Kevin Brine

It’s silly season again in the stock market, and the new “meme stock” is discount retailer Bed, Bath & Beyond (NASDAQ:BBBY). In this article, I’ll explain why Bed, Bath & Beyond why losses keep growing, what that means for the company, and why I think this stock is likely to fall by more than 90% from recent highs. I’m short Bed, Bath & Beyond, and while the stock might bounce around for a while, I feel strongly that trends in retail and weak financial performance will soon be reflected in the stock price in spite of recent price action.

Background

Once a well-known and well-liked retailer with a wide variety of useful products at low prices, Bed, Bath & Beyond has become a victim of a kind of “great extinction” taking down one retailer after another. The stores are famous for both a wide-variety of inventory:

Inside a Bed Bath & Beyond (Business Insider)

Source: Business Insider

And their ubiquitous coupons:

Pymnts.com

Source: Pymnts.com

But a number of trends have made it harder and harder for the company to compete over the last few years. One big issue is the growth in e-commerce and drop–shipping that makes it easier for not only new entrants but also other incumbent companies to compete with Bed, Bath & Beyond and for household goods.

The company is now on its fourth CEO within four years, and as one board member explained on the most recent conference call:

The macro environment right now presents a number of challenges for our business. A convergence of factors and the serial nature of them is unparalleled in my years of experience in the consumer sector.

Earnings Call, Seeking Alpha

As we’ll see below, the current macro environment of higher costs, too much inventory, and high shipping costs and a return to normal from elevated spending levels during Covid-19 are not all the company has to worry about. And the sale of a subsidiary won’t be enough to hold back a rising tide that has hurt so many other “bricks and mortar” retailers.

Financial Performance

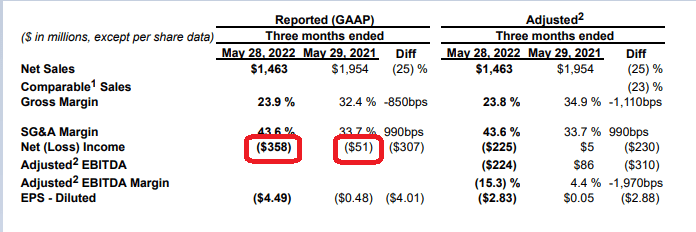

As you can see from the company’s most recent earnings report, Bed, Bath & Beyond lost $300 million in the most recent quarter:

