kameraworld/iStock Editorial via Getty Images

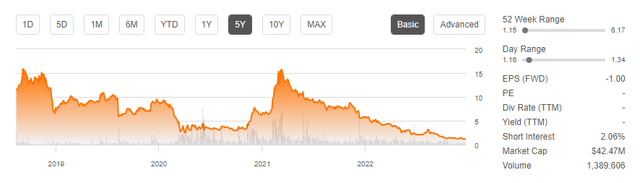

At the time of writing shares of Mesa Air Group (NASDAQ:MESA) are trading 11% higher following the news that it’s restructuring capacity agreements with American Airlines (NASDAQ:AAL) and United Airlines (UAL), which will see the airline exiting the agreement with American Airlines by April 2023. While higher share prices are good news, it’s hard to see why the pop in share prices will be sustained as I discuss in this report.

Regional Airlines Lead The Recovery In An Idyllic World

When the world went into a lockdown in March 2020, the global airline fleet was grounded and billions of dollars were lost. Losses in 2020 were $137.7 billion, according to IATA, followed by a $42 billion loss in 2021. So, not much to cheer about for airlines.

Regional airlines were seen as the tiny bright spot as the recovery would progress from smaller networks and aircraft sizes to the bigger ones. That makes a lot of sense. The expectations were that as air travel would ramp up, local communities were the first to be connected again using smaller aircraft. Those aircraft are in the fleet of regional airlines.

So, regional airlines had a superior positioning. Regional airlines became even more attractive due to their pass-through nature of costs, which Mesa Air Group also highlighted in a filing:

Our capacity purchase agreements also shelter us from many of the elements that cause volatility in airline financial performance, including fuel prices, variations in ticket prices, and fluctuations in number of passengers.

So, regional airlines are shielded from major fluctuations in air fares and fuel price fluctuations. So, there’s significant shielding on revenue and cost level and together with the recovery path flowing from regional operations to long-haul operations that boost the stock prices of regional carriers. By Q1 2021, share prices had recovered to pre-pandemic levels.

Welcome To The Real World: American Airlines Dislocates Regional Airlines

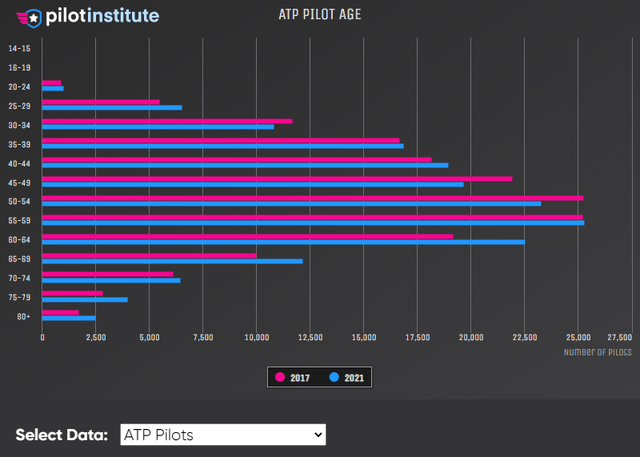

After Q1 2021, the music stopped for regional airlines. To understand the reason, we have to look at the age of pilots. In 2017, 66.5% of the pilots were in the 40-64 age band and by 2021 this was 64.5%. Relatively speaking the pilot pool got a big younger. However, the reason is one that was clear for years. Pilots who were trained as fighter pilots decades ago and transitioned to airline operations are now retiring which naturally means the pilot pool gets younger.

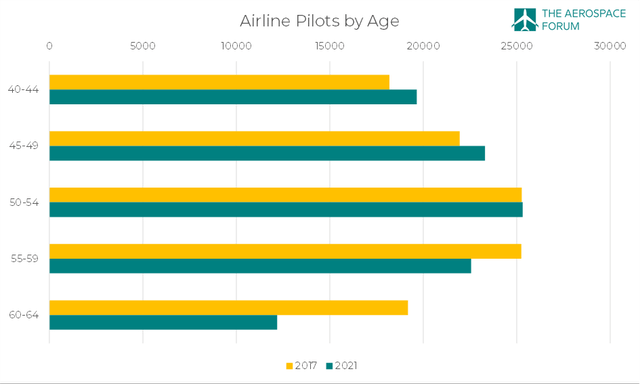

If we were to compare the 40-64 age band between 2017 and 2021, we would see that there virtually is no difference in the absolute number of pilots between 2017 and 2021. However, if we shift the age band by one cohort to account for the aging effect, the problem becomes clear. In the 40 to 49 years bands we see increases in the number of pilots. However in the 50-54 years group it is stable and in the 55-64 years group we see significant declines. What caused this decline? Very simple: Early retirements. During the pandemic, many airline pilots retired early and airlines were OK with that. Demand was not expected to pick up any time soon and early retirements removed pilots from the payroll, so airlines, all of which were looking to manage costs, happily facilitated early retirements. While the mandated retirement age is 65 we see that in the 55-64 bands there were nearly 10,000 pilots less. This was a 20% reduction in those two age bands and a 7% net reduction for the 40-64 age group.

