NNehring/E+ via Getty Images

Introduction

Berry Corporation, (NASDAQ:BRY) has been hard to love as an investor for a number of years. There’s nothing wrong with the company. They have great assets, low decline reserves, and steadily increasing cash flow. It’s their California location that has kept BRY in the doghouse primarily. The government in California just doesn’t like oil or oil companies, and does everything it can to make their lives difficult. We have documented this fact in past articles, to which we will commend you for deep background on these travails.

Our purpose today is to highlight the deep discount at which the company is trading as relates to recent highs. There are a lot of good things that are happening for long suffering BRY shareholders, including stock buybacks, increased dividends, and some new businesses that help the company promote its ESG profile to state regulators.

Along with their location a couple of funds took the May/June rally in BRY to trim their holdings which put a lot of stock in the market. Just before the market cratered in June. An interesting juxtaposition of events.

Analysts rate Berry as a hold with price targets ranging from $9.00-$19.00. That’s quite a range. In our last article I thought Berry might approach $20 per share. It never got that high as the June Swoon sucked all the life out of the market.

The company is now trading about 20% higher-$9.17 per share, than when this article first appeared, July 25th in the Daily Drilling Report.

The updated investment thesis for Berry

Berry is an operator with long-life, low decline reserves-13% annually, mostly in the State of California, with a heavy concentration in Kern country. The Kern Valley is the steam-flood capital of America. Their production is thick and nasty at 15-20 degrees API, but it’s exactly what refineries are needing to balance out the light oil received from imports.

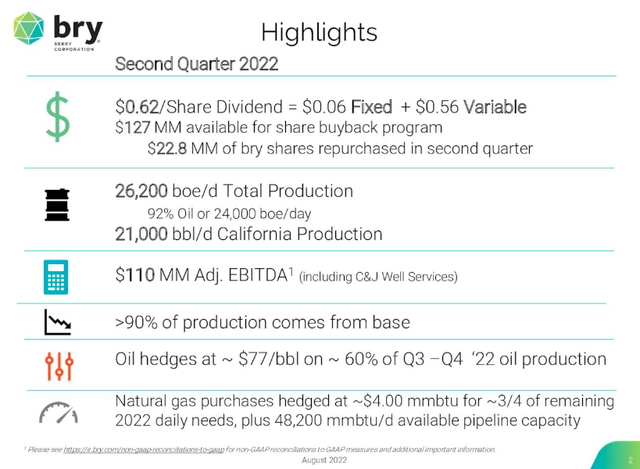

BRY Highlights (Seeking Alpha)

The point here, as I’ve pointed out in recent articles, is that we need this sub-30 gravity stuff and Cali has a lot of it. It turns out that not all heavy oil has to come from a foreign source! Imagine that!

CEO Trem Smith comments on the Berry production advantage-

Our 2022 goal is to maintain our production, which means we plan to keep production flat year-on-year. Let me briefly summarize how we do this. Our low decline production accounts for 90% of our production needs. The remaining 10%, which requires new permits, is achieved by drilling new wells for 6% of the production, and by doing workovers in existing wells for the remaining 4%. Bottom line, 90% of our cash flows come from production out of existing producing wells.

I posited in the prior “Singularity” article that a change was coming to California. It hasn’t happened yet, the real bite of importing so much of their oil could be close. Will reduced or eliminated shipments from Ecuador that provides over 20% of Cali’s crude supply, overcome decades of opposition to E&P development, anytime soon.

It’s hard to say, logic and California aren’t words normally used in the same sentence. High gas prices haven’t done it. We all seen the $6-$8.00 signs coming out of key places on the West Coast. So far people are grumbling, but paying the tab and rolling down the road. What happens if there are actual shortages? We may see if demand stays strong. With their population, if “closed” signs greet drivers when they pull in, the reaction will be swift. Maybe. This is California after all, land of “Swimming pools and movie stars.” Perhaps they will just buy Teslas and skip the gas line. That would be the smart thing to do.

