Andrii Dodonov

Rising rates have led to a bad year for bonds. The best performers in bond land are those with short durations and/or floating rates, like e.g. senior loans.

Rising rates lead to higher income for investors in senior loans. At the same time this translates to higher interest payments for the borrowers. And these higher interest costs come at a moment that the economy is slowing down due to the FED rate hikes. A double whammy. We expect inflation to remain above the FED 2% target in the coming years and hence we think there’s little room for really lower interest rates.

We like senior loans when interest rates are rising due to a booming economy and defaults are low. We like them less in the more stagflationary environment we think we are in now, with rising default rates.

Our favorite senior loan ETF is the Invesco Senior Loan ETF (NYSEARCA:BKLN) given its nice performance and low expense ratio. Hold on to your shares and enjoy the high coupons and the diversification benefits while you’re waiting for the economy to improve (before adding to your position).

What are senior loans?

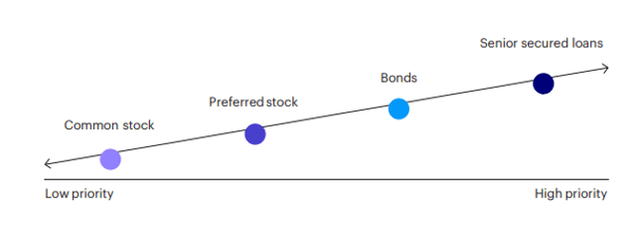

Senior loans are also called bank loans, leveraged loans or syndicated loans. A senior loan is a commercial loan to a high-yield company provided by a (syndicated) group of lenders. They are often used to fund leveraged buyouts. These loans are typically senior debt (secured by the borrowing company’s assets) and are at the top of a company’s capital structure.

Figure 1: Senior loans in the capital structure (Invesco)

Generally, senior loans are the first to be repaid during bankruptcy liquidation. As a result, senior loans have double the recovery rates compared to “normal” high yield bonds and have experienced less volatility than high yield bonds.

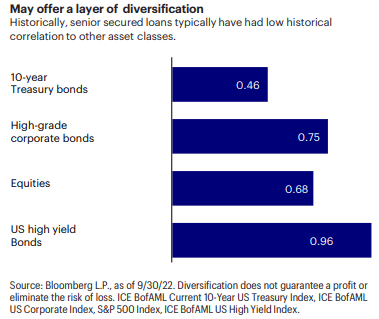

Thanks to this lower volatility, senior loans offer more diversification benefits to investors.

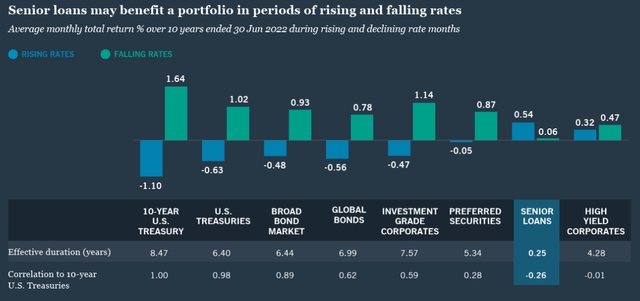

Figure 2: Diversification benefits (Invesco)

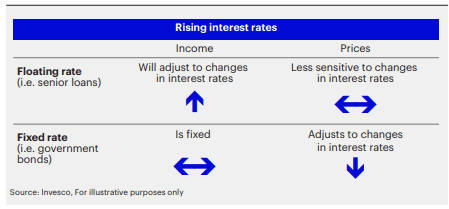

Senior loans are very often floating rate and priced at a spread over a referenced rate such as SOFR (Secured Overnight Financing Rate) or LIBOR in the past. The spread compensates investors for the credit risk they assume by lending money to a high yield company.

Because they are floating rate senior loans have a very short duration. They are less sensitive than other bonds to rising (or falling) interest rates. When rates rise, the coupon payment rises but the price remains rather stable. For (high yield) bonds, the price falls when interest rates rise and the coupon payment remains stable.

Figure 3: Rising rates impact (Invesco)

Changes in default risks can of course have an impact on the price of senior loans regardless if interest rates are rising or falling.

Default risks

Over the last decade, the term “cov-lite” has become virtually synonymous with senior loans, commanding more than 90% of the market. Cov-lite stands for “Covenant-lite.” Debt covenants included in bank loans are an important source of investor protection, as lenders can seek instant repayment of the loan if a covenant is violated.

There are typically two types of debt covenants: affirmative and negative.

