Scott Olson/Getty Images News

In the last month, Exxon Mobil (NYSE:XOM) has fallen despite the President of the U.S. sending out tweets desperate to get energy prices lower. The energy giant even announced a huge profit boost in the recently ended quarter, yet the stock still fell on the next trading day in a bad sign. My investment thesis remains Bearish on Exxon Mobil, as even my view the stock would rally in the short term didn’t even play out.

Recession Fears

As discussed in prior research, Exxon Mobil had already tripled in just over a year when the stock reached $100. Investors had already seen some substantial returns in the last year as oil surged far above $100 following the Russian aggression in Ukraine. At the time in early June, an investor jumping into a position in energy stocks similar to the aggressive moves of Warren Buffett via Berkshire Hathaway (BRK.B) just wasn’t logical.

Exxon Mobil has fallen 15% in the one-month period. The move hasn’t been helped by oil falling nearly 10% on July 5 following recession fears leaving oil prices near the lowest level since Russia started the war in Ukraine.

The Atlanta GDPNow measure of GDP now reads -2.1% and Citi is forecasting oil to dip to $65. My thesis that Exxon Mobil should generally be valued based on 2021 earnings when oil prices were more normalized at an average realized price of $71/bbl for Brent crude is starting to play out.

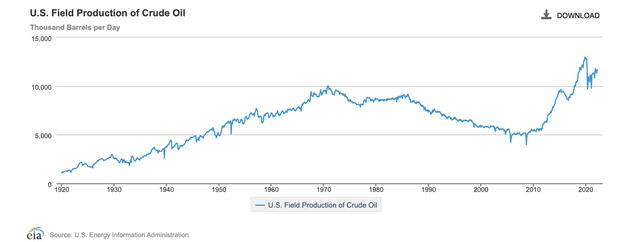

While investors correctly question the supply side of the equation, the U.S. has returned to pre-COVID production levels. April oil production was at 11,628K barrels per day while only 2019 and parts of 2020 production were at higher levels. The U.S. only produced 11,911K in 2020 and peaked at 12,125K bbl/d in 2019. The key here is that April 2018 production was only 10,493K bbl/d, so current U.S. production is far above prior levels.

In essence, the U.S. economy only had oil production above the current levels from early 2019 until COVID hit in the March/April timeframe in 2020. Production is definitely below the peak level, but the U.S. is already producing at near peak levels.

According to the EIA, the U.S. energy sector is predicted to reach record levels topping 13M bbl/d by 2023. Of course, the prediction occurred when oil prices were closer to $130 earlier this year, though oil production last peaked at 13.1M bbl/d in early 2020 when oil prices were much lower in the $50+ bbl range. The oil market is global in nature, but some of the supply shocks of covid are about to be rectified.

No Man’s Land

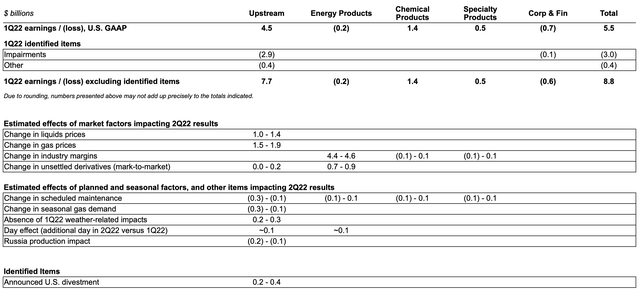

Exxon Mobil just announced the company made up to $5.5 billion in excess refining profits in Q2’22 alone. The company is making so much money President Biden wants the refining sector and gas stations to arbitrarily lower prices outside of market dynamics.

In addition, Exxon Mobil made another $2.5 to $3.5 billion in Upstream profits. The company saw an increase in both the liquids and gas prices contribute to over $1.0 billion each in additional profits for the quarter. In total, the oil giant saw Q2’22 profits soar anywhere from $6.6 to $9.0 billion before other items above already strong Q1’22 profits.

At $85, Exxon Mobil already trades 15% below my prior article and $20 from the recent highs. The recent highs were all-time highs, though the price was in line with the levels reached back in 2014.

The stock definitely will fall much lower than the current price with oil dipping. Exxon Mobil earned $5.38 per share last year and investors should probably pick a multiple of such an earnings stream in order to properly value the stock.

Analysts have the energy giant earning $7 per share annually in the 2024 and 2025 time frame when energy prices and the economy are more normal. The last couple of years have made stocks difficult to value considering the volatile peaks and trough in both demand and supply during the period.

When one looks at the 2021 earnings and the 2024/5 targets, Exxon Mobil is probably a $70 or below stock. Analysts are predicting earnings to decline over the period and the global economy is still pushing for a move away from fossil fuels which doesn’t help the long-term prospects for any business growth.

Takeaway

The key investor takeaway is that the failure of Exxon Mobil to rally despite the preliminary release of a massive profit gain in Q2’22 is very telling of where the stock is headed. When a stock can’t rally on good news, investors should prepare for more weakness ahead.

Exxon Mobil had a hard time topping $60 back in 2021 and investors should probably prepare for a return to those levels over time.

Be the first to comment