The little problem we didn’t anticipate kind of turnaround companies, where the problems are far worse than originally thought.” – Peter Lynch

In biotech investing, it’s imperative that you keep tabs on significant management changes. Whenever senior management leaves the company, that often foretells upcoming troubles. Now, the situation becomes a “gray area” when the CEO doesn’t completely depart from the company. Nevertheless, whenever there is a drastic management change, it pays for you to take closer attention.

The company that epitomizes the aforesaid phenomenon is BioLife Solutions (NASDAQ:BLFS) as it recently went through senior management changes again. Nevertheless, other business fundamentals remain strong. In this article, I’ll revisit BioLife and share with you my expectations of this intriguing turnaround/growth equity.

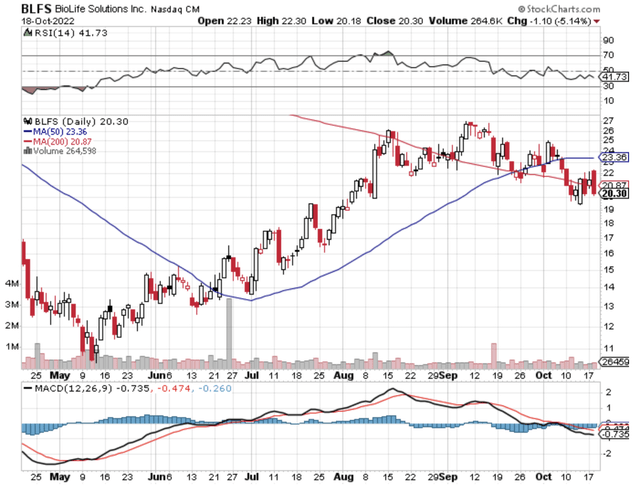

Figure 1: BioLife chart

About The Company

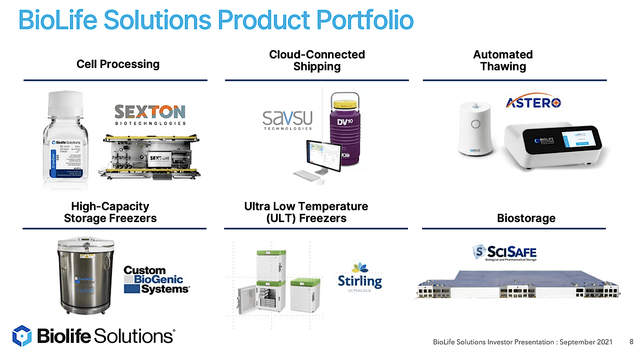

As usual, I’ll present a brief corporate overview for new investors. If you’re familiar with the firm, I suggest that you skip to the next section. I noted in the prior article:

Operating out of Bothell, Washington, BioLife is a premier supplier of bioproduction products and a logistics service provider for the cell/gene therapy (CGT) and biopharma sector. As CGT is growing aggressively, BioLife is positioned to enjoy the huge industry tailwind.

Figure 2: Logistic and service pipeline

More Partnership

Shifting gears, let us walk through the various fundamental developments of BioLife. As you can see, the more strategic partnership a growth company like BioLife can form, the better. The partnership would allow the company to use its resources, absorb costs, and add expertise. Interestingly, BioLife reported on October 11 that the company formed a partnership with CSafe to provide a combined global service network to support cell and gene therapy (CGT) products.

CSafe is another logistic service provider for the CGT sector. The company is unique because it can ship parcels of any size, duration, and temperature. Specifically, CSafe can deliver bulk specimens via air as well as small packages. Operating from 50+ service centers worldwide, CSafe has a strong track record. In other words, the firm already shipped over six billion COVID vaccine doses during the pandemic.

Figure 3: Evo Smart Shippers

As you can imagine, this partnership is important because it gives BioLife more versatility in transport. As BioLife expects to support 10K to 12K Evo shipments in the next 12 months, CSafe can assist in shipping any product (be it investigational, clinical, or commercial). According to BioLife CEO (Mike Rice):

We’re excited to work with a global partner with a strong history of reliability and performance and a deep dedication to innovative therapies. We have the best LN2 technology and cGMP storage facilities in the market, in addition to our other world-class CGT solutions, and we are confident our collaboration with CSafe will extend our reach and result in even more reliability and real-time service for CGT partners.

Strong Customer Base

In the logistics business, your customer base is a strong indication of the quality of your business. As shown below, BioLife is servicing many big-name customers such as Celgene (CELG), Kite Pharma (KITE), and Novartis (NVS). As a general rule of thumb, the more strategic partners that a company can garner over the years, the better.

With a diverse number of customers, there is less of a chance that the business would be affected when one or a few customers leave. Overall, you can see the vast number of customers that BioLife is servicing strengthens its business moat and thereby lower the internal risks.

Figure 4: Strong client profile

Robust Operational Results

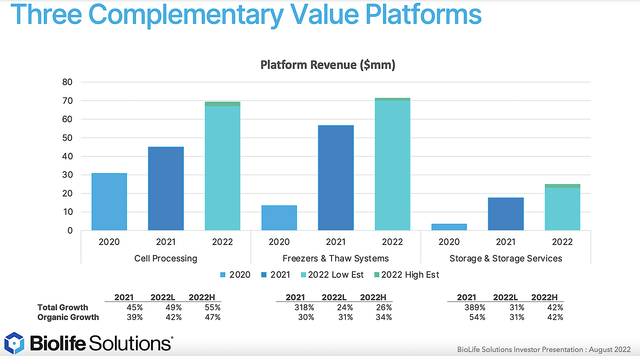

From an operational standpoint, BioLife is doing a phenomenal job. The latest quarterly growth of $40.5M in revenue is nearly 50% higher than the same period last year. Viewing the figure below, you can see that all business segments (i.e, cell process, freezers/thaw system, and storage/storage services) are on an uptrend.

