anyaberkut/iStock via Getty Images

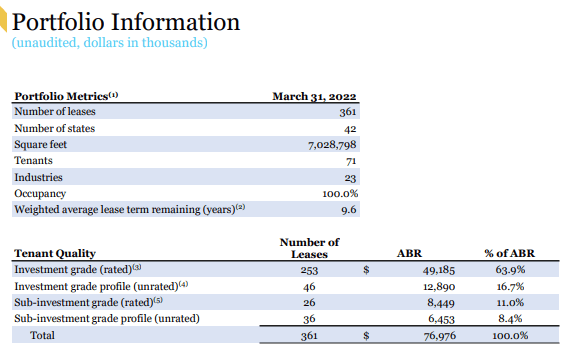

Netstreit Corp. (NYSE:NTST) is an internally managed REIT with interests in a diversified portfolio of single-tenant, commercial real estate subject to long-term net leases. As of March 31, 2022, the company’s portfolio consisted of 361 properties located in 42 states, comprised of 71 tenants across 23 retail sectors.

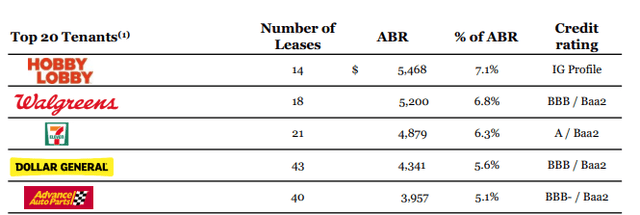

Some well-known tenants of the company include Hobby Lobby, Walgreens (WBA), 7-Eleven, and Dollar General (DG), to name a few. In addition to industry diversification, NTST benefits from the defensive nature of these tenants, with most being necessity or discount retailers.

In addition, the company’s exposure to investment grade tenants is among the highest in the net-lease space at 64%. This provides further confidence to the durability of their incoming cash flows.

June 2022 Investor Presentation – Comparative Exposure to Investment-Grade Tenants

Despite exposure to a quality mix of tenants and 100% portfolio occupancy, NTST is currently trading near the bottom of their 52-week range. With over 50% of annualized base rent (ABR) attributable to drug stores, discount retail, dollar stores, and convenience stores, one would expect NTST to be a staple holding of any defensively positioned portfolio. Instead, the market appears to be favoring the tenants themselves instead of the landlord, with DG, for example, up nearly 8% over the past month and NTST down 9%. At current pricing with a dividend yield in excess of 4%, shares in NTST offer investors an attractive entry point with sizeable upside potential.

Earnings Review and Other Reportable Events

For the three months ended March 31, 2022, NTST reported total revenues of +$21.3M, which was up nearly 80% from the same period last year and just over +$2M better than expected. The increase was primarily driven by a 149 unit increase in their real estate portfolio from January 2021 through period end and a 60% increase in ABR.

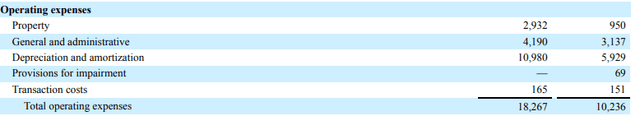

Operating expenses were up during the period, with the most significant increases being depreciation and amortization, which was due to the increase in the number of reportable properties. G&A was also up due to headcount growth and the opening of their new corporate office. Despite the increase in Opex, core FFO still beat by $0.02.

Q1FY22 Form 10-Q – Summary of Operating Expenses

During the quarter, NTST remained active in the market, with +$135M in net investment activity. This includes the company’s first secured mortgage loan in the amount of +$40.4M. This 18-month loan was provided to a developer and was collateralized by three parcels of land that includes a strongly performing Home Depot (HD). Additionally, NTST has the option to purchase the Home Depot at an above-market cap rate of 6%. The transaction is expected to provide accretive returns in future periods, while generating steady interest income in the interim.

The net investment growth during the period was financed principally through forward sales agreements of their common stock, utilization of their ATM program, and through net borrowings on their revolving credit facility.

Portfolio occupancy remained at 100% through period end. In addition, the company added several new tenants, such as Publix, Panera Bread, and Family Fare. The state of Nevada was also newly added to the company’s geographic footprint. Consistent with prior periods, exposure to investment-grade tenants is among the highest in the net lease space.

Q1FY22 Investor Presentation – Portfolio Metrics

Looking ahead, NTST increased their full-year AFFO guidance to a range of $1.14 – $1.17 and their net investment activity to +$500M.

The Fundamentals

As of March 31, 2022, NTST had total assets of +$1.2B and total liabilities of +$335M. Total liquidity amounted to approximately +$135M, which was mostly attributable to the +$130M available on their +$250M revolving credit facility. Additionally, the company has ample capacity to issue additional shares in future periods through their ATM program.

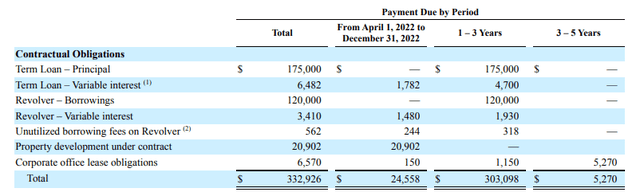

Over the next five years, NTST is exposed to limited repayment risk on their contractual obligations. While most of their current obligations are due over the next 1-3 years, the maturities are still manageable, with the outstanding balance on the revolver due in December 2023 and the term loan due in December 2024.

2021 Form 10-K – Summary of Contractual Obligations

The company does, however, intend on raising additional debt in the back half of the fiscal year. With interest rates on the rise, the timing of the issuances will be unfavorable to the company. At present, management’s rate expectations are between 5% and 5.25%, and the figures outlined in their guidance pertaining to interest expense is reflective of the higher rates.

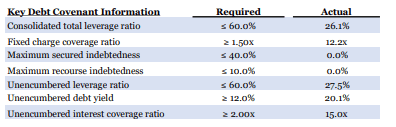

At current coverage levels, NTST does have ample cushion to weather higher rates. Their fixed coverage ratio, for example, is 12.2x versus a requirement of 1.5x or greater. Their 15x interest coverage ratio also greatly exceeds the minimum coverage requirement.

Q1FY22 Investor Supplement – Debt Covenant Compliance Summary

On an overall basis, net debt for the period stood at 4.6x annualized adjusted EBITDA. This is on the low end of their targeted leverage range of 4.5x-5.5x. When considering their remaining shares in their forward sales agreement, leverage is even lower at just 2.3x.

Full occupancy, exposure to quality tenants, and net-lease based revenues are three strengths capable of providing durable cash flows through challenging business environments. In the current period, NTST generated +$9.0M in operating cash flows, which was enough to fully cover their dividend payout. Though their increased investment activities are presently requiring funding through debt and equity financing, these investments are projected to be accretive to continuing growth in future cash flows.

For income investors, the current annual payout of $0.80/share represents a yield of 4.2%. At a payout ratio of under 69%, the dividend appears safe for the foreseeable future and is likely to grow in future periods as the company realizes gains from their investment activities.

Primary Risks

For the full year ended December 31, 2021, a concentration of five states represented 40% of ABR: Texas; Illinois; Ohio; Georgia; and Wisconsin. Furthermore, the southern and midwestern regions of the U.S. accounted for nearly 80% of ABR. Due to the elevated level of exposure, NTST would be negatively impacted if these regions or any of the aforementioned states were to experience a disproportionate level of layoffs or downsizing, industry slowdowns, relocations of businesses, and other negative externalities compared to other areas within the country.

NTST is also exposed to tenant concentration risks, as their top twenty tenants account for approximately 75% of ABR as of March 31, 2022. Their top five, alone, accounted for about 30% of ABR. Even though these companies are defensive in nature and can boast of strong credit profiles, they would likely not be completely immune to downsides incurred during a broader market slide. Any liquidity event that would impair the ability of these companies to continue paying rent would in-turn negatively impact NTST.

June 2022 Investor Presentation – Top Tenants

A focal point of NTST’s strategy is to invest in single-tenant, triple-net leased properties. While this structure does have advantages, there are particular and significant risks related to tenant default. Because there is only one tenant, NTST’s exposure to financial default is elevated. If default were to occur, NTST would not only lose the income on the property, but the value of that property would likely also decline. This could result in further issues in re-leasing or selling the property.

Conclusion

NTST is a net-lease focused REIT that has exposure to high-quality tenants who operate in necessity and discount-based industries. Additionally, the company maintained 100% occupancy all through 2020 and 2021, despite the perilous operating environment. Occupancy also continues to remain full through present-period reporting. With 80% of their portfolio consisting of investment grade tenants or tenants with an investment grade portfolio, investors can likely be assured of continued durability in future cash flows.

A moderate debt profile with minimal repayment risks and sufficient liquidity provides further safety in advance of any broader economic downturn. For income-focused investors, the 4.2% yielding dividend exceeds the average yield provided by the S&P 500 and the yield one could obtain from an investment in the 10-year benchmark. Furthermore, at about a 70% payout ratio with full coverage through operating cash flows, the payout appears safe for the foreseeable future.

At present, shares are down about 9% over the past month. One of their top tenants, DG, on the other hand, is up nearly 8%. Another top tenant, WBA, is down just 3% for the month. NTST, therefore, appears mispriced given the defensive nature of their tenant mix. Utilization of a dividend discount model using a CAPM derived discount rate of 7.6% and a projected dividend growth rate of 4% would yield a target price of approximately $25, which would indicate upside potential of about 30%. For investors seeking to add a defensive REIT to their long-term portfolios, NTST offers sizeable upside at a reasonable level of risk.

Be the first to comment