Petr Hoffmann

Buffett’s take on Bitcoin the rat poison: the result of not staying relatable

When the two respected gurus, Warren Buffett and Charlie Munger, called Bitcoin (BTC-USD) “rat poison squared,” it was a real awakening. It wasn’t about who was right or wrong; it was about how unrelatable blockchain and its leading network, Bitcoin’s innovative technology and development, related to the public. Although there are some enormous disruptive innovations and new future possibilities for finance and the extended layer of the web (called Web3), crypto is often seen as a speculative intangible asset. But there are still limited practical applications for crypto, such as use cases and product market fit, especially given the wild hype, swings and over-enthusiasm surrounding it, as witnessed in the high velocity and volume of these cryptocurrencies and assets trading hands. One test that can be used is to check in with our grandma and grandpa to see if they know what blockchain and Web 3 are, just like they do about the internet and smartphones. It’s a long way to go, but we will get there.

First, I disagree that it’s rat poison based on BTC’s first principles, but yes, there are problems and concerns when the crypto market value is hyperinflated. Second, I do not think the duo dismisses Bitcoin and blockchain technological innovation and its future potential. Although like they always say, technology isn’t in their circle of confidence, they have been neutral about the internet and web-based technology companies, with the big exception of Apple (AAPL). They negatively and heavily criticized the accelerated price appreciation of Bitcoin and the crypto market overall, for which traders turned the virtual bits and bytes into chips at a casino. On a different note, speculation could lend itself as a function of bootstrapping for early-stage innovative development—the future’s next big thing as outlined by Brian Armstrong and as part of the Master plan’s phase 2 of Coinbase (COIN) and the crypto industry evolution.

The original intent and what’s written in the Bitcoin whitepaper was for a digital peer-to-peer (P2P) payment and money network. BTC could then be a probable digital form of currency, but it wasn’t intended to be a digital commodity or digital gold. The original design facilitated financial transactions on an open public ledger via a decentralized efficient blockchain without dependence and control by specific (centralized) parties. The anonymous creator, Satoshi Nakamoto, who could be a person or a group, launched BTC after the financial crisis in 2009 and left the project in the public domain, but it was not proposed as a political or social movement. It wasn’t like the WallStreetBets or Occupy Wall Street movements. Many aspects and features of the Bitcoin network could serve well in that context. Yet, blockchain and crypto technology could be disruptive innovations that would provide open finance for underdeveloped and developed regions. All participants should tread thoughtfully to deliver the goal with sustainable means. Blockchain is a greater innovative force than merely a creative GameStop (GME) short squeeze phenomenon.

At the AIMA Global Investor Forum in October 2022, the main focus was on traditional Alternative Investment Management. But the conference covered digital assets class (crypto asset) at a roughly 20% ratio. Many speakers in the digital asset sessions were from traditional finance (tradfi) and banking backgrounds. That makes sense because they speak the same language and can serve as the bridge. The fact that the term digital assets was used predominantly at the AIMA conference instead of the more common jargon like Defi, cryptos, tokens, and other obscure terms illustrates two points.

First, the big tradfi, finance and banking worlds are warming up and are paying attention to crypto in baby steps. Even the generally conservative OPTtrust in Canada has set up a special unit for crypto (digital) assets, although it’s still a small allocation. Second, the crypto industry needs to grow up and become more relatable. Peter Johnson from BH Digital, a sister branch of the leading alternative asset management firm Brevan Howard said that the next generation, like your kids, doesn’t use the internet for the sake of the internet; they use it because the internet is embedded in the fabric of their daily lives. It’s not like our generation. We used the internet in the early phase because it was cool. We want crypto to grow to that stage, and it will, just like crypto will eventually be built into Apple Pay or others, becoming ubiquitous and intuitive. You will see our kids become disoriented when crypto doesn’t exist. Similarly, now when you hand a book or paper to a young kid, they treat it like an iPad; they start tapping and scrolling on a piece of paper.

