Instants/E+ via Getty Images

With the bear market in Bitcoin (BTC-USD) quickly settling in on the miners, there is rightly only one question permeating the mining industry: what are each company’s costs to mine a bitcoin? So the focus has completely evolved over the past year. Prior to China’s crackdown on mining last May, western mining companies were primarily rated from a perspective of their hash rate and expected future hash rate to their market caps. Following the China crackdown, the bottleneck to acquiring hash rate changed and the focus shifted away from procuring the now readily available equipment and toward acquiring reliable, ESG friendly power sources.

However, with the recent major contraction in the price of Bitcoin and its closer approach to the direct cost of mining a coin, miner costs are forefront. The article below looks at the low cost and historically reliable miner Bitfarms (NASDAQ:BITF) and its ability to maintain a positive cash mining margin despite the current price challenge. Interestingly, Bitfarms’ operations are not entirely reliant on the fastest rigs with the best energy efficiency or even the lowest power purchase contracts. Prior mining experience, ground level execution and overall business practices play a meaningful role as well. This management component, coupled with the more straight forward near future hash rate to market cap, continue to make Bitfarms my top pick among the miners.

Miners & Operations

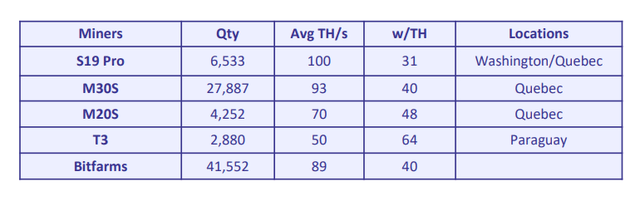

By the end of the year over 75% of Bitfarms’ active fleet will consist of Whatsminer M30S rigs from MicroBT. The company’s primary purchase this year is 48,000 of this model at a cost of $38.50 per TH/s of computational power. For a quick comparison, Marathon Digital (MARA) is purchasing 199,000 S19 miners from Bitmain at a blended cost of $54 per TH/s.

Bitfarms Current Active Mining Fleet – 6/22/2022

Bitfarms’ Mining Fleet (bitfarms.com)

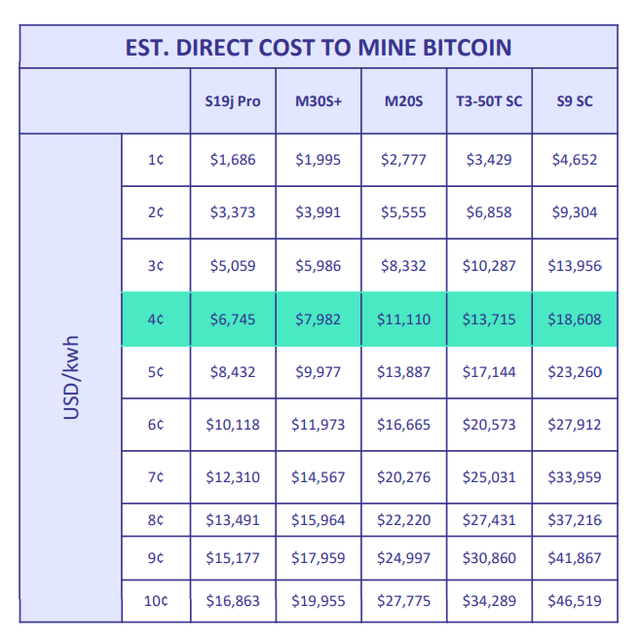

Bitfarms Direct Cost To Mine Bitcoin By Equipment Type

Bitfarms’ Cost Per Bitcoin (bitfarms.com)

[Note: Bitfarms’ average energy cost across all locations is $.04 per kWh as marked in teal above.]

The Bitmain S19 equipment has the lowest watt usage relative to its hash power and therefore lowest direct cost to mine. But because of the additional factors discussed below, and importantly the lower upfront cost paid relative to its hash power, the MicroBT M30S has a faster ROI.

The form factor, including the smaller size, the shape and lower weight of the M30S miners, lowers costs. These miners are less burdensome in terms of square footage, racks and wiring than the Bitmain equipment. Additionally, during the past five years Bitfarms has mined with over a dozen rig models from four different manufacturers and highly rates the reliability, overall quality and longevity of the MicroBT equipment.

