Michael M. Santiago/Getty Images News

According to Britannica, confirmation bias is the tendency to process information by looking for, or interpreting, information that is consistent with one’s existing beliefs. As investors, confirmation bias is something that we need to get rid of to remain objective. Being objective, in return, helps us make prudent investment decisions even if such decisions do not immediately sound pleasing to us.

Although I was a believer in Bed Bath & Beyond Inc. (NASDAQ:BBBY) for more than a couple of years through early 2021, I decided to book my gains in January 2021 as BBBY stock price shot up with the meme stock saga. In my most recent article published on the company in March, I highlighted several challenges faced by the company and concluded that I will steer clear of Bed Bath. After carefully evaluating recent developments objectively to avoid confirmation bias, I still feel many of my findings confirm that Bed Bath stock offers more risk than reward even at these depressed prices.

Where Are We Today?

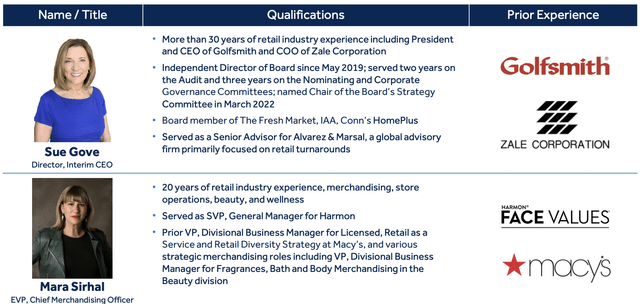

The retail industry has had a difficult start to 2022 as supply chain disruptions and rising transportation costs have led to a decline in sales. Bed Bath & Beyond stock is down 71% this year so far, and the disappointing fiscal first-quarter results released on June 29 did not help the company gain any momentum. Adding salt to the wound, the company announced the departure of its CEO Mark Tritton as well, to which the market responded by thrashing BBBY stock. Board member Sue Gove, a former retail executive and expert in retail restructuring is currently serving as the interim CEO.

Exhibit 1: Executive leadership changes

Bed Bath stock is back to its March 2020 lows after losing more than 85% of its market value from the highs of close to $50 seen at the height of meme stock mania. The company is attempting to turn things around by changing its management team. However, the current economic environment and the company’s market position indicate that the turnaround will be difficult, and I believe this expected turnaround is unlikely to happen anytime soon.

Bed Bath & Beyond’s Struggles Continue

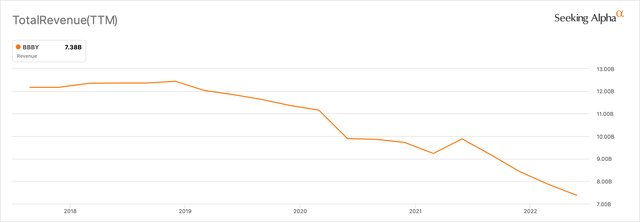

Bed Bath & Beyond reported a net loss of $357.7 million for the fiscal first quarter, topping the previous year’s loss of $50.9 million. The company reported a 25% drop in net sales to $1.463 billion from $1.954 billion in the corresponding quarter last year due to ongoing macroeconomic challenges, a shift in consumer preferences, rising inflation, supply chain challenges such as higher port fees, and considerable fluctuations in inventories. Comparable sales in Stores fell 24%, while Digital sales fell 21% compared to the fiscal first quarter of 2021. Declining sales is not something new for Bed Bath. As illustrated below, the company’s struggles to achieve growth have not improved over the last 5 years.

Exhibit 2: Total revenue (TTM)

The company opened five BuyBuy BABY stores during the quarter and closed two Bed Bath & Beyond stores and one Harmon store. Bed Bath operated 955 stores as of May 28 including 769 of its own brand stores in 50 states, the District of Columbia, Puerto Rico, and Canada; 135 stores under the BuyBuy BABY name; and 51 stores under the Harmon, Harmon Face Values, or Face Values names. The company plans to ditch its new store and remodeling program in order to clear out surplus inventory while it looks for ways to strengthen its business. As a result of these decisions, projected capital expenditures for fiscal 2022 need to be cut down from an earlier projection of about $400 million to around $300 million. After depleting its reserves and using $200 million from its credit line, the retailer ended the May quarter with roughly $100 million in cash.

BBBY’s 3-Year Transformation Plan Has Led To More Cash Burn

Bed Bath continues to struggle in putting together a strong management team, as seen by the most recent departure of yet another executive. Mr. Tritton joined Bed Bath & Beyond in 2019 after serving as Target Corporation’s (TGT) chief merchandising officer and introduced a three-year transformation plan that, based on financial results, was unable to help the company recover.

Plans for transformation included the closure of 200 stores as well as a $1 billion capital allocation strategy that included stock buybacks, debt reduction, and investments in store remodeling, supply chain, and digital enhancements. After joining the board, Mr. Tritton raised more than $250 million by selling almost half of the company’s real estate, including its Union, New Jersey, headquarters. He also got rid of non-core operations including the Cost Plus World Market and Christmas Tree Shop franchises. The proceeds were used to restructure the company, which included reducing prices and switching national brands for private-label products. He launched 10 private-label brands, none of which were able to achieve desired results. According to RC Ventures’ Ryan Cohen, Bed Bath’s management failed to cater to customers’ core demands while putting all of their efforts and energy into this business transformation.

Additionally, in November 2019, the board approved investing $1 billion in a three-year share repurchase plan, which was completed a year earlier than anticipated. Last fiscal year, the company spent about $600 million on share repurchases and another $43 million in the most recent quarter. For the three months that ended on May 28, Bed Bath & Beyond burned $332 million in cash, leaving it with $108 million in reserves, and also drew down $200 million from its $900 million asset-backed revolving credit facility.

The aggressive buyback plan deployed by the company appears not to have created any value for long-term shareholders, which we highlighted in our previous article as well. It is unusual for a company going through a turnaround to focus on shareholder distributions all the while reporting continuous losses. Mr. Cohen recently criticized executives who do not prioritize long-term wealth creation for shareholders in a Tweet, saying:

I’m sick of seeing failed executives make millions in risk-free compensation while shareholders are left holding the bag.

Even though the company has shut down underperforming locations and reduced the number of stores to around 1,000, inventory management at Bed Bath is still far from ideal, and persistent supply chain problems only make the situation worse. The company’s margins would probably continue to suffer in the present inflationary climate. Consumer spending was strong in 2021 and early 2022 despite rising inflation, however, the Commerce Department said earlier this month that domestic retail sales of goods such as cars, electronics, and also online shopping had dropped for the first time this year. This is not good news for Bed Bath as it mostly sells discretionary products. With consumers becoming more cost-conscious, Bed Bath’s ongoing struggles seem far from over.

Takeaway

Bed Bath is in a tough spot, and we all knew that from the start. Recent developments go on to suggest the expected recovery will be further delayed. Even in the best-case scenario, Bed Bath will take many years to recover, thereby leading to lackluster investment returns in the long run. In the worst-case scenario, the company could be forced to go out of business, eroding shareholders’ wealth.

Be the first to comment