Vertigo3d

I am a long-term believer in the crypto space, particularly in the ability for Bitcoin (BTC-USD) to serve as a viable alternative to fiat money and a store of value with legitimate scarcity (which itself is a scarce resource). Unfortunately, far too often crypto advocates forget that they live in a world dominated by fiat currencies and central bank monetary policy. Macro drives Bitcoin, and not the other way around. If you get cocky and think you’ve found a “revolutionary technology” that can drive substantial positive returns while the remainder of financial assets lose value and global money supply contracts, you will end up being the bag-holder for more disciplined institutional investors.

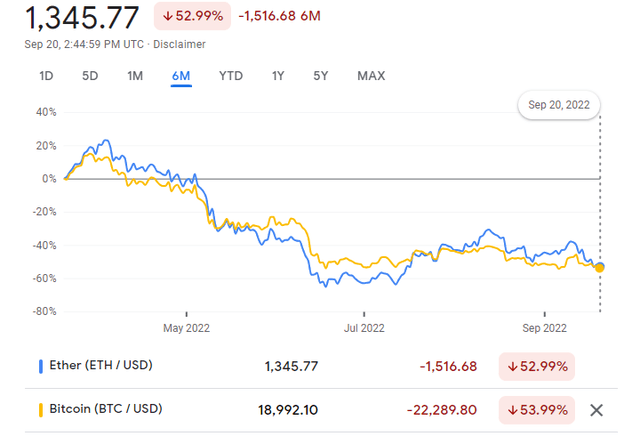

Look no further than the Ethereum (ETH-USD) Merge debacle – hopeful investors (mostly retail) piled into ETH ahead of the merge as they expected the currency to outperform, pushing ETH/USD to nearly $2000 from the middle of August from lows of $1000. Already, a mere 5 days after the merge, ETH has fallen to nearly $1300 and a retest of the June lows looks likely. While ETH enjoyed a small period of outperformance relative to BTC, this margin has been erased. This is not to mention the potential issues with ETH centralization due to The Merge (topic for another article…).

Macro (this is all that matters really)

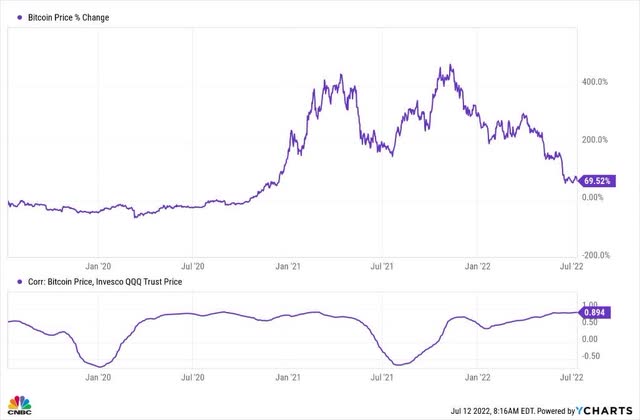

From a portfolio perspective, BTC has essentially acted as NASDAQ beta for most of 2022, with correlation hovering near 90% for most of the year. Looking back further, this same relationship existed for most of the COVID bubble buildup (2H 2020 and FY 2021). This relationship exists for a simple reason – the NASDAQ and Bitcoin’s meteoric rise post-COVID were driven by the global liquidity cycle, and their current demise is being driven by precisely the same dynamics.

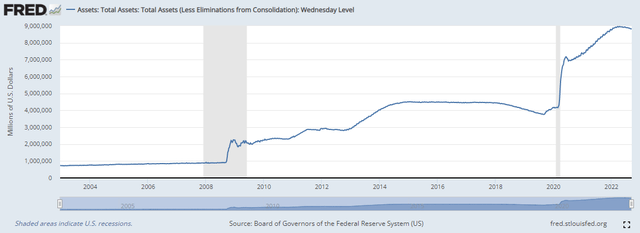

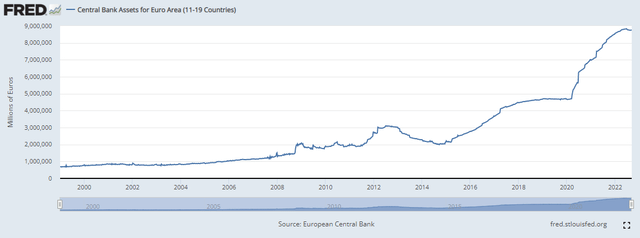

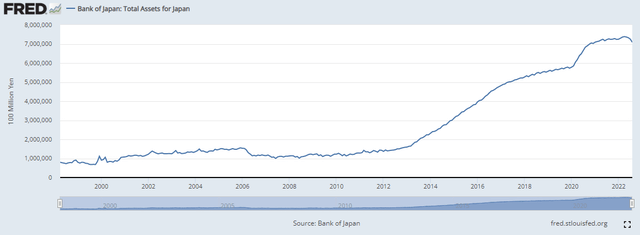

Already globally, central banks are tightening financial conditions both through reduction of balance sheet assets and the raising of rates. While the Fed has been particularly aggressive in raising rates thus far, balance sheet reduction has barely begun, and we are far away from getting back to even YE 2020 levels. The Federal Reserve is committed to shrinking its balance sheet at an annualized pace of over $1.1T which, if executed, will represent the most rapid reduction in balance sheet assets in Fed history.

While the historic rise in rates has largely been priced into financial assets (particularly bonds), the global reduction in liquidity and in particular dollar supply has not been priced in as the actual monetary tightening has largely not occurred yet.

