AndreyPopov/iStock via Getty Images

Investment Thesis

Bill.com (NYSE:BILL) has seen its stock fall nearly 60% from its highs. Are investors now likely to find a bargain opportunity in this stock?

While I recognize the viral element of Bill.com’s platform, where one customer joins and then asks its own customer to join the platform, I question whether that’s enough to drive the stock higher to former highs?

Needless to say that in an economic recession, the hardest-hit businesses are small and medium-sized businesses. Even if one makes the argument that Bill.com provides a critical payment solution to SMBs, if the small business ends up going under, whether Bill.com is critical or not, Bill would still struggle to continue its unabated revenue growth rates.

What’s more, keep in mind, that Bill struggles to report attractive bottom-line profitability.

Altogether, I recognize that the stock is already down significantly from its former highs. This means that a lot of enthusiasm has already washed out.

So with that framework in mind, I’m neutral on the stock.

Revenue Growth Rates Continue to Sizzle

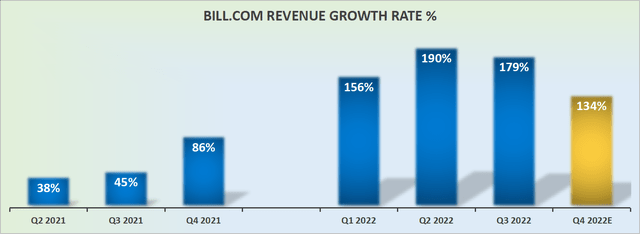

Bill.com revenue growth rates

Anyone that has ever cast their eyes upon Bill.com knows that the business is growing extremely fast on the top line. As you can see above, Q4 is still expected to see significantly more than triple digits topline growth.

And despite having really tough comparisons next year, most investors are still expecting to see Bill.com’s topline report impressive growth.

But is there more to this story than a “growth at any cost” story?

Bill.com’s Near-Term Prospects

Bill.com May presentation

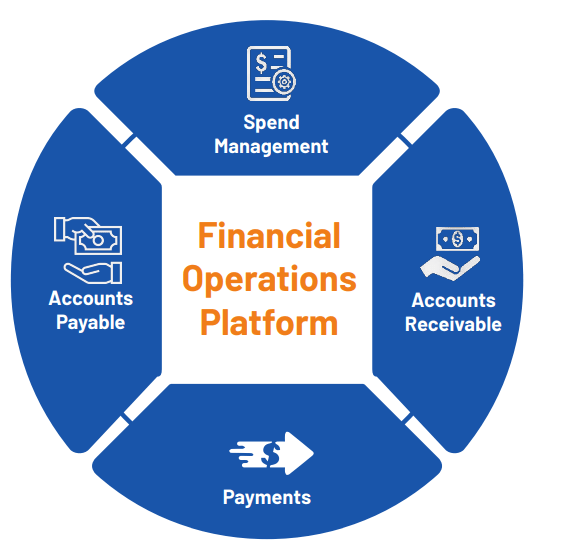

Bill.com simplifies back-office financial operations for small and midsize businesses (“SMBs“). For SMBs, back-office operations can often be a lot of trouble and a time-consuming endeavor that detracts from the main business.

Bill embraces tailwinds from the digital transformation to make it quick and simple to automate financial operations. For SMBs, Bill.com solves a problem and provides a super easy solution.

Essentially, Bill.com provides liquidity to customers. Bill provides a gateway to collect invoices and get cash from buyers on one side, the cash inflow side of the operation.

And on the other side, the cash outflows, Bill.com connects with suppliers and processes invoices, and facilitates payments, see below.

Bill.com May presentation

As the graphic above alludes to, Bill.com has a high level of virality to it. Where the customer using Bill gets its buyers and suppliers to embrace its platform to facilitate cash inflows and outflows.

Next, let’s discuss how the near-term prospects could unfold for Bill.com.

