investors like myself, this probably doesn’t come as too big of a surprise. The reason being BKT was trading at very lofty valuations in the second half of 2021. In fact, back in November, I cautioned against buying this fund as it had a premium above 4%. While that 4% premium was a concern, it was a far cry from the 7% premium the fund saw earlier in that year. To me, this fund was simply not worth that price, and recent share price action suggests me line of thinking has been vindicated.

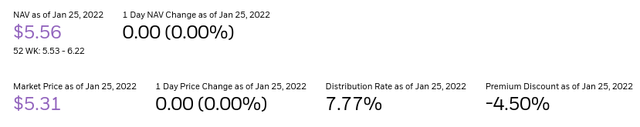

The good news is that where we stand now is much more in-line with an entry point investors can get behind. The premium to NAV is gone, and the fund sits with a discount that is quite attractive:

As I write this (on 1/26), BKT is having a positive day, so this discount will probably narrow to the 4% mark. However, this is still a very reasonable buy-in point, especially for an asset class like agency MBS that have very little credit risk at the moment. To me, this story illustrates how patience has been rewarded, and that now is finally the time to act.

UNII Metrics Are A Problem, But Relief In Sight

I will now turn to another critical area, but one that is less positive. This is the fund’s income picture, which is a concern I highlighted back in November. On the surface, the distribution looks attractive, with a current yield nearing the 8% mark and a CEF filled with very quality holdings. However, the concern a few months ago was the distribution level was not sustainable. Today, that concern is as valid as ever.

To understand why, let us consider the most recent UNII metrics. Simply, these paint a worrying trend. BKT has a distribution coverage ratios in the mid-60%s, and it continues to sport a hefty negative UNII balance. In fact, the current UNII metric represents almost three months worth of distributions, which is not a good sign:

The takeaway here is pretty obvious. BKT is overpaying what it is earning in income, and that is not a sustainable strategy. I had hoped to see some progress since my last review, but that is not the case. At this point, it is hard to imagine the fund not being forced to cut its distribution, which is certainly a headwind worth mentioning.

Fortunately, there is some good news. First, the fund can afford an income cut. With a current yield near 8% for MBS, this is well above what investors would typically expect for these types of assets. So, BKT could see a reasonable cut and not send investors panicking. Ultimately, while it could be painful in the very short-term, I would few it as a positive because it sets the fund on a more sustainable course.

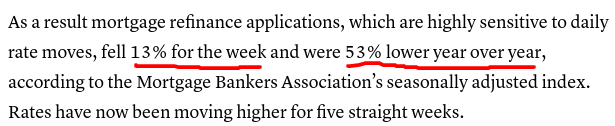

Second, an important macro-trend is developing that should help the fund earn more income in the coming months (and hopefully years). Specifically, as mortgage rates have ticked up, refinancing activity has started to fall rapidly. This is positive for BKT because it removes some of the prepayment risk the fund is exposed to. This is because as rates fall, homeowners can refinance their mortgages. While BKT gets paid the par value (usually) for these assets, it is then left without an income-producing debt product. To replace it, the fund can pick up a similar asset on the open market, but will be getting the prevalent, and lower, income stream. This has been a key reason why BKT’s income metrics have been in such poor shape. But relief is in sight, with refinancing activity falling on both a week-over-week and year-over-year basis, according to an article out by CNBC this week:

Refinancing Activity

The thought here is that while refinancing has been pressuring BKT’s earnings power, there are signs this pressure is abating. In fairness, it will take more of a movement on yields to generate a positive impact, but at least this is stopping the bleeding. I would expect to see BKT’s income metrics improve modestly in the year ahead, although I am not entirely confident it will be enough to prevent an income cut. That said, I stand by the thesis that even if BKT does reduce its distribution, the income stream will still attract buyers.

Managing Expectations: Fed Taper Will Impact MBS

So far I have highlighted a couple reasons why I would consider buying BKT at the moment. However, I do want to manage expectations here. I do not expect strong out-performance from this fund. I think the yield, even if it sees a cut, will be enough income to compensate for the risks one would take. I also think the discount to NAV indicates a decent time to initiate positions. However, I would be surprised to see this fund generate more than a 5% or so return for the year. My thesis here does not bank on BKT moving back in to expensive premium territory. For those who have been watching this fund over the past year, they have seen in hit premiums in the 5-7% range. With that as a benchmark, buying now and hoping to return to those levels would generate a substantial return. My point is to manage the expectation away from that thesis. I do not see those lofty premiums returning this calendar here, and would simply be content with a narrowing of the discount back to par value.

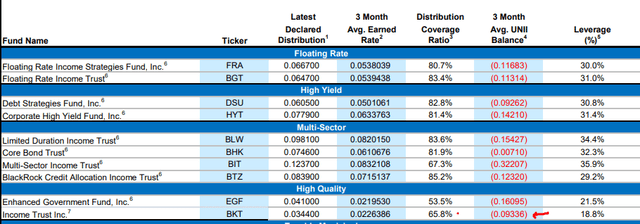

So, why is that? An important piece of the puzzle when evaluating BKT is the Fed’s tapering actions that are sure to come to light over the next few quarters. This fund in particular is exclusively long agency MBS, and that is a key sector the Fed had been buying as part of its support program:

An immediate concern here is that agency MBS as a sector were major beneficiaries of the Fed’s buying program. This helps to explain why BKT was in premium territory last year – the Fed was buying the underlying assets, and investors wanted to own those assets as a result. This contributed to a lot of buying of this normally stable sector.

