simpson33/iStock via Getty Images

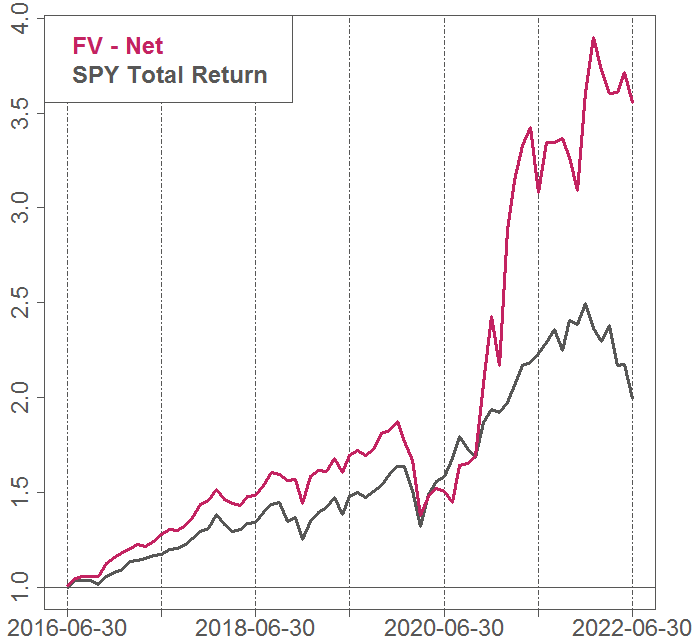

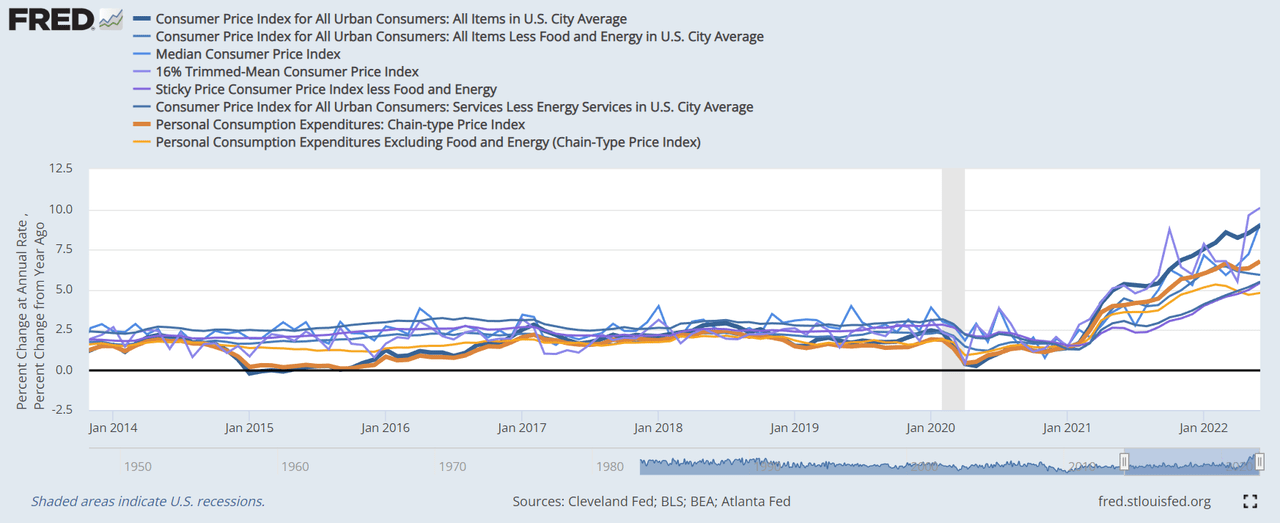

Fundamental Value dramatically outperformed the market in Q2, returning -1.4% net of fees versus -16.1% for the S&P 500. This outperformance was due primarily to the gains provided on our short positions, which declined on average -38.4% during the quarter and made a +16.9% contribution to the portfolio.1

