adaask

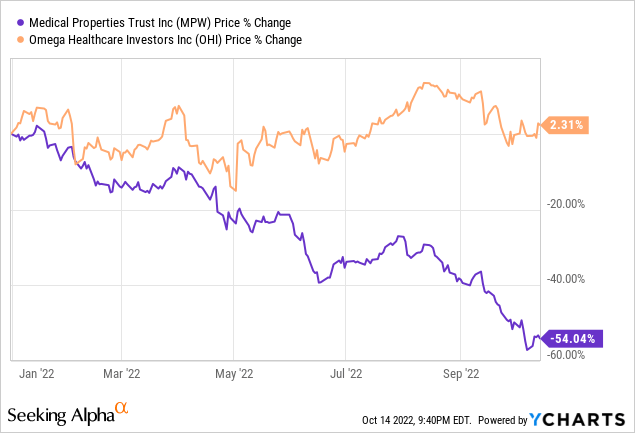

Omega Healthcare Investors (NYSE:OHI) and Medical Properties Trust (NYSE:MPW) are two high-yield healthcare REITs. MPW’s stock price has declined by over 50% year-to-date, while OHI’s stock price is actually slightly in the green this year:

In this article, we compare them side by side and offer our take on which is the better buy right now.

Medical Properties Stock Vs. Omega Healthcare Stock: Business Model

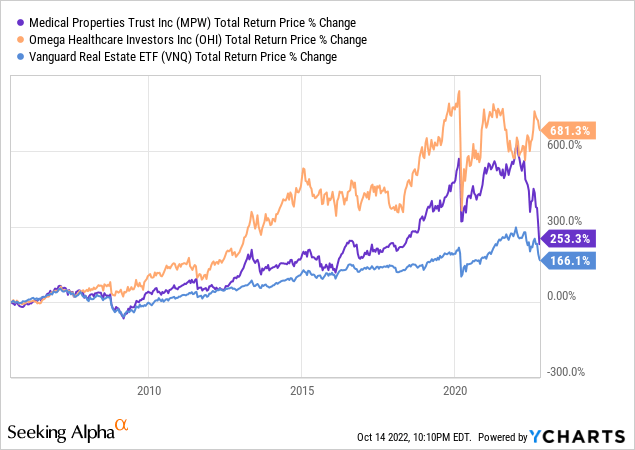

Before this year’s sell-off in MPW’s shares, MPW and OHI had generated very similar total returns over time. Even after MPW’s massive sell-off this year, it has still significantly outperformed the broader REIT market (VNQ) over time:

This is largely the result of MPW’s dominant scale in the hospital space, giving it access to more deals and greater insights into the industry than competitors. As a result, it has found numerous methods for generating alpha for shareholders. On top of that, it has had access to many deals and has benefited from a stock price that has typically traded at a premium to NAV. As a result, it could issue cheap debt and combine it with equity raises at premiums to NAV and reinvest the proceeds into purchasing new hospitals. This would then continue to grow NAV per share and cash flow per share while simultaneously further diversifying the property portfolio, optimizing the risk-reward for shareholders. This strategy has worked well and enabled the company to consistently grow its dividend at an attractive rate.

On top of this, MPW also has some of the very best CPI-based lease escalators in the entire REIT space, giving it another source of growth on top of its acquisition-heavy growth strategy.

The biggest risk facing MPW at the moment is its exposure to several hospital operators – particularly Steward Health – that are reported to be facing financial challenges. If these companies end up having to file for bankruptcy there is always the chance that the end result could be a reorganization of leases or even a cancellation in some cases. This would undoubtedly lead to a meaningful loss in revenue for MPW, making its business model a bit riskier at the moment.

OHI meanwhile, owns a well-diversified portfolio of skill nursing facilities. While its tenants are also struggling a bit in the wake of COVID-19 and a challenging demographic environment right before the silver wave of aging baby boomers hits, it does enjoy conservative lease structures that are triple net in nature and have over 9-year weighted average terms to expiration.

As a result, we give the edge to OHI here given that its risks are less severe than MPW’s, which is largely reflect in its now superior long-term track record.

Medical Properties Stock Vs. Omega Healthcare Stock: Balance Sheet

MPW has a junk credit rating from S&P, though it is only one upgrade away from achieving an investment grade credit rating (BB+). Notably, its rating outlook is also classified as Stable, which – given all of the short attacks on the company and its plummeting stock price – is perhaps a bit surprising, if not reassuring to investors. Moody’s gives it an equivalent Ba1 (Not on Watch) credit rating and says the following about MPW’s condition:

[MPW’s] rating reflects the REIT’s prudent capital structure, unencumbered asset base, and history of stable operating performance. The rating also takes into account MPW’s large scale and geographic diversification, with about 60% of pro forma assets invested in the United States, 20% in the United Kingdom and 20% across other countries. MPW also maintains some property type diversity with its investment focus in general acute care hospitals, inpatient rehab facilities, and behavioral health hospitals which each serve different patient populations and have different reimbursement mechanisms.

Credit challenges include MPW’s aggressive acquisition strategy that sometimes causes temporary increases in leverage. But we believe the REIT remains committed to maintaining a sound capital structure and strong liquidity as it continues to execute its growth objectives. MPW also maintains high tenant concentration with Steward Health Care, although this exposure has been declining and we expect will continue to do so given the REIT’s growth trajectory.