Affirmative covenants are straightforward, requiring the borrower to take basic actions associated with the loan (e.g., pay interest).

Negative covenants are more tailored to the specific company’s situation, concerning restrictions on corporate activity (e.g., mergers & acquisitions, dividends, asset sales).

Negative covenants take two basic forms: incurrence and maintenance.

Incurrence covenants require the issuer to meet specified financial tests only if the company wants to take a specified corporate action (e.g. paying a dividend or issuing additional debt).

Maintenance covenants are more restrictive, compelling issuers to meet specified financial tests each quarter (even if there is no specific action management would like to take).

Senior loans that are issued with only incurrence covenants and no maintenance covenants are classified as cov-lite. The vast majority of leveraged loans today are classified as cov-lite. This means fewer restrictions on the borrower and the potential for issuance of even more debt.

The additional flexibility for issuers without maintenance covenants may allow those borrowers to circumvent default. One can’t default on covenants that are not there. On the other hand, a lack of maintenance covenants can delay a default for some time, but when it happens it may result in lower recovery rates for lenders.

On top of the “light” covenants many senior loan borrowers took advantage of low rates in recent years and refinanced. As a result, no senior loans are maturing in 2022, and the amount coming due in 2023 has fallen by about three-quarters since the start of 2021.

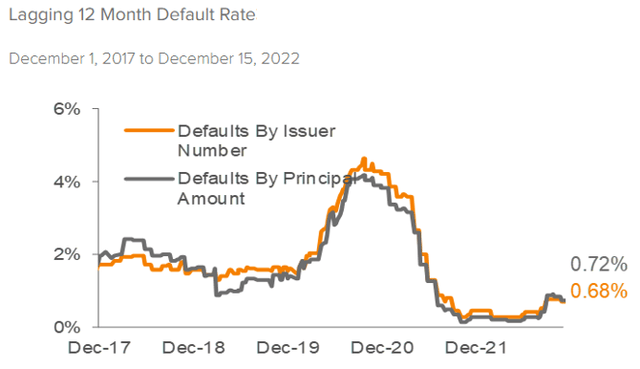

According to the Morningstar LSTA US Leveraged Loan Index, only 9% of outstanding senior loans will come due prior to the end of 2024. This may help high yield companies to survive the economic weakness caused by the FED rate hikes. Anyhow, the default rates are very low for the moment.

Figure 4: Default rate (Voya Investment Management)

But according to Fitch Ratings, the outlook for U.S. Leveraged Finance in 2023 is deteriorating. Fitch’s 2023 default rate expectations are 2.5%–3.5% for high-yield bonds and 2%–3% for senior loans, showing growing macroeconomic headwinds, such as the mild U.S. recession Fitch expects to occur in mid-2023.

Of course, if we experience a really hard landing, default rates will be higher. A hard landing could at the same time force the FED to lower rates and this should alleviate the interest costs.

Where are interest rates headed?

Senior loans may benefit an investor both when rates are rising and falling. When rates are falling the positive impact is mostly limited to lowering the volatility of a (bond) portfolio. When rates are rising, senior loans are the top performers, as we could experience this year. So it is important where interest rates are heading.

Figure 5: Impact interest rate movements (Nuveen)

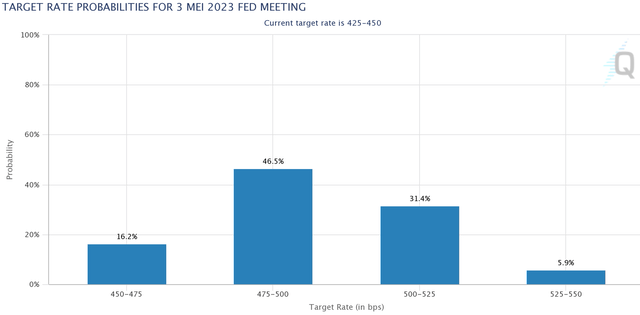

The FED added another 50 bp to the fed funds rate in December. What comes next? Based on futures markets there is a 66% chance that the FED will hike with 25bp at the next FOMC-meeting in February. There is a 56% chance for an additional 25bp rate hike in March. This would bring the FED rate to a range of 475 to 500 bp. This meeting would mean the end of the rate hikes, according to the futures markets. The FOMC-meeting in May would leave the FED rate unchanged.

Figure 6: May 2023 target rate probabilities (CME Group)

So, there is still some limited room for higher senior loans coupons due to the persistent inflationary pressures. It remains to be seen if the borrowing companies can pass through these higher prices to their customers. If not, they will face not only higher interest costs but also margin pressure.