Market commentary

As we did in our January and April letters, let’s check in on our predictions from Part III: Apex of a Bubble. In Part III, published last September, we said that the US capital markets were mired in an “everything bubble,” presaging real returns that investors would find severely disappointing – and likely negative – for many years to come. And we predicted an imminent top and a proximate cause:

We believe inflation is likely to be the catalyst that ultimately pops the everything bubble. If we are correct, eventually the Fed will have to reverse course, tightening policy and raising interest rates. When this happens, investors who have speculated in low or no-yielding assets like SPACs, high-flying growth stocks, and NFTs may find their portfolios permanently impaired.

We said in April that these “predictions had already largely come true,” yet “the main equity indices have been eerily resilient”:

Investors seem increasingly in denial of what is an unequivocally disastrous fact pattern for an equity market that is still trading near all-time high valuations. And despite all the bad news that has come in since September, the worst is yet to come… Investors are poised with their fingers over the sell button. This creates the conditions for a crash. Caveat emptor.

The S&P proceeded to crater -16.1% during the second quarter, finishing the worst first half of a year since 1970. The Nasdaq was down -22.5%. The bond market had its worst start to a year ever, shocking many investors who had become accustomed to bonds providing a hedge against equity declines. Cryptocurrencies were decimated. Nearly everything experienced abysmal returns as the aptly-named “everything bubble” popped.

As we predicted in September, we have seen “the death of easy real returns from passive investing.” We were able to largely avoid the drawdown. On the long side, our conservative holdings already traded at reasonable valuations, and thus did not suffer proportionately from the dramatic valuation re-rating. On the short side, our positions comprised some of the most speculative securities in the market, and these suffered disproportionately from the tightening of financial conditions and the reassessment of euphoric growth projections.

We continue to find attractive opportunities among our core value names, as well as new and compelling looks at the “transcenders,” like Facebook (META) and Netflix (NFLX), who have fallen so far from grace that they now trade at sub-market multiples. Unfortunately, we do not think prospects for the equity market as a whole are nearly as compelling. First of all, we find it hard to believe that a bottom is in when some of the most speculative securities, like AMC (AMC), GameStop (GME), and MicroStrategy (MSTR), still trade at transparently irrational prices.

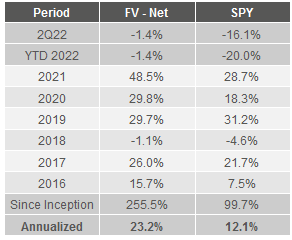

Our short book remains chock full of such companies. Capitulation in these retail favorites is a likely prerequisite for a durable bottom. Second, we expect equities to be pressured by falling corporate profitability. The drop in the stock market this year has been solely due to lower valuations, as earnings have remained resilient. We worry that earnings will be the next shoe to drop. Corporations have benefitted from insatiable consumer demand catalyzed by unprecedented government largesse.

But stimulus – both monetary and fiscal – is rapidly falling from all-time pandemic-era highs. And demand destruction is coming: high inflation is a tax on the consumer, especially spikes in the cost of food, energy and shelter. Margins are decelerating from the all-time highs reached in 2021: corporations will be squeezed by rising input costs and an extremely tight labor market, and many will have difficulty passing those costs through to consumers. Real GDP fell in both the first and second quarters.

Dollar strength is a severe headwind for American corporations that have costs predominantly denominated in dollars but derive roughly half of their revenue from international markets. This atmosphere is a stark contrast from the halcyon days of the 2010s when low inflation combined with a structurally weak labor market and sustained government stimulus. While Wall Street has forecasted earnings growth in 2022, it is almost entirely due to the phenomenal 250% increase in energy sector earnings. If you exclude energy, earnings growth is an anemic ~2% nominal (and decidedly negative in real terms).

