Scott Olson

Thesis

Leading retailer Best Buy Co., Inc. (NYSE:BBY) stock has been battered since forming its highs in November 2021. The market has set up the massive de-rating in BBY, as it anticipated slowing growth in 2022.

Given its significant exposure to consumer discretionary spending, we believe the de-rating is justified. The company’s weak performance was palpable, as it lapped highly challenging and unsustainable comps driven by the surge in 2020-21.

Moreover, the worsening macro headwinds, exacerbated by high inflation, interest rate hikes, and high energy costs, sent BBY down nearly 46% from its November 2021 highs.

Notwithstanding, we believe the worst seems to be over. Our analysis suggests that Best Buy’s revenue and profitability growth could recover moving forward after hitting its nadir last quarter.

Our price action analysis also suggests that BBY could have staged its long-term bottom two weeks ago. Notwithstanding, it appears overbought in the short term, as it recovered markedly from its June lows.

However, our valuation model indicates that BBY is still reasonably valued if it can execute its recovery cadence well.

Therefore, we believe investors who have been waiting for a potential bottom to add BBY can consider adding exposure.

Accordingly, we rate BBY as a Buy.

Perfect Storm In Retail Decimated Best Buy

Retailers have been undergoing some of the most challenging headwinds since the COVID pandemic, driven by the culmination of a series of upheavals. The geopolitical conflict, surging inflation exacerbated by high energy costs, and a hawkish Fed had all come together to create a perfect storm.

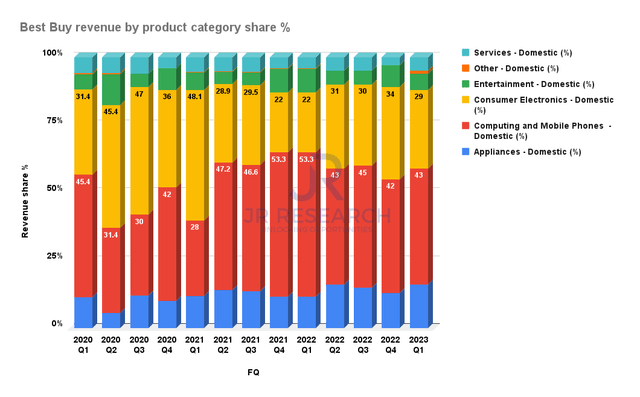

Best Buy revenue by product category share % (Company filings)

As a result, retailers with significant exposure to consumer discretionary spending have suffered tremendously. As seen above, consumer electronics and PC/mobile devices accounted for 72% of Best Buy’s revenue in FQ1’23. It also led to a series of downgrades by the Street recently, as analysts anticipated further challenges. BofA (BAC) cautioned in a recent note (edited):

We believe retail will continue to feel the impact of US consumers shifting their spending habits and budgets to prioritize non-discretionary categories (such as gas, groceries, and home & auto maintenance) over discretionary categories (such as consumer electronics and hobbies). For Best Buy, we caution that there’s increasing uncertainty around 2023 earnings, and therefore its valuation looks incrementally less attractive. – Barron’s

In addition, Morgan Stanley (MS) also slashed its retail outlook for 2022, as it added (edited):

Inflation is running well above our expectations entering the year, and it’s outpacing disposable income growth. The result is a higher proportion of consumers’ incomes is being spent on necessities like food (which is seeing 10%+ inflation) and rent, while dollars are being pulled away from discretionary purchasing.

Therefore, the Street is getting increasingly negative on retail. Notwithstanding, we urge investors to use independent analysis and not just rely on the Street’s commentary.

Best Buy Should Perform Better Moving Forward

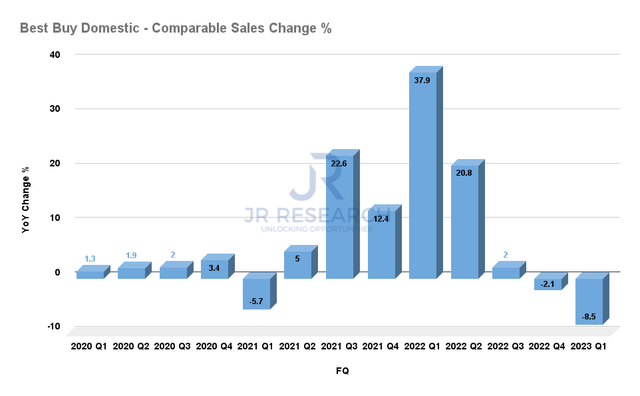

Best Buy domestic comparable sales change % (Company filings)

Those massive revenue gains, as seen in its comps sales growth in FY21-22, were unsustainable. Therefore, we believe the de-rating by the market is well-deserved, as investors normalize their expectations of BBY’s growth cadence ahead.