For Fiscal 2022, cell processing is expected to reach roughly $70M while freezers/thaw system is likely to bank over $70M. At the same time, the storage/storage services are also anticipated to generate roughly $25M. Altogether, you can project this year to garner over $165M.

That aside, another promising trend is that while growth via M/A significantly contributed, organic growth is also a major growth driver. As such, that tells you the company has a healthy business.

Figure 5: Stellar topline growth

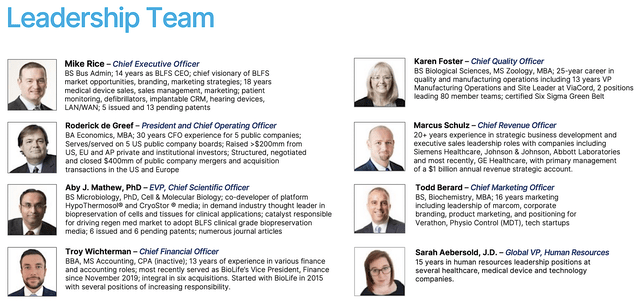

Management Concerns: COO Retirement

You already saw all the positive developments (strong customer base, additional partnership, and excellent operational results). Now, the biggest question that you should be asking is why would the former CEO (who transitioned to CFO) decide to leave his post. Precisely speaking, Mr. Rod de Greef is retiring from his executive position to join the Board of Directors.

Over the decades, I noticed that whenever senior management leaves, there are always unforeseen or undisclosed problems that would surface in the coming months or years. Consequently, the stock would tumble. That made sense because if the company is about to enjoy huge success, wouldn’t you want to stay to take the credit? Conversely, if there will be problems down the line, it’d made sense to leave, thus letting the new guys take the blame.

Interestingly, this situation is not clear-cut because Mr. de Greef is not completely departing the company. He’s still a part of the Board. Had he completely left the company, then it’s obvious that something is seriously wrong with BioLife. And, in that situation, you should sell all your shares to exit this position.

Figure 6: Leadership team

Financial Assessment

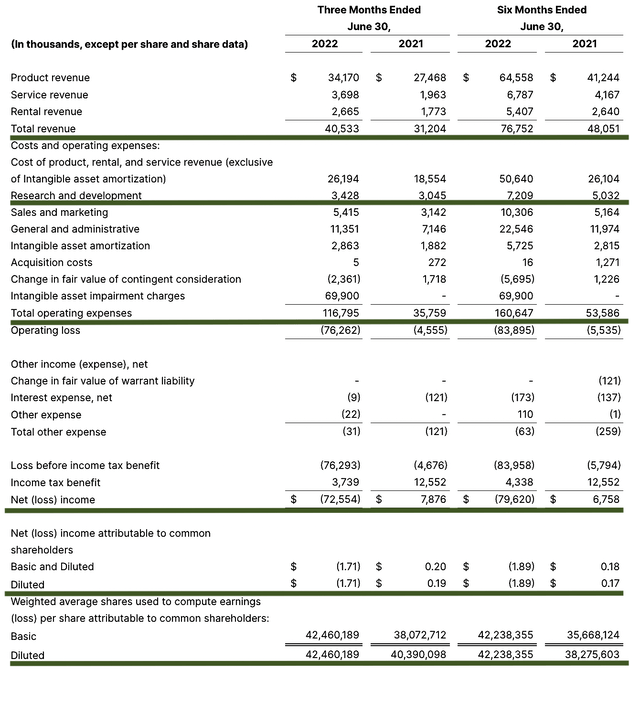

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 2Q 2022 earnings report for the period that ended on June 30.

As follows, BioLife procured $40.5M in revenue compared to $31.2M for the same period a year prior. On a year-over-year (i.e., YOY) basis, the revenue is increased by a remarkable 49.3%. And, this is due to improvements in all revenue sources including, product, service, and rental.

That aside, the research and development (i.e., R&D) for the corresponding period registered at $3.4M and $3.0M. I viewed the 13.3% R&D increase positively because the money invested today can turn into substantial profits in the future. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $72.5M ($1.71 per share) net losses compared to $7.8M ($0.19 per share) net gains for the same comparison. As you can see, the net losses are due to a non-cash intangible impairment charge related to Stirling.

Figure 7: Key financial metrics

About the balance sheet, there were $46.6M in cash, equivalents, and investments. Against the $116.7M quarterly OpEx and on top of the $40.5M quarterly revenue, the company is likely to undergo cash flow constraints soon. As such, they’ll likely raise capital via a public offering this quarter or the next.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the biggest concern for BioLife is whether the company can continue to ramp up topline growth while being conscientious of its OpEx.

The other risk is that not all acquisitions would bear fruits. Acquiring a company is the easier part. The more challenging part is in integrating and running it. Moreover, there is a good chance that BioLife might run into a potential cash flow constraint, thus needing to raise capital soon.

Conclusion

In all, I maintain my hold recommendation on BioLife Solutions with a 4.4/5 stars rating. BioLife is an interesting “turnaround/growth play” because there is tremendous profit potential that is coupled with an elevated risk. In turning around, BioLife seemingly fixed the issue with NASDAQ compliance. After all, they already filed their annual return that was previously missing. The company also took prudent steps to alleviate the supply constraint related to Stirling. Just as important as those developments, the latest quarterly figures were off the chart with nearly 50% YOY topline growth. The biggest lingering concern is that Mr. de Greef left his executive position as COO to join the Board. Perhaps, there are upcoming insurmountable issues that you and I are not aware of. As such, it’s crucial that you keep an eye on any pertinent development centering BioLife.

Be the first to comment