Equipment does break though. And in May of last year Bitfarms became the first authorized MicroBT service center in Canada. The new repair center in Cowansville, Quebec meaningfully reduced repair times and costs for downed miners. Note here that in September of last year Hut 8 (HUT) was also certified as a MicroBT repair center.

Additionally, Bitfarms owns an electrical engineering and maintenance firm called Volta that provides repairs plus expertise for new buildouts. Volta was started by master electrician Benoit Gobeil in 2010 and acquired by Bitfarms in 2018. Gobeil is now Bitfarms’ Senior VP of Operations and Infrastructure. In-house electricians reduce downtime and costs compared to using an outside vendor. Interestingly, in a somewhat similar move Riot Blockchain (RIOT) bought electrical equipment provider ESS Metron in December of last year to speed buildouts.

As a last point on equipment, Bitfarms uses software to monitor their miners. The actual hash rates and theoretical hash rates are provided for each location along with a miners offline percentage. To minimize downtime, the software also provides miner specific uptime tracking, temperatures, error codes and the miners exact rack location. In the future the software will control usage and clocking based on outside economic factors.

Bitfarms’ Chief Mining Officer is Ben Gagnon. He has experience building and operating mining facilities and got his start in mainland China in 2015. Gagnon has been with the company about a year and is highly knowledgeable and articulate on the intricacies of mining economics and how they apply to the financing side of the business.

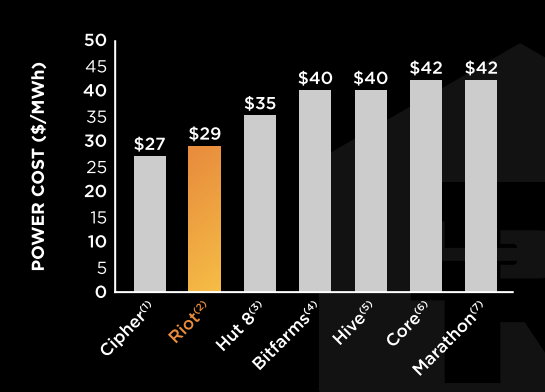

On the energy front Bitfarms does not have industry best pricing. But their costs are low with the following pricing for current operations: $0.046/kWh in Quebec, $0.037/kWh in Paraguay and $0.033/kWh in Washington State.

Industry Power Cost Comparison From Riot

Power Costs Per MWh (riotblockchain.com)

But importantly, Bitfarms’ current supply is all hydro based and generally from systems with excess capacity. These factors are important as the excess capacity makes it less likely to face restrictions during peak demand and hydro faces less inflationary pressures with more stable prices over time. And of course, hydro is generally more acceptable from an ESG standpoint.

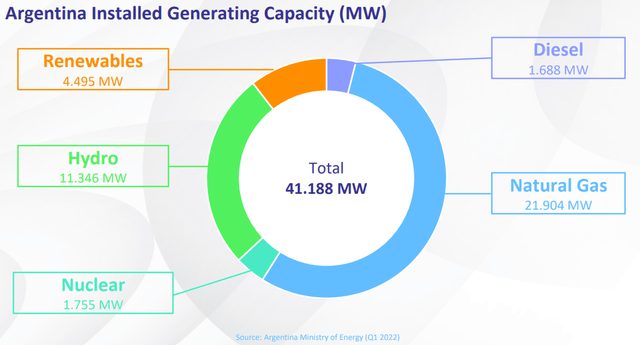

Note Bitfarms latest buildout in Rio Cuarto, Argentina will be natural gas based. This energy source is vitally needed to power a majority of the incoming M30S miners from MicroBT. However, the plan is being reassessed as President Geoff Morphy briefly explained during the Q1 earnings call in May:

With a 4 phase approach to this project, 100 megawatts of capacity are under construction at present in the initial 2 phases. Phase 1, which is for a 50 megawatt facility. We anticipate completing in October, 2022. Phase 2, which is another 50 megawatt facility, is also under construction and our revised timing for building completion and initial production is in Q1 2023….

