wildpixel

Investment Summary

In our last two publications Bioventus Inc. (NASDAQ:BVS), we had advocated the stock as a strong buy. Both notes reported on Durolane’s offering as a key differentiator in the hyaluronic acid (“HA”) market, amongst other mid-term growth drivers. Things look to have changed, however.

Management trimmed FY22 guidance at the top-bottom lines following a weaker than expected third quarter. Chief to the downside was tighter Gelsyn volumes coupled with unfavourable pricing in this segment. Alas, growth across the rest of the portfolio is expected to pull in tighter for the year as well.

We covered BVS’ product portfolio, and its key differentiators in our previous publications on the company. You can observe them by clicking here:

- Bioventus: Strong Value Gap, Insulated Via Leading Market Share

- Bioventus: Reiterating Buy Thesis Following Q2 Earnings

There’s been important changes to our outlook. What’s changed:

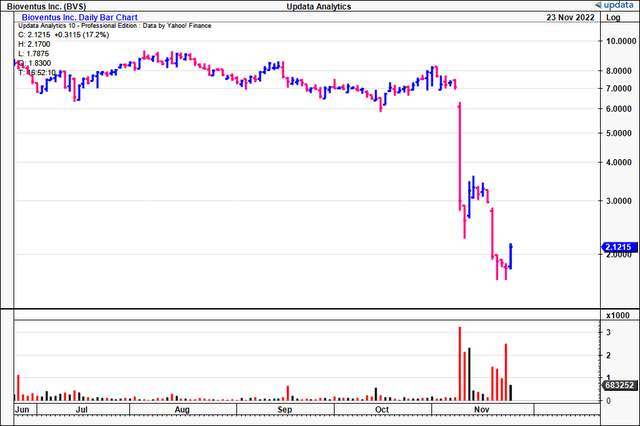

- The market was swift to price in the FY22 earnings revision with a corresponding re-rating to the BVS stock price [Exhibit 1].

- It now trades a shade above $2 – well off the $9.35 price target we assigned previously. It also trades at a respective discount of 0.3x book value and 1.1x EV/sales.

- Yet, even as the valuation calculus has contracted, we aren’t certain there’s value to be made at these compressed multiples.

- Further, with visibility on growth less certain, we revise down to neutral.

Key upside risk:

- Given the company’s small market cap, now trading at $2.12 per share, we believe there’s upside risk to our thesis.

- At these compressed prices, there’s risk BVS could rally hard to the upside, back to previous levels.

- We’d expect technicals to become disconnected from fundamentals in that situation, and volatility to be high.

- There could be numerous causes to this, ranging from BVS’ announcements, general market sentiment, and more.

- There’s no reason to consider BVS a short candidate, for that reason.

- Hence, we advocate investors to remain on the sidelines for now and seek an opportunistic entry should the stock rally back towards previous highs of c.$7 apiece. Until then, we are a firm hold on BVS.

What’s caused the selloff?

We’d suggest investors sold their positions en masse following the language on guidance from the Q3 earnings call. The stock is 40.75% held by institutions, and 7.4% and 10% by hedge funds and public corporations respectively. Hence, large orders from any of these entities can move the stock price.

Turning to guidance, management reduced revenue range to $527-$532mm. It previously saw $547.5-$562.5mm at the top line. It hopes to pull this down to adjusted EBITDA of $75-$79mm, down from $94-$104mm. Perhaps most concerningly to the market, it narrowed EPS guidance to $0.20-$0.25 from a previous range of $0.47-$0.57.

It cited 3 key reasons for the downgrades. Namely, further contraction of Gelsyn sales making the bolus of reduced guidance. Management also project Exogen sales to recover more slowly than expected, “operational challenges” as the main reason given. Moreover it sees lower revenue from its advanced rehab segment. Collectively, these issues as the factors reducing guidance.

We’d suggest these adjustments aren’t to be taken lightly. The wind-back in forecasts could imply headwinds at the end-market level in our opinion [in particular, pricing], especially given management’s language on Gelsyn pricing on the earnings call.

The market’s reaction to the revision is further evidence of this [Exhibit 1].

BVS now trades at its lowest mark on record, and to us this says investors are searching for positive updates around the company’s HA division. In other words, it could mean that the BVS share price has high beta to HA sales, in our opinion.

That’s not to say the company can’t surprise to the upside come Q4 FY22 earnings time. However, looking to the wider macroeconomic landscape, we’d suggest BVS’ language on the call fits the data.