At the same time, the report and survey by Linedata shows that over 50% of the surveyed asset managers (with over $500 billion in aggregated AUM) are ready and in the process of considering and embracing digital assets as part of an investment and trading strategy. They also adopt blockchain and crypto technology, including smart contracts and a distributed ledger, more as part of the operational solutions and infrastructure, which are indeed even more of an interesting trend showing true adoption as a fintech layer.

In that case, it’s important to understand and monitor the trend by the big financial institutions in the following two ways:

- Operational preparedness for crypto-asset investing

- Smart contracts, DLT and blockchain as operational solutions

The key considerations and operational readiness remain in crypto compliance and regulation. While custody was weighted lowest by the respondents in the report, the responses should be different and given a higher priority now after the collapse of various centralized crypto platforms and exchanges, such as the Celsius Network (CEL-USD), after the report was published.

What is decentralization vs. inclusivity/accessibility?

Decentralization is an essential technical aspect and feature for the success of the blockchain and Bitcoin implementation and operations. Many speculative participants use the narrative to artificially create emotional and societal influence and mobilize a community to drive up the price and value of some projects. More often than not, many projects lack fundamental value, substance, and merit in technological innovation, artistry, and creativity. Emotional anti-establishment themes and movements grab attention and hype up the project. For example, one of the blue-chip NFT collectible projects, Bored Ape Yacht Club (BAYC), is valued at $4 billion and raised $400M from a well-known VC a16Z. Because of its success, it’s not uncommon for it to create some resentment and even hatred among those who did not financially benefit from it. So, an anonymous creator, Ryder-Ripps, created a new project to spread a conspiracy theory about the BAYC project, accusing it of being Pro-Nazi and racist. There is no solid ground and proof of this, but all the materials and viral videos stirred up many debates on Twitter and exposure on some established tech, crypto, and art media. The anti-racism theme and narrative flipping of a successful BAYC earned him a good amount of exposure and, in turn, some good financial profits by selling a complete clone of the BAYC digital NFT collectibles called RR/BAYC. Those rooting and buying RR/BAYC collectibles could result in financial losses after all the drama and dust are settled.

The key takeaway is that the current advocacy around decentralization appears to be off the mark and used as social influence levers by bad actors. Decentralization has cultural, societal, and technical significance in the steps ahead and the evolution of open finance and the next generation of the web. At this stage, those in the crypto space need to have a keen mind to differentiate the substance from the froth.

At least in the intermediate phase, what is needed is “inclusivity and accessibility.” The real need is an open environment and system with broader inclusivity and accessibility for artists to access commercial revenue. In addition, citizens in underdeveloped regions need access to stable and sustainable financial solutions and currencies. Developed nations need access to more efficient and interoperable fintech and infrastructure to provide even more scalable and robust financial solutions via blockchain technologies.

While crypto technologies like NFTs do help some of the unknown artists gain exposure and financial rewards, in general, the result is the opposite of inclusivity. Many artists don’t have access to investors unless they are a super Twitter (TWTR) celebrity or influencer or know the right circles and networks. Many investors can’t access many of the high-profile projects and artists because of the limited quantity and a gatekeeper mechanism called a whitelist or allow-list. Those are implemented in an ad hoc and chaotic manner to limit access and open entries. Normally, the procedure and operations are highly centralized, not too different from the collectible sneaker drop and private nightclub access. In some cases, it primarily mirrors the old world of private banking and fine art business for high net-worth circles.

Blockchain is a technology layer that allows any developer to create engineering solutions for different purposes. Not all projects or apps are made the same. Some use blockchain but do not necessarily solve larger problems. So, not all crypto or blockchain projects lead to multi-million or billion solutions and businesses. Investors shouldn’t let the bandwagon effect make blindsided investment decisions.

Anecdotally, an NFT project called Mavenarte started with the initial goal and vision to democratize the art world or at least to bridge the gap in the art market, especially those specialized digital artists who normally aren’t included or are a part of the traditional fine art market and auctions that affluent art collectors participate. The old art market is a closed network and system where auction houses control the deal flow and access to affluent collectors and buyers. It’s very much like opaque private banking and breaking down the barrier has proven to be rather difficult. The Mavenarte project tried to establish a partnership with Asian regional prestige galleries and auction houses by indirectly working with wealthy art collectors. While the partnership was established, it didn’t truly create an open environment and network. In fact, putting art in an NFT token and making it distributable on the blockchain in the Mavenarte project didn’t solve the fundamental problem of a closed network. They created exclusive and limited access to a private network. Such a mechanism isn’t a stable and scalable solution since traditional art collectors are more conservative, and their sentiments swing easily based on the broader market. The overall crypto trend dropped in mid-2021 after a few negative market downturns, which was mild compared to the current bear cycle in 2022.