Given the adverse impact of recent geopolitical events on natural gas prices, we are reassessing the timing and scale of the potential full build out of the in Rio Cuarto farm. However, to be clear, Argentina still remains an attractive area for new development opportunities. We are active in the region and ultimately anticipate developing a diverse mix of farms within the country.

Argentina Energy Mix (bitfarms.com)

The takeaway from the Argentina reassessment is that based on current construction plans, the company’s year end hash rate will be 6 EH/s with delivered miners capable of 7.2 EH/s once energized.

Reconciling Direct Costs To Cost Of Sales

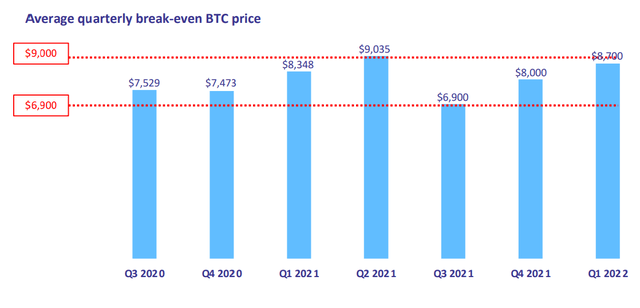

Bitfarms’ direct cost of mining has basically fallen between $7,000 and $9,000 over the past seven quarters. Direct costs are defined as follows:

Represents the direct cost of Bitcoin based on the total electricity costs and, where applicable, hosting costs related to the Mining of Bitcoin, excluding electricity consumed by hosting clients, divided by the total number of Bitcoin mined.

Source: Bitfarms Q1 2022 MDA

Direct Costs Per Coin (bitfarms.com)

Bitfarms’ cost of sales for Q1 were $23.3 million which included $13.1 in non-cash depreciation and amortization costs. Direct costs for 961 bitcoins mined at $8,700 was $8.4 million.

This leaves about $1.8 million in costs relating to repairing existing miners and upgrading existing facilities. Note there are also minor, non-mining costs and other electrical costs captured here making this calculation an approximation. So from an approximate, adjusted cost of sales perspective, excluding the non-cash equipment depreciation costs, the cost per coin was $10,600.

Also note, this adjusted cost of sales per coin likely decreases as Bitfarms continues to capture share and additional coins each quarter. This is because repair and facility costs benefit from economies of scale.

Considering Administrative Expenses

Bitfarms’ general and administrative expenses for Q1 were $13.8 million which included non-cash, share based payments of $6.1 million. The company also had $1.9 million in shipping costs and duties related to transferring their older generation miners to the lower cost farm in Paraguay. This leaves approximately $5.8 million in more routine, more ongoing quarterly administrative expenses.

So on 961 coins, administrative costs represent an additional $6,000 per coin. As with cost of sales above, these adjusted expenses per coin likely decrease as Bitfarms captures share because administrative expenses also benefit from economies of scale.

In total, for Q1 Bitfarms’ adjusted costs and expenses per coin, excluding non-cash deprecation and share based compensation, as well as before interest expense, was about $16,600.

Protection Against Falling BTC Price

Because of recent IMF pressure on the local government, Bitfarms has some above average regulatory risks with its expansion in Argentina. These risks are somewhat offset by the company’s geodiversity. Note also that the company founders and top leadership are Argentinian entrepreneurs.

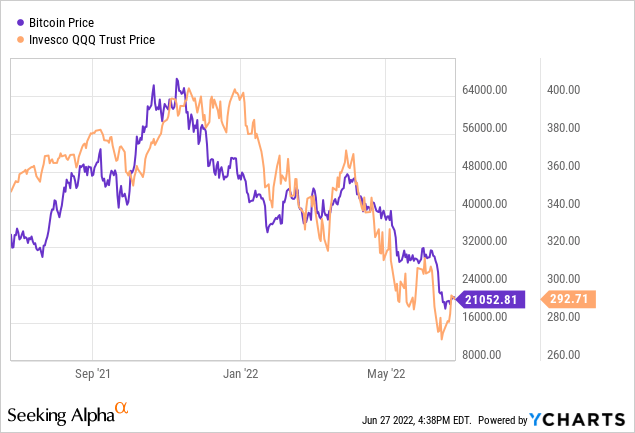

But the main risk to Bitfarms is a continued and sustained decline in the price of Bitcoin to below its adjusted costs to mine. The Bitcoin price is currently completely tethered to the technology sector and rate sensitive assets. And of course, this market has faced a quick revaluation in light of the rapidly evolved Fed policy on interest rates. So in the short-term, BTC pricing likely directionally follows the broader market sentiment as it reacts to incoming inflation data and any Fed deviations from market expectations.

