Paul Morigi/Getty Images Entertainment

Warren Buffett and Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) have been busy in the first quarter of 2022. The company has acquired a significant stake in Occidental Petroleum (NYSE:OXY) (OXY.WS) and announced the acquisition of Alleghany (Y) last week. I figured an update was in order.

Investment Thesis

Berkshire Hathaway is finally starting to put some of its cash to work. They recently announced the acquisition of Alleghany for $11.6B in cash and have been building a significant stake in OXY in the first quarter of 2022. OXY has had an impressive start to 2022 as shares have nearly doubled. Despite the outperformance, shares are still reasonably valued today. Some investors have speculated that Berkshire might look to acquire the whole business, and I think that it is definitely a possibility. It would probably take at least $70 a share or higher for an acquisition offer. Either way, I think both Berkshire and OXY offer double-digit upside for investors today.

Alleghany Acquisition

Berkshire announced that it will be acquiring Alleghany last week. I think it’s a good use of the cash mountain on Berkshire’s balance sheet and should fit right in with the company’s current operations. My favorite piece of the news on the acquisition had to do with the purchase price. Berkshire is paying $848.02 per share, which seems like an odd amount at first. This amount is $850 per share minus the $27M in fees paid to Goldman Sachs (GS). This shows the disdain Buffett has for the Wall Street vultures and is another reason Berkshire is the only financial I own.

Occidental Petroleum

Buffett has also been adding aggressively to Berkshire’s position in Occidental Petroleum. Berkshire now owns just under 15% of OXY’s common shares, but they also have a large chunk of preferred stock related to OXY’s acquisition of Anadarko in 2019. The warrants that Berkshire holds would allow the company to buy 84M shares of OXY just under $60 a share and would put Berkshire’s stake well above 20% of the company.

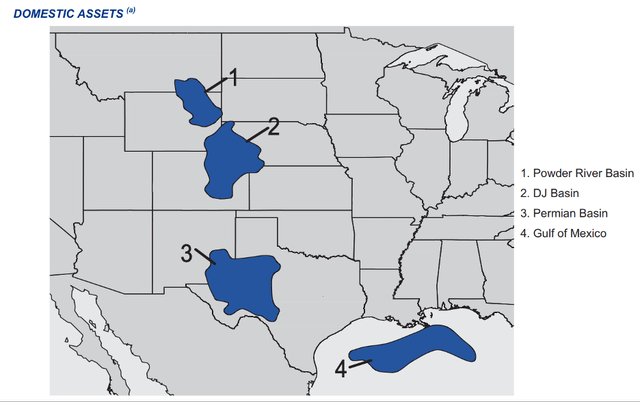

For some background, OXY is one of the large oil companies in the US and has significant operations in the US, primarily in the Permian Basin. While their acquisition of Anadarko left them overleveraged and forced a dividend cut in 2020, it also left them with some of the best assets in the US. Shares have already had a huge run in 2022 (up 89% YTD), but they still aren’t overly expensive in my opinion. I have talked with my uncle (a long-suffering OXY shareholder who had the foresight to load up on shares and warrants in 2020) and we both agreed that the share prices of major oil companies like OXY are lagging the actual price of oil. Energy giants like Chevron (CVX), Exxon (XOM), and OXY are printing money with oil over $110 a barrel. To be fair, I don’t think Chevron or Exxon is quite as cheap as OXY right now, but I still think energy giants are a good way to get exposure to an inflationary trade.

OXY US Assets (oxy.com)

There has been some speculation that Berkshire is preparing to acquire all of OXY as they continued to build their stake in the first quarter of 2022. This was another piece I talked about with my uncle because he is familiar with the energy industry. He thinks that Berkshire won’t acquire OXY, but if they do, it would have to be at $75-80 a share. I lean a little bit the other and I think that they might acquire OXY, but either way, I’m still bullish on Berkshire and OXY at current prices.

Valuation

Valuation can be tricky when it comes to oil companies, as it can be very dependent on the price of the underlying commodity. Like I mentioned earlier, the oil majors are making huge amounts of money with oil over $110 a barrel. I think there is further upside in OXY, especially if oil prices remain elevated. Based on what I know about the supply picture for oil, I think that the current oil prices are here to stay, and we might be wishing for $110 oil in a year or two.

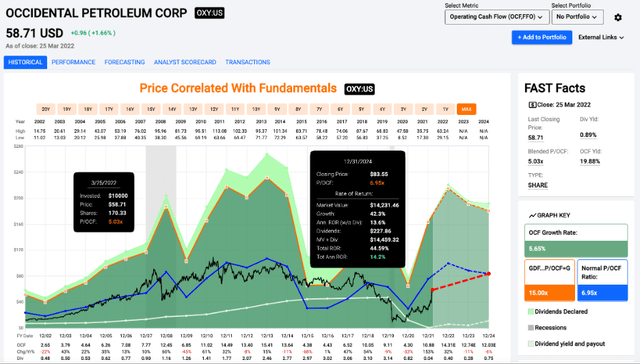

While OXY also looks cheap on an earnings basis, I think using cash flow makes the most sense here. Shares sit just over 5x cash flows, with a normal cash flow multiple of 7x. The biggest risk is that a significant drop in oil prices leads to a drop off in cash flow, but I think the downside risk is limited at the current valuation and oil prices.

Price/Cash Flow (fastgraphs.com)

Berkshire has also had a strong start to 2022, with shares up 18% YTD. I think shares are still attractive, but I’m not looking to add to my position right now. I still think investors buying today are looking at forward returns in the double digits, but there are other companies that look more attractive to me right now. The biggest thing that I’m excited about as a Berkshire shareholder is that the company is starting to put some of their cash to work with the acquisition of Alleghany and the significant stake in OXY.

Conclusion

Whether OXY is acquired by Berkshire or not, its business has been improving significantly in 2021 and 2022. The company has been reducing debt at the same time as hiking the dividend for the first time since the cut as well as buying back stock. Investors that want to hop on the inflation train with a pick in the energy sector are likely to see that OXY still has more room to run. I think we are probably going to see increased dividends and buybacks, especially if oil prices stay elevated.

I’m not sure if Berkshire will push for acquiring the whole business, but if they do make an offer, I think it would probably have to be at least $70 per share and could be significantly higher. Berkshire still has a mountain of cash to work with, but they are finally starting to put it to work with the acquisition of Alleghany and the OXY stake. I’m still bullish on Berkshire, and I’m curious to see how this situation with OXY plays out. I can see pros and cons of acquiring the whole business, but either way, I think Berkshire and OXY will outperform the broader market in 2022. I plan to hold Berkshire for a long time, and I’m bullish on the future of OXY as well. Investors with a long-term time horizon can buy both businesses and expect double-digit forward returns.

Be the first to comment