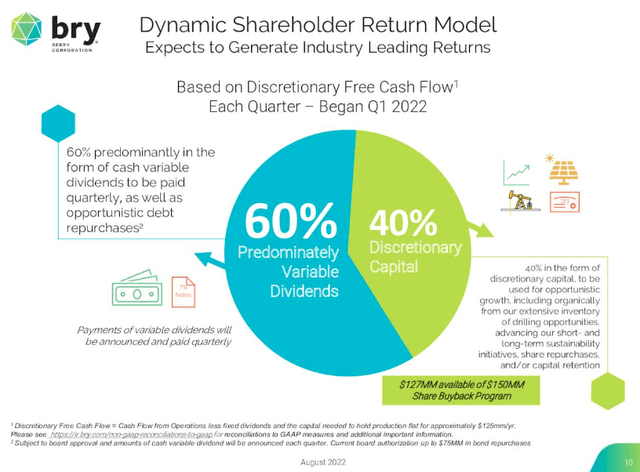

The company has recently reinstated and boosted its dividends, announced an aggressive shareholder return model, repurchased 7% of its shares for $52 mm, with another $48 mm of availability for future purchases, increased production by 5% YoY, made a strategic asset disposition, reduced debt, and entered a new business on the service side. In short in addition to this, with PV-10 reserves worth $1.5 bn at $69 Brent, which exceeds their current market cap by a factor of nearly 2, we think Berry presents an attractive entry point at current prices.

BRY Shareholder Return (Seeking Alpha)

I had forecast a Q-2 special dividend increase in the range of $.40-$.45 per share, as a combination of share repurchases and cash or special dividends.

In Q-1, they took the dividend from $.06 to $.19, a tripling at one fell swoop. Another sizeable boost from here would not surprise me. Something in the range of $0.40-$0.45 is possible in the special!

The company exceeded my expectations with a special dividend of $0.56 per share, which combined with fixed dividend of $0.06 per share made for a tasty combined dividend of $0.62 per share. With my single digit cost basis in the $5’s, the yield is over 10%.

Finally, BRY is surprising to the upside!

A couple of catalysts for BRY

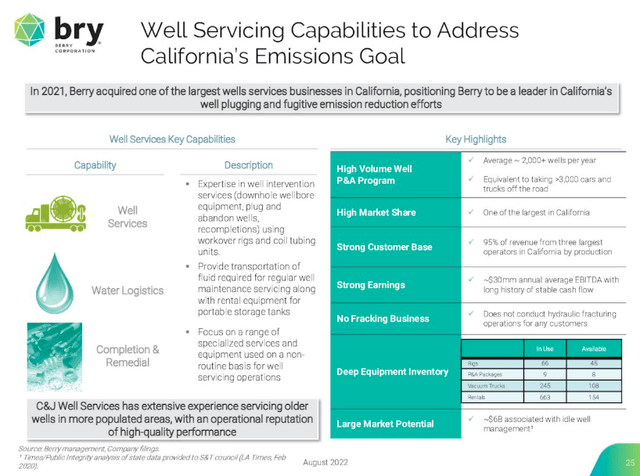

I continue to think BRY’s acquisition of C&J Well Services is a positive for the company. Fernando Aurajo, CFO commented on the impact of well servicing:

We improved our capital efficiency by allocating more resources to working over existing wellbores in Q2, which is our most efficient use of capital.

So far this year, we have completed 169 workover jobs with a rate of return greater than 100% for the program. Also in Q2, we began implementing a robust surveillance program, which includes enhanced data gathering and reservoir management. The program helps us maximize oil recovery from our fields, has generated additional work over scope and is helping us optimize new wealth placements. This is another effective way to enhance base production performance.

Workovers in California fall into a few categories. Most commonly the shallow, unconsolidated reservoirs load up the tubing with sand and have to be cleaned out with coil. Scale deposits can also reduce production and require an acidizing treatment. Poor-boy gravel packs are installed to minimize sand production. This involves pumping sand around a screen to put a layer of sand sized to restrain friable formation sand. There are a few other common treatments as well. All are low cost, and if they return the well to production, well worth the time and treasure. Being able to do this internally is a plus for BRY.

There is also the ESG codswallop with which to contend in the Golden State. Genuflecting in that direction is good for relations with state regulators.

BRY Workover business (Seeking Alpha)

The company is also making some progress on alternative completion methods for their thermal diatomite fields. Trem Smith, Berry CEO noted this in the call:

The wells target our Thermal Diatomite reservoir in North Midway Sunset field, using a new development concept that takes advantage of existing reservoir energy.

In short, the wells leverage the heat from existing thermal steam operations and therefore do not need new steam injection. This application opens up a lot of exciting potential and with continuous success represents an important opportunity for Berry.

If you follow Berry you are probably aware that last year the intrepid Governor of California signed an order banning steam injection and other “risky” completion techniques, essentially moth-balling a significant portion of BRY’s California assets.

It seems like they’ve engineered a workaround to the ban which could reopen the Midway-Sunset area for new wells. That’s why we have engineers.

