guvendemir

Bitcoin (BTC-USD) and the broader crypto sector across alts, blockchain tech startups, DeFi players, and digital mining companies have been nothing short of a disaster. From the strong momentum for much of 2021, BTC fell nearly 75% from its high when it briefly traded under $18,000 amid the broader market selloff last month. Favorably, the trading action has turned more positive and we have several reasons to believe that “the low” is in. We last covered Bitcoin back in May, heralding the start of a “crypto ice age“. While that article worked at the time, signs of a crypto spring thaw with a new outlook that this current rally has legs warrant an update.

We Saw A True Capitulation in Bitcoin

We likely saw a true capitulation in June. When BTC moved under $20k, the volatility effectively wiped out gains from any investor purchase since Q4 2020 when Bitcoin first took out the old 2017 highs. This is important because the move worked to wring out the speculative “hot money” into the sector while also consolidating positions into more committed investors. Holding ~$20k was a big deal with the result being that BTC has now formed a strong bottom of support.

source: finviz

As a recap, the headlines have been brutal. This year we’ve seen major crypto players collapse, including crypto-lending platform Celsius which at one time noted it had over $25 billion in assets under management. The brokerage platform, Voyager Digital Ltd. (OTCPK:VYGVQ) is another example of a recent sector bankruptcy. There was also the crash of stable coins like TerraUSD (UST-USD) losing its peg to the Dollar. In this regard, it’s impressive to us how well Bitcoin has helped up over the past 2-3 months despite all these pressures.

If the apocalyptic bearish calls for BTC to become worthless and trade down to zero were to come true, this was the time for it to happen, yet here we are as BTC is currently up over 35% from its recent $17,592 low and over 20% higher in just the past week. A report from Coinbase Global Inc (COIN) which said it does not have any exposure to bankrupt firms provides some confidence that the sector is ready to move forward and the worst days are in the past.

source: finviz

Bitcoin’s Underlying Strength

The latest feather in its cap is from Tesla Inc (TSLA) quarterly report when the company noted it had liquidated 75% of its holdings to raise nearly $975 million in cash to deal with corporate liquidity purposes. BTC continued trading higher on the day despite the report. The support of crypto from Tesla CEO Elon Musk was long seen as a major boost to the asset class credibility and it’s encouraging to see BTC brushing aside this surprising turn of events.

In many ways, the combination of all these developments and Bitcoin’s ability to survive help reaffirm its more structural long-term bullish thesis. Fundamentally, the strong factor supporting an outlook for a higher price of Bitcoin over the long-run is its supply limit of 21 million coins, while over 19 million have already been mined.

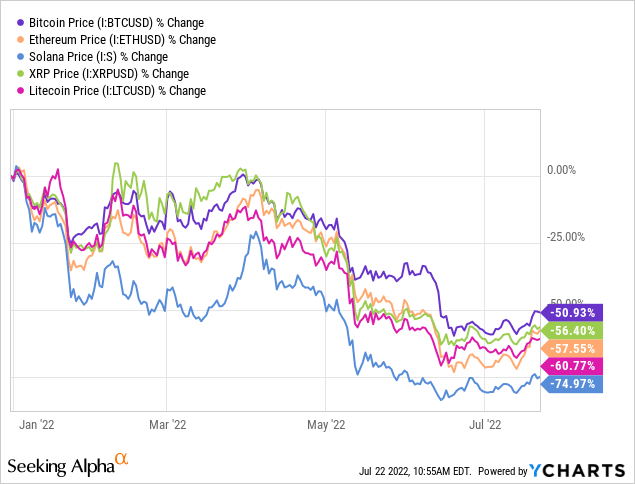

The reality is that digital assets and related blockchain technologies still have enormous potential which will generate an organic level of demand growth as digital payments and transaction volumes climb. Web 3.0 incorporates concepts like decentralized finance and blockchain platforms that are still in the early stages. Bitcoin here benefits as the “gold standard” of crypto as evident by its outperformance of several other high-profile alternative cryptocurrencies this year

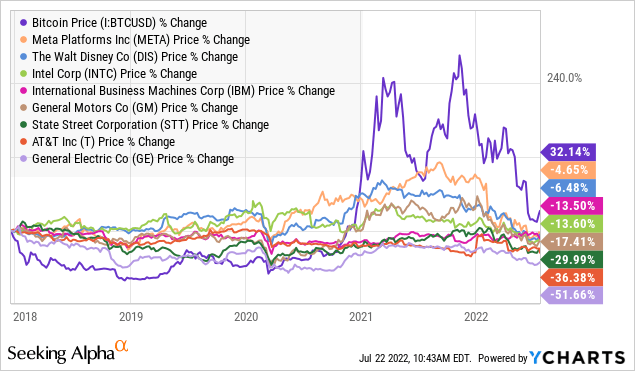

As it relates to volatility, the moves are all relative. Considering Bitcoin’s performance since its December 2017 high, nearly 5-years ago, someone loading up on BTC that day would be sitting on a 32% gain while several “blue-chip” S&P 500 stocks are down over the period. BTC has also outperformed most major market indexes since 2019. The aspect of Bitcoin being a store of value is still in play.

We See Bitcoin Climbing Back Above $30,000 In 2022

We are bullish on Bitcoin, but we don’t see any scenario for a heroic “v-shaped” recovery. The all-time highs are likely out of reach for the foreseeable future but we can take it one step at a time. It likely won’t be a straight line higher but we highlight 3 reasons to expect more upside from the current level.

- The ability of Bitcoin to weather the onslaught of negative headlines reaffirms the underlying strength of its long-term bullish thesis.

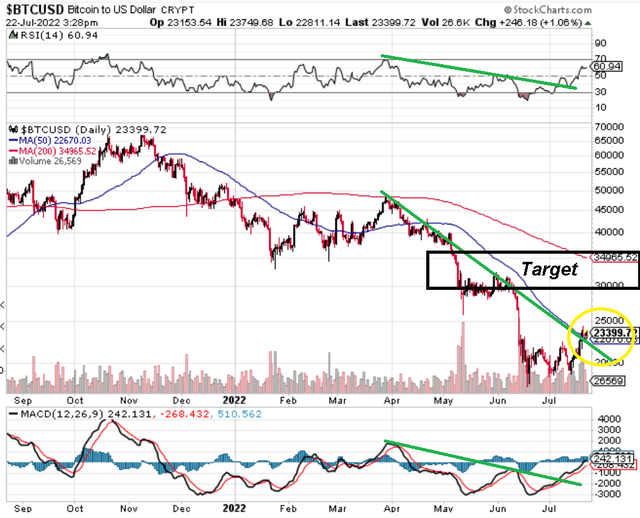

- Bitcoin capitulating under $20k suggests the bottom is in place with a compelling chart setup for continued momentum.

- Positive shifting macro dynamics including pullback in US Dollar.

We like to use technical analysis in conjunction with fundamental developments. Ultimately Bitcoin will need stronger sentiment toward risk-assets to really build momentum and breakout significantly higher. We can look for to the July CPI report in early August that may confirm inflation has peaked and is ready to trend lower. From there, a sense that the Fed’s strategy is working may ease up further rate hike expectations and support a narrative towards a macro rebound. An early signal would be a pullback in the dollar compared to its recent strength.

This week, a key headline was the European Central Bank moving to hike the Euro policy rate by 50 basis points, the first increase in a decade. This is important because it works to support the Euro against the Dollar through a narrower interest rate differential. Bitcoin as a cryptocurrency traded against the Dollar can end up benefiting from USD Index weakness from here.

source: finviz

First, we note that BTC currently at $23,350 is trading above its 50day moving average, breaking out of a downtrend channel that had been in place since April. Similarly, the relative strength index (“RSI”) above 60 along with the moving average convergence divergence (MACD) momentum oscillator implies the bulls are regaining control. From here, $30k as upside resistance and eventually the $35,000 level representing the 200day moving average are the next targets.

source: stockcharts

Final Thoughts

it’s always worth covering the risks with an understanding that the segment remains speculative with ongoing volatility. A deterioration in the macro environment from here could open the door for another leg lower in BTC through financial contagion. There is also the possibility that global governments take a more assertive effort to regulate or even ban digital assets which would undermine some of the long-term bullish cases in crypto.

Being a crypto investor has been tough, but the takeaway here is that calls for its demise and the end of crypto may turn out to be wrong – again. There is still a bullish case with significant upside potential looking out over the next several years. In the near term, the $20k range of price support will be a critical level to watch.

Be the first to comment