adaask

Both Western Midstream Partners (NYSE:WES) and Enterprise Products Partners (NYSE:EPD) are investment-grade midstream businesses that each pay out high yields of 7.8%.

In this article, we will compare them side by side and offer our take on which one is a better buy.

Western Midstream Partners Vs. Enterprise Products Partners – Business Model

WES focuses primarily on natural gas and natural gas liquids, performing gathering, processing, transportation services in Texas, New Mexico, the Rocky Mountains, and North-central Pennsylvania.

With a primarily fee-based contracted cash flow profile, WES has considerable commodity price resistance. Furthermore, over 80% of its natural gas throughput, 96% of its crude oil throughput, and 100% of its water cash flows, are covered by some sort of cost-of-service contract or minimum volume commitment.

The company’s cash flows have proven to be very recession resistant, as its 2020 EBITDA was actually higher than its 2019 EBITDA. On top of that, the vast majority of its contracts run into the late 2020s with some even extending into the mid 2030s. Furthermore, its main counterparties are Warren Buffett backed Occidental Petroleum (OXY) and investment grade ConocoPhillips (COP). With no more than 7% direct exposure to commodity prices, WES should enjoy stable cash flows for years to come.

EPD, meanwhile, has one of the best-diversified midstream infrastructure portfolios on both a geographic and energy commodity exposure basis. On top of that, management has proven to be extremely prudent and strategic in its allocation of capital, enabling EPD to consistently generate double-digit returns on invested capital across market cycles. Similarly to WES, EPD has well-laddered contract maturities and derives the vast majority of its cash flows from fixed fee, commodity price resistant, and inflation-linked contracts.

Overall, we give the edge to EPD here due to its superior scale, track record, and diversification. That said, we like WES’ business model as well and particularly like their contract positioning.

Western Midstream Partners Vs. Enterprise Products Partners – Balance Sheet

Both businesses also have solid balance sheets and investment grade credit ratings.

Overall, we award EPD the superior balance sheet here given that its credit rating is BBB+ from S&P and equivalent from Moody’s. In contrast, WES only has an investment grade credit rating (BBB-) from S&P while Moody’s has not yet granted it an investment grade credit rating.

EPD’s leverage ratio is incredibly low relative to peers at 3.1x (which is also below the low end of its target range of 3.25x). Furthermore, it has an immense amount of liquidity ($4.1 billion) along with a weighted average term to maturity 21-year. As management stated recently, they have been preparing for this current (rising interest rate) environment for years and have little to nothing to worry about when it comes to their solvency and ability to respond opportunistically to potential financial distress in the markets.

Meanwhile, WES also has a very low leverage ratio at under 3.4x and they are laser-focused on continued to slash their leverage ratio through a combination of EBITDA growth and debt reduction. Management expects to be at a 3.0x leverage ratio by the end of 2024. Management plans to retire its maturity in early 2023 with cash and has plenty of liquidity that – combined with some of its immense free cash flow – can handle all of its other maturities through 2026. As a result, they have no concerns about the rising interest rates and are fairly agnostic when it comes to the interest rate at the moment.

Western Midstream Partners Vs. Enterprise Products Partners – Growth Potential

WES is taking a pretty conservative approach to growth investments as it is only pursuing growth opportunities that it believes will generate returns that are at least two times of its cost of capital. Still, it has plenty of attractive opportunities for growth and – when combined with its fairly aggressive unit buyback program and debt reduction (which reduces its interest expense pretty meaningfully) – analysts are forecasting a mid-single digit DCF per unit CAGR through 2026.

Meanwhile, EPD is also investing more aggressively in high-return, low-risk organic growth projects. On top of that, through its recent purchase of Navitas Midstream Partners EPD has also shown a willingness to flex its strong balance sheet to invest in opportunistic acquisitions that are expected to be highly accretive to DCF per unit, both immediately and long-term through incremental growth projects. However, EPD is not buying back a meaningful percentage of its units, and analysts are not as bullish on its long-term DCF per unit growth prospects with a 2.0% CAGR forecasted through 2026.

That said, WES expects to focus on special distributions and buybacks whereas EPD will likely continue growing its quarterly distribution moving forward. This is something that investors should keep in mind when comparing the two.

