Dilok Klaisataporn

Written by George Spritzer

(Data below is sourced from the BlackRock website unless otherwise stated.)

Author’s note: An earlier version of this article was released to Yield Hunting members on Nov. 21, 2022. Please check latest data before investing.

Every year, tax loss selling effect can cause major selling pressure in sectors that were especially weak earlier in that year. This often results in stock weakness in that sector along with higher discounts in some of the sector closed-end funds.

In 2022, “disruptive” technology stocks have been especially weak.

In this article, I cover another technology-based closed-end funds that’s trading at a high relative discount. It can benefit from a tax loss selling bounce once the tax loss selling season is over.

Blackrock Innovation & Growth Trust Ticker: (NYSE:BIGZ)

Inception Date: March 26, 2021

Total Common Assets: $ 2.105 Billion

Baseline Expense Ratio= 1.29%

Leverage: None

Discount= -21.13%

Average 1 Year discount= -14.44%

Annual Distribution Rate (market price) = 11.31%

Percent Over-Written Covered Calls= 10.84%

Current monthly distribution= $0.07

Annual Distribution= $0.84

Investment Objective

BIGZ seeks to provide total return and income by investing mainly in smaller and mid cap “innovative” securities that have above-average earnings growth potential. These are companies that have introduced new products or services that can change a marketplace.

Investment Strategy

BIGZ also uses an option writing strategy to generate current gains from option premiums and to enhance risk-adjusted returns. BIGZ seeks to invest using a diversified portfolio that reaches across multiple sectors and industries, using both publicly traded and private companies. Up to 25% of the portfolio may be invested in less liquid private investments.

The fund managers commented on their private investments in the last shareholder update:

During the Trust’s first year, we actively built up the portfolio’s exposure to private companies toward our target range, surpassing that level earlier this year as declining public markets inherently raised our private allocation above the 25% threshold. With 29 private investments already in the portfolio, we turned our attention to constructing a robust pipeline of new ideas, which we continue to build upon as market wide valuations decline. Throughout the year, we have spent time engaging with our existing portfolio companies, stressing the imperative of conserving cash and elongating their runway for the road ahead. The portfolio’s private sleeve has several companies which we believe will resume pressing toward initial public offerings as financial markets improve, the pace of both rate increases and inflation eases, and the US economy normalizes after an exceedingly turbulent year.

Portfolio Sector Breakdown (as of 10/31/2022)

BIGZ Portfolio Sector breakdown (BlackRock web site)

Market Cap Breakdown

|

Large Cap > $10 Billion |

31.85% |

|

Mid Cap- $2 to $10 Billion |

30.66% |

|

Small Cap < $2 Billion |

33.18% |

|

Cash and Derivatives |

4.31% |

Geography

BIGZ geography breakdown (BlackRock web site)

BIGZ- Top 10 Holdings (as of 10/31/2022)

BIGZ Top 10 Holdings (BlackRock web site)

Limited Term Feature

BIGZ was set up as a limited-term fund with a termination date of March 26, 2033. This will provide a tailwind as the current 21% discount gradually dissipates as we approach the termination date in a little over 10 years.

Share Repurchases

BlackRock publishes quarterly updates on its share repurchase activity. The fund has authorized open market share repurchases through November 30,2022 up to 5% of its outstanding shares.

In the third quarter of 2022, they repurchased 1,975,283 shares with a dollar value of $14,811,781. The average purchase price was $7.50. This resulted in $3,204,019 in NAV accretion, or a little bit over a penny a share.

Since the inception of the share repurchase program, they repurchased 9,507,667 shares with a dollar value of $109,684,782. The average purchase price has been $11.54. This has resulted in $18,594,272 in NAV accretion.

BIGZ- Institutional Ownership

Institutional investors own about 18.4% of the shares outstanding. The top two institutional investors are Morgan Stanley who owned $67.4 million and Cornerstone Advisors who owned $30.7 million as of 09/30/2022. These shares are likely held by financial advisors in managed accounts.