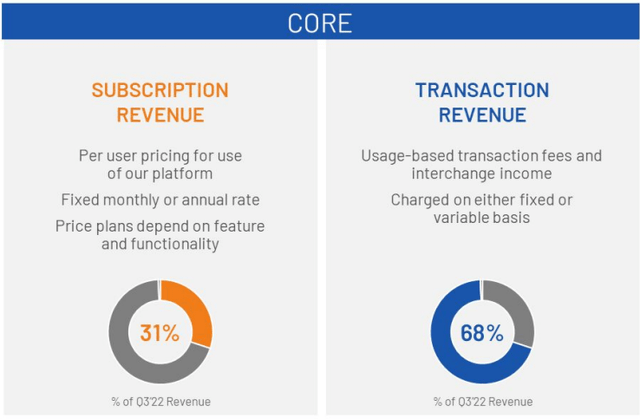

Bill.com May presentation

As you can see above, nearly 70% of Bill’s business model is transaction-based. What’s more, given that Bill.com services SMBs, in an economic recession, there’s a meaningful likelihood that businesses could struggle to keep their operations afloat.

Consequently, SMBs may at times look to cut back on the usage of Bill.com’s platform.

Also, keep in mind that SMBs have a tendency to suffer from liquidity and fall into arrears during a downturn. That could get in the way of Bill.com’s own ability to report very aggressive growth rates.

Bear Thesis: Profitability Profile

Next, consider the GAAP operating margins for Bill.com that follows:

- Q2 2021: -26.2%

- Q3 2021: -25.6%

- Q4 2021: -70.6%

- Q1 2022: -59.8%

- Q2 2022: -48.6%

- Q3 2022: -47.6%

If we compare Q2-Q3 2021 with Q2-Q3 2022 we see a business that despite gaining significant scale in a y/y period, isn’t actually benefitting in terms of profitability.

Furthermore, looking ahead to Bill.com’s Q4 guidance, on a non-GAAP basis, it appears that once stock-based compensation is added back, its profitability will be very close to breakeven.

And more importantly, it does not appear that Bill.com is seeing much improvement from the negative $5.8 million of non-GAAP net income reported last year, with Q4 non-GAAP net income expected to report circa negative $3 million this time around.

BILL Stock Valuation – Difficult to Value

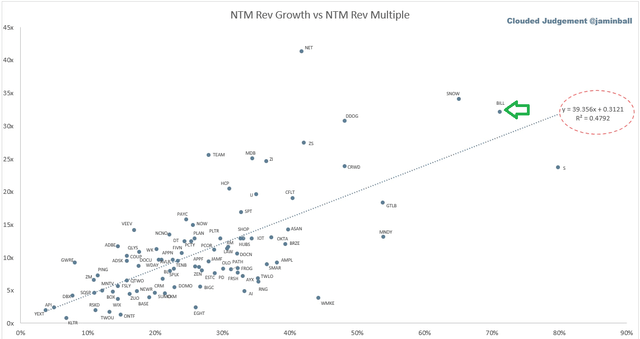

cloudedjudgement.substack.com

As you can see above, compared with countless other peers, Bill.com’s revenue growth rates to p/sales multiple puts it directly in line with many of its peers.

Investors continue to be unperturbed by its lack of profitability and its negative free cash flows.

In essence, investors are fairly content to recognize the fact that Bill.com isn’t likely to generate clean GAAP profits for a considerable amount of time, and they are still largely willing to extrapolate its very high growth rates into the future.

The Bottom Line

Bill.com is a cloud-based spend management solution. The business has been successfully managed and amply recognized by investors for the solutions it provides to SMBs.

However, the problem is now twofold.

Firstly, in an economic recession, most SMBs struggle. They simply don’t have the wherewithal to survive a downturn.

Secondly, even though I recognize that the stock is already down 60% from its previous highs, I’m not entirely convinced that investors will continue to clamor for growth at any cost SaaS businesses.

In sum, I’m neutral on this stock.

Be the first to comment