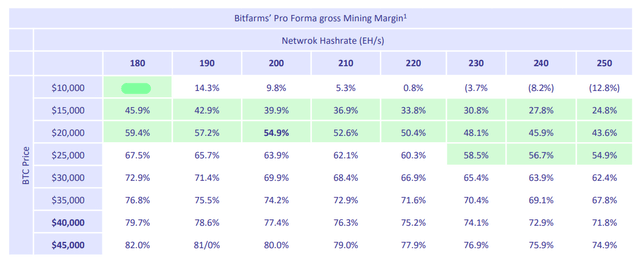

Interestingly, as a low cost producer Bitfarms has built-in, systemic downside protection to a sustained decline in the price of Bitcoin. The following chart contains Bitfarms’ projected margins after mining related costs at various total network hash rates and BTC prices.

Margins At BTC Price and Total Network Hash (bitfarms.com)

[Note: First entry was obscured for containing a substantial typo.]

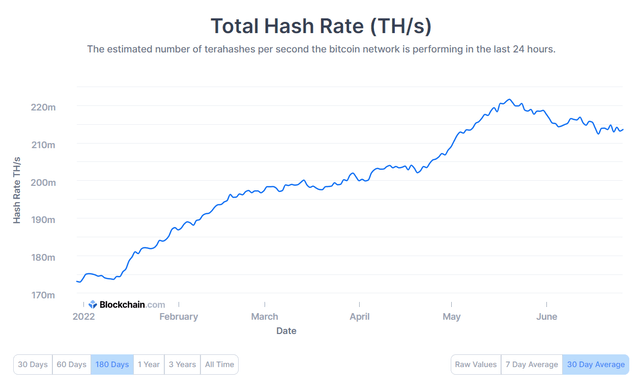

Historically the total network hash rate has rapidly increased with the strong price appreciation of BTC. But the current meaningful pullback in BTC prices has flattened the rise in the total network hash rate by driving low efficiency miners offline. The current 30-day average for the total network hash rate is 214 EH/s. Due to the slowdown in total network growth, Bitfarms is capturing share percentage more quickly than previous anticipated as they move toward 4 EH/s of deployed hashing power. Put differently, a lower BTC price decreases competition in the cryptographic puzzle race, partially offsetting the lower reward value received.

Bitcoin Total Network Hash Rate (blockchain.com)

Looking to the raw values over the past two weeks, it is likely sustained pricing below $20,000 per coin would arrest the heretofore upward trend in the total network hash rate. In the top left portion of the Mining Margin chart above, the positive sensitivity of Bitfarms’ gross mining margin is quantified at lower total network rates.

Reasonably Priced

Relative to earnings potential, Bitfarms appears well priced at the current market cap of about $300 million. As show above, adjusted EBITDA per coin at a BTC price of $20,000 is near $3,400. Rough numbers, if we assume Bitfarms’ average hash rate over the coming 52 weeks is 6 EH/s and the total network hash rate averages 250 EH/s, total production would be 7884 coins. At this level, adjusted EBITDA would be approximately $27 million. So the current market cap stands at a reasonable multiple, less than 12x of this forward, adjusted earnings methodology.

| BTC Price |

Adjusted EBITDA / Coin |

Estimated Production (52 weeks) |

Adjusted EBITDA |

Valuation @ 12x EBITDA |

| $20,000 | $3400 | 7884 | $27 million | $324 million |

Source: Author’s calculations

For those ready to enter long BTC positions and believe macroeconomic factors are now priced into the technology sector, Bitfarms offers an interesting value, growth and profitability play.

