LosRobLos

Note:

I have covered BIOLASE Inc. (NASDAQ:BIOL) previously, so investors should view this as an update to my earlier articles on the company.

Shares of dental laser systems provider BIOLASE Inc. or “Biolase” are down by more than 75% since I downgraded the stock to “Sell” seven months ago.

At that time, I was particularly concerned about the looming reverse stock split and the likely requirement to raise additional capital.

Indeed my concerns proved to be well-founded as the company indeed accessed the capital markets in late June:

On June 27, 2022, BIOLASE entered into a Securities Purchase Agreement with certain accredited institutional investors, pursuant to which BIOLASE agreed to issue, (i) in a registered direct offering, 678,745 shares of BIOLASE common stock and pre-funded warrants to purchase 726,660 shares of BIOLASE common stock, and (ii) in a concurrent private placement, warrants to purchase 1,405,405 shares of BIOLASE common stock.

As stated in the company’s most recent 10-Q, net proceeds amounted to $5.8 million with $1.0 million used for an agreed prepayment under the company’s primary loan facility with SWK Funding LLC or “SWK” in exchange for extending the interest-only period by two quarters and providing some covenant relief:

On June 30, 2022 the Company entered into the ninth amendment to the Credit Agreement (the “Ninth Amendment”), which extended the interest-only period by two quarters from May 2023 to November 2023 and lowered the required minimum unencumbered liquid assets. In connection with the Ninth Amendment, the Company prepaid $1.0 million of the outstanding loan balance. Principal repayments begin in November 2023 and will be approximately $0.7 million quarterly until the SWK Loan matures in May 2025. The loan bears interest of 9% plus a LIBOR floor of 1.25% or another index that approximates LIBOR as close as possible if and when LIBOR no longer exists.

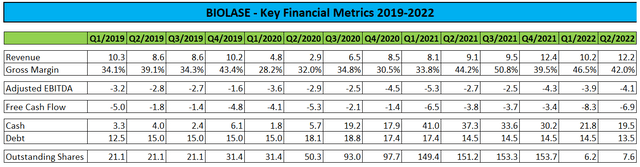

For Q2, Biolase reported decent year-over-year and sequential revenue growth while the impact of supply chain issues and addition of the company’s lower-margin Edge Pro product caused gross margins to decline somewhat.

Unfortunately, cash burn remains a major issue. In Q2, Biolase recorded negative free cash flow of $6.9 million and ended the quarter with $19.5 million in cash and cash equivalents. Please note that the terms of the credit facility require the company to retain $3.0 million in minimum liquidity at all times.

At the current pace of cash usage, Biolase would be required to raise additional capital in H2/2023 at the latest point.

On the conference call, management reiterated its expectations for full-year revenue to increase at least 15% over 2021 but abstained from affirming previously outlined profitability targets. Remember, on the Q1 conference call, CEO John Beaver projected the company to report positive EBITDA in Q4 and for the full year 2023.

Bottom Line

While the company’s business continues to show respectable growth, elevated cash burn will likely require Biolase to raise additional capital next year, particularly with principal repayments on the company’s term loan facility scheduled to commence approximately 12 months from now.

With no visible path to profitability, investors should continue to avoid the shares.

Be the first to comment