While this was good for 2021, the problem is we are not likely to see the same in 2022. In fact, the Fed has already begun to slow down its asset purchases, which again is partly why BKT has seen such weakness. Going forward, this probably isn’t going to change. The Fed is going to be buying less, and also letting some of these securities “roll-off” its books (letting the bonds mature and not replacing them). This signifies a major shift in policy, and will prove to be a headwind for BKT in the months to come.

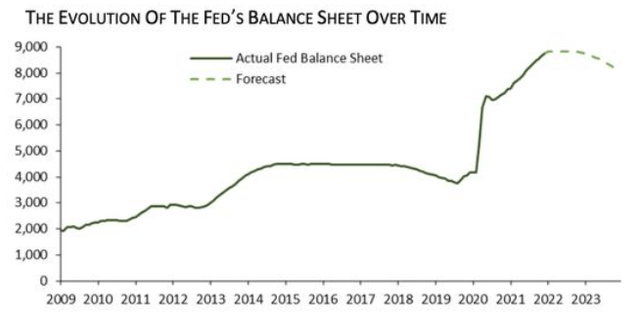

Just how important is this? Considering the size of the Fed’s balance sheet, which ballooned during 2020, this is very important:

Of course, the balance sheet growth has mainly been due to the Fed buying treasuries, but agency MBS (as well as corporate bonds) are another important piece. Recent forecasts suggest a decline in the balance sheet over the course of 2022 and 2023, which means both a reduction in bonds purchased and a rolling off of existing bonds. All things being equal, this is a headwind for BKT, and something investors need to keep in mind when deciding whether or not to buy this fund.

Still A Great Way To Buy Quality Assets

My final point just touches on the underlying credit quality of BKT. I have discussed some pros and cons – such as the valuation, income, and Fed tapering of the MBS sector. These all balance out to some degree, so investors really need to understand what their goals are and their own outlook for the sector before buying this fund. Importantly, these attributes are of critical importance because one area I normally look at critically when it comes to fixed-income products, credit quality, is not really a concern for this sector.

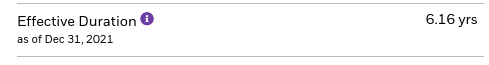

The reason is that agency MBS have a very low historical default rate. In addition, they are better poised to handle an increasing rate environment than corporate bonds of similar ratings. While high yield credit has a lower duration than both MBS and IG corporates, if we compare agency MBS and IG corporates, we see that agency MBS are actually less interest rate sensitive. That means, for readers who want to stay in the investment grade/quality end of the spectrum, funds like BKT could be the right move.

For comparison, consider that BKT has a duration over 6 years. This is not “low”, and does suggest the fund will see pressure as interest rates rise. However, if we compare this to the iShares Investment Grade Corporate Bond ETF (NYSEARCA:LQD), which holds IG bonds, we see that LQD’s duration is less attractive during a period of rising interest rates:

BKT Duration BlackRock LQD Duration

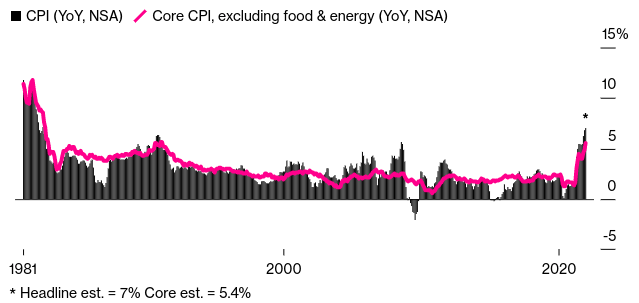

The conclusion I draw here is that investors who do not want to push the risk envelope, and are worried about inflation, would be wise to choose BKT over the IG corporate sector. With inflation remaining stubbornly high, I see this as very relevant for the year ahead:

CPI

Simply, inflation is going to pressure fixed-income for the foreseeable future, so managing duration risk should be on the minds of every investor. BKT offers one reasonable way to do this, if we compare it to other IG options.

Bottom Line

BKT has seen a sharp drop in the short-term. Rather than getting worried here, I would advocate starting a position. The discount to NAV is compelling, the income stream should be getting some relief as refinancing activity dries up, and agency MBS remain a very strong asset class in terms of quality. This is because home values keep rising, American households have record equity, and the Fed has time and again re-committed itself to supporting this sector. While the income metrics and Fed tapering are headwinds, I think the buy-in price is finally pricing in these risks in an adequate way. This makes positions justifiable at this time, in my view. As a result, I am looking to re-start a position in BKT in the near term, and suggest readers give this fund some consideration going forward.

Be the first to comment