NoDerog

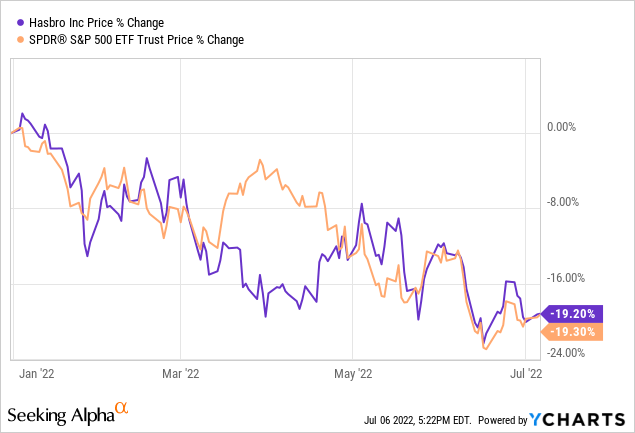

Hasbro’s (NASDAQ:HAS) stock price has declined as much as 19% year to date, in line with the performance of the broader market.

Despite this price decline, we believe that Hasbro’s stock still remains overvalued. Although in times of low consumer confidence, the firm has managed to outperform the broader market in two out of three cases, there is no certain indication that in the current market environment it would outperform again. Also, the sustainability of the dividend payment is questionable.

In this article, we will be looking at several factors to decide what are the pros and cons of investing in Hasbro now.

Consumer confidence

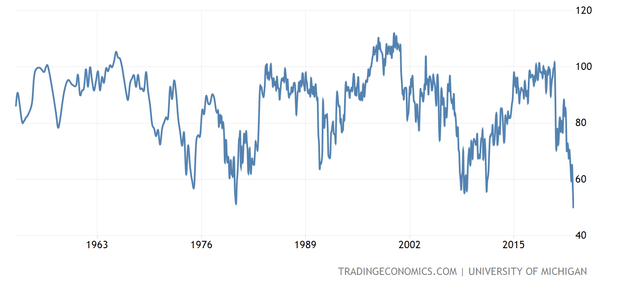

Consumer confidence is often treated as a leading economic indicator, used to predict the potential trends changes in consumer spending in the near future.

In 2022, consumer confidence in the United States has been steadily declining, falling below levels that were seen during the 2008-2009 financial crisis.

U.S. Consumer confidence (Tradingeconomics.com)

Although consumer spending has remained strong for in the first half of the year, we believe that the low consumer confidence is likely to have a negative impact in the not so distant future. In times of low consumer confidence, people are likely to reduce their spending on durable, discretionary, non-essential goods. They may decide to cut their purchases completely, but more often purchases are simply delayed or a lower cost, more affordable alternative is chosen instead.

As Hasbro sells consumer discretionary, leisure products, we would expect the firm to be negatively impacted by a declining consumer confidence. But the performance of Hasbro’s stock has been actually better in two out of three periods, characterised by low consumer confidence.

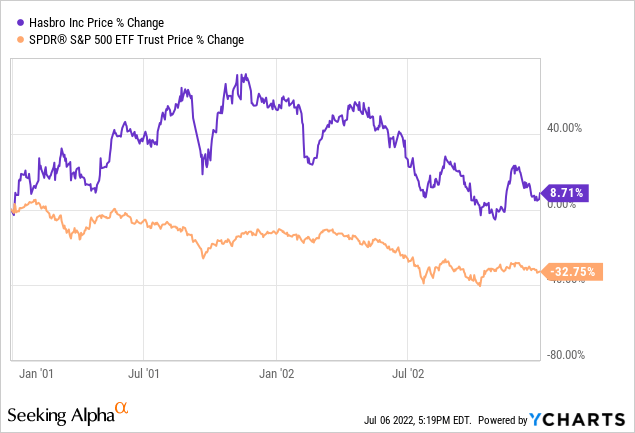

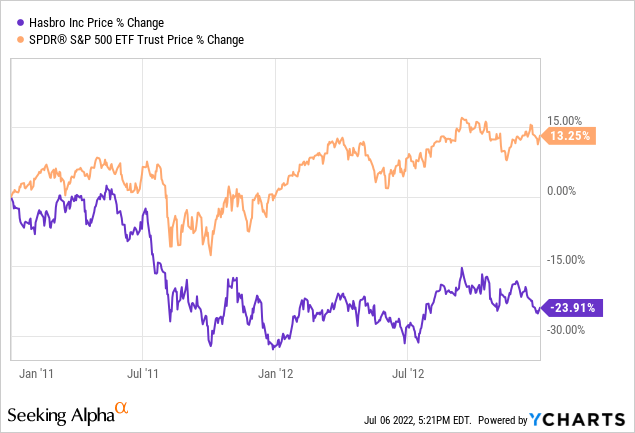

2001-2003

While the S&P 500 (SPY) has declined by more than 32% between 2001 and 2003, Hasbro’s stock price has gained almost 9%, significantly outperforming the market.

