Andy

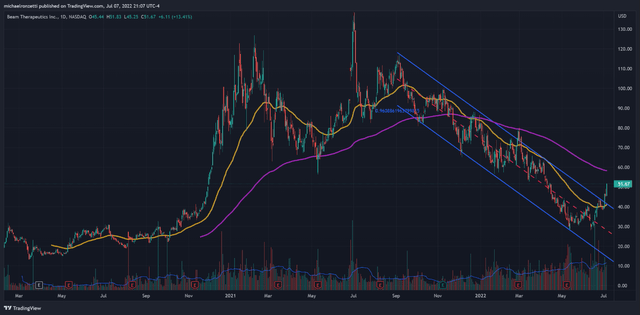

At the time of my last publication on Beam Therapeutics (NASDAQ:BEAM), its stock price was chopping around $82.52, and, if anything, the bear market of 2022 has only accelerated the bottoming of this gene editing leader. Recently, BMO Capital Markets initiated coverage on Beam with a “Market Perform” rating, driving the stock up >10% on the news. This came on the heels of a massive 4-year partnership announced with Pfizer (PFE) in April that delivered $300 million in upfront payments and the potential for over a billion more. While the S&P 500 and NASDAQ both remain in a technical bear market (as of writing this article), we may have seen the bottom set in for Beam and a new opportunity to accumulate a long position in anticipation of positive gene editing news in 2023.

Beam Therapeutics

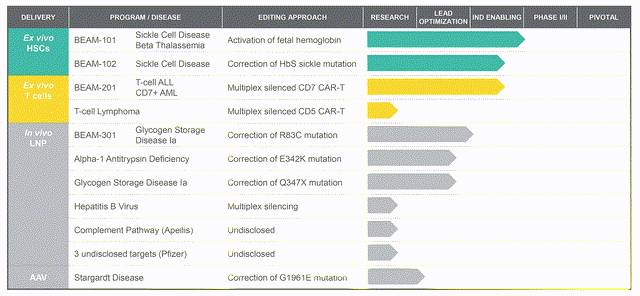

The Beam Therapeutics gene editing platform is built to perform base edits without double stranded breaks in the target DNA, a slight variation of the classical CRISPR-cas9 system (for reference see previous articles here or other well-performed analysis by SA authors). Their portfolio has a solid foundation with flagship programs that include:

- BEAM-101: hematopoietic cell therapy that activates fetal hemoglobin protein for the treatment of sickle cell disease and beta-thalassemia.

- BEAM-102: directly correcting the hemoglobin mutation for sickle cell disease by base-editing to mimic a naturally-occurring hemoglobin variant.

- BEAM-201: multiplexed base editing that silences the CD7 chimeric antigen receptor T-cells for the treatment of relapsed/refractory T-cell acute lymphoblastic leukemia and T-cell lymphoblastic leukemia.

Beam Therapeutics Pipeline (Beam Investor Presentation)

Recent Agreements and Catalysts

The Pfizer deal comes after massive obstacles for Pfizer’s own gene editing portfolio, most notably the tragic death of a patient in their Phase 1b mini-dystrophin gene therapy trial for Duchenne muscular dystrophy (DMD). Additional issues have arisen from the Roche (OTCQX:RHHBY) partnered hemophilia B asset that is delayed another year to 2023. Addressing these shortfalls with a step into base editing gene therapy is a natural choice for the pharmaceutical giant, captured well with their stated focus “… on in vivo base editing programs for three targets for rare genetic diseases of the liver, muscle and central nervous system.” In all, Beam receives an upfront payment of $300M, potential milestone payments up to $1.35B, and eligibility to receive royalties on global net sales for each licensed program. In addition, Beam will conduct research activities through development candidate selection for three undisclosed targets, one each in liver, muscle, and CNS, at which point Pfizer may opt in to exclusive, worldwide licenses to each development candidate (and be responsible for all development activities, potential regulatory approvals, commercialization, etc).

We have a strong history in developing gene replacement therapies for rare diseases, and we see this collaboration with Beam as an opportunity to advance the next generation of gene editing therapies – an exciting scientific frontier – potentially leading to transformation for people living with rare genetic diseases.