Often, technology and blockchain are tools in this case, but business and project creators have the liberty to apply and take full advantage of them or not. Another crypto company called Boax.io intends to help private art galleries build digital solutions using blockchain. The solution wouldn’t help make art more accessible or the market more inclusive but could streamline the art and asset ownership and make it transferable across different networks.

A truly decentralized, open network and financial system that achieves true financial inclusion will take a long time to establish, especially if the vision is borderless globally and requires enormous coordination and adoption by governments and commercial corporations.

Going to decentralization prematurely also opens up more issues, including it becoming the de facto platform for many anonymous (reputable or not) running projects with large amounts in the treasury from the project without fiduciary responsibility and accountability, which results in many incidents of financial collapse and loss. The disreputable and potentially an anonymous scammer could have profited from fraud projects and walk away (rug pull) while others suffer financial losses.

Decentralized finance (“DEFI”) is like an AI chatbot in customer service now. It’s in the very early stages and cannot replace a live human agent to help with most of the problems, especially for banking-related issues. While many feel the central bank and government have made wrong policy decisions and have printed money excessively, and are to blame for the collapse, it doesn’t mean the world can rely purely on an autonomous money and banking system within a few years, just like we can’t rely on AI autonomous cars. No matter how advanced the system is now, certain supervision and targeted training in designated zones or controlled environments are needed. Many institutions have higher interest and confidence in Bitcoin as a network and asset because it has been battle-tested for over 13 years and hasn’t experienced major security breaches. On the other hand, scams and hacks frequently occur with some of the emerging networks and platforms.

Valuation – $10 to 30 trillion market

Evaluating and giving a proper valuation of digital assets is a relatively challenging exercise. This is especially hard for traditional value investors who look for a long history of financial models of traditional business and metrics, such as cash flow, earnings, revenues, the multiples, and how we get that from the new nascent assets. While Gary Gensler famously has labeled most digital tokens or currencies as securities, there isn’t a way to evaluate the value, unlike publicly traded companies, where the underlying value of their stocks and derivative products could more or less be evaluated based on business financial performance.

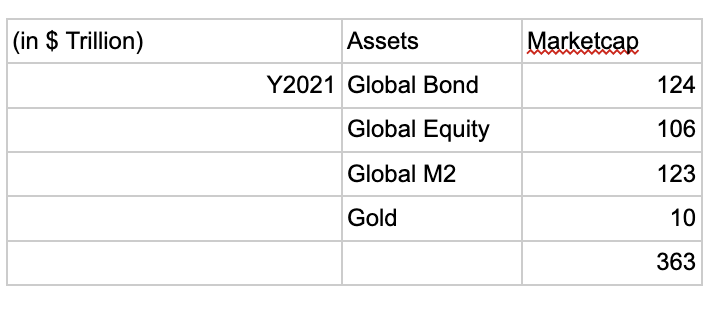

The overall current crypto market accounts for $0.92-1.0 trillion dollars. This means about $1T is in open circulation based on the total holding positions of all sorts of tokens in existence, including the highest value of Bitcoin. Many are investing in its future potential and promises, and it’s not too different from the early-stage startup ventures. However, the total market valuation is equivalent to 41-42% of Apple’s market value between September 25 to October 16 (crypto market cap is between $0.926T – 0.974T vs. Apple’s $2.23T to $2.5T). That’s a big benchmark because Apple generates much tangible value. Some analysts and investment firms, such as Ark Invest (ARKK), advocate that the top two cryptocurrencies will take a percentage of the market share from the existing capital markets. Based on the TAM (total addressable market) of the $122T+ capital market, the foreseeable potential market for crypto could grow to over several trillion dollars with real intrinsic value. We will look into the numbers and model in more detail.

