Jian Fan

Investment summary

Whilst we’ve wound back strategic exposure to equities, there are still numerous opportunities within the asset class to capture idiosyncratic risk premia. One prime example is Bioventus Inc. (NASDAQ:BVS) by our estimate. The stock has been compressed in FY22, however, we note Q2 numbers are supportive of future upside. Our estimates point to a December 2022/January 2023 price target of $9.35 or 9x projected FY22 FCF. As seen in Exhibit 1, price action has faltered in recent months, and this could present an opportunity to size up the position at respective multiples.

Exhibit 1. Price action has been mute lately – declining volume with sideways action is considered resistance, in our estimate.

Note: 6-month daily data showing RSI, Volume and price action with EMA. (Data: Refinitiv Eikon)

We continue to be net buyers of BVS, having covered the name extensively in previous analysis here.

From there, we found the following salient points create an asymmetry to the upside in the risk/reward calculus:

- Durolane, combined with the Gelsyn protocol, holds >c.20% of the single and 3-injection knee osteoarthritis (“OA”) treatment markets.

- As a second-line defence, Durolane could be embedded into the standard of care, vs. directly competing.

- The Exogen segment is a potential long-term compounder with quality economics tied into the mix.

- BVS also has 40% of the 5-injection protocol market for OA.

- Its business model builds in additional sources of value to the core offering vs. cannibalising its own end-markets.

With these points in mind, we were impressed with BVS’ latest numbers and reiterate the buy recommendation.

Risks to investment thesis

Investing in small-cap equities carries inherent risks associated with price volatility, fluctuations in market value and sensitivity to announcements. We are bullish on the stock and downside risks to the thesis include weaker than expected forward earnings, reduced market share from competitors and a dislocation of fundamentals from market activity. We encourage investors to keep these risks front of mind when reading this report.

Q2 earnings comments

Second quarter revenue was in-line with longer-term growth trends, with a 28% YoY growth of $140 million (“mm”) at the top. Growth was seen across all segments of the portfolio. The restorative therapies business came in with a 23% YoY growth, whereas the Misonix wound products portfolio contributed 28% to the top line. Gross margin decompressed by ~30bps YoY to 77% despite cost of sales increasing ~$10mm YoY. Management note a 20% increase in revenue related to the Misonix acquisition. It brought this down to EBITDA of $23mm ($0.37/share).

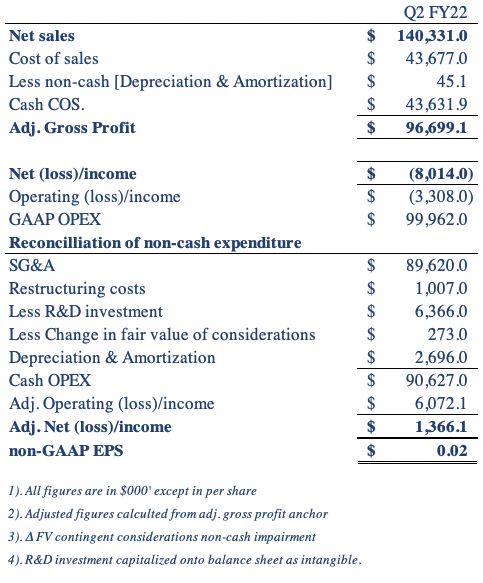

In tandem with a weaker economic and industry outlook, BVS narrowed guidance to $547-$562mm ($545mm-$565mm previous). This still calls for 30% YoY growth at the top. We have made some minor reconciliations to the company’s GAAP earnings to gauge how much it invested during the quarter. Note, as in Exhibit 2, we have capitalized 100% of the R&D investment onto the balance sheet as an intangible (assuming 5-year useful life with straight-line expenditure), removed $2.7mm of depreciation from OPEX. Doing so, see a slight upshift in earnings to $0.02/share.

Exhibit 2. BVS consolidated statement of reconciled GAAP-non-GAAP earnings. We have capitalized 100% of the R&D investment, and removed non-cash charges from operating expenditures, resulting in a marginal change to earnings.

However, we note that the company’s total invested capital for the quarter increased by $6.3mm.

Data: BVS Q2 FY22, HB Insights Estimates

Modified CariHeal purchase agreement

We noted the cancelled $14mm senior notes offering to acquire CartiHeal in the previous analysis. Management remained optimistic on a solution and has delivered. It modified the purchase terms to five milestone payments to $215mm tied to deliverables.

The first two are $50mm each and will be paid by Q3 FY23. Following that, two more at $25mm in FY24 and FY25 respectively, and the remainder in a $65mm payment to FY26. In addition, the payments accrue interest at 8% until each payment is met. This interest expense is to be paid annually.

BVS also secured additional liquidity to finance these payments in increasing its Term A facility by $80mm. The balance is now at $430mm with no early repayment penalties. From the culmination of milestone payments, interest and the new bank facility, management estimates net leverage (net debt/EBITDA) will sink to below 3.5 turns by FY23’s end. This is consistent with previous language.

Valuation and conclusion

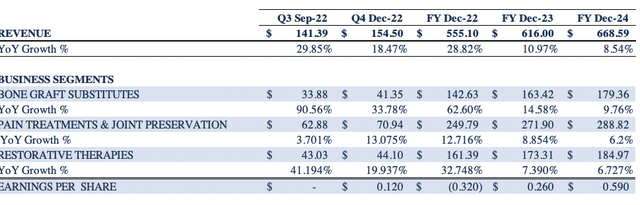

Following its sequential performance of growth, our research team was confident in revising BVS’ forward sales estimates across its operating segments. In particular, we estimate GAAP earnings per share of $0.26 in FY23, stretching up to $0.59 by FY24.

Exhibit 3. BVS forward estimates, FY22-FY24

Note: Estimates revised from previous forecasts made after Q1 FY22. Earnings per share estimate is calculated on GAAP basis. (Data: HB Insights Estimates)

Shares are also trading at ~1x book value and are priced at a discount to peers at 0.8x sales. We believe this discount is unfairly applied to BVS, all else considered. Shares are also priced at ~9x our FY22 FCF estimates, and assigning this multiple sets a December 2022/January 2023 price target of $9.35.

With these points in mind, we reiterate the buy thesis on BVS and believe it is well positioned to deliver continued earnings and FCF growth into a weaker economic climate. Rate buy on price target of $9.35 per share.

Be the first to comment