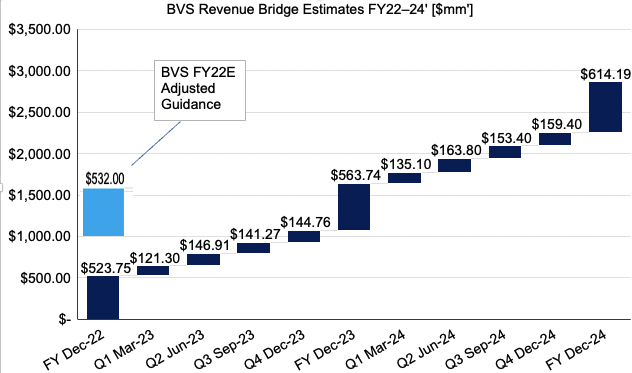

In that vein, and considering the magnitude of the decrease, we project FY22 revenue behind BVS at $523mm. You can see our revised revenue estimates in Exhibit 2.

Exhibit 1. BVS’ guidance adjustment resulting in large selloff in BVS shares [heavy institutional, fund ownership].

Exhibit 2. Revised FY22-24′ revenue estimates. We project FY22 revenue behind company estimates.

Data: BVS Q3 FY22, HB Insights Estimates

Q3 results marred by contraction in Gelsyn sales

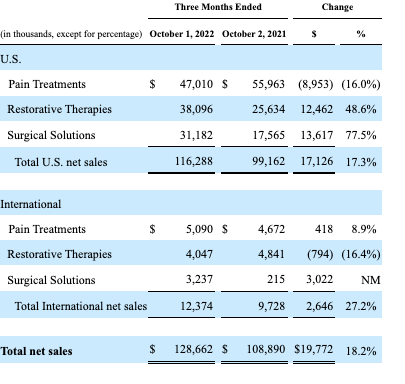

Examining BVS’ financial results further, we observed BVS incurred several headwinds that had a negative impact on revenue. Turnover still climbed 18.2% YoY to $128.6mm, with organic growth of 700bps. This pulled to adjusted EBITDA of $23mm. Both were well below company expectations.

We note the revenue miss stemmed from the 3-injection protocol, Gelsyn, as mentioned previously. A couple things to note here:

- Medicare’s recent changes to reimbursement rates had a negative impact across BVS portfolio.

- The company faced a specific issue with one of its private payers, adding to rebate headwinds. Further explanation of this is explained in the 10-Q.

Both of these pressured the ratio of wholesale price to BVS’ average selling price (“ASP”) and pulled averages south.

Looking at the divisional highlights, Durolane sales were again the standout in pain treatments, up double-digits in management’s terms. Any growth in its pain treatments business was offset by the heavy decline in Gelsyn sales.

Turning to the surgical solutions business, we note the 94% YoY growth to $31.1mm as a standout. Driving this growth was a 62% contribution from the Misonix surgical portfolio, along with ~32% of organic growth.

It’s also worth noting that restorative therapies was strong at $38mm in turnover for the quarter. Noteworthy, we saw improvements in BVS’ supply chain, evidenced in c.8% growth in its advanced rehabilitation numbers.

BVS’ divisional breakdown is summarized in Exhibit 2.

Exhibit 3. BVS Segment Breakdown with corresponding variance, Q3 FY21 – Q3 FY22.

Data: BVS Q3 FY22 10-Q, pp. 29

Valuation and conclusion

The stock has re-rated heavily to the downside and now trades at 0.2x forward sales. In addition, we can buy BVS at a substantial discount to its book value, trading at just 0.25 book value.

Question immediately turns to whether these are value numbers or not. Let’s take a step back and think of it in terms of corporate value, instead of market capitalization.

In our last coverage, we estimated BVS’ non-GAAP EPS growth to $0.27 in FY22, $0.26 in FY23, stretching up to $0.59 by FY4.

We hoped to see some upside on this from Q3, however, we’ve remained flat on these assumptions. This, as its book value per share decreased YoY. Moreover, BVS itself downgraded estimates vertically down the P&L.

Where’s the upside to BVS’ corporate value in that scenario? Ideally, a combination of earnings growth and return on invested capital would demonstrate otherwise. Alas, this supports our neutral view. With the stock trading at such discounted multiples, we withdraw our previous target of $9.35, and assign no price objective for now. Rate hold.

Be the first to comment