This boom in energy earnings isn’t an indicator of economic health – it’s a sign of geopolitical turmoil and elevated energy costs which dampens economic activity. Finally, we expect it will be harder to rein in rampant inflation than the Fed and the market currently believe. The Fed’s latest Summary of Economic Projections projects a peak fed funds rate this cycle of 3.8% in 2023.

Markets are even more sanguine, currently pricing in a peak rate of 3.3% in February of 2023, before the rate rapidly falls back to 2.7% by the end of the year.2 It strains our credulity to imagine that a peak fed funds rate of 3-4% will tighten financial conditions enough to lower inflation to the Fed’s 2% target when it is currently running at 7-9%. Yet both the Fed and the market expect that will happen rapidly. The Fed anticipates PCE inflation of only 2.6% in 2023. Market pricing anticipates CPI inflation of only 2.7% over the next five years.

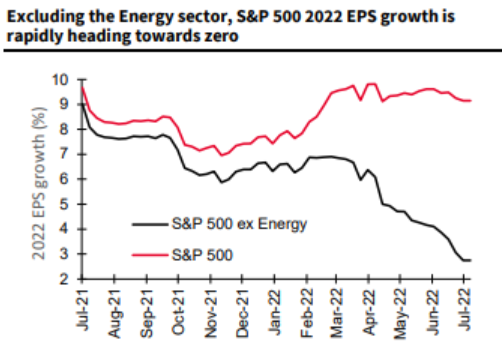

We do think that headline inflation will probably moderate. Commodity prices are well off their highs, supply chain problems should ease, and demand for goods is dropping after the pandemic-driven surge. However, inflation “moderating” from a headline ~8% should be cold comfort. Furthermore, evidence indicates that what was once an inflationary surge driven by a few items – primarily food, energy and durable goods – has morphed into a far broader and stickier inflationary pressure.

There are various ways to attempt to more reliably ascertain the underlying trend of inflation than the headline rate. For both main consumer inflation indexes, CPI and PCE, we can look at the “core” rate, which strips out food and energy prices. This tends to be a better predictor of future inflation than the headline figures, as food and energy prices are volatile and idiosyncratic. We can look at the Cleveland Fed’s Median CPI or their Trimmed-Mean CPI, which they believe provides an even better signal than the core figures by excluding outliers in the price-change distribution.

We can look at the Atlanta Fed’s Sticky Price CPI, which is made up of prices which change relatively infrequently and so are thought to incorporate expectations about future inflation to a greater degree than prices that change more often.

Finally, we can look at services inflation, which has been significantly lower than goods inflation this cycle, to see if price pressure is percolating through that side of the economy as well.3All of these measures have their strengths and weaknesses, but it is not critical to differentiate between them today: they uniformly paint a dreadful picture.

Underlying inflation is running somewhere from 5-10%, price increases pervade the economy, and there’s no sign of an imminent decline. This is a radical departure from the post-financial crisis era of low and stable inflation. Not only does the Fed project this elevated and pervasive inflation will rapidly moderate, they also project this will happen in an excellent economic environment. They expect trough real GDP growth of 1.7% in 2022 and 2023 – a very healthy growth rate not at all consistent with a dramatic slowdown in economic activity, or with current figures (QoQ growth was negative for the first two quarters of 2022).

They expect peak unemployment of only 4.1% – a level so low that we’ve attained it only fleetingly during the three greatest economic booms of the past 60 years. Frankly, these projections seem comically optimistic to us. The Fed still seems to be praying that inflation is transitory. Furthermore, monetary and fiscal policies are still much too loose to be a restraining force on inflation today. The Fed is moving in the right direction, but conditions are emphatically not tight.

At a 2.3% fed funds rate, short-term real interest rates are still extremely negative. Further out, the real yield on 5-year inflation-protected Treasury bonds is barely positive. The size of the Fed’s enormous balance sheet is still unprecedented and has barely begun to shrink. Fiscal stimulus, though down substantially, is still unsustainably high: transfer payments as a percentage of GDP were higher in the second quarter than any other quarter since data begins in 1948, excepting the pandemic.

We expect bringing underlying inflation down to the 2% target will be much harder than currently anticipated – occurring more slowly, requiring much tighter financial conditions, and causing more damage to the economy. Thus, the famous “Fed put” is no more. Since the late 1980s, the Fed has loosened policy in response to every bear market, providing a jolt of energy when most needed. No more. Instead of alleviating investors’ pain, the Fed will be exacerbating it.

Despite a terrible first half to the year, we believe further pain is likely for investors in stocks, bonds, cryptocurrencies, and more. Bireme clients have weathered the storm well thus far, and we believe they are positioned to continue to do so. We expect our short book to continue to be a large positive contributor, and we expect our long book to fare much better than the market in the short term and appreciate significantly in the medium term. It’s not too late to get on board. Please reach out.

Portfolio commentary

On the long side, many of our core holdings have declined substantially. Between Jan 1st and June 30th, Facebook was down 29%, HCA was down 34%, RICK was down 21%, and NFLX was down 54%. Our positions started 2022 cheaper than most, and today are even more so. We believe they are all trading at extremely attractive prices.

HCA Healthcare (HCA)

HCA, at 10x 2022 earnings at 6/30/22, is quite cheap despite having many competitive advantages. HCA is the world’s largest hospital company, with 182 hospitals, 125 ambulatory surgery centers, and thousands of physician clinics. The company was started in 1968 by the Frist family, who to this day hold about $11b worth of shares in the company. HCA sees 2m patients per year and is on track to generate about $60b in revenue for 2022. We have owned the stock for years, first writing about it in 4Q17.

Though it has appreciated ~230% since our initial purchases, HCA trades at a lower earnings multiple today due to excellent business results. HCA’s long-term track record is very impressive. They have methodically expanded their healthcare empire over the decades, achieving annual revenue growth of 7% and EBITDA growth of 8% since 2010. This growth has not come with a rise in share count; in fact, shares have declined from 448m in 2013 to 295m today due to repurchases.

Instead, the growth has been due to the high returns on capital enjoyed by the firm, with ROIC of more than 20%. HCA’s operating results are also better than most of its peers, many of whom struggle to consistently generate free cash flow and solid returns on capital. Among nonprofits, smaller community hospitals have notoriously weak financials. Health care services businesses consistently over-index in bankruptcy filings. The industry is not for the faint of heart, but HCA has used its scale and financial strength to outperform its peers over a long period of time.

And yet, the company continues to trade in line with comps such as Tenet Healthcare. Tenet, which owns 80 hospitals, has closer to 10% returns on capital and 12-15% average EBITDA margins, ratios that are materially lower than HCA’s. HCA has more scale, better margins, less debt, and better occupancy ratios (70% vs 50% last quarter).

We fail to see why HCA should trade at 7x EBITDA along with THC. We think it should trade much closer to (if not above) market multiples. But low valuations do have their advantages for cash-flowing companies. HCA has been no exception, with management buying back $8b worth over the past 4 quarters. At current prices, that $8b equates to a roughly 13% buyback yield. HCA remains a large position for our firm.

Short positions

During the first half of 2022, investors unlearned many of the fallacious “lessons” that became ingrained during the epic bull market that started in 2009 and culminated in 2021. Investors had come to believe that “stocks only go up,” and that a sexy story was more important than profitability.

Now they have belatedly remembered that valuation matters for even the highest growth companies. This has led to a precipitous decline in the share prices of many of the names in our short portfolio, helping us to escape with losses of <1% YTD despite a ~20% downturn for the overall market and much larger losses for the “growth at any price” strategies that did well in 2020 and 2021. We recently covered our short position in Affirm (AFRM) after a rapid decline brought the share price to ~$30 – down from our entry point above $100 – in only 7 months. We discussed Affirm in our Q4 letter, saying the following:

