BeyondImages

BHP Group Limited (NYSE:BHP) has embarked on a transformation to align the business with the narrative of a growing population and climate change. After the sale of the Petroleum segment, BHP is developing its first potash mine and increases capital expenditure for copper mines. This way, the company can claim to support the electrification required to battle climate change while helping to feed the world.

As the diversification into copper and potash acts as a risk mitigation measure, I still consider BHP a buy at the current price of US$58 per share.

Company overview

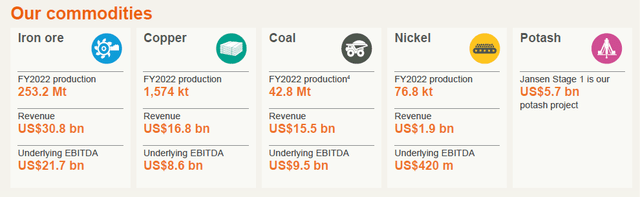

BHP is a global mining group with a long and rich history. After divesting the Petroleum segment, the company has focused exclusively on mining and derives its income mainly from iron ore, copper and coal, as shown in figure 1.

Figure 1 – Production and revenue numbers per commodity (bhp.com)

The majority of revenues is derived from iron ore, but the segments Copper and Coal in aggregate reach similar revenues as the Iron Ore segment. This means BHP is better diversified than its competitors Rio Tinto (RIO) and Vale (VALE). To further diversify, BHP is investing US$5.7Bn in its Jansen project, a greenfield mining site for potash. Start of production is forecasted for (potentially) 2026, after which revenues will be earned in this business segment as well.

The case for potash

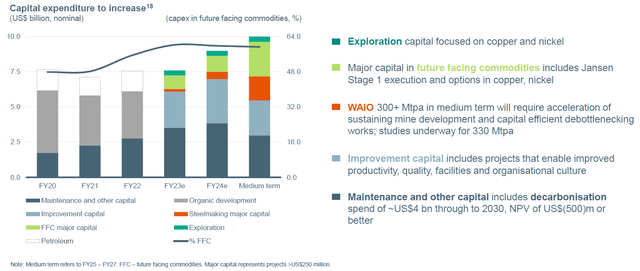

Diversification requires investment, and, therefore, BHP is ramping up capex spending over the coming years, see figure 2. The green color in the figure indicates the investments in “future facing commodities,” among which the company qualifies potash.

Figure 2 – BHP forecasted capital expenditures (bhp.com)

In 2021, approximately 70 percent of potash production came from deposits in Canada, Russia and Belarus. Obviously with the Ukraine war going on, the Canadian share of production has become more important. As a result, BHP indicated to speed-up its Jansen development.

Similar plans, however, have also been shared by Nutrien Ltd (NTR), the largest potash producer worldwide. More specifically, at the Q3 earnings call, Nutrien doubled-down on the commitment to raise potash production, in spite of management lowering its guidance as high prices led to reduced demand for potash. Although the market did not appreciate the outlook shared by Nutrien, management is taking advantage of the record earnings to both reward shareholders and invest in growth, see figure 3.

Figure 3 – Nutrien 3Q22 investor update (nutrien.com)

A logical consequence of production increases is that the price of potash will most likely not remain at the current elevated levels. With BHP bringing online the first stage of Jansen no earlier than 2026, one could argue it is rather late to the game.

On the upside, BHP has been eye-balling potash for a long time. The most clear-cut example is the failed takeover bid of former PotashCorp in 2010. PotashCorp eventually merged with Agrium, creating a new entity which is known today as Nutrien, the very same company it will now compete with. Given this background, it is clear BHP knows potash, and the business case is solid. This was further supported by CEO Mike Henry during the BMO Farm to Market conference:

While early days, it is expected to achieve an internal rate of return between 18 and 20 per cent and a payback of around four years at long term consensus prices, which are well below spot prices.

Copper is key

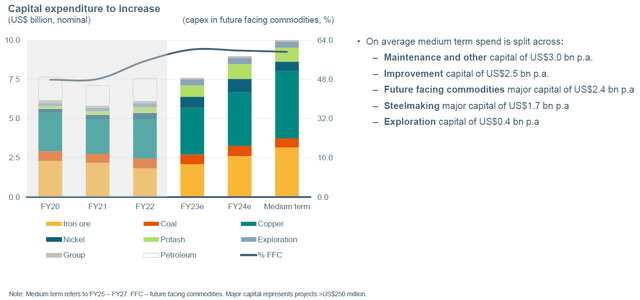

Although a lot of emphasis is put on the Jansen potash development, BHP is actually investing more heavily in copper, see figure 4.

Figure 4 – BHP FY22 presentation, capex per commodity (bhp.com)

The main reason for large investments in copper is the drive for decarbonization, which will spur electrification. Or alternatively, as shared in this piece on Rio, the economy is being “metallized.”

What makes the copper business even more interesting is the expectation that demand will surpass supply. When it comes to electrification, the adoption of electric vehicles (“EVs”) is taking center stage in the media. What is more important, however, in my opinion, is that societies will demand more (electric) energy for which the entire electrical infrastructure in the world needs to be expanded. The first signs of grid deficiencies are now emerging. In Europe, for example the Netherlands is now struggling with an overloaded grid:

The energy transition and growing demand for electricity has led to congestion issues with the country’s overloaded power grid. In some locations businesses face long waiting times to gain access to the grid.

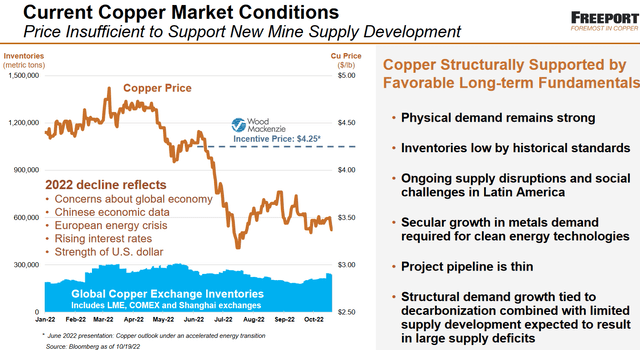

Effectively, the country will need to face the reality GDP growth will be hampered by an outdated grid. This news couldn’t contrast more with the current rate of development of copper mines. Freeport McMoRan (FCX) presented an interesting slide on this subject during its 3Q22 update, see figure 5.

Figure 5 – Freeport 3Q22 conference call, copper market outlook (fcx.com)

Summarizing, FCX expects large supply deficits as current conditions lead to underinvestment in copper mines. The situation as described in the figure is reminiscent of the last decade in the oil and gas sector. Anyone following the market knows what a thin project pipeline did to the oil price.

Add to this the investment plans shared by some of the largest utilities, and it becomes clear demand is locked-in for this decade. For example, one of the world’s largest utility companies, Enel (OTCPK:ENLAY), announced a massive €170Bn investment plan to expand its grid and boost renewable generation. This amount translates into annual capex spending of nearly €19Bn, with literally everything being built with this money depending on copper. And this is just one of many examples.

As momentum continues to build for electrification, BHP is perfectly positioning itself to benefit from future demand.

Valuation

Following the divestment of the Petroleum segment, BHP paid a high dividend of US$7.11 over FY22. It should be noted US$3.86 of this amount was an in-specie dividend from distributing Woodside shares received as consideration for the sale of BHP Petroleum. After this divestment, and a drop of iron ore and copper prices, it is worthwhile to assess what investors can expect in terms of the dividend.

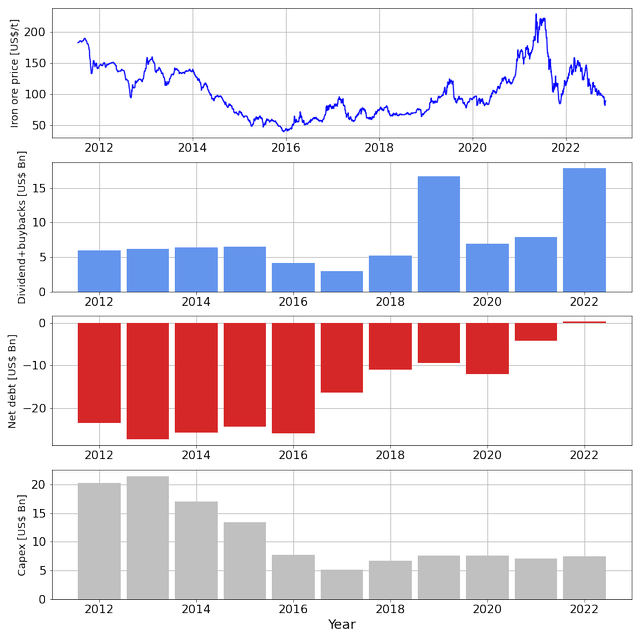

As BHP’s revenue streams are relatively well diversified, the company displays less cyclical behavior than its peers Rio and Vale, who both depend on iron ore much more. This becomes clear when the dividend is referenced against the ore price, see figure 6. The company managed to eliminate net debt and grow the dividend throughout the ore cycle over the last decade. Capex spending was reduced as well, but the company has diligently worked to improve the finances before increasing investments again in the coming years.

Figure 6 – Ore price versus BHP metrics (seekingalpha.com, bhp.com; chart by author)

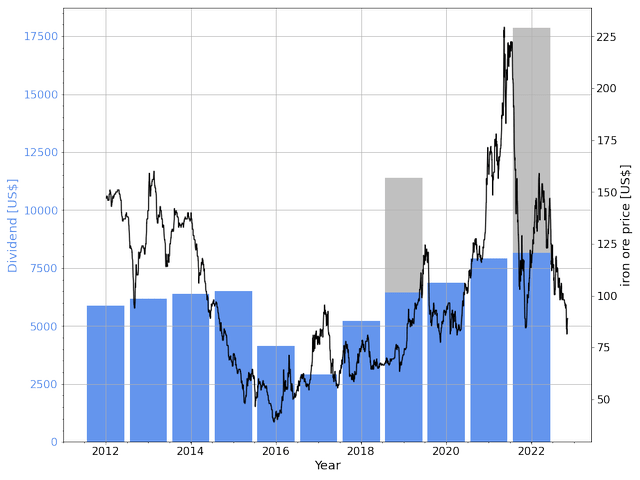

The outsized shareholder returns in 2019 and 2002 actually distort the dividend growth the company aims for. Therefore, in figure 7 the dividend resulting from the 2019 sale of the Onshore U.S. assets and the 2022 divestments of the Petroleum segment have been colored grey. Furthermore it should be noted part of the proceeds of the Onshore US asset sale was returned in the form of share buybacks.

But, more important, excluding these one-off gains, it becomes clear BHP intends to grow the dividend at a rather constant rate. It is true the dividend was cut in 2016 and 2017, but this decision was mainly driven by the Samarco disaster in 2015.

Figure 7 – Dividend growth versus ore price (seekingalpha.com, bhp.com; chart by author)

The BHP dividend policy provides for a minimum 50 per cent payout of Underlying attributable profit at every reporting period. Although the iron ore and copper prices came off their highs, and the policy leaves room for a cut, it does not make sense to distort the track record especially as the balance sheet looks good. I therefore expect a dividend payment of at least US$3.25 for FY2023. At the time of writing this generates a 5.5% forward dividend yield.

From a valuation perspective, the company has higher P/E and EV/EBITDA ratios than peers Rio and Vale, but then again is superior in terms of diversification and consistency.

Even as the stock gained significantly over the last weeks, it remains attractive. Therefore, at the current US$58 per share BHP still presents an opportunity for long term investors.

Risks

By developing a potash mine and ramping up the copper production, BHP is diversifying and increasing the importance of commodities other than iron ore. Yet, this does not imply it will only be smooth sailing hereafter.

The company is still dealing with the consequences of the Samarco Dam disaster. Actually, several days after the FY22 results presentation in June, it appeared BHP had “lost an appeal in a London court seeking to block an over £5 billion (over $6bn) lawsuit … from proceeding in London.”

Without negating the horrendous consequences for those affected, investors should be aware of the potential financial effect on the company. The relevance of the case going to court in the UK becomes clear when the changing relation between society and corporations is considered.

Nowadays, virtually every major corporation has attention for Corporate Social Responsibility ((CSR)) and Environmental, Social and Governance ((ESG)). This is exemplary of an ongoing shift from the Anglo-Saxon to the Rhineland business model. For those unaware of the latter model, the following quote summarizes it best:

A Rhineland firm views itself as an interdependent part of a wider community that offers a lasting place for each of its members rather than simply as a moneymaking machine for investors

The distinctions between these models will not be detailed further in this piece, but several examples brought on by this shift will be given.

Oil majors for example are held accountable for the emission of greenhouse gases with Shell (SHEL) losing a landmark case in Dutch court last year. As another example, Rio Tinto and BHP jointly spent over US$1Bn on the Resolution copper project, located at an Apache worship site, without breaking ground. The potential risk here is that sites like Resolution may become stranded assets.

To continue this line of reasoning, at COP27 discussions started about funding for climate loss and damage. Basically developing countries, who contributed least to climate change, are looking to be compensated. If this materializes, rich nations will be presented with substantial claims. Before footing the bills themselves, I wouldn’t be surprised if governments will try to transfer responsibility to large corporations such as BHP. After all, the ease with which windfall taxes for energy companies were announced this year has created the precedent.

Conclusion

After the sale of the Petroleum segment, BHP is developing its first potash mine to maintain diversification among the different segments. Although a lot of emphasis is put on this development, the company is actually investing more heavily in copper, an investment fueled by the drive for decarbonization.

With large utility companies announcing massive investments in renewables and grid expansion, the capital to make decarbonization fly has now become available. With these plans for electrification, BHP is perfectly positioning itself to benefit from future demand.

On top of this, the company is in good shape financially and will continue to reward shareholders. The main risk for the investment thesis, however, is the ongoing shift where the Anglo-Saxon business model is gradually exchanged for the Rhineland model. Several examples have been presented, and investors are advised to make the trade-off whether the forward dividend yield weighs up to the increasing attention for ESG matters.

In this respect, I view BHP Group’s diversification into copper and potash as a risk mitigation measure and still consider BHP a buy at the current price of US$58 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment