Wanwalder/iStock via Getty Images

B&G Foods, Inc. (NYSE:BGS) is a 132-year-old company with over 50 brands in the consumer staples industry at a market cap of $872.20 million. Its expansion strategy was supported by high debt intake through variable interest rate loans. Consequently, it was hit extremely hard by the ongoing federal fund interest rate hike. It was forced to reduce its dividend payout by 60% earlier this year to compensate for poor fundamentals. The market has not reacted well to the news, and the stock is currently at one of its most historically low price points.

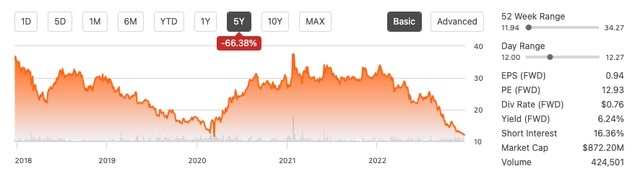

Five-year stock trend (SeekingAlpha.com)

In light of negative sentiment, this may be a good moment to pick up a cheap dividend stock with topline growth. However, its bottom line has decreased over the last five years with diminishing profit margins. Furthermore, an aggressive brand growth strategy has increased its debt yearly. Although the stock price has dropped by 61.54% year-to-date, the company likely has yet to reach its lowest point as interest rates continue to rise, raw material inflation has not gone down, and consumer spending is dropping. Therefore, recommend a Sell rating for B&G Foods, Inc.

Overview

BGS was founded in 1889 by two families selling pickles in Manhattan. The company IPOed in 2007 and grew through acquiring existing brands that had lost value at their original parent companies. It is in the staple food product industry producing and selling everyday household goods such as shelf foods, frozen foods, and household products in the USA, Canada, and Puerto Rico, with more than 50 brands.

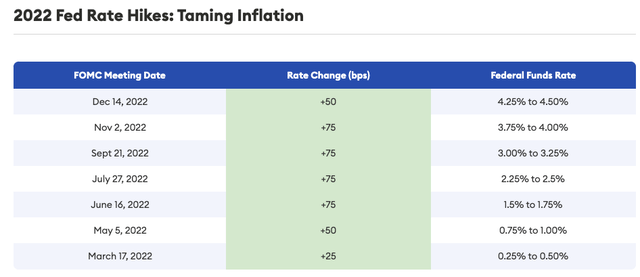

Today, we see a company that has made 24 acquisitions since 1996 in addition to growing through organic sales. It has rewarded shareholders with a growing above-market dividend payout. However, BGS’s growth strategy required high debt intake through high-interest-rate variable loans. Taking on these variable rate borrowings, BSG has been hit extremely hard by today’s market conditions and by the federal fund interest rate hikes to control inflation. Net interest rate expenses have increased by 10.3% yearly due to these variable rate borrowings. At the same time, BGS has been growing its dividend payout at unsustainable rates if we compare it to the company’s unstable free cash flow, which heavily fluctuates yearly.

2022 Federal Rate Trend (forbes.com)

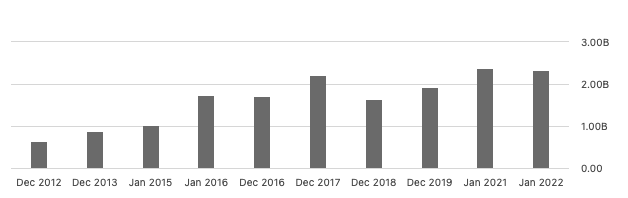

Below we see the growing intake of total debt, which is currently a severe weight on the company due to the increasing variable interest rate loans.

Total debt (SeekingAlpha.com)

The company has had to make reputation-impacting decisions, such as reducing the dividend payment this past quarter. Furthermore, it has sold one of its brands, Back to Nature, to improve fundamentals.

Financials and valuation

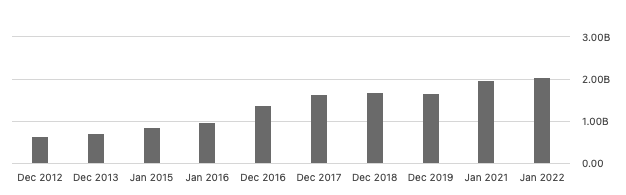

If we look at the company’s fundamentals, there has been a disappointing downward performance over the last five years. The company’s top-line performance has done consecutively well during the previous five years, increasing by 24.9%. However, gross margins have been decreasing over the last decade. We have seen margins go from 35.24% in 2012 to 22.21% last year. Due to the nature of the products, the company may have little pricing power to adjust to increased raw material costs.

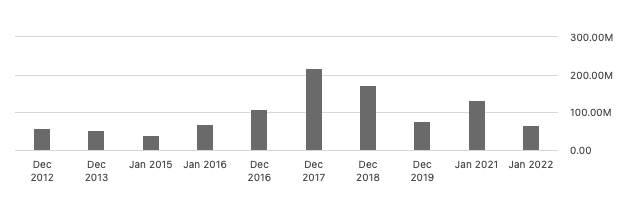

Annual Revenue (SeekingAlpha.com)

Net income has decreased by 69% over the last five years, from $217.5 million to $67.4 million at the end of last year’s fiscal year. The graph below shows that this has been a relatively consistent decrease year by year. 2021 may have been an irregular increase due to the COVID-19 pandemic restrictions keeping people indoors and increasing their cooking and household activities.

Annual net income (SeekingAlpha.com)

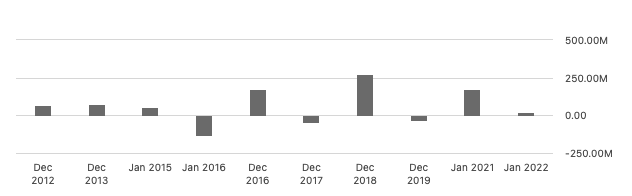

The results are very inconsistent if we look at levered free cash flow. Five years ago, the company had a negative cash flow of $45.8 million, jumping to $274.3 million the following year and back to a negative $33.8 million. This last quarter, the company had a levered negative cash flow of $104.4 million. This tells us that the company will have issues with its dividend program.

Levered Free Cash Flow (SeekingAlpha.com)

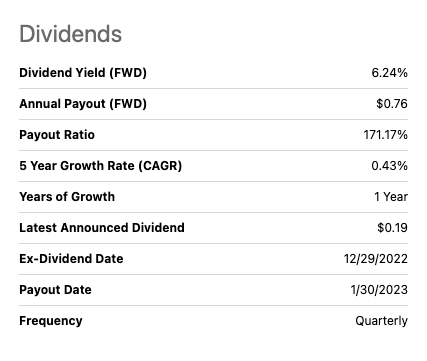

Over the last five years, the company has had a consistent and growing dividend program. It has an annual dividend of $0.76 per share with a current yield of 5.78%. This payment ratio of 171.17% is well above 100% and tells us the company is taking on debt to pay this off. On top of that, the company has a low CAGR of 0.43. The company has recently announced a reduction in its dividend from $0.48 to $0.19, which received a massive backlash from investors.

Dividend overview (SeekingAlpha.com)

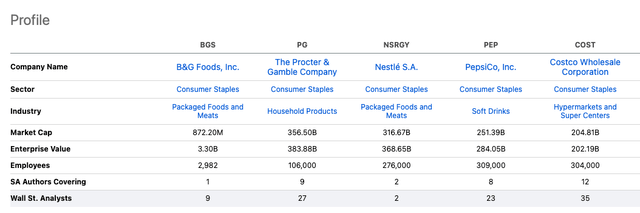

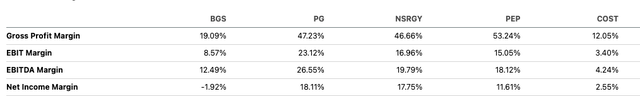

If we have a look at analysts’ evaluation of the stock, there is definitely a negative sentiment towards the stock. We see that Wall Street rates it as a Hold at 2.66, while Zacks Rank has it at a Strong Sell rating of 5. It has a price target of $13.94, which is higher than its current pricing. The market cap of $872.20 million is much lower than the enterprise value of $3.30 billion, which is heavily related to the company’s debt problem. For context, I have compared BGS to some of the top consumer staple companies in the market – Costco (COST), Procter & Gamble (PG), Nestle (OTCPK:NSRGY), and PepsiCo (PEP) – all of which have proportionally less debt intake.

Peer Comparison (SeekingAlpha.com)

We can see that BGS has a meagre gross profit margin compared to its larger peers, excluding Costco. This could continue to worsen as inflation continues to impact costs.

Peer Comparison (SeekingAlpha.com)

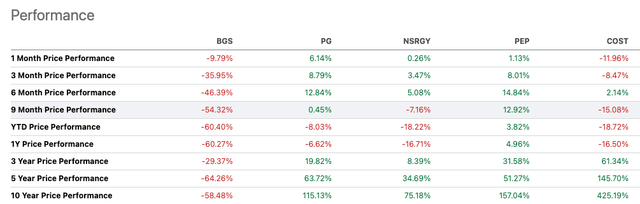

If we look at the stock performance, the company needs to do better. The most attractive part of investing in BGS has been its generous dividend yield, which has been at a higher % than all four of its much larger peers.

Peer Comparison Stock Performance (SeekingAlpha.com)

Final thoughts

B&G Foods, Inc. is an excellent reminder that an attractive dividend program with a high yield should not make us less critical of a company’s performance. It means very little if the company cannot pay for these yields. While a consumer staple company like B&G Foods, Inc. may look like a safe bet on the surface, if the company is taking on massive debt to operate its business, changing economic conditions such as high-interest rates can be detrimental. In uncertain times, with record-breaking interest rates and a long way for the company to go to cut down its costs, I recommend a sell rating B&G Foods, Inc.

Be the first to comment