Investment Thesis

Bilibili Inc. (BILI) is the biggest community for Anime, Comic, and Gaming (ACG) in China. The high user retention rate of BILI makes us believe that the company is able to maintain strong growth in the future. Currently, the company still suffers operational losses due to the relatively low level of monetization efforts. We believe the profitability of the company will improve significantly once BILI puts more effort into monetizing through its users.

Generation Z: The Key to Growth and Monetization

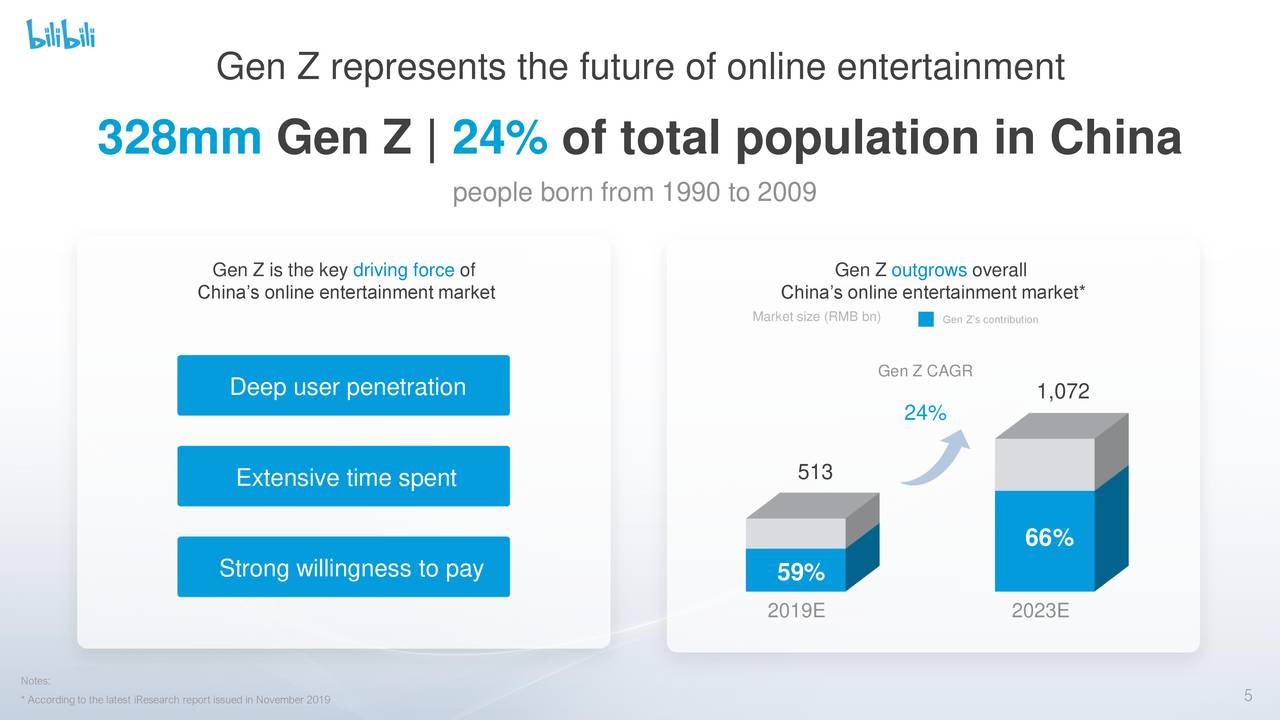

The main target of Bilibili’s service is Generation Z (people born from 1990-2009) in China, which is around 328 MM and accounts for 24% of the total population.

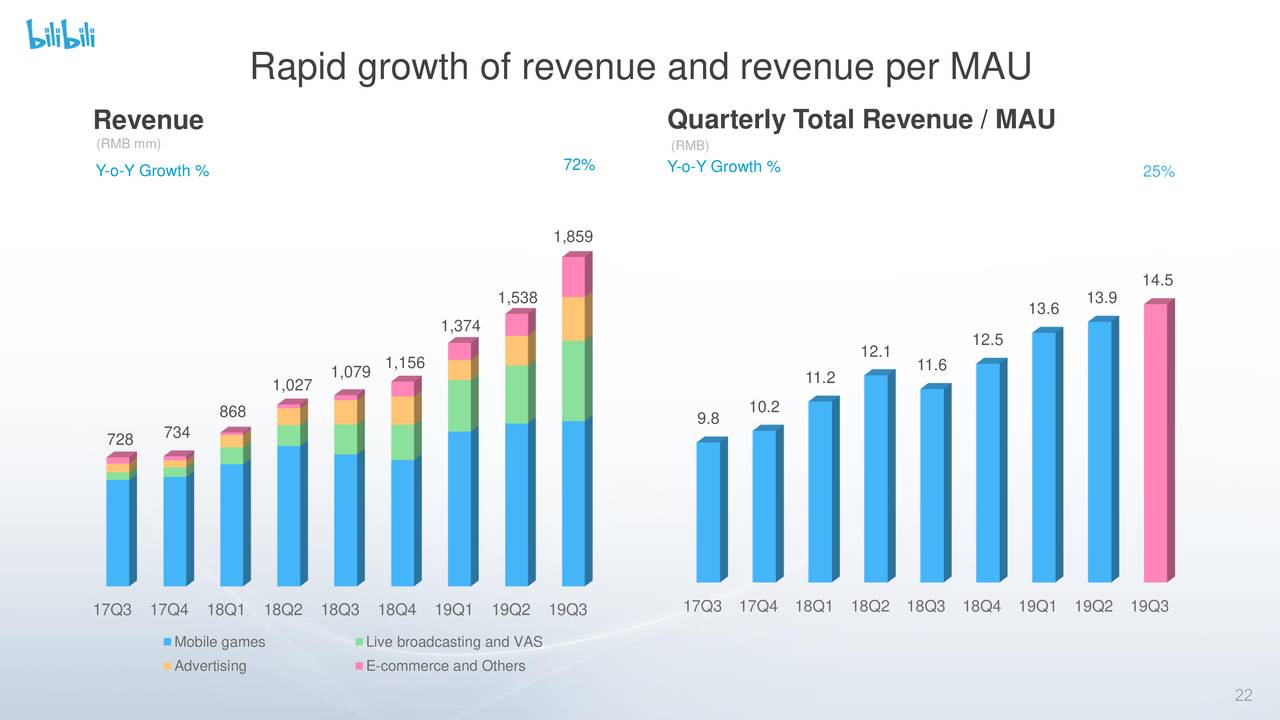

Source: Q3 Presentation

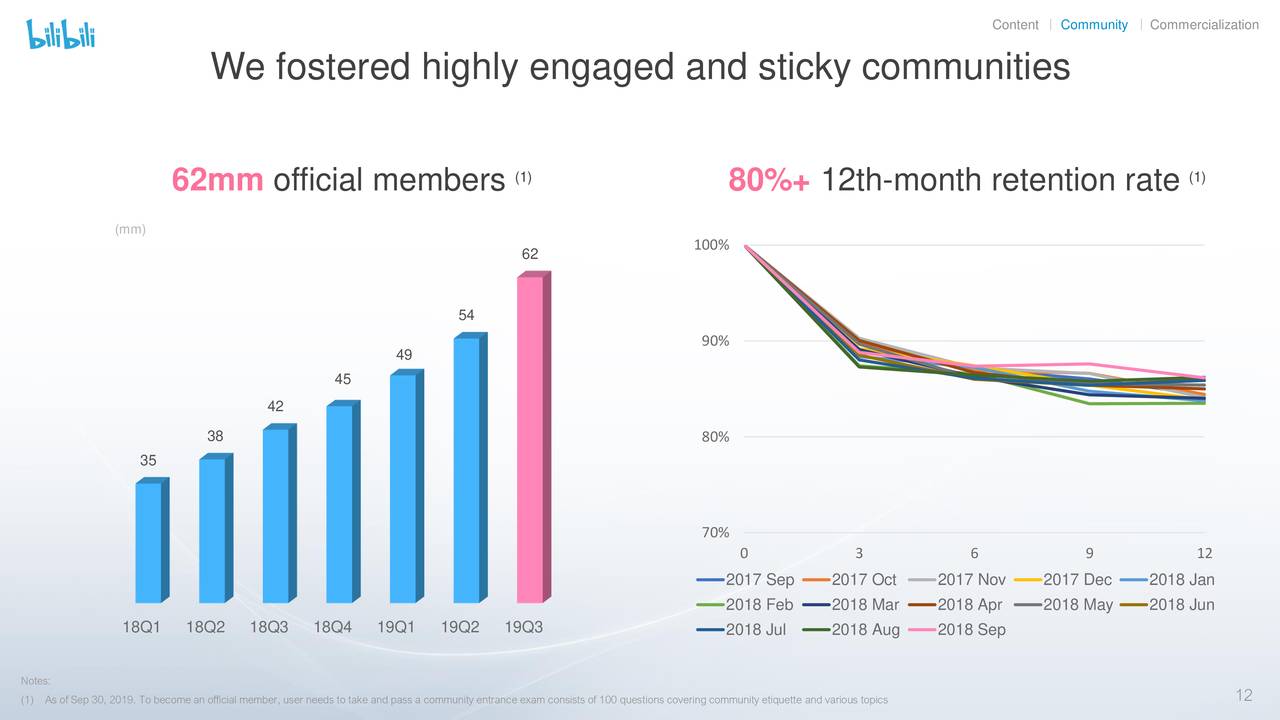

Currently, BILI’s services include Anime and Movie Streaming, Online & Mobile Games, and Live Broadcasting. The product offering fits exactly the demand of Generation Z, which leads to the 80+% of 12-month retention rate of its users:

Source: Q3 Presentation

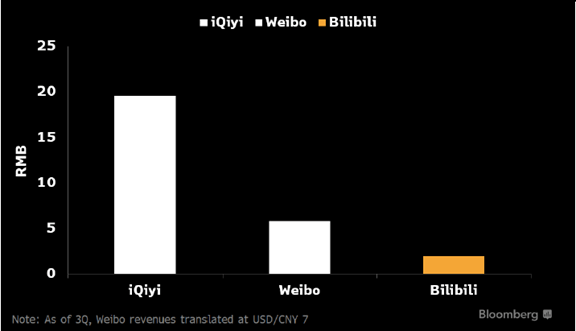

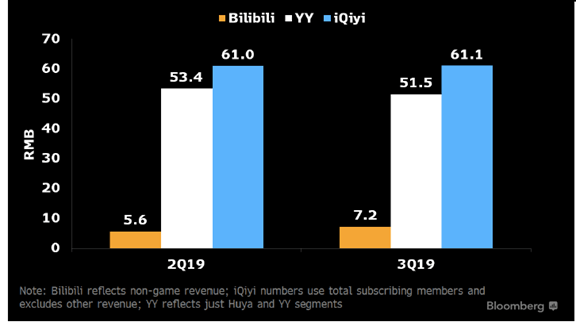

Currently, BILI is still at the lower end in terms of monetization compared with its peers. As shown below, BILI’s current advertising revenue is around RMB2 per user and RMB7.2 for its video platform. This is significantly lower than iQIYI (IQ), whose numbers are RMB20 and RMB61.1 respectively.

Advertising Revenue Per User, Source: Bloomberg

Video Platform Revenue per User, Source: Bloomberg

Given the stickiness of BILI’s user community, we are quite positive about BILI’s capability of improving the monetization without losing the user base. In fact, we have witnessed BILI’s revenue/MAU improving consistently:

Source: Q3 Presentation

Coronavirus: A Short-term Boost to BILI’s Business

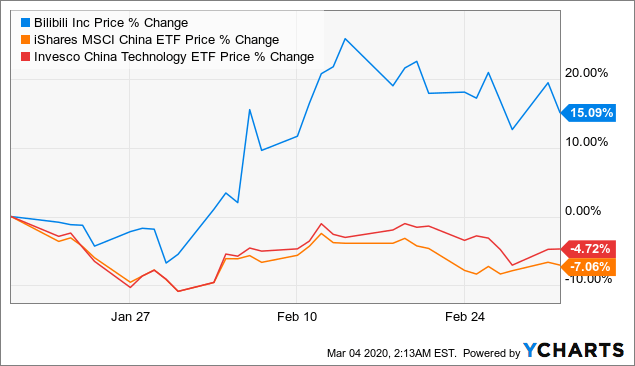

Since the outbreak of the coronavirus, BILI’s share price outperformed the major Chinese ETFs by over 20%, indicating that the company is pretty much immune to the epidemic:

Data by YCharts

Data by YCharts

In fact, we believe the recent outbreak will actually help boost BILI’s business in the following aspects:

- First of all, as people quarantined at home during the outbreak, their activity on online video streaming and gaming will significantly increase. This will help boost the revenue growth of BILI throughout Q1 2020. Also, we expect the outbreak to accelerate the monetization of online streaming content.

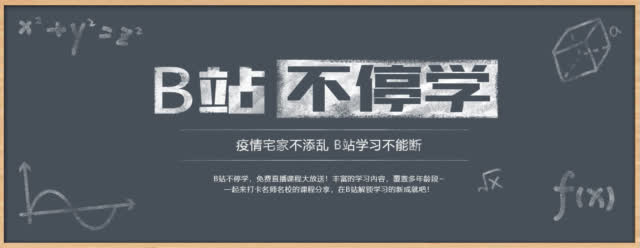

- Also, BILI seized the opportunity to expand on its relatively new online education and music streaming services. Bilibili recently launched the “B-site never stops learning” campaign, cooperating with Tsinghua University, Peking University, and approximately 10 other agencies. In fact, Chen Rui, the CEO of Bilibili, estimated the number of people utilizing Bilibili for learning purposes to be over 2 million, twice as the number of people taking China’s National College Entrance Exam.

“B-site never stops learning”, Source: SINA

- Furthermore, BILI launched online concerts for quarantined users. An online concert, Strawberry Festival, was organized by Modern Sky, one of China’s most recognized Indie labels. The concert ended up being a big success, with more than 480,000 simultaneous visits during peak time.

- Even though BILI hasn’t publicly released any plan to monetize online education and online concert streaming, we believe this business can help the company attract more users and build a more complete product spectrum.

Potential Risk Factors

- Government Regulation. The Chinese government is posing stricter standards on online gaming and streaming. The government punished and publicly criticized BILI for streaming “inappropriate videos” in 2018. Although the company has already built at least two examination stations, along with 36,000 examination members, new regulations can still hurt the company in the future.

- Competition. Despite the popularity among Generation Z, BILI is facing intense competition on online gaming, music streaming, and online education. The two biggest players on online gaming, Tencent (OTCPK:TCEHY) and NetEase (NTES) have dominant positions in the field. Although the proportion of revenues from gaming has been declining for BILI, it is still the largest component of its overall revenues. The competition from the leading players in the market is still a big concern for BILI.

Conclusion

BILI is a great growth target in China, with a unique target user community, Generation Z. Although the company still suffers operational losses, we are confident that the profitability of the company will improve significantly once BILI puts more effort into monetizing its users.

Disclosure: I am/we are long BILI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment