Gwengoat/iStock via Getty Images

Investment Thesis

Bed Bath & Beyond (NASDAQ:BBBY) is a home furnishings retailer operating primarily in the U.S., but also in Canada, Puerto Rico, and Mexico. The company currently has a little less than 1,000 stores, consisting of Bed Bath & Beyond, Buy Buy Baby and Harmon Face Values, the latter of which is probably less well-known and offers branded and private label personal care and beauty products at a good value. I have analyzed the company in 2018, when it already announced an updated strategy aiming at a cleaner shopping experience, better omnichannel experience, and streamlined inventories. BBBY still appears to be in turn-around mode, however, and provided another updated strategy in late 2020, when the company was still licking its wounds of the pandemic and related government-mandated store closures.

In the midst of the Meme stock frenzy, buyers drove the stock price to $45, and I briefly felt like I had missed out, having sold my position much earlier. However, fears of a recession and waning interest in Meme stocks brought the share price back to more meaningful levels, and it has even been testing the March 2020 lows. The most recent decline is largely due to the departure of former CEO Mark Tritton, who obviously failed to successfully turn the company around – BBBY recently reported a 23% comparable sales decline for the first quarter of fiscal 2022 and margins continue to contract.

Since peaking in mid-2021, BBBY’s share price has fallen nearly 90%, so one might rightly ask whether the stock is now a compelling deep value pick. After all, the company is trading at just 0.05 times fiscal 2021 sales. In this article, I will explain why I decided against investing in the company, even though it is exceptionally cheap, at least from the perspective of price-to-sales.

Margins Are A Company’s Lifeblood

As a retailer, it is not surprising that BBBY operates on relatively thin margins. However, when I analyzed the company four years ago, BBBY’s level of margin erosion was already quite advanced as the company continued to rely on discount membership programs, engaging in a race to the bottom with e-commerce giants like Amazon (AMZN). Management was likely looking for the easy way out to stabilize its sales rather than transforming the shopping experience at BBBY in a timely manner, thereby creating a small but still important economic moat in the highly competitive retail environment.

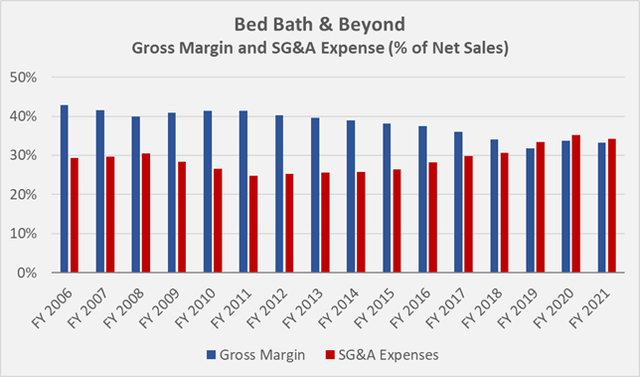

The company’s lacking operating performance is best illustrated by Figure 1, which shows the historical development of BBBY’s gross margin and sales, general and administrative ((SG&A)) expenses as a percentage of net sales. This is a textbook example of how a company’s financials should not develop.

Figure 1: BBBY’s gross margin and sales, general and administrative expenses, as a percentage of net sales (own work, based on the company’s fiscal 2006 to fiscal 2021 10-Ks)

It is important to note that BBBY was in a much better position during the Great Recession and was actually operating from a position of strength, highlighted by gross margins of well over 40% and SG&A expenses of less than 30% of net sales, resulting in a theoretical operating margin of 10%. In addition, the company had no debt (other than operating and finance lease obligations). During the Great Recession, BBBY’s profit margins shrank, but its gross margin stabilized at a very respectable 40%. Most importantly, the company managed to grow sales during these turbulent times, at a compound annual growth rate (CAGR) of nearly 6% between fiscal 2006 and fiscal 2009.

The years after the Great Recession, BBBY continued to grow its top-line at a – for a retailer – very respectable rate of 5.8% per year on a compounded basis and between fiscal 2006 and fiscal 2017, the year in which sales peaked. However, BBBY’s sales growth occurred primarily in the earlier years of the 2010s, and declined since fiscal 2014. Management temporarily stabilized growth in the low single digits by providing quasi-permanent discounts, but sales have been trending downward since fiscal 2018.

Poor operational performance and the failure to right the ship in the late 2010s now weigh heavily on BBBY. The company continues to report declining sales ($9.2 billion in fiscal 2020, primarily due to the pandemic, and worse, $7.9 billion in fiscal 2021), and the first quarter of fiscal 2022 does not inspire confidence either, with net sales of about $1.5 billion, a 23% comparable sales decline. Free cash flow (FCF) turned negative in fiscal 2021, and it is likely to remain negative or only marginally positive in fiscal 2022, considering that interim CEO Sue Gove has announced aggressive action on inventory (i.e., extended markdowns). It may sound a bit harsh, but the measures announced on slide 7 of the recent earnings presentation give the impression that management waited until the last moment. Obviously, not much has changed for the better since Steven Temares stepped down in 2019.

Of course, the pandemic and, in particular, the associated measures to contain the spread of the virus hit retailers like BBBY disproportionately hard. Unlike many of its competitors, however, BBBY failed to capitalize on the opportunities when consumers were finally able to return to the stores. I believe that 2021 was an extremely important year in which consumers learned where to get the best value for their money and the best shopping experience on a reliable basis. Names of retailers like Target (TGT, see my recent article) come to mind.

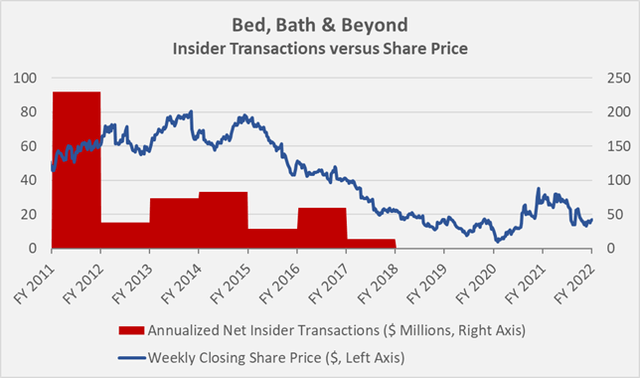

Don’t Be Fooled By Insider Purchases

Insider purchases can be a leading indicator of a successful turn-around. BBBY insiders were net buyers of company shares in both fiscal 2020 and fiscal 2021, purchasing $568,008 and $2.54 million worth of shares, respectively.

However, I would be careful not to overemphasize these transactions for several reasons.

EVP and COO John Hartmann sold 45,000 shares worth $1.4 million in mid-2021, some of which he bought back earlier this year for less than half the price. The fact that he only bought back $100,005 worth of shares suggests this was a window dressing transaction. EVP and Chief Merchandising Officer Joseph Hartsig also sold shares in mid-2021 for $311,285. Like his colleague, he bought shares in January 2022. This transaction can also hardly be considered meaningful, as the value of the shares traded was $68,900 – less than a quarter of the proceeds from the previous sale.

In addition to these filings, I examined all other Form 4 filings with the Securities and Exchange Commission (SEC) since 2011 to get a sense of BBBY’s long-term insider behavior. Including sales related to the exercise of granted options, insiders sold a total of $529 million since the beginning of 2011 (Figure 2). Excluding option-related sales, insiders have still sold a staggering $113 million.

Figure 2: Net insider transactions at BBBY; note that the net transaction volumes in 2020 and 2021 are not visible due to their comparatively small size of $0.57 million and $0.79 million, respectively (own work, based on form 4 filings by company insiders and BBBY’s weekly closing share price)

It may be true that the fact that corporate insiders did not start buying shares until mid-2020 is in itself a positive sign. However, the value of shares purchased ($3.1 million) seems downright paltry compared to the number of shares sold by insiders over the last decade. To be fair, it could be argued that former executives Temares ($146 million) and Castagna ($24 million) accounted for the bulk of the sales transactions. Nevertheless, BBBY continues to struggle to assemble a solid management team, highlighted by the recent departure of CEO Tritton. This is certainly far from an ideal basis for navigating such difficult times.

Share Repurchases And The Likelihood Of A Buyout

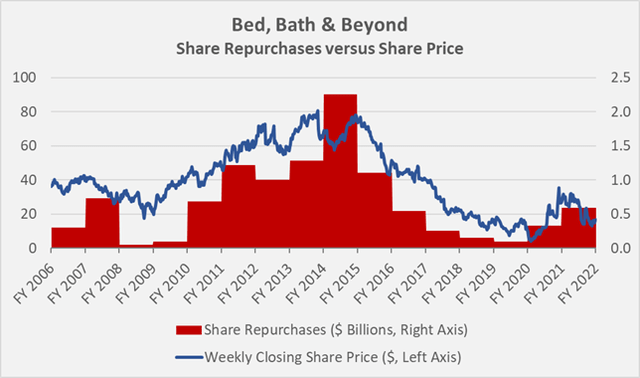

BBBY repurchased a considerable amount of its own shares especially in the early 2010s. Since fiscal 2006, the number of weighted average shares outstanding declined by 65% and as a result, earnings per share increased almost three-fold.

However, the buybacks came at a significant cost, as shown in Figure 3 – the timing of the buybacks by management was certainly suboptimal. It may not be entirely fair to call the buybacks pure malinvestments given the company’s much better prospects in the early 2010s, but it should still be kept in mind that insiders sold very large amounts of stock during the same period, in fact contradicting the company’s capital allocation strategy. It should also be remembered that the company took on $1.5 billion in debt in fiscal 2014. In the same year, the company spent $2.25 billion on share buybacks – at a time when the share price reached its peak of $80.

Figure 3: BBBY’s share repurchases since fiscal 2006 (own work, based on the company’s fiscal 2006 to fiscal 2021 10-Ks)

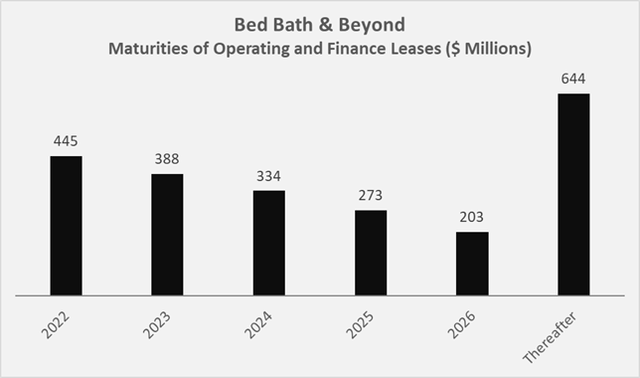

With the greatly reduced number of shares outstanding, BBBY could become a takeover target – the company’s current market capitalization is only $375 million. However, I do not believe an investment thesis should be formed based on a potential takeover of BBBY, as its enterprise value is still significant. The company is still burdened by the debt it has taken on to finance part of what I believe to be excessive share repurchases, and including operating and finance leases, BBBY’s enterprise value is $3.5 billion. The maturity profile of the company’s mostly operating lease liabilities (Figure 4) is another reason not to overstate the potential of a buyout. Recent news of Kohl’s (KSS), which ended its strategic review of a potential sale due to the “current financing and retail environment” suggests that such transactions could indeed become less common in the future.

Figure 4: Maturity profile of BBBY’s undiscounted operating and finance leases (own work, based on the company’s fiscal 2021 10-Ks)

Concluding Remarks

Shares of BBBY have completed their roundtrip and can now be purchased at a price last seen in early 2020 – the stock is priced for disaster. I considered opening a speculative position since the shares are so cheap, but ultimately decided against it for several reasons.

The company is in constant turn-around mode and still struggles for direction, as is underlined by the recent departure of yet another CEO. At least, the company has closed underperforming stores and reduced the total number of stores to less than 1,000 (compared to 1,500 at the end of 2019) and continues to extend on its private labels. Inventory management at BBBY remains far from optimal, and ongoing supply chain issues exacerbate this problem. In addition, much of the goods sold by BBBY is discretionary and I cannot see where the company excels in the highly competitive retail sector. In the current inflationary environment, the company’s margins will likely continue to suffer, given its position as a middle man without much bargaining power due to its relatively small size. The fact that BBBY failed to capitalize on opportunities when consumers were finally able to return to stores says a lot about the company’s positioning and management’s capabilities.

Therefore, I think it’s different this time. Unlike 2018-2020, when a short-term speculation on a turn-around had its justification, I believe the risk that BBBY will not be able to meet its obligations in the event of a prolonged recession is actually heightened. Consumers are increasingly cost-conscious, and BBBY fails to stand out from the crowd – worse, it sells largely discretionary (or at least temporarily discretionary) goods. Buffett once said, “You never know who’s swimming naked until the tide goes out.” – I suspect BBBY is such a candidate.

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.

Be the first to comment