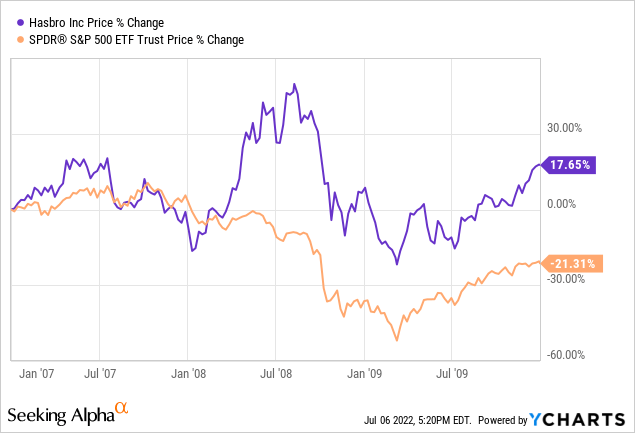

2007-2010

Although in 2007, Hasbro performed worse than the broader market, in 2008 and 2009 the firm once again substantially outperformed.

2011-2013

On the other hand, in the third period, while the broader market ended the period in the positive territory with a gain of more than 13%, HAS has lost almost one quarter of its market capitalisation.

From these three periods, we cannot definitely conclude that the firm has a strong track record of outperforming. Therefore, we believe that Hasbro is not the most attractive candidate based on past performance during times of low consumer confidence.

If you are interested in stocks that may do well, when confidence is low and which we rated as “buy”, check out our previous articles on Consolidated Edison and Conagra.

Hasbro’s business

There are could be other advantages of investing in Hasbro. In this section we will provide a brief overview about what we actually like about the firm.

1.) Diverse product portfolio

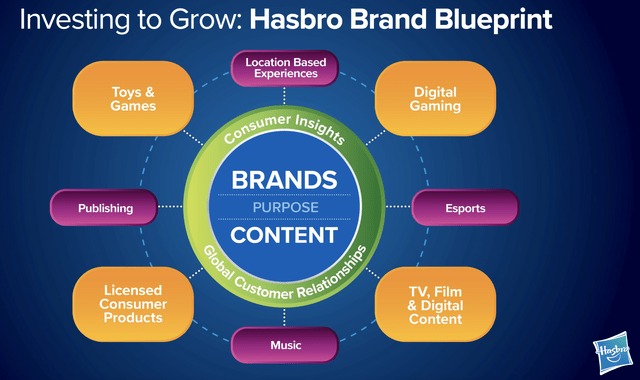

Hasbro does not only sell boardgames. They have a wide variety of products in four main segments: Toys&Games, Digital Gaming, TV, Film and Digital content, Licensed Consumer Products.

We like firms that are not strictly reliant on a single source of income from a certain type of product. We believe that Hasbro is well-positioned to adapt to the changing trends in gaming.

2.) Demand remains strong

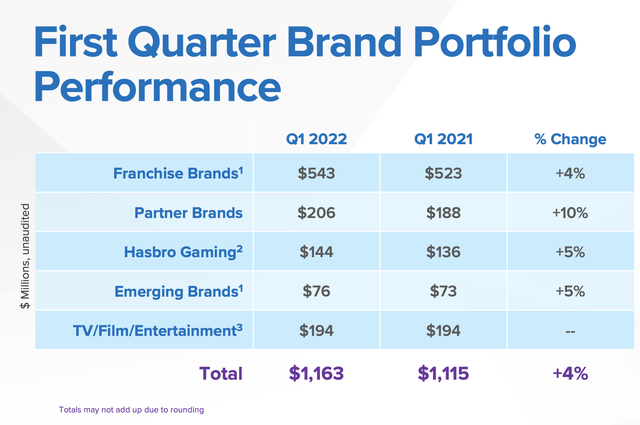

In this first quarter results of the firm. the sales figures also show that the demand for Hasbro’s products has actually remained high.

Sales have increased across all segments in the first quarter. Unfortunately, this increase cannot be observed in terms of net earnings. Elevated input cost and freight cost have significantly hurt Hasbro’s margins, with reported operating margin being 10.3%.

On the other hand, the firm has been expecting to implement price increases in the second quarter of 2022 to offset the elevated costs, and they have guided an operating margin of 16%.

Although the firm’s guidance seems promising, we remain cautious and do not expect a sharp improvement in margins. The reason is the uncertain geopolitical situation in the Eastern European region, which can cause significant volatility in the energy prices in the months ahead. Due to this, freight costs and input costs may remain elevated or even increase, while the efforts to offset these with price increases may not work.

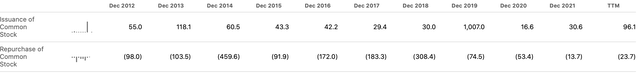

3.) Resuming the share repurchase program

Hasbro has also communicated in the first quarter that they are planning to resume their share repurchase programs. Such initiatives we like for two reasons. First, it may be an indication that the firm believes that their share outstanding are undervalued and they try to buy them back at a low price. Second, it is an attractive way of returning value to the shareholders.

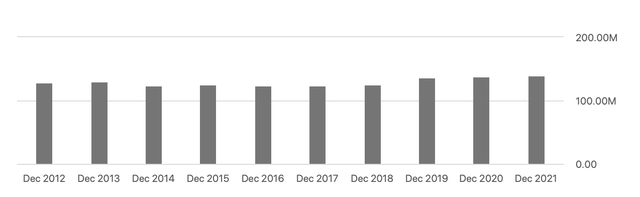

Although the firm has been consistently purchasing back its shares during the last decade, the number of shares outstanding has slightly increased as HAS has issued more shares than bought back.

Share issuance and share buy back (Seekingalpha.com)

Shares outstanding (Seekingalpha.com)

We believe that the resumption of the share repurchase program is an attractive change from the firm’s side.

4.) Healthy Current- and Quick-ratio

Hasbro has a current ratio of 1.59, while a quick ratio of 1.1. This means that the firm is able to cover its current liabilities and is not expected to face significant liquidity issues. In times of low consumer confidence and in an uncertain market, we like when the firm has enough resources to allow a certain financial flexibility.

Valuation

According to a set of traditional price multiples, Hasbro appears to be trading at a significant premium compared to the consumer discretionary sector median. In terms of price-to-earnings ratio, EV-to-EBITDA and price-to-cash flow, Hasbro seems to be 50-100% more expensive than the median company in the sector.

We believe that in the current market environment such a premium is not justified.

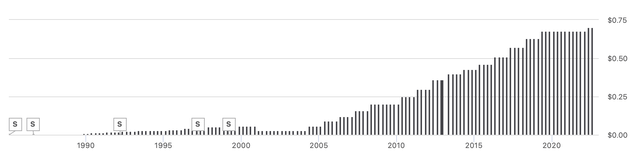

Further, we also have to recognise that many investors find HAS appealing due to its dividend payments. The firm has a strong track record of returning value to its shareholders. They have been paying dividends to shareholders for the last 32 years consecutively.

Dividend history (Seekingalpha.com)

The main question is however, is the dividend safe and sustainable?

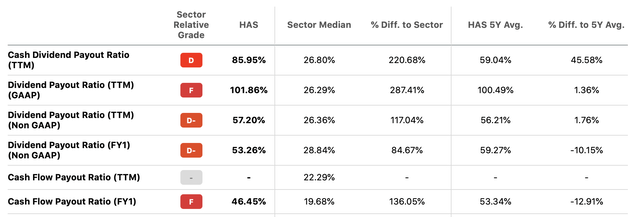

By looking at the current dividend payout ratios, we are not particularly impressed.

Dividend pay our ratios (Seekingalpha.com)

According to the GAAP figures, the trading twelve month dividend pay out ratio is more than 100%, indicating that the firm does not have enough resources to cover its dividends. Although this figures is expected to significantly decline going forward, we once again recommend to remain cautious. Once, we in fact see the pay out ratio to decline, we can recommend adding Hasbro to a dividend portfolio.

Kay takeaways

Although Hasbro’s stock has managed to outperform the broader market during two out of three periods of low consumer confidence, we are not convinced that they would be able to do so again.

Also, the firm appears to be trading at a significant premium compared to the consumer discretionary sector median, while its dividend payout ratio appears to be extremely high.

On the other hand, we like Hasbro’s product portfolio. The first quarter results have indicated that the demand for the products has remained high so far, however elevated costs have caused a significant margin contraction.

We also like that the firm is planning to resume its share buyback program.

Due to these factors, we currently rate Hasbro as “hold”.

Be the first to comment