Many complain or argue that there is no practical value in Bitcoin and Ethereum (ETH-USD) unless the current regular centralized companies integrate with them. Some argue that Bitcoin’s value could be evaluated based on the energy cost for block generation or Ethereum based on the network fees generated for the validators. However, it generally doesn’t make sense to value a company based on cost or compensation payout. Those might indeed undervalue the potential real economic and commercial value generated by the ventures or businesses built on top of Bitcoin and Ethereum.

El Salvador is trying to jump the gun and make it a national legal tender and put out the wishful thinking that they can be the first to digitize the financial system and leapfrog the market. But whatever is behind the hidden political agenda, it’s not working. There are a lot of activities, but most are just traded and used for other digital assets within the same bubble. Like the internet, adoption is needed by developing and underdeveloped regions since they have the least financial infrastructure, and many are unbanked. Yet, the current volatility imposes a challenging condition and makes it unusable.

The first step would be to have the developed nations and regions finance and lay out the groundwork and playbook. Successful ventures in the developed nations could refunnel and refinance those untapped markets which need more upfront investment to grow and stabilize the market.

All these are very similar to how e-commerce has evolved. The underdeveloped countries had very low and limited scale and were too disparate or fragmented to be profitable businesses.

Using the e-commerce proxy model is much closer to mass market adoption as a valuation framework. Some of the criteria and characteristics that e-commerce, and open finance and next generation web3 will share:

- Ubiquitous

- Scalability & Speed

- Instant & real time

- Trackable

- Streamlining

- Cross border

- Disruptive to the traditional retail business

- Push back from traditional business mainly from the commercial standpoint

- Lower cost & cheaper

- Solve real world problems such as during the pandemic, contactless virtual shopping

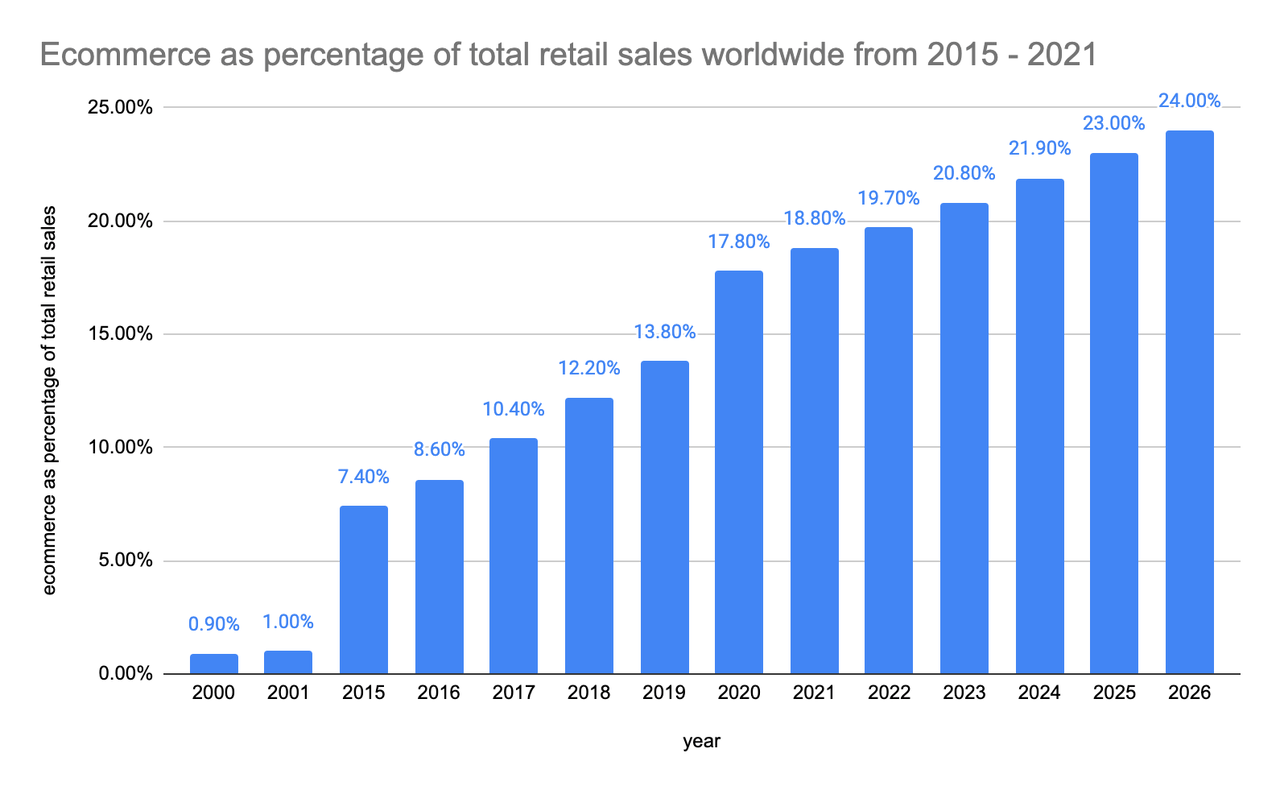

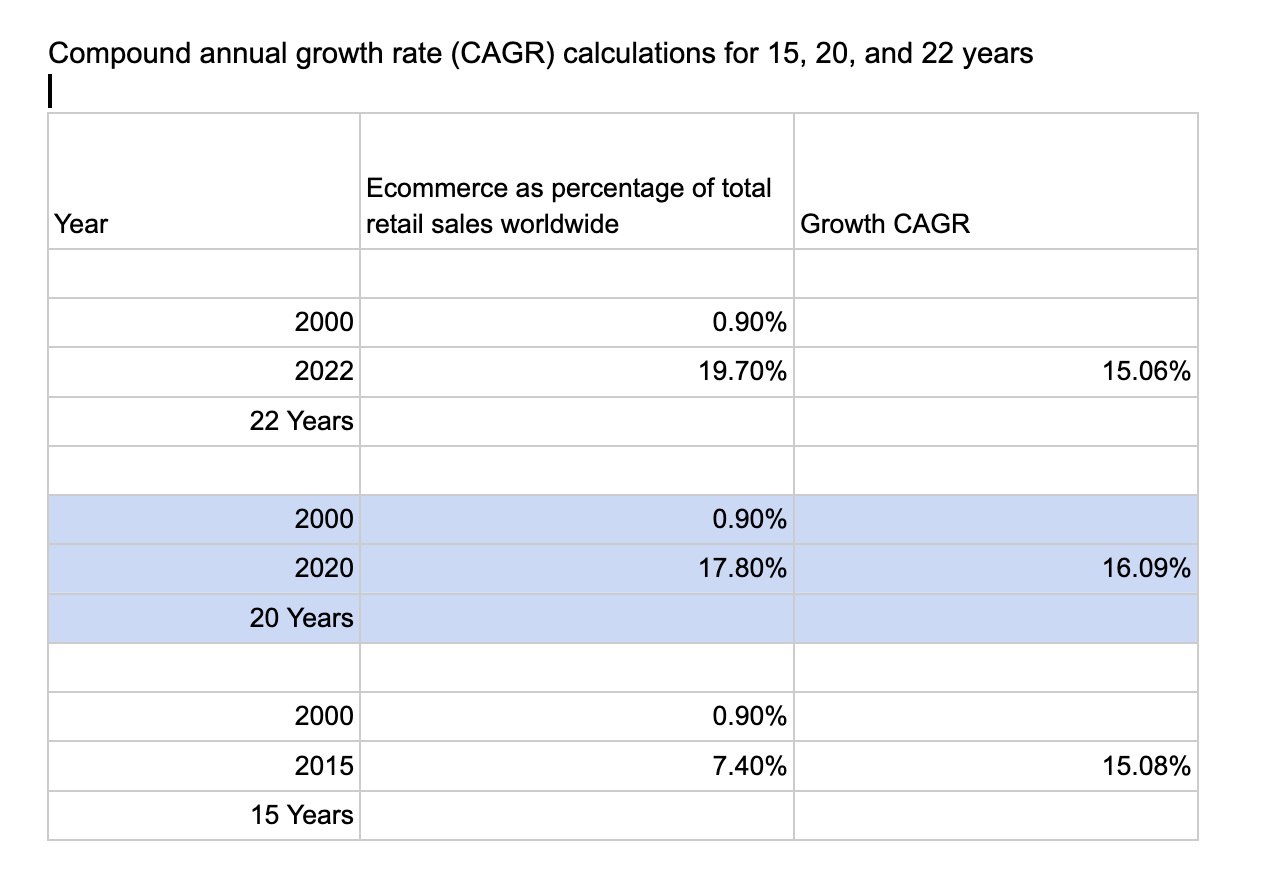

Below is the valuation model using an e-commerce historical growth rate as the proxy:

E-commerce historical growth rate (Statista; Chart by Author)

E-commerce CAGR Calculations for the past 15-22 years (Author’s calculation)

Based on data in the Ark Invest Big Idea 2022 report and cross-referenced with the SIFMA report, the market capitalization of major Global Asset classes are as follows (in Trillion):

Global assets value (Ark Invest Big 2022 report and SIFMA)

