adaask

Both Antero Midstream (NYSE:AM) and Enbridge (NYSE:ENB) are high yield midstream businesses with dividend yields of 8.1% and 6.4%, respectively.

In this article, we will review their Q3 results and then compare them side by side and offer our take on which one is a better buy.

Antero Midstream Vs. Enbridge: Q3 Results

AM generated solid results in Q3. Its biggest takeaways were:

- As its growth projects continue to come online, its CapEx budget is declining while its EBITDA is improving, leading to significant free cash flow growth after going a period previously with little to no free cash flow net of dividends. In Q3, it generated $30 million in free cash flow after dividends.

- AM is using this enhanced free cash flow to pay down debt in an effort to reduce leverage as quickly as possible and eventually achieve an investment grade credit rating.

- Otherwise, it was a pretty stable and uneventful quarter for AM, with solid performance for its existing infrastructure.

ENB’s Q3 was pretty steady-as-she-goes as well. Highlights included:

- Remained on track to achieve its 2022 EBITDA and DCF per share guidance, along with ~$3.8 billion in capital projects coming online this year. ENB still expects to grow its DCF per share by 8% this year while growing its EBITDA by 9%.

- ENB also secured $3.8 billion in new organic investments during Q3 while also acquiring a 10% interest alongside Plains All-American (PAA) in the Cactus II Permian pipeline from Western Midstream (WES).

- ENB also continued to advance its renewables business growth via the acquisition of Tri Global Energy.

- Meanwhile, it sold its Regional Oil Sands assets for $1.12 billion in order to raise capital to recycle into the aforementioned investments.

Antero Midstream Vs. Enbridge: Business Model

AM and ENB differ significantly in terms of the size and diversification of their asset portfolios. While AM does have a fully integrated value chain (as does ENB), AM is nearly a pure play on natural gas processing (~85% of its business) while it also has 15% exposure to water handling. Its main competitive advantages is that it operates in the lowest cost natural gas basin in the United States. It is also important to note that virtually all of its business is with Antero Resources (AR) (which also happens to own a large stake in AM), so it is highly dependent on AR’s solvency, while AR also benefits from AM’s success given its large stake in the company. At the moment, AR is booming and is rapidly deleveraging its balance sheet, which implies that AM should enjoy a degree of stability for the foreseeable future.

ENB, meanwhile, has a very large and well-diversified portfolio of assets that give it economies of scale, insulate it from individual asset, commodity, or geographic risk, and give it some of the best midstream service capacity in North America along with numerous organic growth opportunities.

For example, it owns the United States’ second-longest natural gas transmission pipeline network, in addition to North America’s largest natural gas distribution business. On top of that, it is a leader in crude oil, with North America’s longest pipeline network. Last, but not least, it is diversifying into a rapidly growing renewable power generation business. A whopping 98% of its contracts are commodity price-proof and 95% of its cash flow stems from investment grade counterparties.

Antero Midstream Vs. Enbridge: Balance Sheet

While AM’s balance sheet has a junk credit rating (BB from S&P), management is making rapid progress towards deleveraging and improving its financial positioning. As management stated on the earnings call:

During the quarter we generated $30 million of free cash flow after dividends and began paying down debt. We have been talking about this critical inflection point for several quarters and it has finally arrived…In addition, AM’s capital budgets will continue to decline, which will drive expanding free cash flow and declining leverage…we still expect to achieve that three times leverage target in 2024. Once we achieve this target, we will be in a position to evaluate or the return of capital strategies.

Meanwhile, ENB boasts a sector-leading BBB+ credit rating, which gives it access to capital at attractive rates. On top of that, it routinely engages in capital recycling in order to harvest proceeds from assets at attractive valuations and reinvest them at incrementally better risk-reward profiles. Last, but not least, its debt maturities are mostly in the 2030s, 2040s, 2050s, 2060s, and even 2080s. This means it has little risk of financial distress for the foreseeable future.

Dividend Outlook

Based on consensus analyst estimates, AM is not expected to grow its dividend at all for the next several years. This is because AM is currently laser focused on deleveraging the balance sheet and trying to improve its credit rating before assessing increasing shareholder capital returns. Meanwhile, ENB is expected to grow its dividend at a 2.7% CAGR through 2026. While this is not a significant growth rate, it still beats AM’s. As a result, we give ENB a slight edge here, though neither is at any risk of cutting their dividend any time soon.

Antero Midstream Vs. Enbridge: Track Record

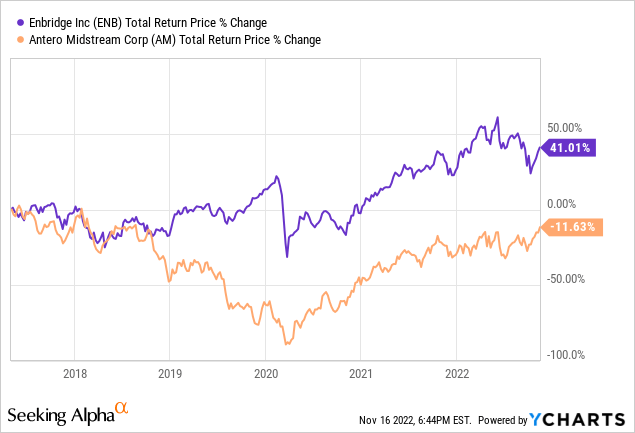

ENB has a vastly superior track record to AM when it comes to dividend growth and total returns. In addition to crushing the market since going public and growing its dividend per share for 27 consecutive years, ENB has also significantly outperformed AM since AM went public:

Catalysts And Risks

AM is a riskier midstream business than ENB given its smaller size and lower credit rating. It does not enjoy the same geographic, counterparty, asset, or commodity diversification as ENB either. As a result, if its main counterparty AR were to experience financial distress, it could severely threaten the solvency of AM as well. On top of that, if its basin were to experience a natural disaster of some kind, it could also threaten the company’s viability. Finally, if the natural gas industry were to suffer disproportionately, AM would also experience a major setback.

On the flip side, if AR were to strengthen its financial standing and AM continues to successfully deleverage its balance sheet, AM could also see greater upside than ENB. Overall, AM enjoys greater upside catalyst potential as well as greater downside risk than ENB, making it a more aggressive investment.

AM Vs. ENB: Valuation

Both AM and ENB are undervalued when comparing their current EV/EBITDA to their five-year averages. AM is overall considerably cheaper on a EV/EBITDA, P/DCF, and Dividend Yield basis:

| AM | ENB | |

| EV/EBITDA | 9.14x | 12.50x |

| EV/EBITDA (5-Yr Avg) | 11.61x | 12.61x |

| P/DCF | 8.10x | 10.16x |

| Dividend Yield | 8.1% | 6.4% |

That said, this makes sense given that ENB is lower risk, has more proven management with a better track record, and also has a stronger near-term dividend growth profile. Overall, however, we give AM the edge on valuation as it is significantly cheaper.

Investor Takeaway

This comes down to a choice between high concentration, risk, yield, and total return potential in AM and greater diversification, lower risk, lower yield, lower total return potential, but greater dividend growth and better management quality in ENB.

We think there is room for both businesses in a portfolio. If investors were looking to only own one midstream business, we would prefer ENB given its greater diversification and lower risk profile. ENB is also preferable for those wanting consistent annual dividend growth. However, if investors were wanting to add a higher yielding, higher risk – higher reward opportunity to round out their midstream portfolio, we think AM is an attractive option.

Overall, we consider this to be a draw, as both are Buys in our view. A final factor that investors should keep in mind is that, while both issue 1099 tax forms, ENB is a Canadian company that has a foreign tax withheld if owned in a taxable account for U.S. investors, whereas AM is a U.S. company.

While we like both companies, we are finding better opportunities elsewhere in the midstream sector at this point in time, so we are long neither at High Yield Investor.

Be the first to comment