Bed Bath &Beyond

Source: Bed, Bath & Beyond

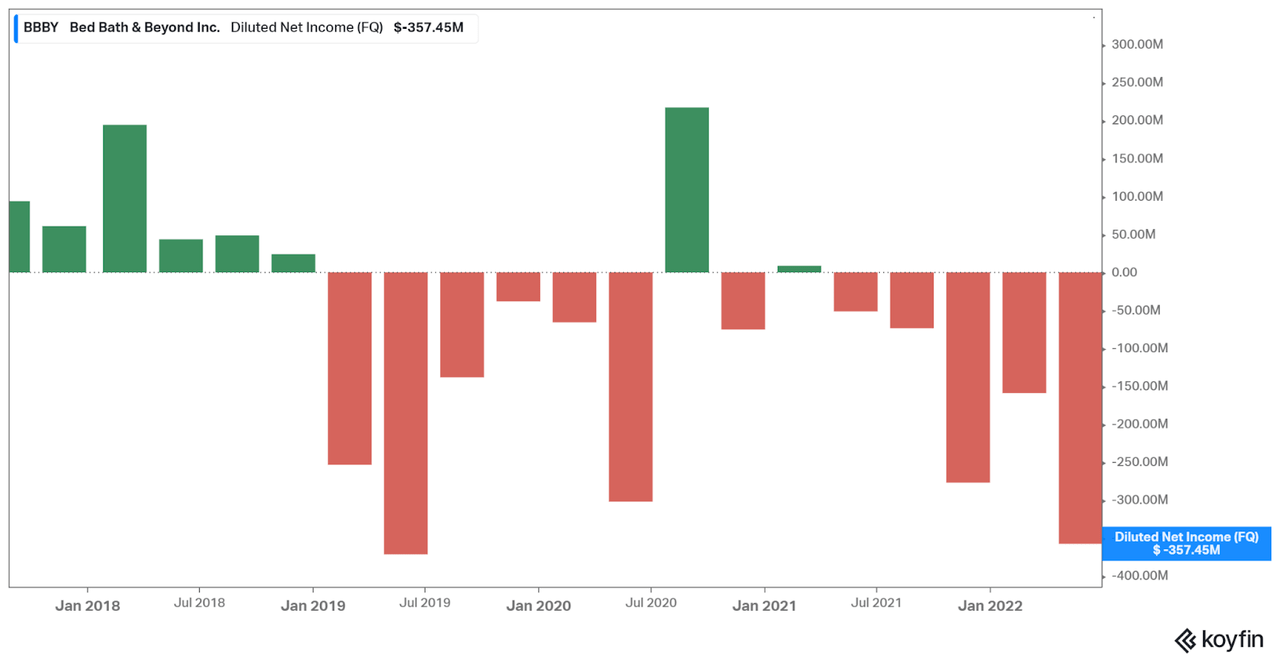

Not only did they lose money last quarter and the same quarter a year ago as you can see above, they’ve lost money in all but two quarters going back to 2018:

Koyfin.com

Source: Koyfin

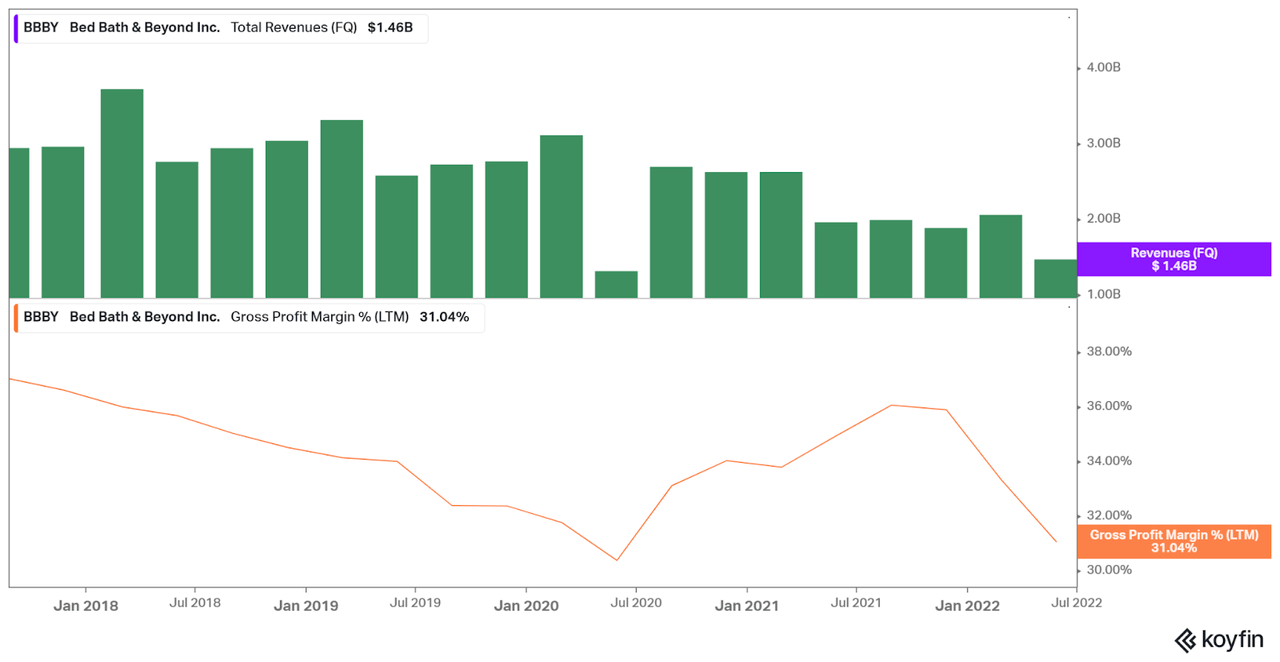

The very profitable summer of 2020 was of course the height of the world’s Covid-19 related lock-downs and stimulus payments. Revenues and gross margins have been falling in tandem:

Declining Sales and Margins (Koyfin.com)

Source: Koyfin

Operating Prospects Look Grim

Now to be clear, I don’t think the current trends of shipping costs and liquidating inventory will continue to be as dramatic next quarter as they were last quarter – but that doesn’t mean the company will stop losing money any time soon. Look on online for examples of shoppers’ experiences of trips to the stores and you may find many examples of either good merchandise at uncompetitive prices or less attractive merchandise that’s unlikely to sell at any price. Retail is a hard business to be in, and I’m aware of few if any turnarounds that occur while a company is in the kind of financial distress they have at Bed, Bath & Beyond.

