Jeff Fusco/Getty Images News

BJ’s Wholesale Club Holdings (NYSE:BJ) is one of the leading membership warehouse club operators in the United States. There are many things to like about BJ like how the company has been able to grow its revenue by opening new clubs. In fact, they recently bought four distribution centers and transportation fleets from Burris Logistics. Additionally, the company successfully improved its customer service and increased sales through digital channels and a partnership with DoorDash (DASH), making its membership base grow exponentially.

It has also been able to keep its operating margins elevated over pre-pandemic levels. However, from a valuation standpoint, I believe BJ is ripe for a pullback, making this stock worth monitoring.

Company Overview

Despite today’s operating environment challenges, BJ finished Q2 2022 with an exceptional 22.18% year-over-year top line growth of $5,103.8 million, a record high figure for the past 10 quarters. This is due to its consistent club expansion even despite the pandemic; in fact, as of this writing, BJ has 229 clubs, up from 219 clubs in 2019. Another interesting catalyst is that management expects 8 new clubs to be opened in FY2022, for a total of 11 new clubs in FY2022. In addition to its improving scale, the company has seen a year-over-year increase in comp club sales of 7.6% (excluding gasoline sales), which is better than 4.1% and 0.9% seen in Q1 2022 and Q4 2021, respectively.

A big part of this performance is its success in acquiring new memberships; as of this quarter, the company has over 6.5 million paying members annually, up from over 5.5 million in 2019. In fact, their membership fee income increased 11% year-on-year during this quarter, totaling $98.8 million. One driver of its growing membership base is its strong digital presence, which makes things more valuable and convenient for customers and assures another growth record this FY2022, as quoted below.

Our business starts with membership and it continues to be the strongest that I’ve seen in my history with the company. In the second quarter, growth in our member count was impressive at 6% year-over-year, this was led by a combination of strong renewal rates, and membership acquisition helped by our growing success in digital acquisition.

…Our first year and tenured renewal rates are improving over last year’s levels and we continue to believe that we will report new all-time high results in these rates at year-end. Source: Q2 2022 Earnings Call Transcript

Overall, BJ is seeing impressive results with the growth of its membership base and its easy renewal rate.

Our membership base has grown roughly 25% since our IPO. Higher tier membership penetration is 37%, up from around 21% at our IPO.

Own brands penetration is trending up 600 basis points from our IPO. And easy renewal penetration is at 77%, which compares to 39% at our IPO. Source: Q2 2022 Earnings Call Transcript

There is no wonder why the management is so confident in providing a better EPS outlook to be in the range of $3.5 to $3.6, better than its last guidance of $3.25, which potentially may generate BJ another record figure to monitor in FY2022.

Inflation Stings

This quarter, despite being a controlled matter as demonstrated by its EPS guidance, BJ’s merchandise gross margin actually decreased by 50 basis points due to supply chain costs and inflation, indicating an early warning for investors to keep an eye on. This snowballed to a declining gross margin of 16.85% this quarter compared to 18.28% in the same quarter last year.

Looking forward, BJ ended this quarter with a higher trailing EBITDA of $883.3 million, compared to $509.2 million during the peak of the pandemic. Although it seems logical as people may have excess cash to splurge, thanks to previous Covid-19 stimulus checks, a prolonged combat with inflation may put pressure on BJ’s operating margin.

Less Debt, More Share buyback

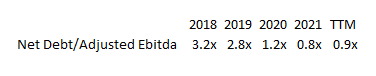

It is nice to see how BJ’s long-term debt has declined to $699.4 million over time. Furthermore, as shown by its Net debt to adjusted EBITDA ratio, we can see that there is a significant improvement in its liquidity, as shown in the image below.

BJ: Improving Liquidity (Source: Company Filings, Prepared by InvestOhTrader)

On top of its improving liquidity, the company has $413 million remaining under their share buy back program, making this stock a bit more attractive if there’s a potential correction this year.

Fairly Valued

Although the company has a strong top line and controlled margin growth, BJ has a deteriorating ROE trend and is trading at a higher multiple than its 5-year average. This quarter, its trailing ROE is around 74.3%, down from 88.2% and 317.7% in FY2021 and FY2020, respectively.

Looking forward, the company is trading at a trailing EV/EBITDA ratio of 14.81x, higher than its 5-year average of 13.32x. However, it is still below its peers’ average of 17.42x, with Costco (NASDAQ:COST) and Walmart (NYSE:WMT) having 22.62x and 12.22x, respectively.

Additionally, looking at its trailing price/cash flow of 13.85x, it is also trading above its 5-year average of 9.0x. BJ is also trading relatively cheap compared to its peers’ multiples of 29.39x and 17.19x, respectively.

Assuming a generous 5.3% EBITDA margin, at a forward EBITDA of $1,145 million in FY2024, and a 4.8% discount rate, comparatively, BJ is fairly valued at ~$83 fair price.

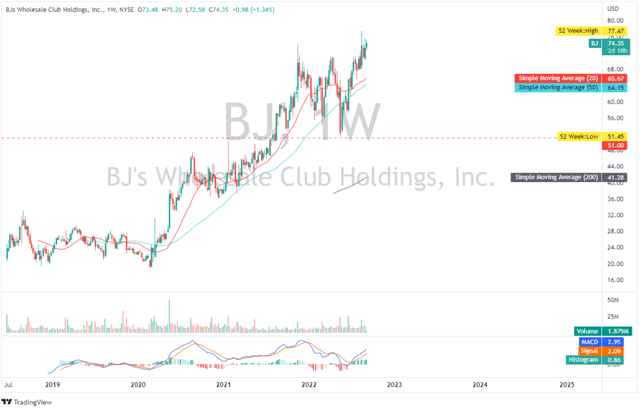

Challenging Its 52-Week High

BJ: Weekly Chart (Source: TradingView.com)

BJ is still fundamentally sound, however, with the ongoing bearish market, I would rather play safe and enter at a correction rather than buying aggressively at this level. Looking at its weekly chart above, if there will be a bearish move, our next logical support will be around $62-$65, proving an ample room of decline as of today. If this zone breaks, I believe the next safer support will be around $51. While looking at its MACD indicator, it is still in bullish territory, however, printing a potential lower high implying an exhausted bullish rally.

Conclusion

In BJ’s gas segment, inflated gas prices appeared to help the company’s membership base and total sales grow. This quarter, their Gas and other income contributed 24% of total revenue, up from 15% in the same period last year. Furthermore, the management does not anticipate significant changes in the membership trend due to the volatility of gas prices, as stated below.

I think there is certainly more of a relevance factor to higher gas prices go and I’d tell you in the beginning of the year, in the first quarter, we were seeing higher comp gallon gains than in the second quarter and some of that is the falling gas prices in the second quarter. However, our membership gains have not slowed down. Source: Q2 2022 Earnings Call Transcript

BJ did well this quarter, with strong guidance from the management., interesting club expansion, declining debt, and a buyback catalyst. However, the company is trading above its historic levels with a deteriorating ROE and trading near its psychological resistance. This makes BJ ripe for a potential pullback.

Thank you for reading!

Be the first to comment