Mikael Dolsten, M.D., Ph.D., Chief Scientific Officer and President, Worldwide Research, Development and Medical of Pfizer.

Surprisingly, the recent Verve-Beam agreement amendments didn’t warrant a press release, but they deserve mention here. The amendments grant Beam the target-by-target option to license Verve Therapeutics’ (VERV) GalNAc-LNP delivery technology for base editing machinery delivery, as well as additional rights to a 35% expense and profit share for an additional liver-mediated, cardiovascular target. Another big reveal in the new agreement is Verve granting Beam an exclusive, fully paid license relating to an undisclosed preclinical program being developed by Verve. All this considered, it reads as another shot on goal for the Beam Therapeutics team, with another biotech falling in line with the potential of genetic base editing.

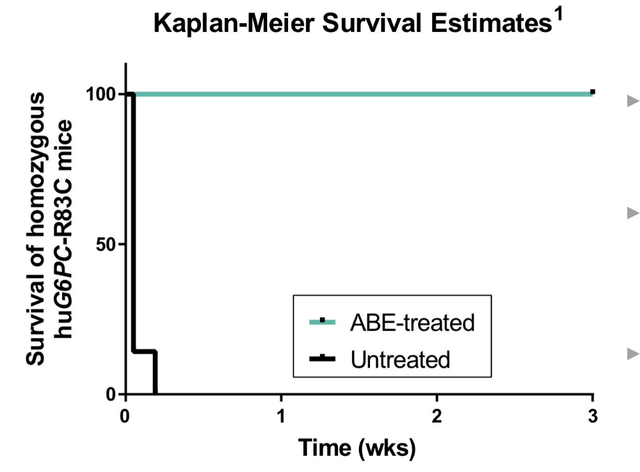

Besides these external collaborations, Beam has several planned preclinical data releases for 2H2022. Firstly, Beam plans to present updated preclinical data from its BEAM-301 program at the 25th American Society of Cell and Gene Therapy (ASGCT) meeting. BEAM-301 is a base editing therapy using liver-targeted LNPs which aims to correct the R83C mutation in patients with glycogen storage disorder Ia (GSDIa). Beam also plans to initiate IND-enabling studies for BEAM-301 in the second half of 2022. Below is the pivotal bit of mouse data showing that once-treated mice survive normally whereas untreated mice die within days of birth (taken from this post).

Survival Curves for BEAM-301 (Beam Therapeutics)

Company Finances

Looking to the company’s finances for the first quarter for 2022, we see a cash and short-term investment balance of $1.23 billion (as compared to $965.6 million in December 31,2021) and R&D expenses of $65.4 million. Of note, only about $6.3 million of the upfront Pfizer revenue has been accounted for. From the 10-Q:

For the three months ended March 31, 2022, the Company recognized $6.3 million of revenue related to the Pfizer Agreement. As of March 31, 2022, there is $95.6 million and $198.1 million of current and long-term deferred revenue, respectively, related to the Pfizer Agreement.

Technical Analysis

The fall from Beam’s July 2021 highs has been enormous, entering a downtrend channel (Pearson r: 0.96) that’s lasted nearly 10 months, erasing 75% of its value from September. While Beam is still trading underneath it’s 200EMA (purple line), it has closed over the 50EMA, and with the posting of higher lows and the confirmed break from the 10-month channel, there is certainly some bullish momentum to consider. The overhead 200EMA seems like the next point of resistance, and a break over that would signal sustained bullish momentum.

Beam Technical Analysis (Author (TradingView))

Conclusions

While the bear market is an especially massive headwind to cash-burn heavy, risky biotech stocks, a technology platform like the one Beam Therapeutics is developing warrants a long-term approach to investment. There are a number of gene editing biotechs with clinical data are set to report through 2H2022 and into 2023, and as we’ve seen with bluebird bio’s (BLUE) positive β-thalassemia data, gene editing data affects all related companies. Finally, the due diligence done by Pfizer and Verve Therapeutics is more impactful than any analysis an outside analyst like myself can perform, and having these names behind Beam should give investors confidence to hold through the chop.

Be the first to comment