Problematic Balance Sheet

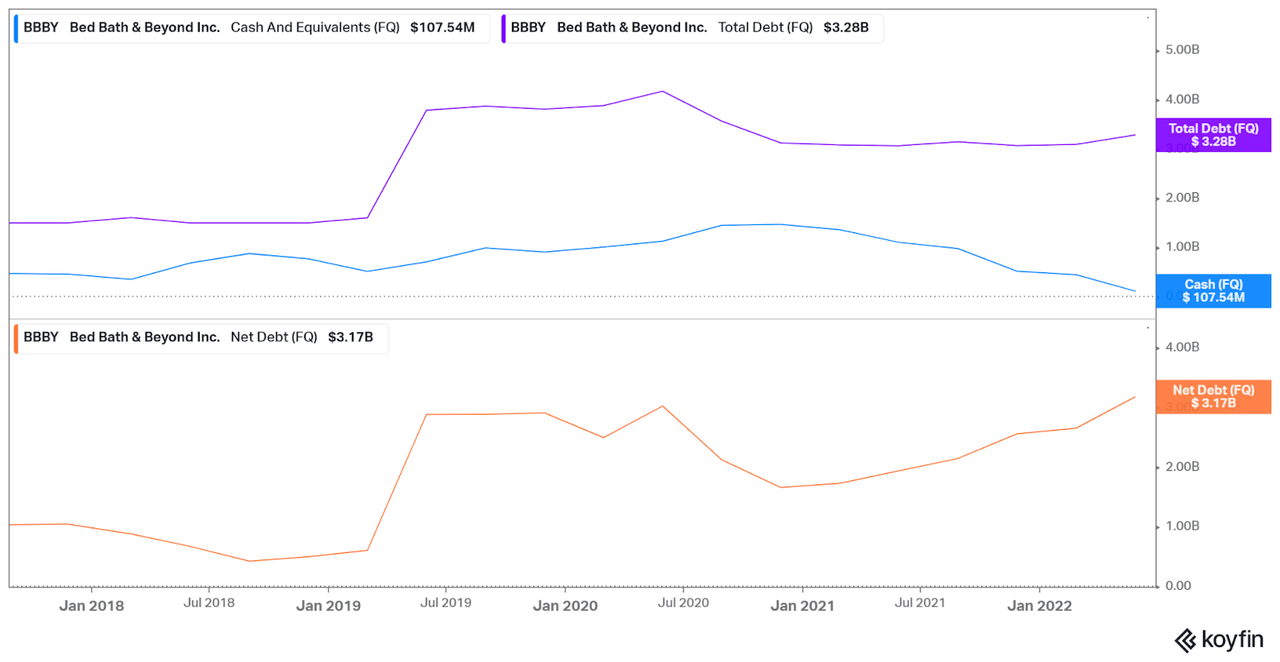

Retailers (or other businesses) with plenty of cash and a stable financial position can survive lots of challenges. Unfortunately, that’s not the case here. As you can see here, total debt is climbing while cash is dwindling rapidly:

Koyfin.com

Source: Koyfin

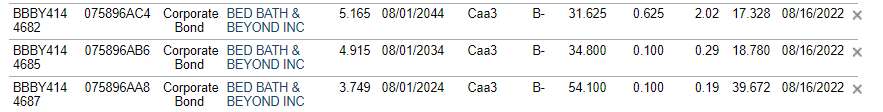

In my opinion, the effect of this problem is clear as a bell from looking at the prices of the company’s bonds:

Finra / Morningstar

Source: Finra/Morningstar

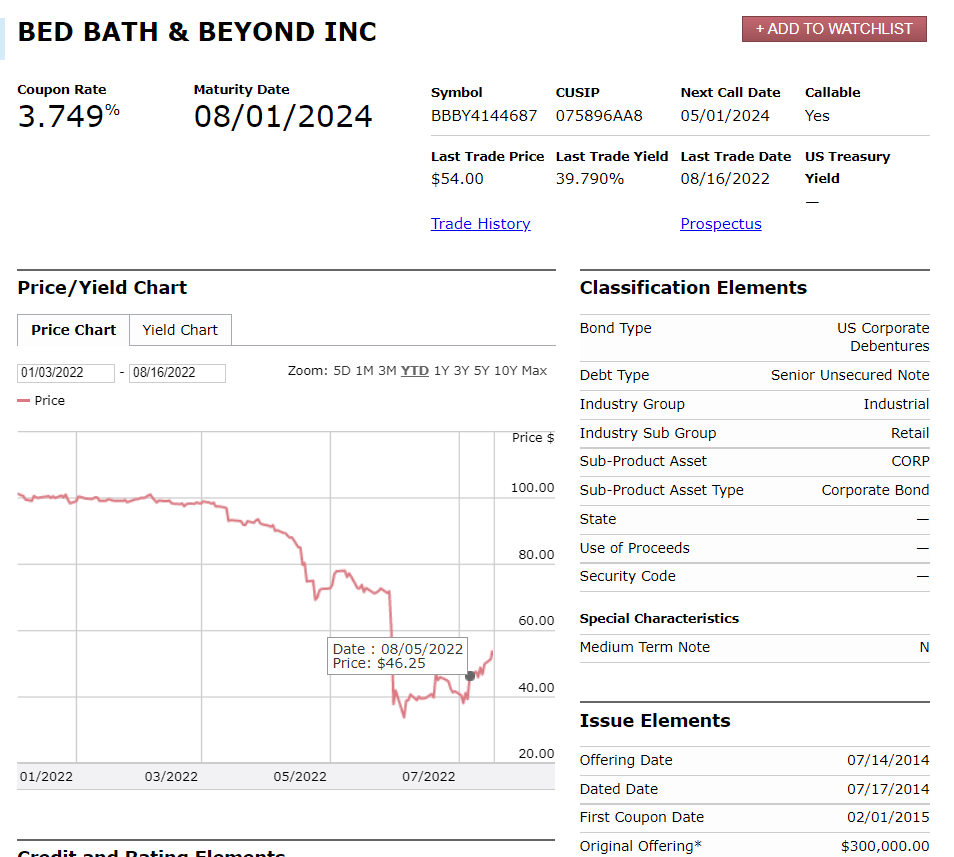

The nearest term bonds maturing in 2024 are selling at 54 cents on the dollar and the longer-dated maturities are in the low 30s. The true picture may be even worse than the probabilities implied by these bond prices because as you can see here, the near-term bond was trading under 40 cents on the dollar until Bed, Bath & Beyond became a “meme stock.”

Finra / Morningstar

Source: Finra/Morningstar

The inference is pretty clear that as experienced investors short the stock, they are probably also buying bonds as a hedge. That doesn’t mean the company is any more credit-worthy; it just means that it’s worth it to a hedge fund to lose a little money going long the bonds in order to make them more comfortable making a lot of money by shorting the stock.

Selling buybuy BABY Will Not Fix The Problem

A number of people seem to believe that Bed, Bath & Beyond could sell its baby products subsidiary buybuy BABY and thereby save the company. One such argument was made by Ryan Cohen in his letter to the board

WSJ.com

Source: WSJ:

Based on more than ten years of experience dealing with indebted companies, I don’t find this suggestion to be credible for a few reasons. First of all, as other analysts have pointed out buybuy Baby might more reasonably be worth $800 million to $1.7 billion. Second, if the subsidiary were sold for that much, that still wouldn’t even take care of two-thirds of their outstanding debt! Third, and most importantly, even if Bed, Bath & Beyond sold its good asset and got a huge one-time cash infusion, the day after that they’d be left with substantial debt still and all they’d have is to keep running the legacy business. The company doesn’t break out finances for this division separately, but if you think buybuy BABY is a good business, then it stands to reason that margins at the stores of the remaining company could be much worse than what you see in financial statements – which reflects the mix of the main stores and buybuy BABY.

The Risks of Meme Stock Madness

I don’t know what makes stocks go up or down in the near term. But over any meaningfully long period of time, it seems that the company’s problems are growing faster than its opportunities. There is substantial reason to doubt whether or not it can repay its debts, and at some point the stock price should reflect the likelihood of negative outcomes.

Shorting stocks is risky (you can lose more than you can make), but the key to limiting losses is only shorting in small position size and being willing to cut losses if a position goes up too much against you. Options can be great for limiting losses, but options volatility here is extremely expensive, so it may be best to consider options spreads or strategies designed to short expensive volatility such as selling a straddle.

The biggest risk to my short thesis would be that a rally driven by retail traders goes on longer and drives the stock higher than I anticipated. The second biggest risk would be meaningful change in the company’s business prospects.

Conclusion

Once crazy things start happening in the market, I can’t tell you how they resolve themselves. I don’t know how long this stock will be “up,” but before too long it seems likely to come “down.” If you’re long, sell. If you’re short – be patient. And try to keep a sense of humor about things.

Thanks for reading!

Be the first to comment