helen89

The restaurant industry has had a rough year, and while some quick-service names like McDonald’s (MCD) have held up well, casual dining names have been pummeled. One name that’s been hit especially hard is BJ’s Restaurants (NASDAQ:BJRI), down more than 60% from its highs. The stock might appear undervalued at ~17x FY2023 earnings estimates, but annual EPS estimates look ambitious, given the challenging macro backdrop. This suggests that even if BJ’s has a decent Q2 in a seasonally strong period, it could be a tough H2 ahead for the company. Hence, I wouldn’t rush in to catch this falling knife at $22.30 and believe patience is the best course of action.

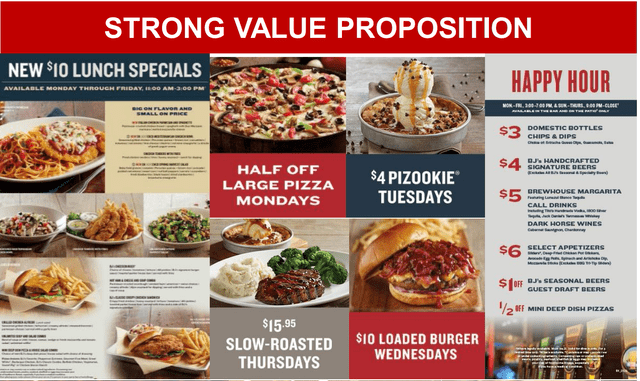

BJ’s Brewhouse Offerings (Company Presentation)

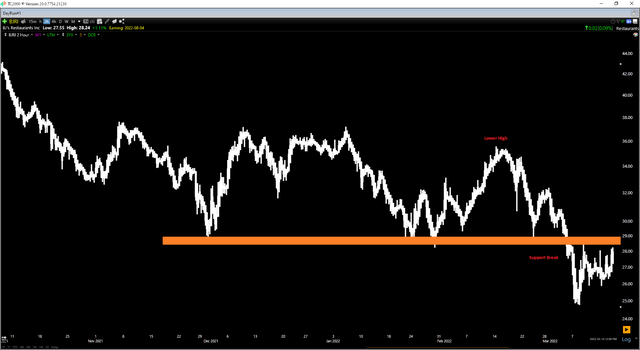

Just over six months ago, I wrote on BJ’s Restaurants (BJ’s), noting that while the stock’s valuation was improving, I didn’t see nearly enough margin of safety at $36.00 per share and that waiting for a dip to $31.00 looked like a safer bet. While BJRI did enjoy a 15% rally off the $31.00 level in just over one month, that rally printed a lower high, and the stock has since broken key support at $29.00 per share. This softness can be attributed to the general market weakness, coupled with continued headwinds for the casual dining segment, in a period where we could see some trading down. Let’s take a closer look at recent developments below:

Q1 Results

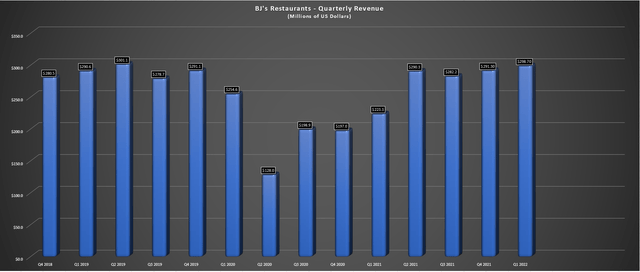

BJ’s Restaurants released its Q1 results in April with a very positive tone, sharing that they exited Q1 with $118,000 in sales, 1.2% above pre-COVID-19 levels. While Q1 comps were down 1.5% vs. 2019 levels, this was largely due to the impact of Omicron early in the quarter, with sales continuing to improve as the quarter progressed. This translated to a record Q1 revenue figure of $298.7 million, a solid performance considering the headwinds and the fact that restaurants remain below peak staffing levels. Finally, April sales were also trending nicely, with a strong Q2 ahead with Spring Break, Father’s Day, Mother’s Day, and graduation celebrations on deck.

BJ’s Restaurants – Quarterly Revenue (Company Filings, Author’s Chart)

Overall, this busy quarter combined with menu pricing (February: 1.8%, June: 1.4%) should help the company to put together a solid Q2, allowing for another set of strong headline numbers, with much higher weekly sales vs. Q2 2021 levels and should come in above pre-COVID-levels (2019: $113,000) according to guidance ($118,000 – $119,000). However, with the market being forward-looking, I believe the more relevant figure is not the Q2 performance which strong seasonal trends could buoy, but the H2 2022 performance, which could disappoint.