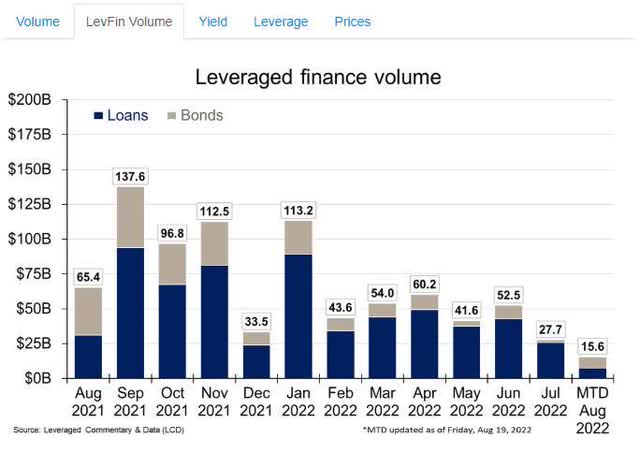

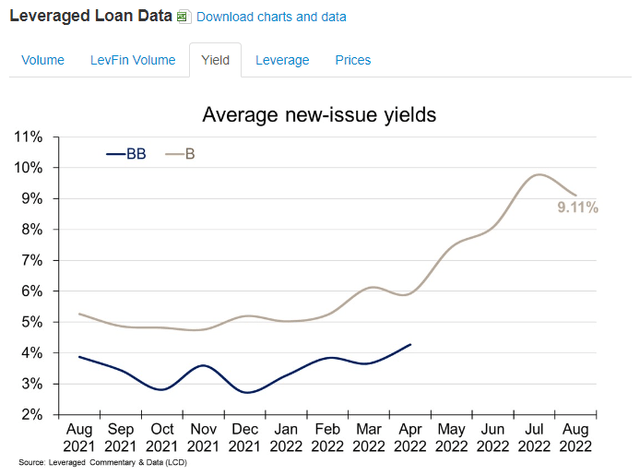

Given the massive levels of leverage present in financial markets and the global economy (global debt to GDP in excess of 263%), it is particularly dangerous for money supply to shrink as this results in “deflation” of financial assets and puts pressure on borrowers who are already over-levered. Without the ability to refinance, over-levered borrowers will not be able to keep the “monetary ball rolling” so to speak and the process of increased financialization that has dominated financial markets post great recession will reverse, resulting in a de-leveraging. This is already apparent through the reduction in high-yield and leverage finance activity YTD.

This is particularly threatening to Bitcoin as the asset is “levered” to central bank balance sheet expansion. Its value is dependent on its relative scarcity to fiat currency; however, as fiat currency levels decrease (or at least slow their rate of increase, i.e., lower delta) globally Bitcoin will lose its relative value.

Idiosyncratic Risk

Given the nascent development of institutional capacity in crypto, there still exists a large degree of idiosyncratic risk (on top of macro risk discussed above). Some of this micro risk is exacerbated by macro risk – a great example of this is exchange risk.

Recent headlines in the industry (such as BlockFi’s fire sale to FTX) should cause great consternation to crypto investors who hold assets with these brokers. Unfortunately, risk controls across the industry are largely inadequate and the business model of these crypto brokers is over-levered to the price of cryptocurrencies.

This is a relative advantage of the ProShares Bitcoin Strategy ETF (BITO) as a trading vehicle, as this exchange-specific counterparty risk is greatly reduced. However, it is still a great threat to the industry if crypto exchanges start going under as this could cause more investors (particularly institutions) to permanently flee the space as they need access directly to the currency, not to mention storage and prime brokerage services. There has been much speculation as to the breaking point price for various exchanges. While this type of analysis is inherently an oversimplification, I think it’s useful as a heuristic. I personally believe that the strength of $19,000 as a support level for BTC/USD is indicative of its importance to crypto exchanges viability. Any meaningful drop below this level will quickly result in more defaults from hedge funds similar to the Three Arrows Capital default and greatly increase stress on brokers.

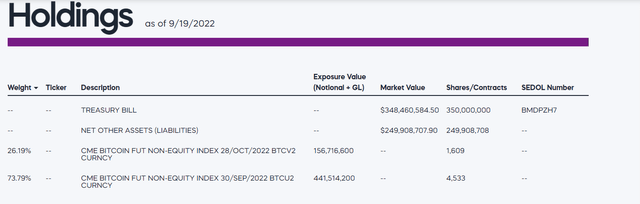

Bitcoin Futures (CME) BITO Holdings (Proshares.com)

The Bitcoin futures curve is essentially flat, and I don’t expect this to change anytime soon, so you won’t have to worry about negative roll yield negatively impacting BITO returns. There has been much fuss made about this point, but since BITO’s inception I believe the average futures curve has been in very slight contango, and in my opinion, BITO is a more than valid means for trading BTC. Furthermore, given some of the outrageous fees (and potential counterparty risk) associated with many crypto exchanges, I believe in many ways BITO is a safer way to trade/invest in Bitcoin.

I’ll end with a picture of BTC-USD, which is displaying a monstrous head and shoulders patterns…

In my opinion, once the $19,000 support is broken on BTC/USD, the next level test will be at pre-COVID highs near $9,000. This is precisely why it’s dangerous to invest in falling knife assets like crypto, even though BTC has already fallen ~$45,000 from the peak, if it falls another $10,000 this equates to a 50% drop from current levels. I know many Bitcoin believers pride themselves on “diamond hands” but don’t fall for this classic disposition effect psychological bias. Even if you’re down, sell (or hedge) and wait for the global liquidity cycle to turn before buying back in. Bitcoin in previous drops has fallen by >90% from peak to trough, this can happen again (and, in my opinion, is seeming more and more likely).

Be the first to comment