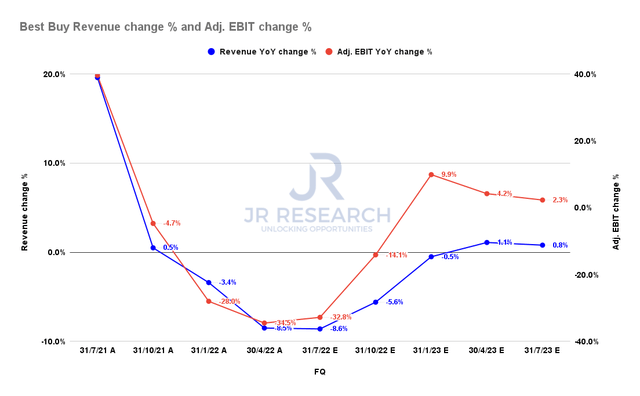

Best Buy revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Despite downgrading retail broadly, the consensus estimates (bullish) indicate that Best Buy’s worst days could be behind it. The Street consensus expects the company’s revenue growth to recover through FY23, even though it cut its guidance. Notably, the company’s inherent operating leverage should also see it regain momentum, which is critical to support its valuation.

BBY – Not Expensive, Reasonable Valuation

| Stock | BBY |

| Current market cap | $17.29B |

| Hurdle rate [CAGR] | 10% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 9.05% |

| Assumed TTM FCF margin in CQ4’26 | 4.6% |

| Implied TTM revenue by CQ4’26 | $51.96B |

BBY reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied BBY’s 10Y total return CAGR as our hurdle rate. We also used the 10Y mean of its FCF yield in our model. Accordingly, we need Best Buy to deliver a TTM revenue of $51.96B by CQ4’26. Based on the revised consensus estimates, we believe it’s achievable.

Therefore, despite the marked recovery from its June bottom, its valuation still seems reasonable. However, investors looking for better chances of market outperformance can consider waiting for a retracement first before adding.

BBY Has Likely Formed Its Long-Term Bottom

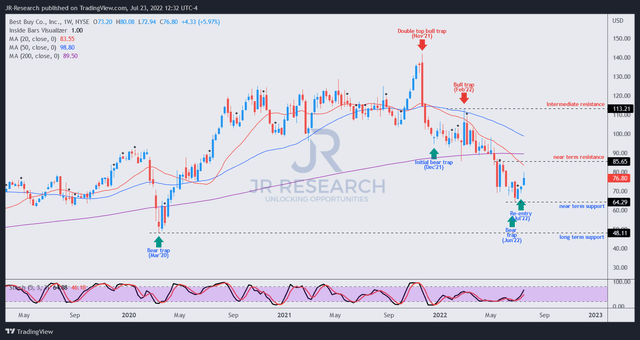

BBY price chart (weekly) (TradingView)

We noted a very subtle bear trap formed in June, as seen above. The market uses bear traps to create false breaks to the downside to ensnare pessimistic/bearish investors/traders into executing directionally-bearish set-ups.

However, another sell-off quickly invalidated the bear trap before revalidating it again two weeks ago. We call such revalidation a re-entry signal. Re-entry signals are often highly reliable and potent price structures that further corroborate the original signal (i.e., June’s bear trap). The market had used the sell-off to force capitulation and trap pessimistic investors/traders before reversing back up.

Notwithstanding, our analysis shows that BBY is likely short-term overbought. Therefore, a retracement is expected to shake out some weak hands who joined the rally last week.

Is BBY Stock A Buy, Sell, Or Hold?

We rate BBY as a Buy.

Even though it’s short-term overbought, we are confident in its medium-term recovery. However, investors can consider a retracement first before adding exposure.

Be the first to comment