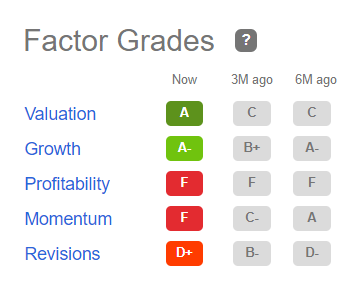

Factor Grades (seekingalpha.com)

Using Seeking Alpha’s Factor Grades note that this quarter the company’s Valuation ranking rose to A and it now receives an F in Momentum, both of which are directly due to the market cap falling sharply. Strong Growth metrics continued and received an A- rating.

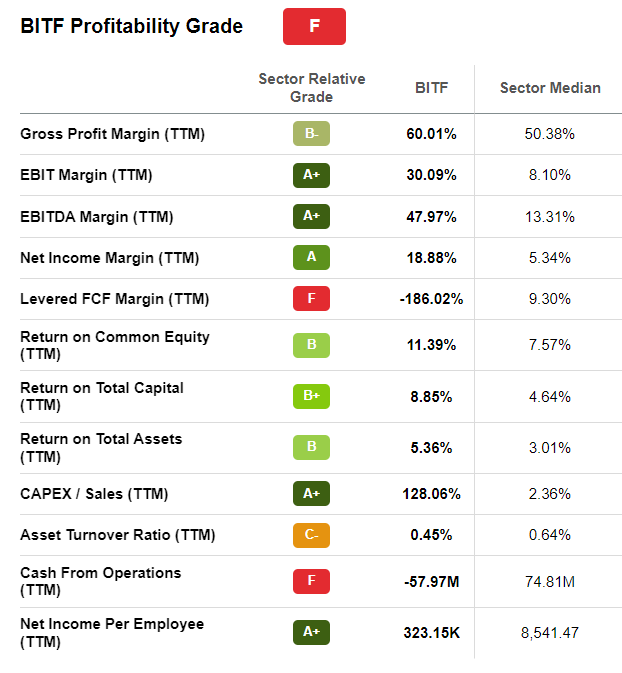

Profitability (seekingalpha.com)

And looking inside the Profitability grading of an F, Bitfarms actually performed well. The entire metric was dragged down due to the methodology of not recognizing Bitcoin income as cash in two key categories.

Bitfarms is profitable at the current Bitcoin price level and is not overpriced from an earnings perspective. The company has strong, proven business practices and is executing in a challenging price environment. Their hash rate will expand notably by yearend, and the company will capture meaningful share even if the total network hash rate resumes its prior upward trend.

Authors Note:

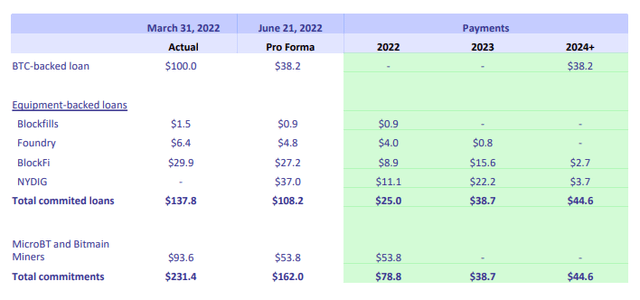

Obviously Bitfarms has substantial capital costs and financing expenses not considered above. The following chart breaks out the major commitments and their timing.

Bitfarms Commitments (bitfarms.com)

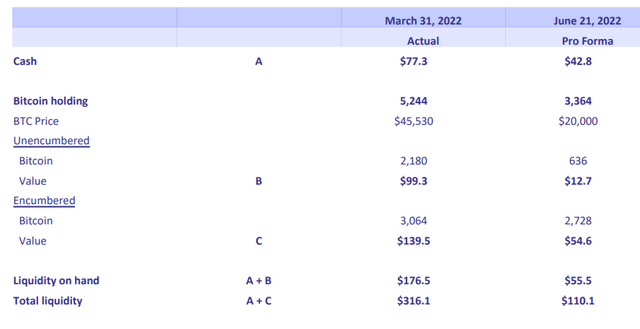

The following chart breaks out the liquidity available to meet the commitments above without additional financing. Note the BTC price used is $20,000 and “Total liquidity” is A+B+C.

Be the first to comment