Some CEF activists also hold BIGZ shares, but in smaller amounts:

|

Owner |

$ Value (Millions) |

|

City Of London |

$13.50 |

|

Lazard |

$11.37 |

|

Saba Capital |

$10.05 |

|

RiverNorth Capital |

$ 8.21 |

|

Matisse Capital |

$ 1.51 |

Source: nasdaq.com

Investment Performance: BIGZ versus ARKK (as of Dec. 2, 2022)

| 1 Year NAV | YTD NAV | |

| (BIGZ) | -39.89% | -38.66% |

| (ARKK) | -59.65% | -61.11% |

Source: morningstar.com

While the BIGZ year-to-date performance is quite bad on a relative basis, they have outperformed at least some of their competitors in the “disruptive” technology sector. The table above shows that they have clearly outperformed the popular ARKK ETF which is run by Cathie Wood.

I believe BlackRock must be embarrassed by the bad performance and will do its best to improve things going forward. They have authorized share buybacks which are quite accretive to NAV when the discount is above 20%.

The management discussed the poor performance in the last shareholder report:

Our approach during this period of uncertainty is to stay the course. First, we are positioning our portfolios to be potentially ready for a recession, but not fearful of one. While openness to new information is essential, sticking to our investment philosophy gives us a road map to guide decision-making.

Second, we are remaining disciplined in executing on our investment process. Research-driven insights help to bolster our investment conviction, and we are focused on filtering out the day-to-day noise and being opportunistic.

Third, our experience as growth investors has taught us the importance of time horizon. Fundamentals such as earnings and earnings growth drive long-term wealth creation and extending our perspective beyond the current observable trends can bring clarity during periods of volatility. The year-to-date sell-off has moderated stock valuations and some great businesses now trade at meaningfully cheaper prices. Amid widespread pessimism, this can be a reason for optimism.

Although market bottoms are impossible to predict, and downside risks remain, it is worth reiterating that growth stocks are about innovation, and innovation is propelling decisively forward. Trends toward digitization, e-commerce and artificial intelligence, to name just a few, in our opinion are firmly intact. We believe the challenges companies face today will only motivate further innovation, and that the benefits will accrue mostly to those firms willing to address the needs and demands of the future.

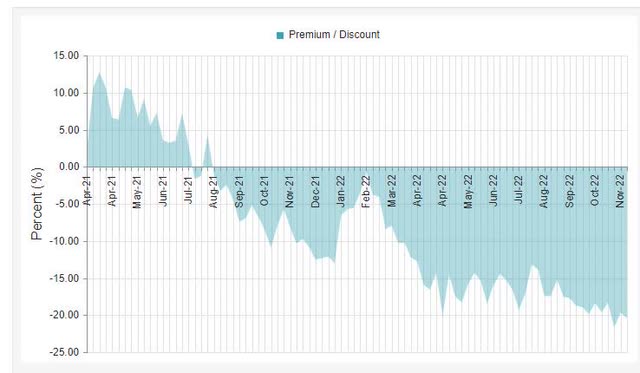

BIGZ- Discount History Since Inception

BIGZ Discount History (cefconnect)

Z-Score Analysis

The discount to NAV as of November 18 is -21.13%.

Here are some of the current Discount Z-Scores:

Three months: -1.37 Six months: -1.60 One Year: -1.31

Source: cefconnect

Summary

There are several reasons I like BIGZ here:

- Year end tax loss selling is greatly affecting many of its holdings. We could see a bounce as we approach year-end or in early 2023.

- Tailwind from the 21% discount and termination date in 2031.

- Regular share repurchases are accretive to NAV. In the third quarter of 2022, BIGZ repurchased $14.8 million in shares.

I would try to buy BIGZ at a discount of 20% or higher. The fund is quite liquid with an average trading volume of 1,182,000 shares a day.

Be the first to comment