piranka

Thesis

Equities have been recording losses since the beginning of the year on a global scale, following escalating inflationary pressures, the war in Ukraine and a global energy crisis. In this precarious environment, investors that previously owned or were considering owning stocks and especially ETFs with exposure towards foreign equity markets are growing warier. In this analysis, I look into one of the most popular international ETFs, the Schwab International Equity ETF (NYSEARCA:SCHF), in the context of the challenges and prospects surrounding the globe as well as the fund’s own features and parameters.

Fund Identity

Schwab’s international equities ETF tracks the FTSE Developed ex US Index, offering exposure towards developed stock markets across the world. Often viewed as a choice for diversification, SCHF invests in international mid and large-cap equities. Currently, the fund maintains around $28B of Net Assets, establishing its position as one of the largest international ETFs. SCHF charges a very low and competitive 0.06% expense ratio and pays a generous 3.9% dividend yield.

Some of the ETF’s largest holdings include companies like Nestle (OTCPK:NSRGY) (1.8% allocation), ASML Holding (ASML) (1.4%) and Samsung Electronics (OTCPK:SSNLF) (1.2%). More than 70% of the fund’s holdings are companies with market capitalizations greater than $15B and less than 4% are geared towards companies with a $3B or less market cap. SCHF also carries low average valuation multiples, with a P/E of 12x and a P/B of 1.43x.

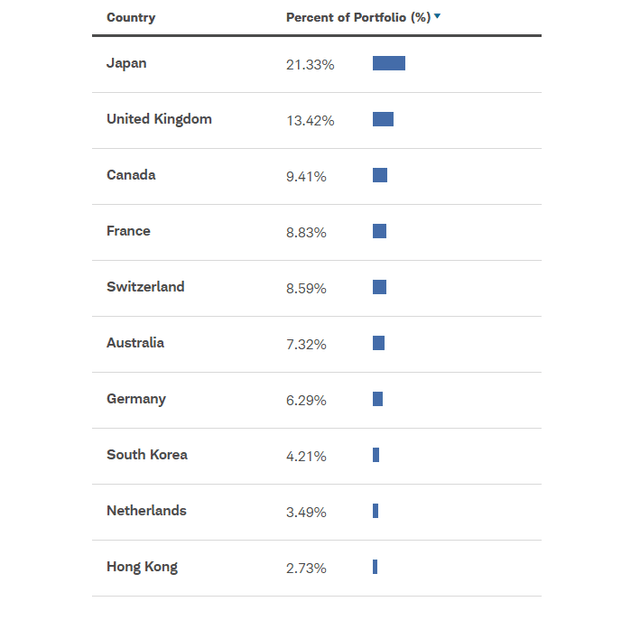

In terms of geographic diversification, SCHF largest exposure is geared towards Japan (21.3%), followed by the U.K. (13.4%) and Canada (9.4%). The fund only tracks developed economies and offers no exposure towards emerging markets. This makes SCHF a more conservative and less risky choice compared to most international ETFs.

Global Challenges for Equities

A phenomenon almost forgotten since the 80s, persisting inflationary pressures hurt investor sentiment, decrease consumers’ purchasing power and lead central banks to engage in contractionary monetary policy that puts downward pressure on asset prices and valuations. European markets are currently at the forefront of inflation, recording YoY increases in prices of as much as 9.5%. The situation is also pretty severe in both the U.K and the U.S. Asia-Pacific markets have been relatively less affected so far. The war in Ukraine and the subsequent energy crisis add to the pessimistic outlook for European markets, aided by worsening business expectations.

International vs U.S. Equities

As the U.S. markets have captured an overwhelming amount of investors’ attention and interest for many decades, in recent years, investing in U.S. stocks and ETFs has been easier than ever for investors outside the United States. Equities and ETFs are now widely accessible at very low costs to virtually every potential investor with access to the necessary technological means. The same is true for U.S. investors as well, that are now able to easily invest in assets across different markets. Overall, this globalization trend in financial markets is likely to benefit both domestic and foreign investment vehicles, especially as far as the retail investor is concerned.

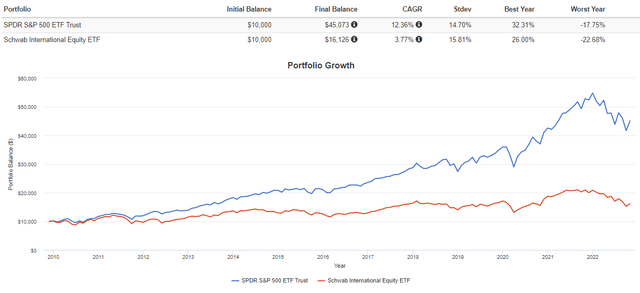

Over the past decade, U.S. stocks have rallied to new highs year in and year out, with international markets falling behind by miles. Since 2010, the CAGR of 12.4% for the S&P 500 has compared to a 3.8% CAGR for SCHF, with most international ETFs following a similar low-performance trajectory.

The Dividend Argument

On top of any potential diversification benefits, SCHF offers an attractive dividend yield relative to U.S. broad market indexes and ETFs. The fund offers a 3.9% dividend yield compared to the S&P 500’s 1.6% and the median ETF dividend calculated at around 2.2%. Payouts have grown at a 9.62% CAGR over the last five years, while the payment frequency is semiannual. In short, it is fair to point out that SCHF represents a solid choice for more dividend-oriented investors as well.

International Funds Comparison

While a wide range of international equities ETFs are available for investors in today’s market, for the purposes of this analysis, I focus, for comparison on SCHF’s biggest competitor, Vanguard’s Total International Stock ETF (VXUS). VXUS maintains around $50B of Net Assets, while charging a 0.07% expense ratio and currently offering a 4.0% dividend yield. Unlike SCHF, VXUS offers significant exposure toward emerging markets (25% of total allocation) and even more Asia-Pacific exposure.

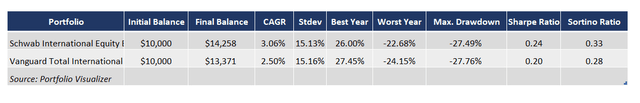

Despite some major allocation differences, the two funds have performed rather similarly over the last decade or so. In the table provided below, employing the tools offered by Portfolio Visualizer, risk and return data for both funds are available. Dividend reinvestment is assumed for both funds.

In fact, despite a more conservative allocation approach, with less exposure towards emerging markets, SCHF has outperformed VXUS (3.06% vs 2.50% CAGR). Schwab’s ETF also displays higher Sharpe and Sortino ratios, indicating superior risk-adjusted returns. In terms of risk metrics (standard deviation and maximum drawdown) both funds perform similarly.

It is important to note once again, however, that both ETFs and international funds, in general, have significantly underperformed over the past decade. As the U.S. equity market has seen one of its best decades in history, foreign markets have lagged. A CAGR around 2.5-3.5% for a stock ETF is rather disappointing overall. It remains to be seen if the lagging performance has provided a signal for faster growth in the future or if the stretch of consolidation is bound to persist.

Final Thoughts

After all things are considered, in the midst of a wide set of challenges that compile a precarious outlook for global markets, coupled with ample evidence of historical underperformance by ex-U.S. markets, many investors would be naturally reluctant to seek further international exposure for their portfolios. For the few that will seek more international exposure however, SCHF’s efficiency, dividends, low-cost, inexpensive valuation multiples and relative attractiveness compared to competitive ETFs are the main reasons for investing.

Be the first to comment