BeyondImages

By The Valuentum Team

Shares of the Australian-based miner BHP Group Limited (NYSE:BHP) have trended lower year-to-date as it appears likely that global economic growth is slowing to a crawl. The chance of a recession occurring in Europe, the UK, and the US is growing by the day. Headwinds facing industrial activities are negatively impacting the demand outlook for raw materials, and that has seen prices for copper, iron, and other commodities shift lower in recent months (after surging higher in 2021 and part of 2022). These factors have all dragged down shares of BHP; however, the company should remain a stellar cash flow generator going forward given its exposure to high-quality mining operations in Australia and South America. BHP is an interesting income generation idea worth taking a closer look at.

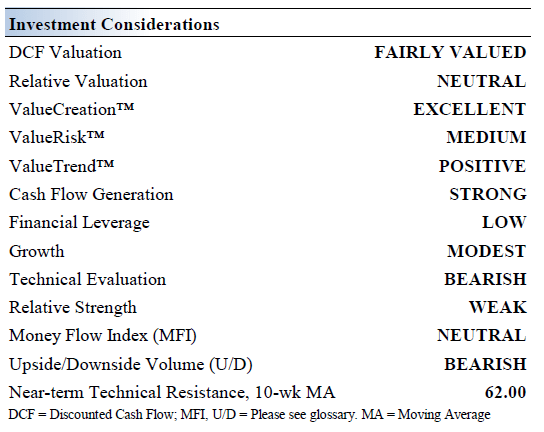

BHP’s Key Investment Considerations

Image Source: Valuentum

BHP is a global mining company and leading producer of iron ore, copper, aluminum, uranium, nickel, metallurgic coal, thermal coal, zinc, manganese, and diamonds. The firm is pushing into the potash space via its Jansen Potash development in Canada, with the first phase of the project sanctioned in August 2021. Each ADS represents two ordinary shares of BHP. The firm is headquartered in Melbourne, Australia.

In June 2022, BHP merged its oil & gas operations with Woodside Energy Group Ltd (OTC:WOPEF) and effectively exited the space. BHP paid out a special dividend of Woodside shares to its shareholders. Looking ahead, BHP aims to grow its global mining footprint.

BHP’s operational execution is excellent, and its margins remain impressive. Through various growth and maintenance developments, its mining operations have been able to maintain significant levels of production. Looking ahead, rising global demand for copper and nickel (two metals BHP has ample exposure to) as electric vehicles become more prevalent underpins BHP’s bright longer term revenue growth outlook. BHP is extending the life of its Spence copper mine in Chile by over 50 years to capitalize on this upside.

BHP has a variable dividend program that’s paid out semiannually and there are also foreign currency movement considerations to be aware of here. Excluding the special dividend relating to merging its oil and gas operations with Woodside, shares of BHP yield ~12.7% on a trailing twelve month basis. However, please note that its payout will likely shift lower in the current commodities pricing environment. The company aims to distribute ~50% of its earnings back to shareholders in the form of dividends.

Acquisition Update

In August 2022, BHP offered to buy OZ Minerals Ltd (OTCPK:OZMLF) through an all-cash deal. BHP offered A$25.00 in Australian dollars per share to acquire OZ Minerals through a deal worth roughly A$8.3 billion (or roughly USD$5.5 billion at exchange rates as of this writing). OZ Minerals operates copper mines in Australia, and BHP wants to grow its exposure to copper given the promising demand outlook for the metal in the wake of the “green energy revolution.” The offer was rebuffed by OZ Minerals, though reportedly the company is open to negotiations at a slightly higher price point.

We like the deal as it would bolster BHP’s current copper production levels while providing BHP with additional growth opportunities down the road. Should a deal not materialize, BHP has plenty of other opportunities to grow its copper production levels, particularly in Chile.

Financial Update

In the fiscal year ended June 30, 2022, BHP’s revenues (in accordance with IFRS accounting practices) from its continuing operations grew by 14% year-over-year to hit USD$65.1 billion. Revenue growth from the sale of copper and coal (thermal and metallurgic) products offset a decline in revenue from the sale of iron ore. Solid operational execution enabled BHP to grow its underlying attributable profit from continuing operations by 26% year-over-year during this period, which reached USD$21.3 billion, and its underlying basic earnings per share from its continuing operations by 25% year-over-year, which reached approximately USD$4.21.

According to BHP’s definition of net debt, it exited June 2022 with USD$0.3 billion in net debt on the books, down sharply from USD$4.1 billion at the end of June 2021. Looking at BHP’s cash and cash equivalents position of USD$17.2 billion and its total interest bearing debt load (inclusive of short-term debt) of USD$16.4 billion at the end of June 2022, the firm exited June 2022 with a net cash position. In any event, we appreciate that BHP took advantage of strong commodities pricing seen in 2021 and part of 2022 to improve its balance sheet health.

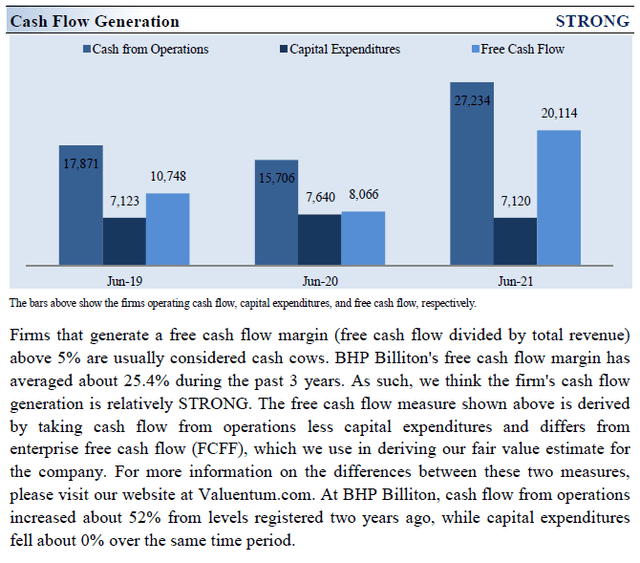

In fiscal 2022, BHP generated USD$26.3 billion in free cash flow (defined as net operating cash flow less capital expenditures and net exploration expenses). The company paid USD$20.4 billion covering its total payout obligations (dividends to common shares and distributions to non-controlling interests) and spent USD$0.1 billion buying back its stock through Employee Share Ownership Plan (‘ESOP’) Trusts. We appreciate BHP’s stellar cash flow generating abilities, though we caution that its financial performance is heavily influenced by exogenous forces.

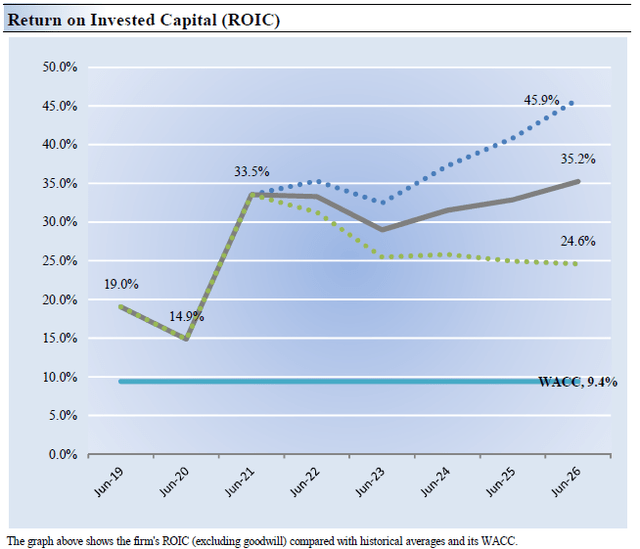

BHP’s Economic Profit Analysis

The best measure of a firm’s ability to create value for shareholders is expressed by comparing its return on invested capital [‘ROIC’] with its weighted average cost of capital [‘WACC’]. The gap or difference between ROIC and WACC is called the firm’s economic profit spread. BHP’s 3-year historical return on invested capital (without goodwill) is 22.5%, which is above the estimate of its cost of capital of 9.4%.

In the chart down below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid grey line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate. BHP has historically been a solid generator of shareholder value and we expect that will keep being the case going forward.

BHP’s Cash Flow Valuation Analysis

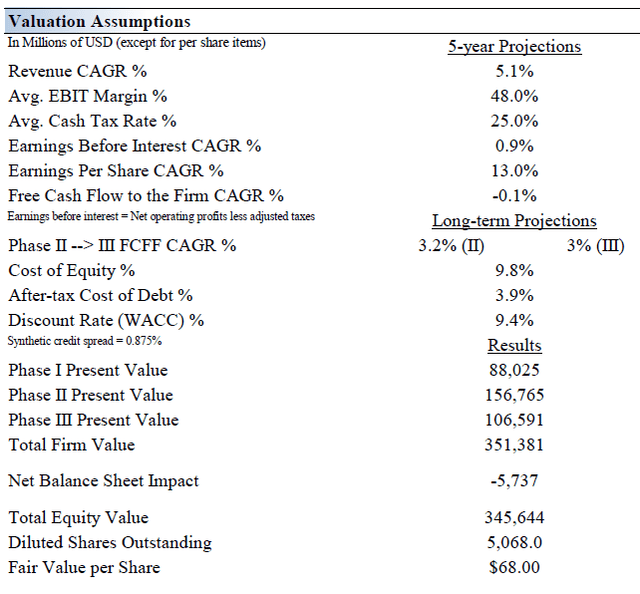

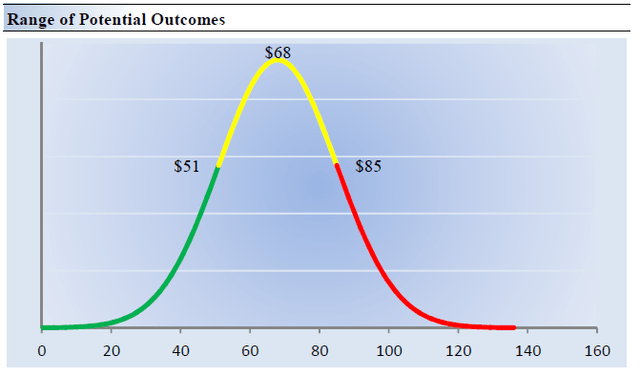

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows, net of its balance sheet considerations. We think BHP is worth $68 per share with a fair value range of $51.00 – $85.00.

The near-term operating forecasts used in our enterprise cash flow model, including revenue and earnings, do not differ much from consensus estimates or management guidance. Our model reflects a compound annual revenue growth rate of 5.1% during the next five years, a pace that is lower than the firm’s 3-year historical compound annual growth rate of 12.1%.

Our model reflects a 5-year projected average operating margin of 48%, which is above BHP’s trailing 3-year average. Beyond Year 5, we assume free cash flow will grow at an annual rate of 3.2% for the next 15 years and 3% in perpetuity. For BHP, we use a 9.4% weighted average cost of capital to discount future free cash flows.

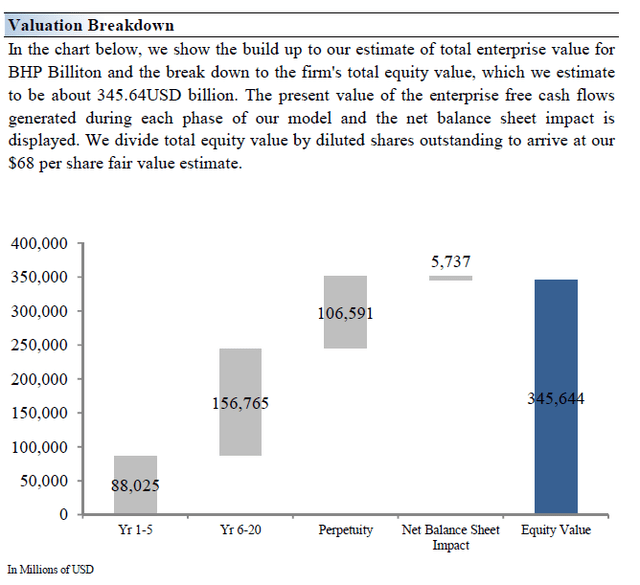

Image Source: Valuentum Image Source: Valuentum

BHP’s Margin of Safety Analysis

Although we estimate BHP’s fair value at about $68 per share, every company has a range of probable fair values that’s created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future were known with certainty, we wouldn’t see much volatility in the markets as stocks would trade precisely at their known fair values.

In the graph up above, we show this probable range of fair values for BHP. We think the firm is attractive below $51 per share (the green line), but quite expensive above $85 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion. Shares of BHP are trading near the low end of our fair value estimate range as of this writing.

Downside Considerations

BHP operates in a highly cyclical and commodity-price dependent industry. We caution that while BHP is a great generator of free cash flow, the volatile nature of its business model along with foreign currency movement considerations means that its dividend payout is volatile as well. Though BHP’s cost cutting efforts have been effective over the past few years, ultimately exogenous forces will always have an outsized impact on its financial performance. Rising trade tensions between US-China need to be monitored.

Operational risks, such as tailings dam failures, are a major concern. The Samarco dam disaster at an iron ore mine in Brazil is an example of the operational risks BHP faces, which resulted in billions of US dollars in fines, legal payouts, environmental cleanup costs, and other expenses while hurting BHP’s reputation. BHP has since improved its operational execution.

Concluding Thoughts

We like BHP’s portfolio and its operational focus should improve now that the firm is a pure-play miner, after spinning off its oil and gas operations. The company’s exposure to copper and nickel along with its top-notch iron ore and coal mining operations should enable BHP to generate substantial free cash flows over the long haul. We appreciate that management aggressively reduced BHP’s net debt load in fiscal 2022, as that better positions the firm to ride out the bumpy road that lies ahead. BHP is an interesting income generation idea.

Be the first to comment