Q-2, 2022

Adjusted EBITDA, on a hedged basis, was $110 million in the second quarter 2022. This represented a 52% increase compared to $60 million in the fourth quarter 2021. The increase was largely the result of higher oil prices and lower greenhouse gas costs, partially offset by higher hedged fuel costs and lower production due to property divestitures.

The Company reported daily production of 26,200 boe/d for the second quarter 2022,with 24K of that in liquids. When adjusted for divestitures and acquisitions, this was a modest decline compared to the first quarter of 2022. The Company’s oil production for the first quarter 2022 was 26,700 bbl/d, or 91% of total production.

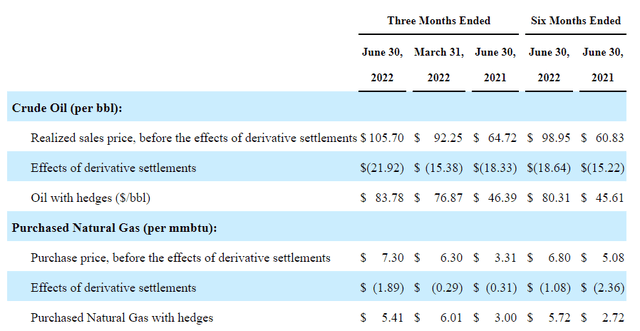

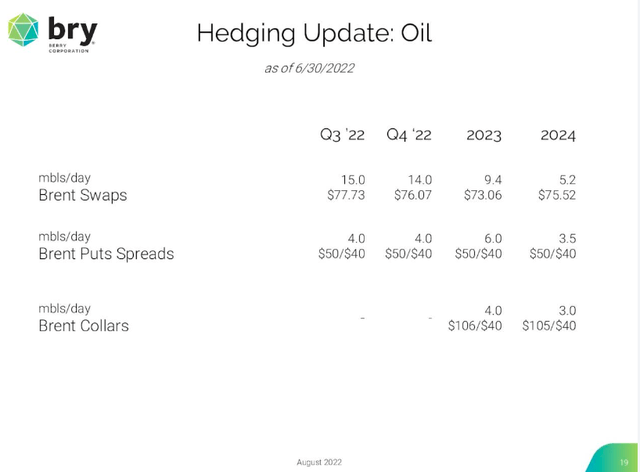

The Company-wide hedged realized oil price for the first quarter 2022 was $77 per bbl, essentially flat from the prior quarter. This covered about 60% of their production and continues throughout the year.

The California average oil price before hedges for the second quarter of 2022 was $105.70 per bbl, reflecting approximately 95% of Brent, which was 12% higher than the $92.25 per bbl in the first quarter of 2022, also approximately 95% of Brent.

BRY Crude Realizations (BRY Filings)

Liquidity consists of ~$52 mm in cash, up 1.5X from Q-1, and availability of $193 on their RBL. Long term debt is managable at $394 mm.

BRY has $150 mm in stock repurchase authority. They used $23 mm in Q-2 to buy 2 mm shares. It must have been in early June as that works out to $11.5 per share. If they’d only waited a month! That is commonly the way it works out with these deals.

Risks

Any expectation of improvement in BRY is hedged to the current oil price regime. That sounds obvious, but I have to say it.

The political environment is ever present in California and permits could become an issue. Trem Smith, CEO commented they were fully permitted through June, but noted they were not having any difficulty getting them. That appeared to have degraded during the second quarter with the company noting delays in permitting that had necessitated shifting to the workover program to maintain output.

The oil price has also pulled back sharply from Q-2 highs and this will result in realizations declining toward Q-1 levels. We don’t think this will have a material effect on the stock from current levels, but the variable dividend will be moderately impacted for Q-3.

Your takeaway

BRY’s EV/EBITDA multiple is pretty low at ~2.5X. The stability of their production assures that they can meet ~90% of their forecast baseline production from existing wells. It remains to be seen if workovers can drive another 3-5K BOEPD. The decline in oil prices also will put some shade in the cash flow story if this sub-$90 regime holds for very long.

Their price per flowing barrel is also in a sweet spot at $35K per barrel.

The company was trading above $11 in early June, when the oil price sentiment shifted to sharply negative. We think that has about run its course with prices firming the high $80’s, and our expectation are that it will move back toward the $100 level where it hovered for most of Q-2. We discussed this thesis in an article last month, and nothing has altered it to this point.

I think BRY makes a compelling investment case $sub-$10 for investors willing to assume the “California” risk for fun and profit.

Be the first to comment