So, by 2021 and even more so in 2022 the one thing that airlines had feared for a long time turned into reality: Pilot shortage. This fear became reality due to the pandemic and the associated early retirements. So, mainline carriers that had previously facilitated early retirements started fishing in the pool of regional airlines. Another natural consequence was that as supply was constrained and demand was high, pilot pay would go up.

That’s what ultimately wrecked regional airlines. Regional airlines mostly use younger pilots with lower pay and those pilots became high in demand for mainline carriers which offered a juicier pay. With no short-term solution to counter the attrition, regional airlines were left with a shortage so big they could simply not fulfill contracted flight services. American Airlines further dislocated the regional airline pilot sphere by offering pay at its fully-owned regional carriers in line with the bottom pay scales at the mainline carrier while not-funding to the same rate for the regional airlines that are contracted but not owned. This stopped attrition at those three airlines as the financial incentive to move from regional airlines to the mainline carrier was virtually eliminated and it increased pressure on other regional airlines in several ways.

So, the mainline carriers are still seeking pilots but those pilots are not coming from the three owned regional airlines. As a result, the pressure on Mesa Air increased. It was set to lose even more pilots to mainline carriers and on top of that even for regional airline pilots it became attractive to work for the American Airlines owned regionals. Mesa Air Group got slammed from multiple sides and the only thing it could really do is hike the pay to stop the bleeding, but it would come literally at a cost as staff pay are not part of costs that can be passed through under the capacity agreements with mainline carriers.

That’s also why I don’t believe the capacity agreement termination with American Airlines is a reason to be cheerful or for share prices to be trending upwards strongly. The shortage remains and the sharp increase in expected pilot pay is still an overhang.

Mesa Air Group Strengthens Ties With United Airlines

Mesa Air Group

The termination of the agreement seems to be the result of mutually directed frustration. Mesa Air Group was frustrated with American dislocating the regional airline pilot pool by hiking regional pay and fishing from that pool while also punishing Mesa Air Group financially for not being able to execute the contracted capacity.

Derek Kerr, American’s chief financial officer, said in a memo:

Mesa Airlines has experienced various financial and operational difficulties this year. We have concerns about Mesa’s ability to be a reliable partner for American going forward.

Mesa Air Group already strengthened its ties with United Airlines earlier this year opening a career path toward United Airlines, which should allow for a more predictable and controlled outflow of pilots. Mesa Air would be a part of this career path. With the termination of the agreement with American Airlines, at least one headache is coming to an end as Mesa Air was losing approximately $15 million per quarter virtually eliminating all of Mesa’s profits.

So, that comes to a halt now. We don’t know how much losses at Mesa will reduce as a result, if at all but the regional airline announced it will transfer some of the capacity from American Airlines contracted operations to United Airlines contracted operations by March 2023 ending the relation with American Airlines by April 2023. To bolster the financial position, leases have been restructured while an earlier agreement for the sale of 8 CRJ-550 jets to United Airlines has been finalized while 11 CRJ-900s are being sold to a third party. So, Mesa has cut ties with American Airlines and put in place an agreement with United Airlines while strengthening its liquidity by selling aircraft.

Conclusion: Proceed With Caution On Mesa Air Stock

While the termination of the agreement with American Airlines seems to be a good one, it does that there will be significant losses on the American Airlines until they conclude in 2023. On top of that we don’t know how profitable (or not), the capacity agreement with United Airlines will be. What we do know is that things have gotten to the point where the airline is selling assets to raise cash and service debt and that is never a good place to be in.

Since I first covered Mesa Air Group shares have tanked 50% while the Wall Street consensus target hinted at share prices roughly doubling. It could be that share prices have hit rock bottom now, especially after share prices tanked on the news that Mesa Air Group would delay its fourth quarter earnings release last week. That announcement caught the market by surprise but is almost certainly related to today’s announcements of the capacity agreement restructuring which the market did not quite seem to like as share prices ended the day on a lower note and almost 12% lower from the intraday higher after surging over 11% earlier in the day. While this could be the absolute bottom for Mesa Air Group, we’re not given enough information that provides confidence to turn bullish on the stock.

Be the first to comment