As of this summer, Steward Health hospitals made up 28% of MPW’s adjusted revenue and – as we already mentioned- could cause problems for the REIT if they get to a point of declaring bankruptcy and are unable to pay their leases. While MPW insists that its properties are high quality and profitable at the asset level, it still could take them a while to get all of those properties released on favorable terms. In the meantime, their leverage ratio would balloon and their dividend would likely have to be slashed, if not eliminated. Again, while we do not see a major risk of financial distress for MPW at the moment, it is certainly not a low-risk investment.

OHI, meanwhile, has a BBB- credit rating, putting it in the investment grade category, albeit only one level above MPW’s. OHI has plenty of liquidity (~$1 billion) and a very stable cash flow profile given that ~97% of its revenue come from long-term triple net master leases.

Overall, OHI is the clear winner here given that it has an investment grade credit rating and its tenant risk is not as great as MPW’s.

Medical Properties Stock Vs. Omega Healthcare Stock: Growth Outlook

MPW has a stronger growth outlook and also looks more appetizing on an organic growth level, thanks to its CPI-linked rent escalators. That said, both companies issue shares to fund much of their in-organic growth investments and neither has an attractive cost of capital at the moment due to soaring interest rates and both stocks’ recent selloffs. Analysts expect MPW to grow AFFO per share by 6.1% in 2022 and 5.5% in 2023 and its dividend per share by 3.6% in 2022 and 5.4% in 2023.

Analysts expect OHI to grow its AFFO and FFO per share at a ~3% CAGR over the next four years. We think this is reasonable as OHI is dealing with increasingly tight tenant EBITDARM and EBITDAR coverage ratios. This is largely a product of reduced Medicare reimbursement rates, rising wages and other inflation-driven cost pressures, and temporarily lower occupancy rates as a result of COVID-19 and current demographics.

However, OHI should be able to overcome these headwinds in the coming years thanks to an expected growth in the 65+ year old population of over 16% between 2020 and 2025. This should lead to a surge in demand for skilled nursing facilities such as the properties that OHI owns, resulting in cash flow growth for the business. Another major boost for the business is that it faces no major lease expirations until after this elderly population boom takes effect, so it should not suffer from too many downside catalysts, assuming its tenants can continue to pay rent between now and then.

Overall, while MPW’s business model has traditionally been growthier, OHI has a better risk-adjusted growth outlook given the major uncertainties and headwinds facing MPW at the moment.

Medical Properties Stock Vs. Omega Healthcare Stock: Valuation

While OHI looks fairly valued at the moment (its metrics are slightly below five year averages, but interest rates are also on the high end of where they have been over the past half decade), MPW looks incredibly cheap across every metric:

| OHI | MPW | |

| Dividend Yield | 8.85% | 10.68% |

| Dividend Yield (5-Yr Avg) | 8.17% | 6.12% |

| EV/EBITDA | 13.02x | 11.70x |

| EV/EBITDA (5-Yr Avg) | 13.39x | 14.47x |

| P/NAV | 1.11x | 0.58x |

| P/NAV (5-Yr Avg) | 1.27x | 1.15x |

| P/FFO | 10.03x | 6.02x |

| P/FFO (5-Yr Avg) | 10.64x | 11.25x |

| P/AFFO | 10.42x | 7.63x |

| P/AFFO (5-Yr Avg) | 11.43x | 13.89x |

As a result, MPW is definitely the better pick for deep value investors. If MPW can navigate through the risks facing its tenants and continue to collect rents from its properties for years to come, investors stand to enjoy enormous total returns through a combination of a double-digit current yield, solid growth, and a potential doubling of the P/NAV multiple.

Through 2026, assuming no growth (as some vacancies and rent concessions due to anticipated tenant issues are roughly offset by rent growth and new acquisitions) and the P/NAV returning to 1x (which is still well below its five-year average of 1.15x), MPW will generate an impressive total return CAGR of ~30%.

OHI, meanwhile, assuming a stable P/NAV multiple and a 3% per share intrinsic value growth rate along with a stable dividend payout will generate an 11.85% total return CAGR through 2026. While not nearly as impressive as MPW’s total return potential, this is still certainly high enough to warrant rating OHI a Buy.

Investor Takeaway

Overall, both OHI and MPW look like attractive high yield options for investors looking for income from healthcare real estate. With the economy on the brink of recession, many investors like to increase exposure to more defensive sectors like healthcare, so that is also something to consider when appraising these two REITs.

That said, neither is risk-free and MPW in particular could be dealing with some significant challenges in the years to come if the shorts are right. Ultimately, it comes down to investor comfort with risk. For investors with a moderate risk profile, OHI is probably the better choice given it has an investment grade credit rating and a high yield with moderate growth prospects.

For investors with a high risk profile and who want to be more aggressive, MPW looks like a great candidate. While the significant downside potential should be accounted for when sizing a position, the double-digit dividend yield and steep discount to NAV make MPW a mouthwatering total return opportunity for investors looking to hit a home run. Perhaps the biggest bullish indicators for this stock right now are the facts that management recently raised the dividend and the company has sold several properties occupied by some of its more troubled tenants (including Steward Health) at cap rates that imply the stock is deeply undervalued. We rate MPW a speculative High Risk Strong Buy and OHI an Average Risk Buy.

Be the first to comment