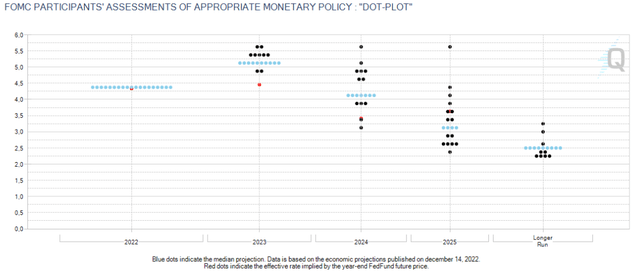

According to the FOMC dot plot, the FED expects that rates will stay at this level until the end of 2023 and to fall to 4% in 2024. In the dot plot below, created by CME Group, the red dots indicate where the futures markets expects the FED rate to be. At the end of 2025, the futures market banks on a FED rate above 3.5%, while the members of the FOMC count on a rate slightly above 3%.

Figure 7: FOMC dot plot (CME Group)

So 2023 could bring both the highest interest rates we have known in years and an economic slowdown. If this turns out to be true, senior loan borrowers are hit hard twice: declining revenues and high interest costs.

Of course, if the economic slowdown is heavy, the FED will have to lower interest rates and this would soften things for senior loan borrowers (due to the lower interest costs).

Invesco Senior Loan ETF

Our favorite way to play the senior loan market is through the Invesco Senior Loan ETF. BKLN has an expense ratio of 0.66% while competitors with a worse performance like SPDR Blackstone Senior Loan ETF (SRLN) and the First Trust Senior Loan Fund (FTSL) have an expense ratio of 0.70% and 0.86% respectively.

The Invesco Senior Loan ETF currently yields 6.7% and the assets under management amount to almost $4 billion.

The ETF is based on the Morningstar LSTA US Leveraged Loan 100 Index. BKLN will normally invest at least 80% of its total assets in the component securities that comprise the Index. The Index is designed to track the market-weighted performance of the largest institutional leveraged loans based on market weightings, spreads and interest payments. The ETF and the Morningstar LSTA US Leveraged Loan 100 Index are rebalanced and reconstituted bi-annually, in June and December.

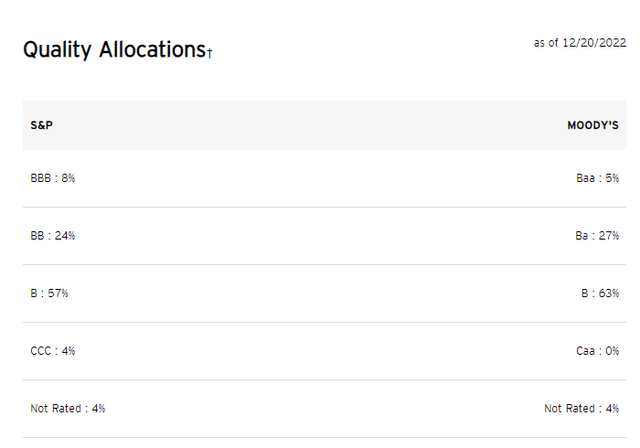

The majority of loans in BKLN are rated B and BB.

Figure 8: Rating allocation (Invesco)

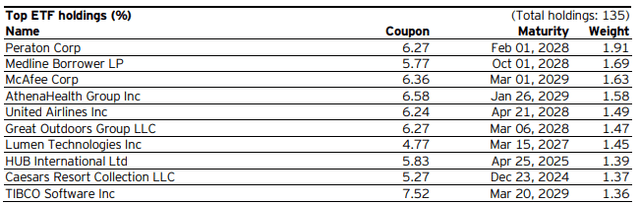

BKLN is not only diversifying, it is also well diversified with a total of 135 holdings. The biggest position accounts for less than 2% of the fund.

Figure 9: Top 10 holdings (Invesco)

Conclusion

When do you want to buy senior loans? When you have a booming economy that leads to rising rates and a low default risk. That’s not really describing the current situation.

When do you want to hold senior loans? Almost always I would say. Not only for the nice yield. They merit a place in bond portfolios as a diversifier and a volatility reducer.

When would you sell? When you have a heavy recession and the central bank doesn’t lower interest rates to combat that recession. We think this combination isn’t the most realistic scenario.

So our conclusion is clear: hold your Invesco Senior Loan ETF, enjoy the nice yield while you’re waiting and consider adding when the economic outlook improves again.

Be the first to comment