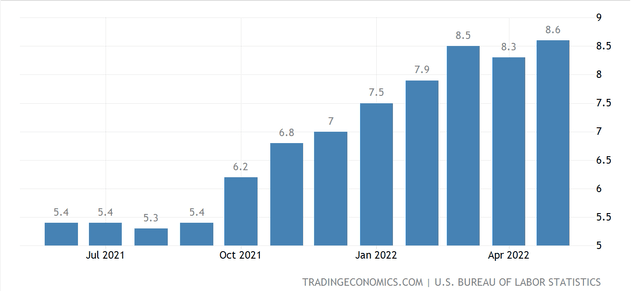

United States Inflation Rate (TradingEconomics, BLS)

Demand Headwinds

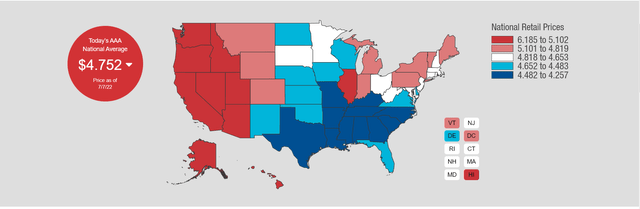

At the time of the Q1 Conference Call, gas prices were at $4.20/gallon (not $5.00/gallon), and mortgage rates were sitting at 5.0%, not 5.80%. In addition, inflation hasn’t cooled off either, with grocery inflation and CPI remaining elevated (May: 8.60%). These headwinds are contributing to a shrinking discretionary budget for consumers, with these headwinds much less severe in April. Hence, the encouraged and optimistic tone in the Q1 Conference Call could shift to a more cautious outlook for the back half of the year if we have seen some moderation in traffic in H2 2022. According to Black Box Intelligence, this is the case, with half of all states experiencing negative sales growth for the week ending June 19th, 2022.

It is important to note that negative weekly sales growth suggests a meaningful dip in traffic, given that menu pricing across the industry is up meaningfully on a year-over-year basis as restaurants work to combat inflationary pressures (food, packaging, labor). In addition, this was the 15th week in a row that the industry saw negative traffic growth, with the last week of traffic growth being March 6th. These trends suggest that rising gas prices and inflation are denting restaurant traffic. Meanwhile, casual and family dining were the only two segments that experienced sales growth, with casual dining being one of the worst-performing segments for a second consecutive week. This doesn’t bode well for BJ’s, a casual dining name.

BJ’s Brewhouse Menu Offerings (Company Presentation)

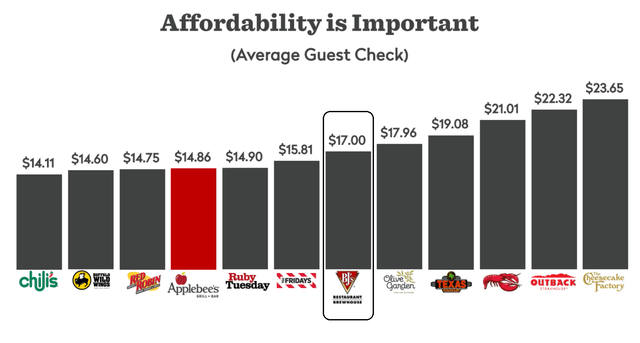

The good news is that BJ’s is being conservative on pricing and even increasing portions in some cases, looking to maintain a value proposition and purposely pricing below inflation this year. The company noted that its lunch value menu is adding weekday traffic and its daily offers allow guests to enjoy the experience of dining out without the guilt of a typical dine-out bill at a time when things might be a little tighter. However, even if BJ’s is pricing below the industry, it still looks like it will raise prices by over 4% this year. In addition, it’s near the middle of the pack from an affordability standpoint (casual dining), even if it does pride itself on superior customer service, which might make it stand out among some peers as a premier choice.

Average Guest Check – Industry (Dine Brands Presentation)

In 2021, when guests were anxious to return to dine-in occasions, this 4% menu price increase might have gone unnoticed. However, this year it’s coming at a time when consumers might be looking for ways to save, hit with higher gas prices, higher mortgage payments, and higher grocery inflation. Last but not least, we’ve seen a crash in crypto and stocks, and although real estate isn’t down, it is appreciating at a much slower rate this year. This could lead to a slight pullback in spending due to the wealth effect. Obviously, this is not company-specific, but it’s another headwind that restaurants could face in H2 from a demand standpoint.

United States Gas Prices (AAA Gas Prices)

To summarize, while I don’t expect much of a hit to sales in this strong seasonal period, we could see sales come in below expectations in the back half of the year when we get past the strong seasonality in Q2 for BJ’s. For this reason, the current revenue estimates of ~$307 million in Q3 and ~$345 million in Q4 could end up being on the high end, reducing sales leverage for BJ’s. This would make it difficult to stay above the 13% restaurant-level margin mark, which it’s expected to reach in Q2 (Q2 guidance: 13.5% – 14.0% restaurant margins) after an ugly Q1 print (9.8% restaurant margins).

