cofotoisme/E+ via Getty Images

Facts do not cease to exist because they are ignored.”― Aldous Huxley

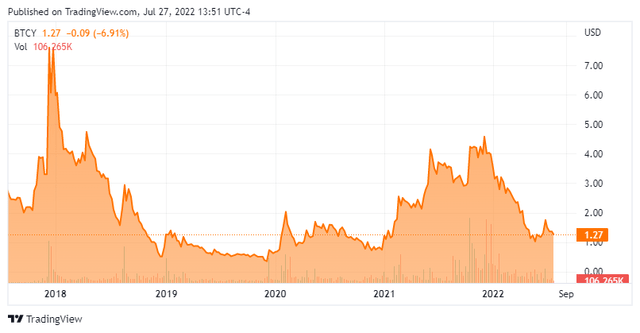

Today, we put Biotricity, Inc. (NASDAQ:BTCY) in the spotlight for the first time. This medical device company finds itself in “Busted IPO” territory. However, a few new product launches should help the company deliver impressive revenue growth in the quarters and years ahead. An analysis follows below.

Company Overview:

This small medical device/technology solution concern is based just outside of San Francisco. The company provides biometric data monitoring solutions. Biotricity is focused on the delivery of remote monitoring solutions to medical, healthcare, and consumer markets, including diagnostic and post-diagnostic solutions for lifestyle and chronic illnesses. The stock trades for around $1.25 a share and sports an approximate market capitalization of $70 million.

The company describes itself as:

Biotricity is a modern medical technology company focused on delivering innovative, remote biometric monitoring solutions to the medical and consumer markets, including diagnostic and post-diagnostic solutions for chronic conditions and lifestyle improvement“

The company’s product portfolio of hardware devices and software solutions are all designed in house.

Fourth Quarter Results:

On July 14th, the company reported fourth quarter results. Revenues rose 80% on a year-over-year basis to $2.15 million as Biotricity posted a non-GAAP net loss of 11 cents a share. Both top and bottom line numbers were in-line with the consensus.

For the full 2022 fiscal year, Biotricity had $7.7 million worth of sales, an 126% increase from FY2021. The company had a full year non-GAAP loss of 66 cents a share, 48 cents a share if you drop one-time items.

The company noted on its earnings press release some notable product news during the quarter:

- The launch of its wireless wearable holter patch device, Biotres. This is a development leadership says represents the future of Remote Patient Monitoring.

- Unveiled Biokit, a personal medical device kit for integration into the Biotricity ecosystem.

- Launched Bioheart, a first-of-its kind continuous heart rhythm recorder and personal heart lifestyle solution.

- Released Biocare Cardiac, a personal, cardiac health application for individuals diagnosed with, or at risk for, cardiovascular disease.

Leadership seems particularly excited by two of these launches. Bioheart, its cardiac monitor now directly available to consumers offers the same continuous heart monitoring technology used by physicians. The patient can now manage heart conditions with retrospective snapshots and long-term data collection in a state-of-the-art manner. The device is worn directly around the chest and goes for just under $200 on Amazon.

Bioheart measures your heart’s electrical activity with high accuracy. The device is small and lightweight, and at approximately 2.5 inches in diameter can fit in the palm of your hand. It can be set up in a few minutes, starting by downloading the Bioheart app. This device can improve remote patient monitoring significantly and is very relevant to senior citizens as doctors can use this data to diagnose and treat heart rhythm irregularities with minimal in-person visits. In this way it advances Telehealth. The company believes this adds an approximate $1.25 billion annual market to its target population.

The company also has high hopes for Biotres, its wireless wearable cardiac monitoring device that just began full commercialization last quarter. This device serves as a three-lead device designed to continuously record electrocardiogram data for early detection of cardiac arrhythmias. Biotres can work for 30 days without recharging. It was approved in January and vastly expanded Biotricity’s addressable market to over $5 billion according to management. It sells for $350.00.

Analyst Commentary & Balance Sheet:

Since quarterly results posted, both Lake Street ($4 price target) and H.C. Wainwright ($2 price target) have reissued Buy ratings on the stock. Maxim Group has maintained its Hold rating on the equity.

A little over one percent of the outstanding float in BTCY is currently held short. Despite the drop, there has been no insider activity in the shares so far in 2022. No insiders have purchase stock in BTCY since it came public. The company ended the first quarter with just over $12 million in cash and marketable securities on its balance sheet against a like amount of long-term debt. The company had a net loss of $6 million during the fourth quarter.

Verdict:

The current analyst consensus has the company losing just over 40 cents a share as revenues rise by two thirds to $13 million in FY2023. Losses are projected to narrow significantly in FY2024 as sales rise to some $35 million.

The company has an impressive projected growth trajectory. That said, I think I will wait to see how much traction Bioheart and Biotres get over the next quarter or two. Initial rollouts can always be tricky. In addition, the company, at its current burn rate, is going to have to raise additional capital sometime on the horizon. Therefore, I have investment recommendation on Biotricity at this time. However, the company’s story is intriguing enough to circle back on once funding needs have been addressed and we have a couple of more quarters of sales data.

Confidence is ignorance. If you’re feeling cocky, it’s because there’s something you don’t know.”― Eoin Colfer, Artemis Fowl

Be the first to comment