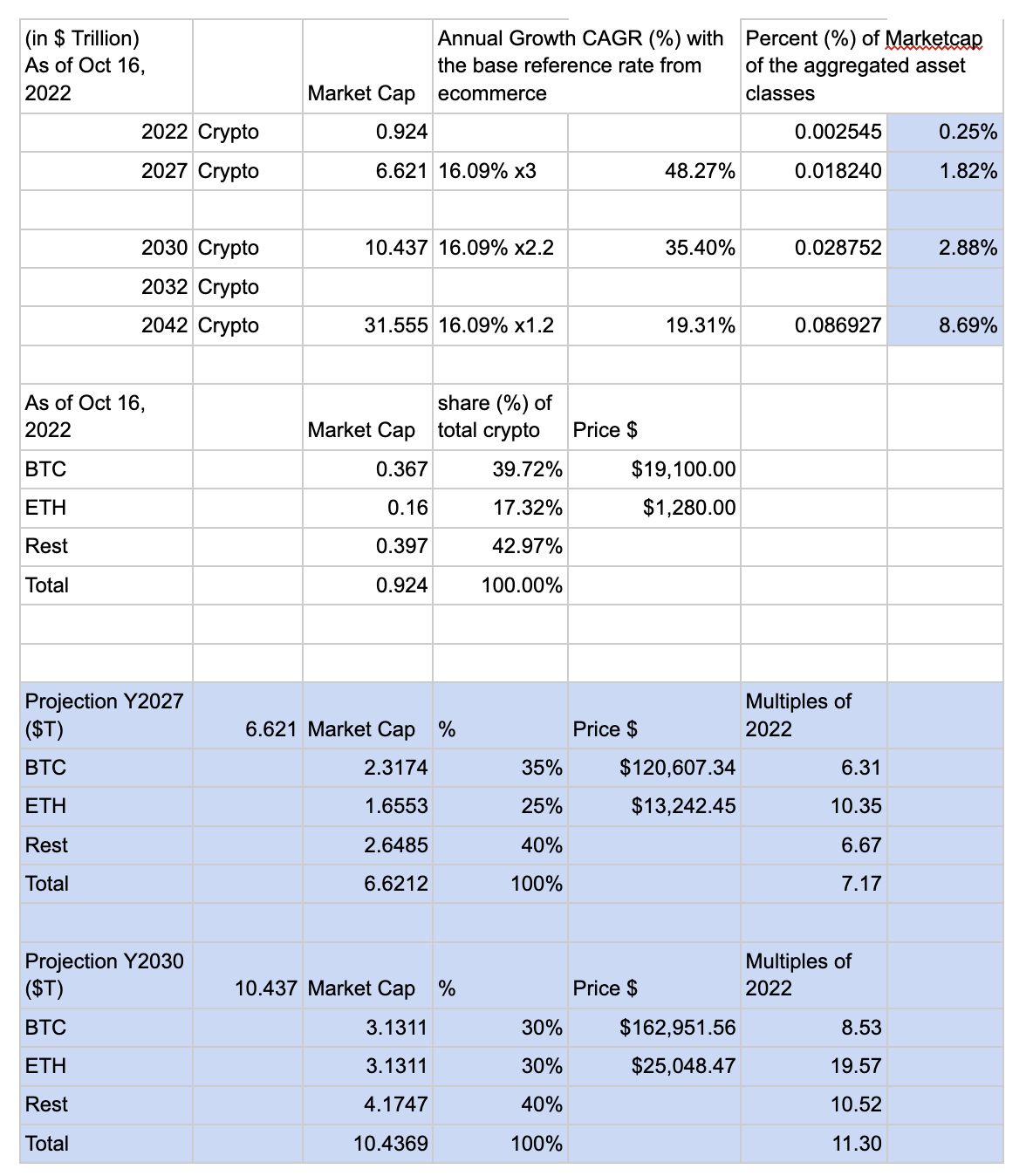

While the crypto market is in its infancy, the volatility is higher. The initial network effect and reflexivity would multiply and push up the adoption rate by two to three times to reflect the parabolic move.

The effect will saturate as the market matures. Currently, we use the value $0.924T (as of October 16, 2022) overall crypto market cap as the overall market size, but the actual economic value generated or the adoption dollar amount should be less than that. In a recent survey and research report by iConnections in collaboration with Galaxy, the word trillion was not mentioned concerning the crypto market.

The report states, “According to Research and Markets, the global digital asset management industry is forecasted to reach $13.4 billion by 2027, exhibiting a CAGR of 19.2% between 2022 and 2027.”

That looks like a very small amount relative to the current market cap value of $0.924 Trillion as of October 16, 2022, which is the total token value traded on the open exchanges. That lends to a relatively high multiple of 69 times. As the crypto industry matures, the multiples will potentially contract, and the actual economic value will increase. That would lead to a more healthy and more stable market.

For long term investors with a five to eight-year timeline, the current price points can be an opportunity to accumulate positions in BTC and ETH, however, there is still a chance for another price drawdown in the crypto market which correlates with the stock market and macroeconomic factors.

Crypto value projection for Y2027 and Y2030 (Author’s calculation)

Key Takeaways

There are a few important key points to monitor that will enable real value creation and real adoption of blockchain. Instead of basing it on ideology and narrative, project creators, venture builders, and investors should have a more pragmatic view of the ongoing development and learn from the growth of the many e-commerce enterprises and how they navigate and conquer the barriers. While blockchain and crypto innovations will overlap with the capital markets and regulation territories, there is a great amount of pressure and headwinds. Each country’s regulatory policy and environment will continue to evolve and adapt. It’s important to size the investment position. Investors can be more methodological about it. Further analysis and approach will be shared in future articles.

Another important consideration is price stability. There are many metrics and on-chain analysis that can be used to measure that. One important monitor is the long-term holding (“LTH”) supplies. The LTH shows the number of tokens and the value in the holding. Based on the Glassnode report and Ark Invest Bitcoin Monthly September Report, it’s trending up. That loosely translates to the larger and longer-term institutional investors and equity holders in the stock market. The higher the ratio, the less volatile the price point, which can also progressively gain higher price stability.

Risks to be considered when evaluating crypto for financial investors, technology builders and content creators:

-

Macroeconomic downturn (evidence shows we aren’t in a dot-com bubble era, but its severe downturn will drag down a broader market)

-

High correlation with broader market, equity market and S&P (high beta)

-

Regulation and politics

-

Technology

-

Human error

-

Fraud

-

Security including unsecured custody

In terms of NFT, it will be an integral part of the new Web services and products, providing utilities and features like interoperability across various existing web (centralized Web2) and online services, including travel, e-commerce, banking, and more. It will be more than mere tokenization of digital collectibles and arts. Yet, digital assets and content value can be transferred ubiquitously across the web and various proprietary platforms, entities, and nations.

This will create and generate many high-value ventures for the next generation.

Fostering a collaborative and pragmatic environment across private and public organizations will enable blockchain and crypto to realize a $10 trillion market and beyond.

Be the first to comment