Overall, we rate this category a draw as – while WES has a higher expected DCF per unit CAGR based on analyst estimates – the potential x-factor here is that EPD has significant room to increase its leverage to juice growth whereas WES is focused on paying down debt and reducing its leverage ratio in pursuit of an investment grade credit rating. As a result, we think that EPD is likely to outperform its expected growth rate moving forward.

Western Midstream Partners Vs. Enterprise Products Partners – Track Record

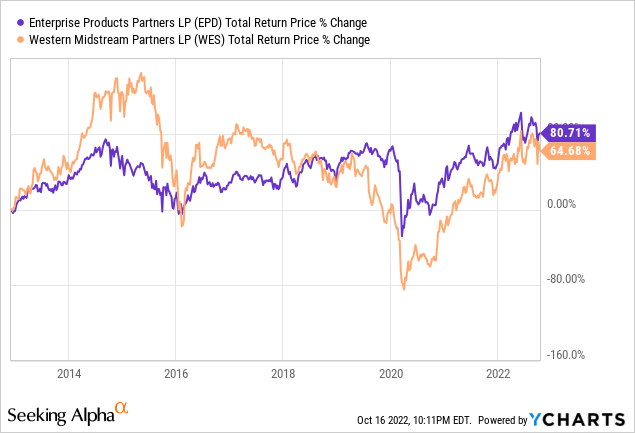

When it comes to total return track record, EPD’s beats WES’ as EPD has one of the very best performance track records in the industry:

On top of that, EPD is closing in on a quarter century of consecutive annual distribution increases, so it is a very reliable income growth vehicle for investors.

Western Midstream Partners Vs. Enterprise Products Partners – Distribution Safety

WES is currently paying out a $2.00 annualized distribution and is expected to generate $4.51 in distributable cash flow this year, putting its coverage ratio at 2.26x. Meanwhile, EPD is currently paying out a $1.90 annualized distribution which is well covered by its expected $3.48 in distributable cash flow this year to the tune of a 1.82x coverage ratio.

As a result, we consider this a draw, as EPD’s superior business model and balance sheet are offset by WES’ higher coverage ratio. The bottom line here is that neither is even remotely at risk of cutting its distribution.

Western Midstream Partners Vs. Enterprise Products Partners – Catalysts And Risks

EPD and WES are both heavily exposed to natural gas and natural gas liquids, while EPD also has greater exposure to oil and WES has some exposure to a water business. Both are quite commodity price resistant for the foreseeable future. However, if commodity pricing and/or demand were to plummet for an extended period of time, it could put downward pressure on their cash flows. Similarly, if commodity pricing and/or demand remains elevated for an extended period of time, it would likely push cash flows higher by providing more growth investment opportunities and also producing a stronger recontracting environment.

Western Midstream Partners Vs. Enterprise Products Partners – Stock Valuation

On a valuation basis, WES appears to be clearly cheaper, as its EV/EBITDA and P/DCF multiples are cheaper compared with WES’ current multiples. Meanwhile, their distribution yields are nearly identical and both businesses appear to offer good value at the moment, given their conservative positioning and the current bullish environment for energy.

|

WES’ Metrics |

Current | 5-Yr. Average |

| EV/EBITDA | 7.55x | 9.62x |

| P/DCF | 5.78x | NA |

| Distribution Yield | 7.81% | 9.63% |

| EPD’s Metrics | Current | 5-Yr. Average |

| EV/EBITDA | 9.12x | 10.72x |

| P/DCF | 7.18x | NA |

| Distribution Yield | 7.82% | 7.55% |

Investor Takeaway

While both businesses are high quality in virtually every respect and well-suited to the current macroeconomic environment, EPD wins this competition in our view as its risk profile is very low thanks to its impressive collection of assets, top-notch management, strong insider alignment (insiders own about one-third of the partnership), and unmatched balance sheet across the midstream sector. Meanwhile, its high yield, solid growth prospects, and attractive valuation multiple give it a high probability of generating double-digit annualized returns over the long-term. As a result, we rate it a Strong Buy.

We also rate WES as a Strong Buy thanks to its attractive risk-reward and very cheap valuation. However, its risk profile is meaningfully higher due to its weaker balance sheet and diversification, so that is why it comes in second here. That said, it should be noted that we own both at High Yield Investor.

Be the first to comment