M. Suhail

Back in August, I detailed how investors in struggling retailer Bed Bath & Beyond (NASDAQ:BBBY) should use the surge in shares as an opportunity to exit. With a terrible balance sheet and plunging revenues, the rally made no fundamental sense at the time. Shares have lost almost 80% since then, yet there still remains significant potential for a massive downside from here.

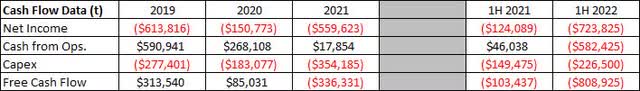

About a month ago, the company reported Q2 results that were ugly at best. Revenues were down more than 27.5% over the year-ago period, yet they still missed Street estimates. The company announced another large loss, regardless of whether you use GAAP or non-GAAP numbers. Perhaps the worst part was the continued massive cash burn, detailed in the graphic below. It’s incredible that the company used so much money on share repurchases in recent years only to be in a massive financial hole this quickly.

Cash Flow Data (Company Filings)

As part of its efforts to shore up the balance sheet in recent months, the company announced a program to sell 12 million shares of common stock. In late August, there were 80.36 million shares outstanding, but as of October 24th, that number was over 88 million. Last Friday, the company announced that the 12 million plan had been completed, but management stated that in a filing to announce another plan to sell up to $150 million worth of stock. I guess things are worse than previously thought, given the following quote from CEO Sue Gove in that Q2 earnings release:

We have worked quickly to deploy strategic and financial changes swiftly to increase cash through business growth and lowering our cost structure by approximately $250 million in the second half of fiscal 2022, or an expected $500 million on an annualized basis. We are confident that our current liquidity will enable the necessary changes we are implementing.

In last week’s filing, management stated that the current $150 million equity sales program, if fully executed, could result in an outstanding share count of over 118 million. Of course, that was based on a per share price of $5, and the stock lost almost 8% on Friday alone to finish at just $4.59. Obviously, every penny lower that shares go from here would increase the amount of shares needed to be sold to bring in that $150 million. Thus, should this new plan be fully utilized, we could be looking at a 50% or more surge in the outstanding share count in a period of just 6 months or so.

As I detailed above, the company burned over $336 million in cash last year, and that was on nearly $7.87 billion in total revenues. Currently, Street analysts are expecting just over $6 billion in sales this year and even less next year, which won’t be helped by even more store closures. While management is trying to cut expenses rather quickly, increased borrowings are also adding additional interest expenses. With key variable rates like LIBOR and SOFR continuing to rise, the company’s borrowing rates are surging, further pressuring the bottom line and cash flow.

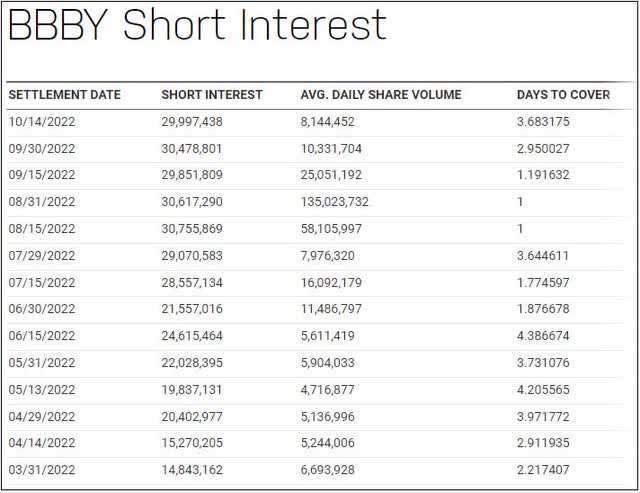

For the moment, I just don’t see how this company gets to a cash flow break-even situation anytime soon. That likely will mean even more debt tacked on to the balance sheet, meaning more interest expenses, or continued dilution over time, which isn’t good for shareholders. A higher number of shares outstanding also gives short sellers an opportunity to short more. As you can see in the graphic below, short interest has more than doubled from its 2022 low since the end of March, and Friday’s $150 million sale plan likely won’t scare any shorts away.

Shares of the company finished Friday a little more than 30 cents from their 52-week low. However, investors can still lose a lot from here, especially if management eventually decides that bankruptcy is the best option. As of the weekend, the average price target on the Street was $4.05 per share, but that might come down a bit as analysts put more shares outstanding into their models. Don’t forget, that Street average target was above $19 at the start of the year, and look where we are now.

In the end, Friday’s news of another potential $150 million in equity sales gives Bed Bath & Beyond investors a continued reason to keep selling the stock. The company continues to burn through substantial amounts of cash, and that situation doesn’t seem likely to stop anytime soon, especially as revenues deteriorate. With another Fed rate hike this week potentially adding to interest pain, the last thing that shareholders need is another 30 million shares or more being added to the overall share count. Unless the overall market surges into year’s end, this stock seems to be a great candidate to see a new 52-week low rather soon.

Be the first to comment