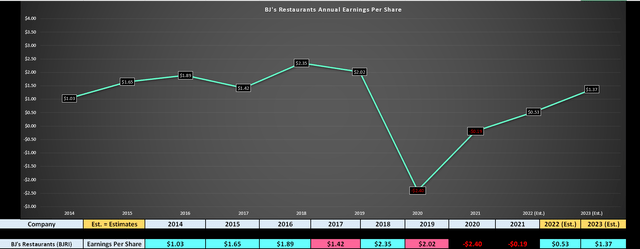

Earnings Trend

Based on this view that sales and margins could come in light (reduced sales leverage), I believe the FY2022 earnings estimates of $0.53 could end up being on the high end, and the FY2023 earnings estimates of $1.37 look especially high, even if BJ’s will benefit from unit growth (8 restaurants planned in 2022), and potentially some commodity deflation. So, while BJ’s might look cheap at ~16.2x FY2023 earnings estimates, it’s much less cheap if we assume a more conservative earnings figure of $1.10 in FY2023. At this earnings figure, BJ’s would trade at just over 20x earnings, a steep valuation for a company with gross margins below 20%.

BJ’s Restaurants Earnings Trend (FactSet.com, Author’s Chart)

Valuation

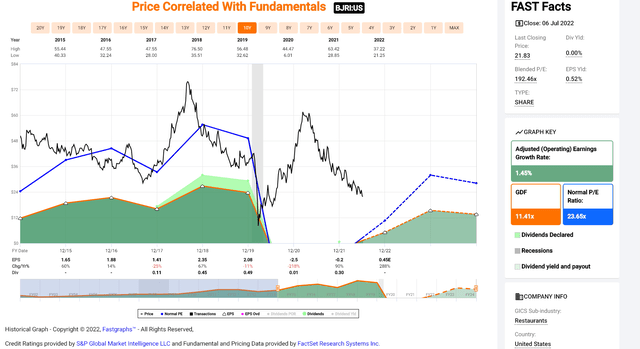

Looking at BJ’s earnings history below and historical P/E ratio, we can see that the stock has historically traded at an earnings multiple of 23.7 (10-year average). However, the company has seen declining gross margins on a 5-year basis, and the industry has the worst backdrop in the past ten years, battling commodity/labor inflation, a tight labor market, and now headwinds from a demand standpoint (shrinking discretionary budgets). Based on this more challenging environment, I believe a more conservative earnings multiple for the stock is 18.0, or a 20% discount from its historical average.

BJ’s Historical Earnings Multiple (FASTGraphs.com)

If we multiply this figure by FY2023 earnings estimates of $1.37, BJ’s may appear undervalued at a share price of $22.20, given that this points to a fair value of $24.70. However, if we use more conservative estimates of $1.10, I don’t see much upside for BJ’s at all. In fact, one could argue that BJ’s is fully valued at current levels. This doesn’t mean that the stock must go lower, and after a 65% decline in the share price from Q1 2021 levels, a bounce is possible. However, I don’t see the reward as worth the risk with barely a 10% upside to fair value using a more conservative earnings multiple (18x).

This is especially true from a relative value standpoint, with names in other sectors like Agnico Eagle (AEM) trading at ~17x FY2023 earnings estimates with 55% gross margins and ~30% operating margins. Obviously, Agnico Eagle may be a price taker being a gold producer, but it benefits from having unlimited demand, with there always being a market for gold ore bars. Hence, while some restaurants could see a pullback in demand in this tricky environment, I see gold producers as much better-positioned, even if they have seen a slight margin hit (assuming the gold price stays below $1,800/oz).

Technical Picture

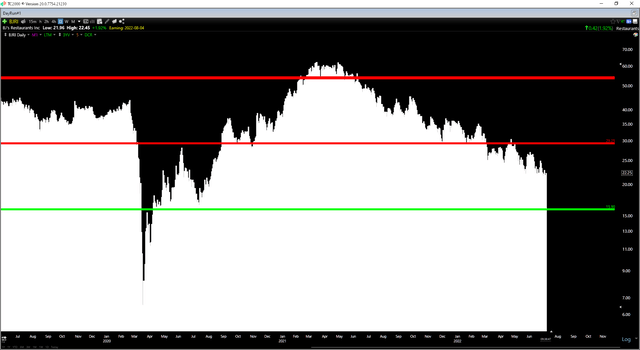

Finally, if we look at BJ’s technical picture, we can see that the stock has a new resistance level at $29.25 and no strong support until its Q2 lows near $15.90. At a current share price of $22.25, BJRI is in the middle of this trading range, with a reward/risk ratio of 1.10 to 1.0. For small-cap names, I prefer a minimum 6.0 to 1.0 reward/risk ratio to justify entering new positions, suggesting that BJ’s is nowhere near a low-risk buy zone yet. Therefore, I don’t see any reason to rush into the stock here above $22.20, and I would view any rallies towards the top of this range at $27.00 as profit-taking opportunities.

Summary

The casual dining space has had a rough past year, and many names like BJ’s are down more than 60% from their highs. While some investors might assume this has set up a buying opportunity for BJ’s, I still don’t see enough margin of safety here, especially given that earnings estimates for this year and next look too lofty unless the negative macro backdrop suddenly changes. For this reason, I believe patience is the best course of action. So, if BJ’s does rally on a strong Q2 report and heads above the $27.00 level, I would view this as a profit taking opportunity.

Be the first to comment