Affirm is a “Buy Now, Pay Later” ((BNPL)) company founded by former PayPal (PYPL) CTO and cofounder Max Levchin. They provide installment loans to consumers, partnering with retail companies looking to drive higher sales. They have two primary products: a zero-fee installment loan for consumers with the best credit scores, and a more traditional product with 20%+ interest rates for subprime borrowers. Their stated plan is to disrupt the credit industry with more transparent, lower-fee loans. At a roughly $28b market cap at the start of 2022, AFRM stock was priced at more than 20x trailing sales, a steep price for a money-losing lender. While their early lead in online BNPL transactions and partnerships with fast-growing retailers like Peloton (PTON) has fueled significant historical growth, a wave of competition has arrived… While the stock has already fallen sharply from where we initiated our short position, we think it could fall another ~40% to trade at 8x FY2022 sales.

Interestingly, not much has changed about Affirm’s business from when it sported a $28b market cap. Estimates for 2022 sales have been inching up, from $1.25b at the start of the year to $1.35b today. And analysts estimate that the company will lose about $150m of EBITDA this year, slightly better than estimates in January.

Rather than a story of deteriorating business fundamentals, this was a story of market participants simply deciding that a fast-growing, money-losing subprime lender – even a disruptive one – with around $1b of revenues should not be worth twenty-eight billion dollars. We think the current valuation is much more reasonable, and we do believe that Affirm will eventually generate profits from its lending platform, so we covered our short position.

In contrast, we don’t foresee fuboTV (FUBO) finding a profitable business model. The company, which operates a streaming TV service, still has negative gross margins and in 2021 generated over $300m in operating losses. This company may end up in bankruptcy, given that it already carries around $400m of debt and looks set to burn over $300m of cash this year. The stock has fallen from $26 when we last mentioned it to $2.60 today. We remain short.

We described our short position in Skillz (SKLZ), Inc in Q3 2021. The business never improved, and the company looks set to lose $300m this year on just $400m of revenue according to Street estimates. The stock has fallen from $20 in the summer of last year to just $1.50 today, and we covered our short position at a profit.

Amazingly, GameStop is one of our only short positions to not fall in 2022. The stock trades at an $11.5b market cap, exceeding its pre-pandemic peak by billions of dollars. This is despite the fact that revenue is down 30% from the peak, gross margins are down 1500 bps, and the company has generated a negative free cash outflow of $700m in the last four quarters (we had to double check that number because it is so high). Wall Street has consistently revised downward their estimates of GameStop’s profitability, making its stock price stability in 2022 even more perplexing.

Analysts currently estimate an EBITDA loss of around $400m, markedly worse than their estimates as of 2/3/22 of a loss of $60m. Their recently launched NFT marketplace will do nothing to fix their core business and comes about a year too late to be relevant in the NFT space. Instead, we see this as another example of a meme stock company hoping it can ape its way into a new business model, utilizing the popularity of the stock to drive new lines of business. We are not optimistic, and think the $11.5b market cap drastically overestimates the capability of GameStop to pivot into something more profitable. We find it unlikely that GameStop books a GAAP profit ever again.

We also remain short MicroStrategy, a middling business analytics software company that turned itself into a gigantic levered bet on Bitcoin at the height of the hype cycle – losing over a billion dollars in the process. Now, the company will need all the cash flow from the business just to pay off the interest payments on the enormous debt load, leaving no earnings for equity holders. Despite shares down over 60% for the year, the company continues to trade at a material premium to the value of its assets. For more detail on our thesis, please see our blog post here, as well as the Forbes and Fortune write-ups that feature our short position.

We are grateful for your business and your trust, and a special thank you to those who have referred friends and family. There is no greater compliment.

– Bireme Capital

Footnotes

1 Net calculations assume a 1.75% management fee. Fee structures and returns vary between clients. FV inception was 6/6/2016.

2 Data from Bloomberg’s World Interest Rate Probabilities function calculated on 7/29/2022.

3 All series are percent change from a year ago except Median and Trimmed-Mean CPI which are reported as MoM percent change annualized.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment